The Financial Assessment Excel Template for Small Businesses provides an easy-to-use tool for analyzing cash flow, expenses, and profitability. This template helps entrepreneurs track financial health and make data-driven decisions to optimize business performance. Customizable charts and formulas offer clear insights into key financial metrics essential for growth.

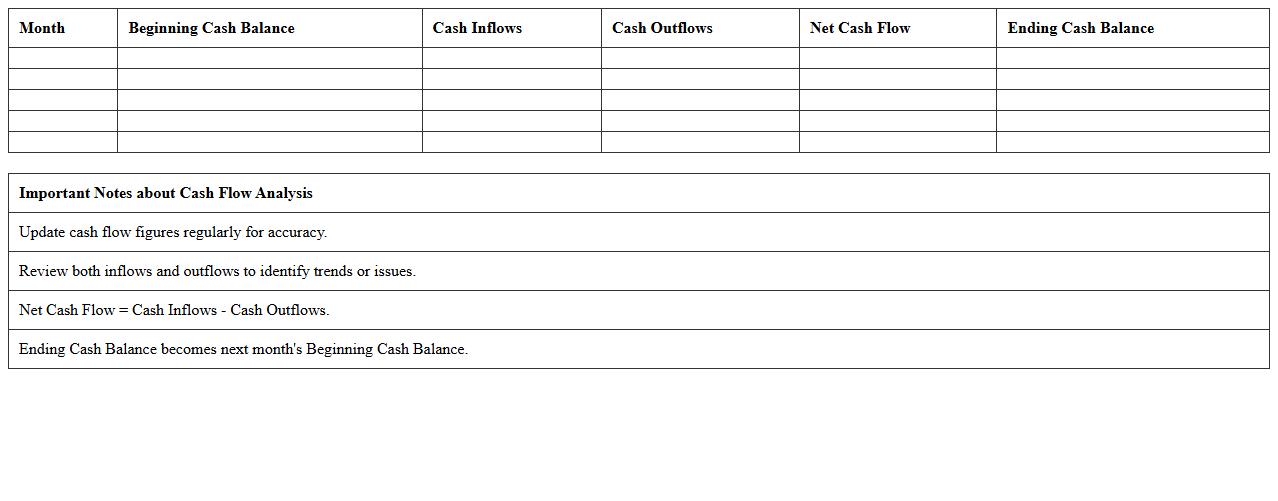

Cash Flow Analysis Excel Template for Small Businesses

The

Cash Flow Analysis Excel Template for Small Businesses is a dynamic tool designed to track and project cash inflows and outflows, enabling precise financial planning. It organizes revenue streams, expenses, and net cash position in a clear, customizable spreadsheet format, allowing business owners to identify liquidity issues early. This template supports informed decision-making by highlighting periods of cash surplus or shortage, ultimately enhancing financial stability and operational efficiency.

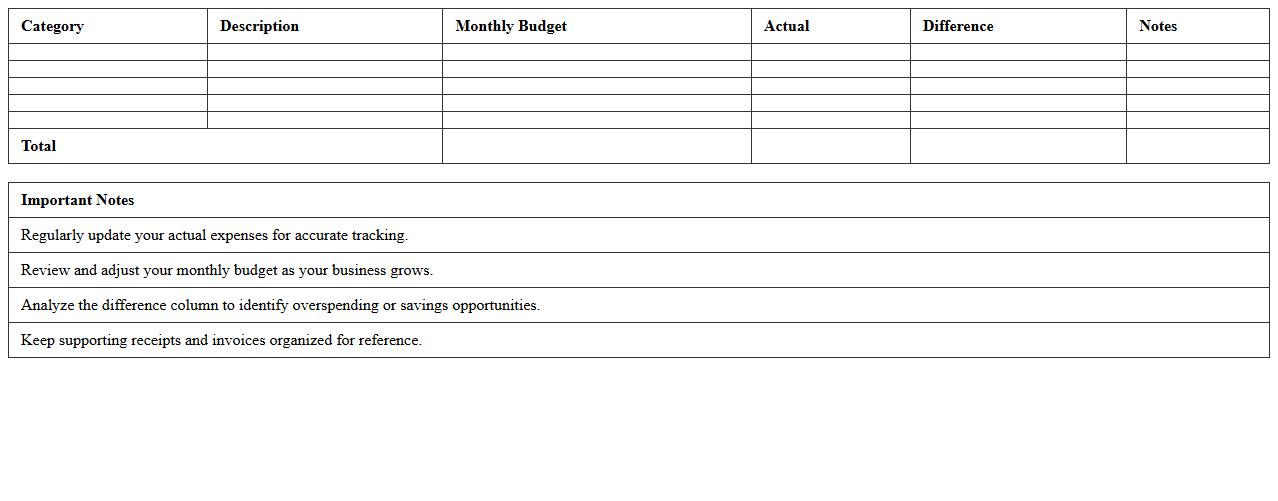

Small Business Budget Planner Spreadsheet

A

Small Business Budget Planner Spreadsheet is a digital tool designed to help entrepreneurs organize and manage their financial resources efficiently. It tracks income, expenses, and profit margins, enabling clear visibility into cash flow and helping to identify cost-saving opportunities. This document enhances decision-making by providing accurate financial projections and maintaining budget accountability.

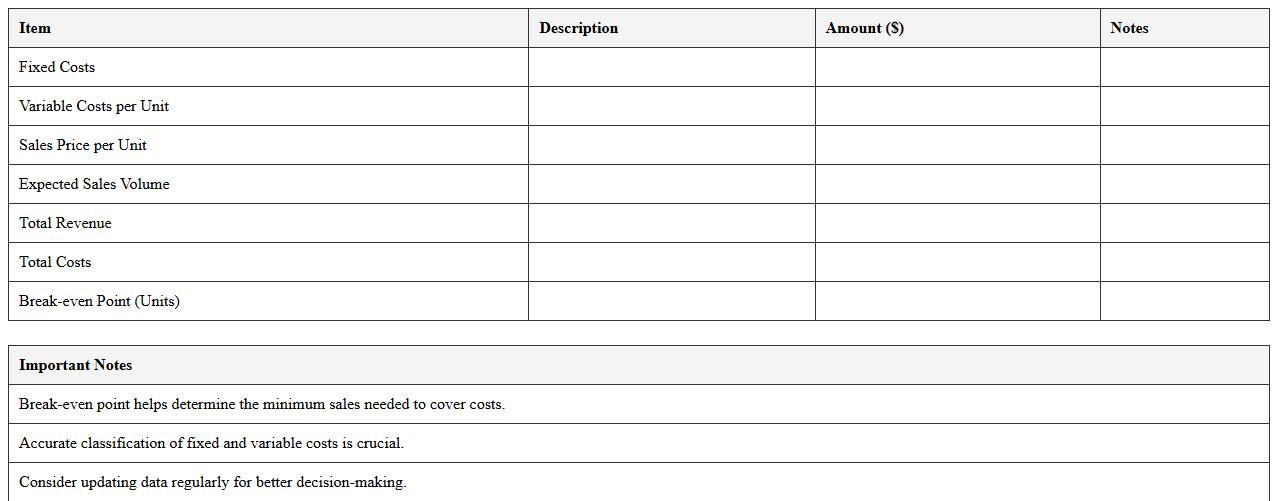

Break-even Analysis Excel Sheet for Entrepreneurs

A

Break-even Analysis Excel Sheet for entrepreneurs is a financial tool designed to calculate the point where total revenues equal total costs, indicating no net loss or gain. This document helps entrepreneurs determine the minimum sales volume required to cover expenses, aiding in budgeting and pricing strategies. By providing clear visibility into fixed and variable costs, it supports informed decision-making and financial planning.

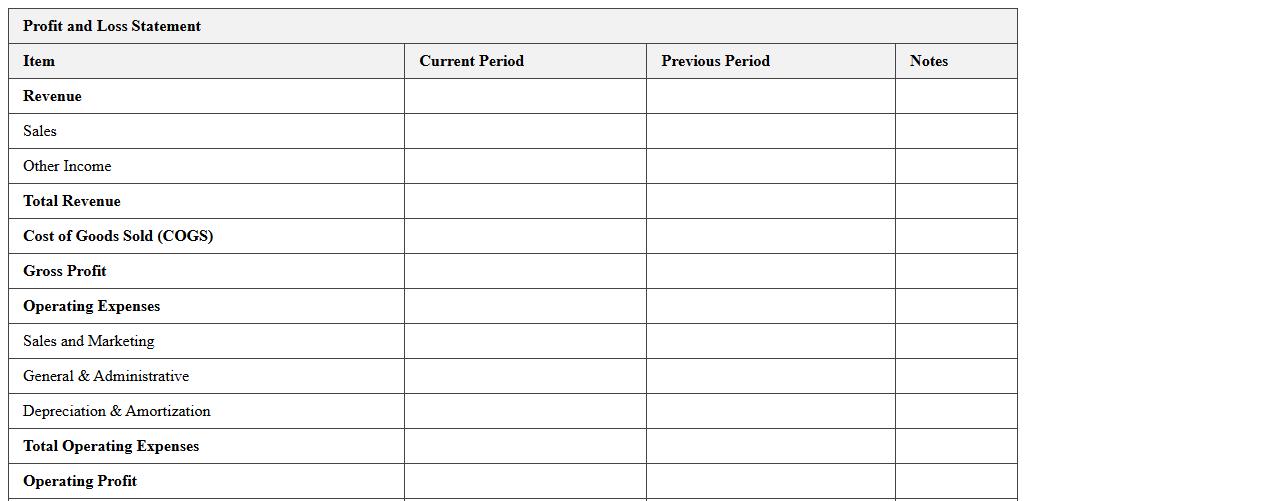

Profit and Loss Statement Excel Template for SMEs

A

Profit and Loss Statement Excel Template for SMEs is a structured spreadsheet tool designed to record and analyze business revenues, expenses, and net profit over a specific period. It helps small and medium-sized enterprises track financial performance, identify cost-saving opportunities, and make informed budgeting decisions. Using this template enhances accuracy, streamlines financial reporting, and supports strategic planning for sustainable growth.

Expense Tracking Spreadsheet for Small Businesses

An

Expense Tracking Spreadsheet for small businesses is a digital tool designed to record and categorize daily expenditures accurately. It helps monitor cash flow, identify spending patterns, and maintain budget control, ensuring financial transparency and aiding in tax preparation. Utilizing this spreadsheet enhances decision-making by providing clear insights into operational costs and profit margins.

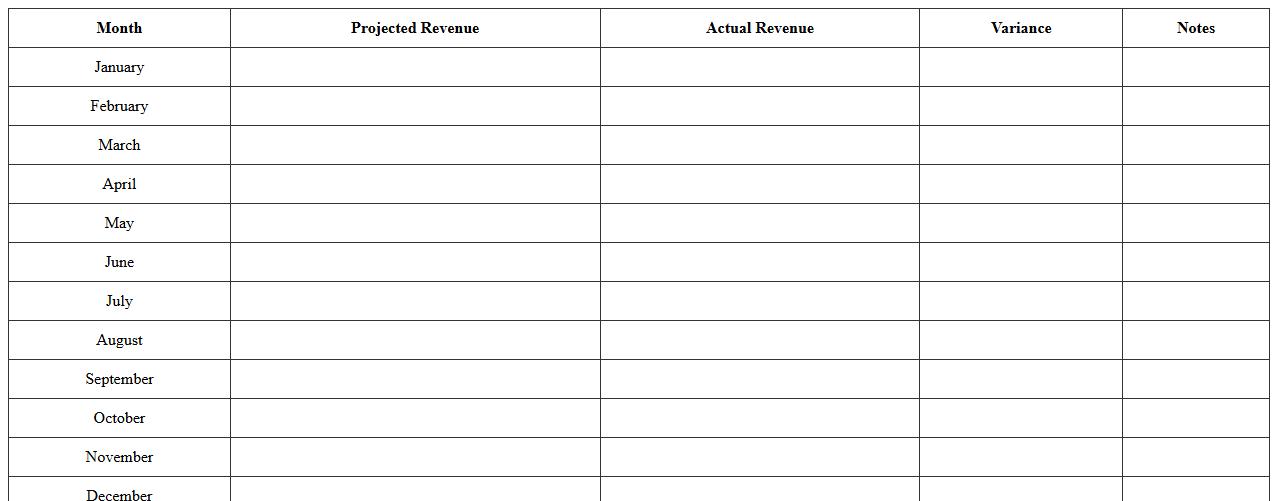

Monthly Revenue Projection Excel Template

The

Monthly Revenue Projection Excel Template is a powerful financial planning tool designed to estimate future income by analyzing past sales data, seasonal trends, and market conditions. It helps businesses and individuals create detailed revenue forecasts, enabling better budgeting, cash flow management, and strategic decision-making. By visualizing projected earnings month-by-month, this template aids in identifying potential revenue shortfalls and growth opportunities, ensuring informed financial planning.

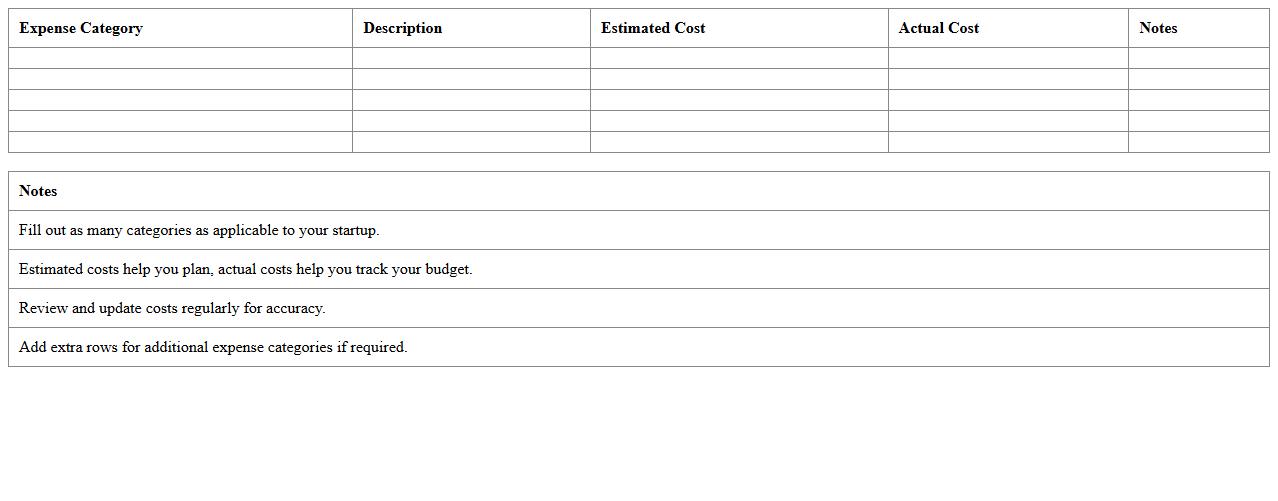

Startup Cost Estimator Excel Sheet

A

Startup Cost Estimator Excel Sheet is a comprehensive tool designed to calculate and organize all initial expenses involved in launching a business, including equipment, licenses, and marketing costs. It enables entrepreneurs to plan their budget accurately, avoiding unforeseen financial shortfalls and ensuring efficient allocation of resources. Using this document helps streamline financial forecasting and supports informed decision-making during the critical startup phase.

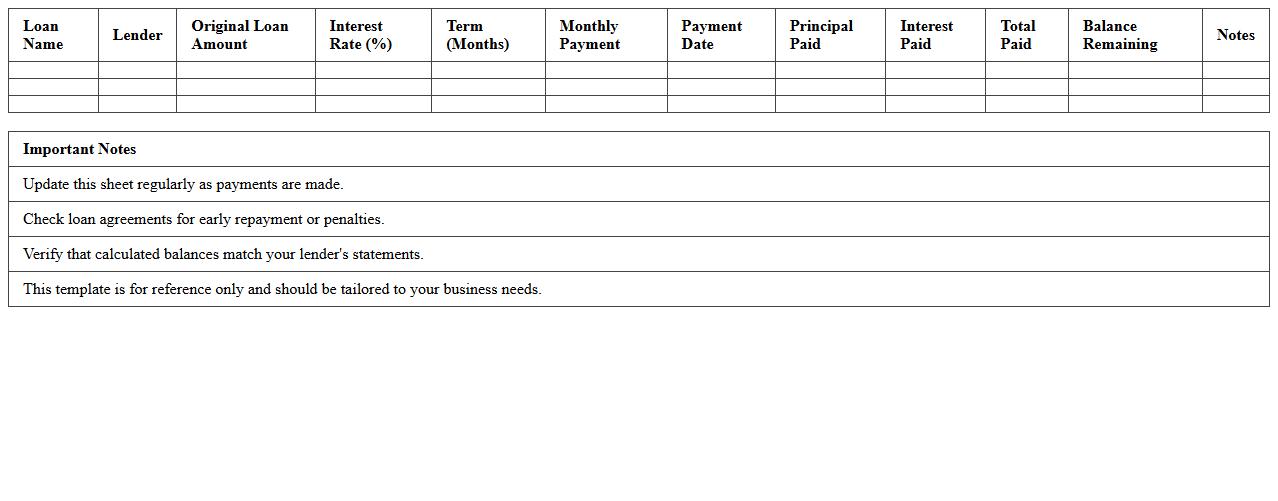

Debt Repayment Schedule Spreadsheet for Small Businesses

A

Debt Repayment Schedule Spreadsheet for small businesses is a detailed tool that tracks loan balances, payment dates, interest rates, and principal amounts due, providing a clear timeline for debt elimination. This spreadsheet helps businesses manage cash flow efficiently by forecasting upcoming payments and ensuring timely settlements to avoid penalties and improve credit ratings. It also supports strategic financial planning by offering insights into debt reduction progress and potential savings on interest costs.

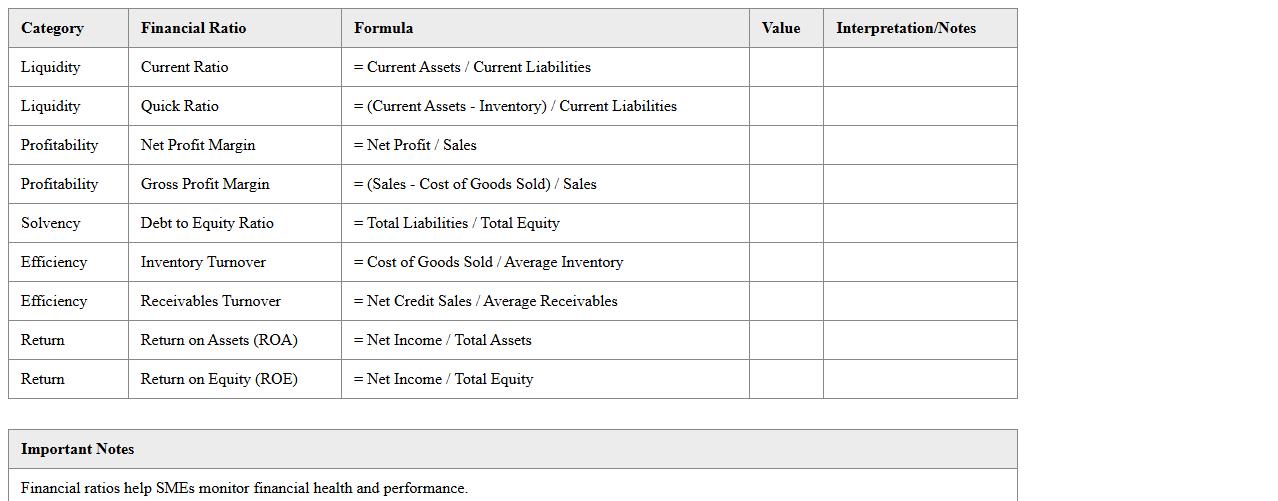

Financial Ratio Analysis Excel Template for SMEs

The

Financial Ratio Analysis Excel Template for SMEs is a practical tool designed to simplify the process of evaluating a company's financial health by systematically calculating key financial ratios such as liquidity, profitability, and solvency. This template helps small and medium-sized enterprises (SMEs) gain clear insights into their operational efficiency and financial stability, enabling informed decision-making and strategic planning. By using this Excel template, SMEs can efficiently monitor performance trends over time and benchmark against industry standards to ensure sustainable growth.

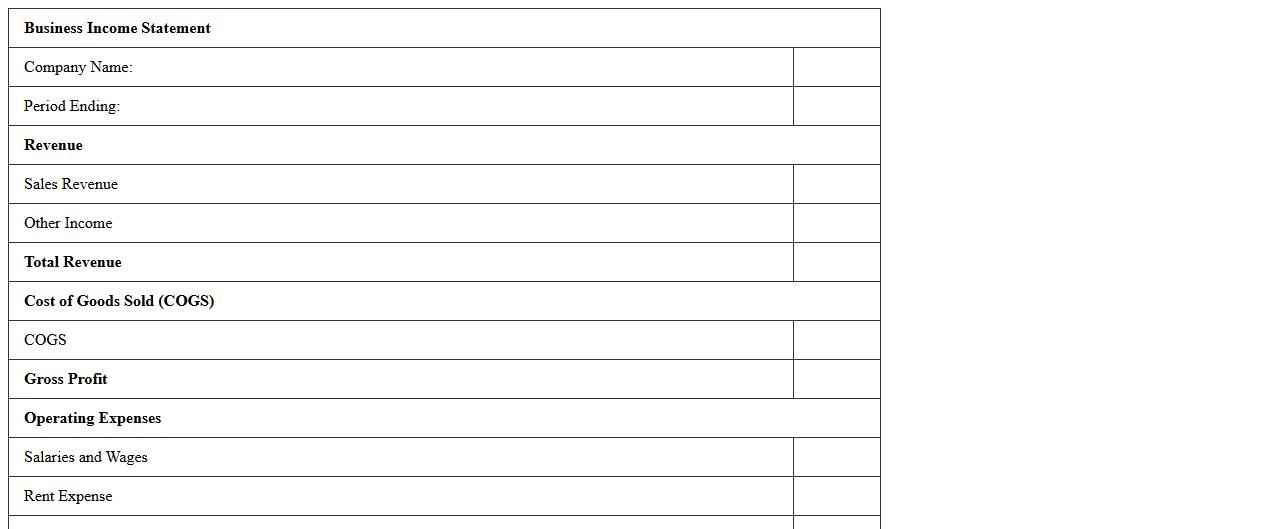

Business Income Statement Excel Spreadsheet

A

Business Income Statement Excel Spreadsheet document is a financial tool designed to track and summarize a company's revenues, expenses, and profits over a specific period. It helps businesses analyze their financial performance, make informed decisions, and prepare accurate reports for stakeholders. Utilizing this spreadsheet enhances efficiency by automating calculations and organizing data in a clear, accessible format.

How can Financial Assessment Excel track cash flow in micro-enterprises?

Financial Assessment Excel tracks cash flow in micro-enterprises by recording all inflows and outflows of cash systematically. It uses built-in templates to categorize transactions, which helps monitor liquidity over time. This enables small business owners to make informed decisions based on current cash availability and forecast future financial positions.

Which formulas best analyze small business expense trends in Excel?

Excel's SUMIF and AVERAGEIF formulas are ideal for analyzing expense trends by summing or averaging costs within specific categories or time periods. The TREND function further helps in identifying patterns over months or quarters. Together, these formulas provide clear insights into spending behavior and potential areas for cost reduction.

What Excel features optimize profit margin comparison for small businesses?

Excel features such as PivotTables and conditional formatting are effective tools to optimize profit margin comparison across products or time frames. PivotTables summarize revenue and expenses, making margin calculations straightforward. Conditional formatting highlights areas with low margins, enabling quick identification of opportunities to improve profitability.

How does Excel automate financial risk assessment for startups in the template?

Excel automates financial risk assessment by incorporating scenario analysis and what-if tools within the template. These features simulate different financial conditions, assessing impacts on cash flow and profitability. Automated alerts and data validation also help flag potential risks, facilitating proactive decision-making for startups.

What custom charts visualize debt-to-equity ratios in small business assessments?

Custom combination charts in Excel, such as bar and line graphs, effectively visualize debt-to-equity ratios over time. These charts allow business owners to compare debt levels against equity visually and identify trends. Additionally, using dynamic slicers enhances interactivity, enabling detailed analysis across various periods or business units.

More Assessment Excel Templates