The Sensitivity Analysis Excel Template for Investment Evaluation allows investors to assess how changes in key variables impact financial outcomes, enhancing decision-making accuracy. This customizable tool provides dynamic scenarios, helping to identify risks and opportunities by analyzing variations in costs, revenues, and discount rates. Its user-friendly interface streamlines complex calculations, making it essential for thorough investment project assessments.

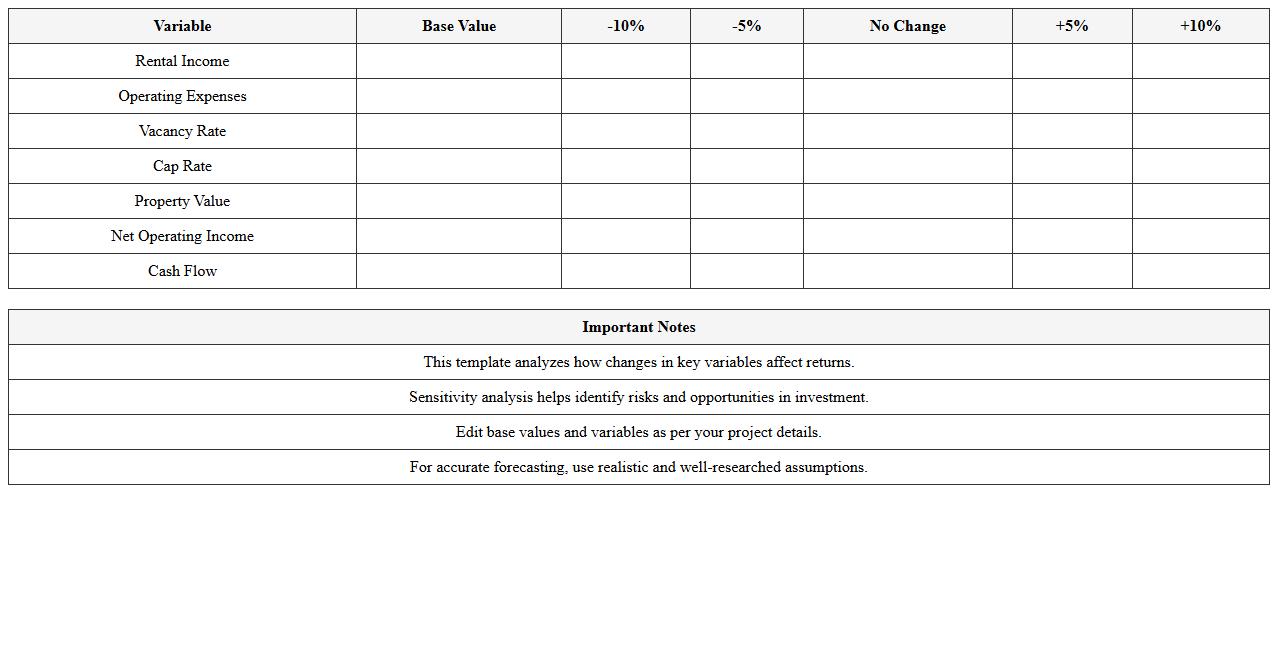

Real Estate Investment Sensitivity Analysis Excel Template

The

Real Estate Investment Sensitivity Analysis Excel Template is a powerful tool designed to evaluate how different variables such as interest rates, rental income, and property appreciation impact the financial outcomes of a real estate investment. By adjusting key inputs, investors can identify potential risks and forecast returns under various scenarios, enabling more informed decision-making. This template enhances strategic planning by quantifying the sensitivity of cash flows, net present value (NPV), and internal rate of return (IRR) to changes in market conditions.

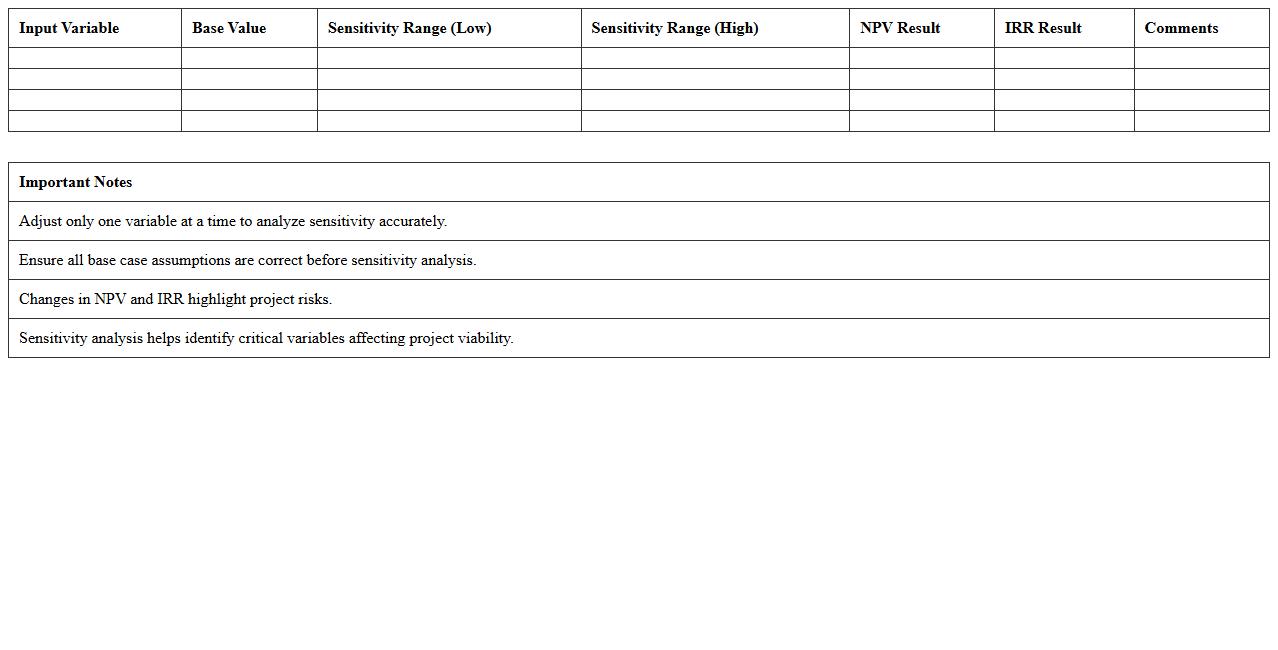

Capital Budgeting Sensitivity Analysis Spreadsheet

A

Capital Budgeting Sensitivity Analysis Spreadsheet is a financial tool designed to evaluate how changes in key assumptions, such as cash flows, discount rates, or project costs, impact the overall viability of investment projects. This document allows decision-makers to identify critical variables and quantify the risk associated with different scenarios, enabling more informed capital allocation. By highlighting the most sensitive factors affecting project outcomes, it improves strategic planning and enhances the accuracy of investment appraisals.

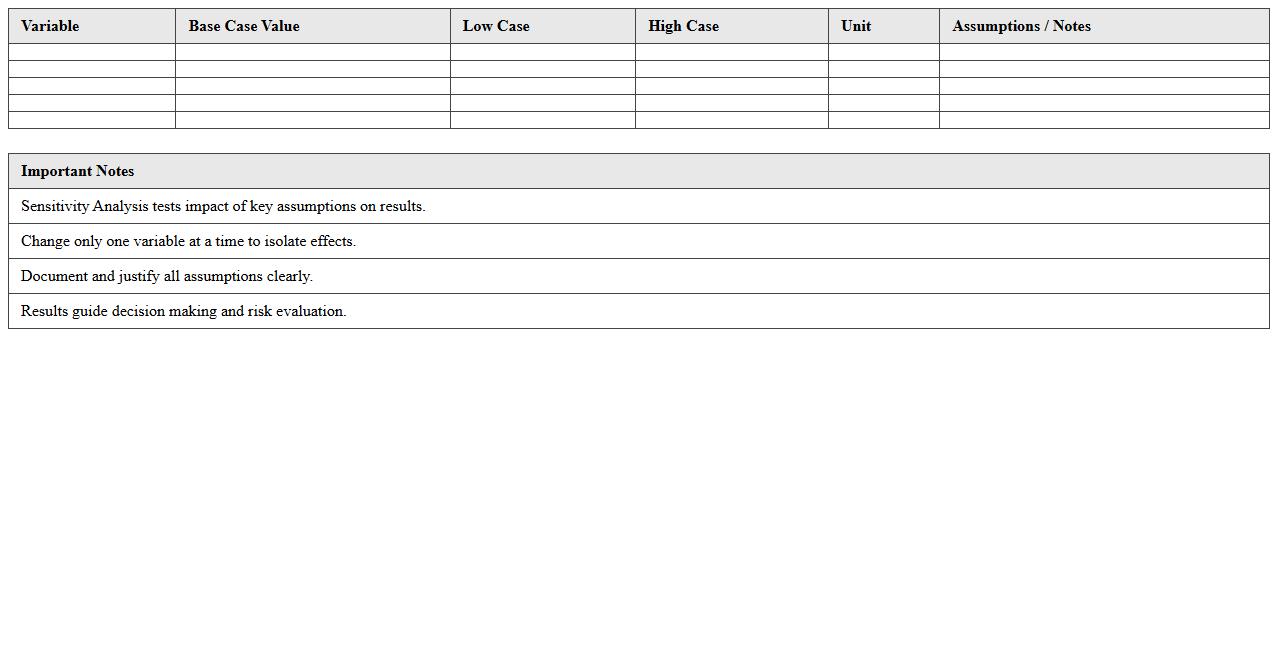

Financial Sensitivity Analysis Model Excel Template

The

Financial Sensitivity Analysis Model Excel Template is a powerful tool designed to evaluate the impact of varying financial variables on a project's outcomes, such as cash flow, ROI, and profitability. It allows users to input different assumptions, enabling scenario testing to identify key drivers of financial performance and potential risks. This model helps businesses make informed decisions by illustrating how changes in costs, revenues, or other factors affect overall financial health and strategic planning.

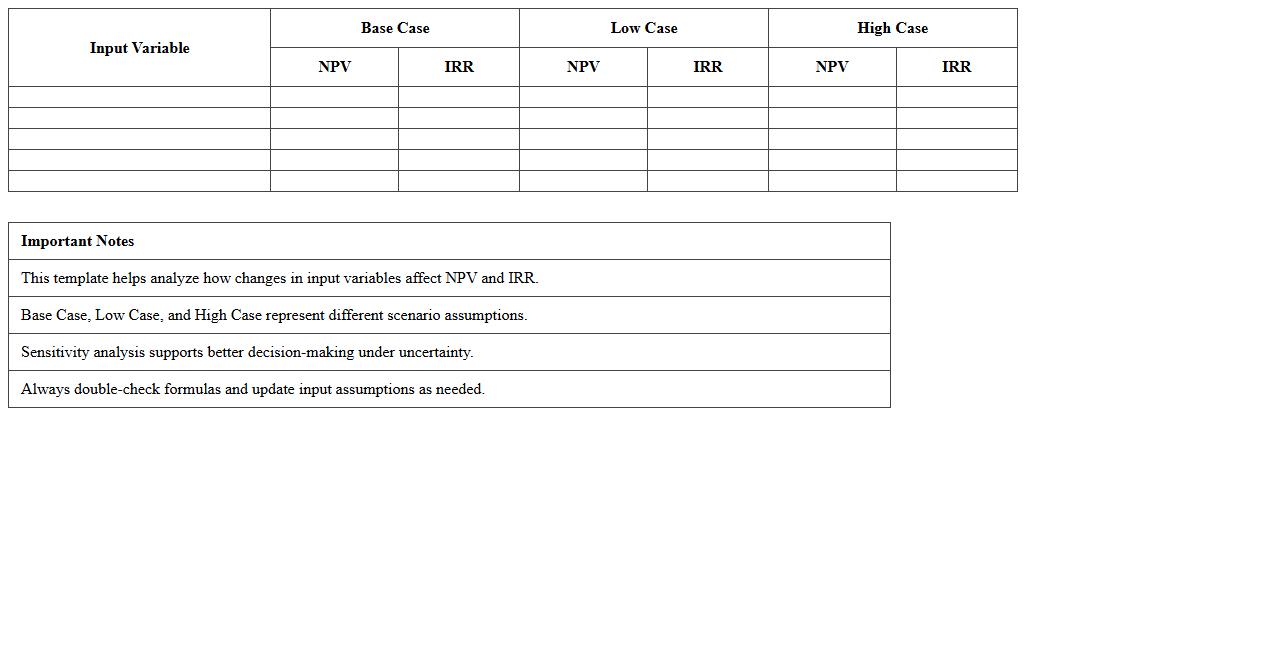

IRR and NPV Sensitivity Analysis Excel Sheet

The IRR and NPV Sensitivity Analysis Excel Sheet is a powerful financial tool designed to evaluate the impact of variable changes on a project's Internal Rate of Return (

IRR) and Net Present Value (NPV). This document allows users to model different scenarios by adjusting key inputs such as discount rates, cash flows, and project timelines, providing a clear understanding of financial risks and potential returns. It is essential for decision-makers to make informed investment choices and optimize project viability under uncertain conditions.

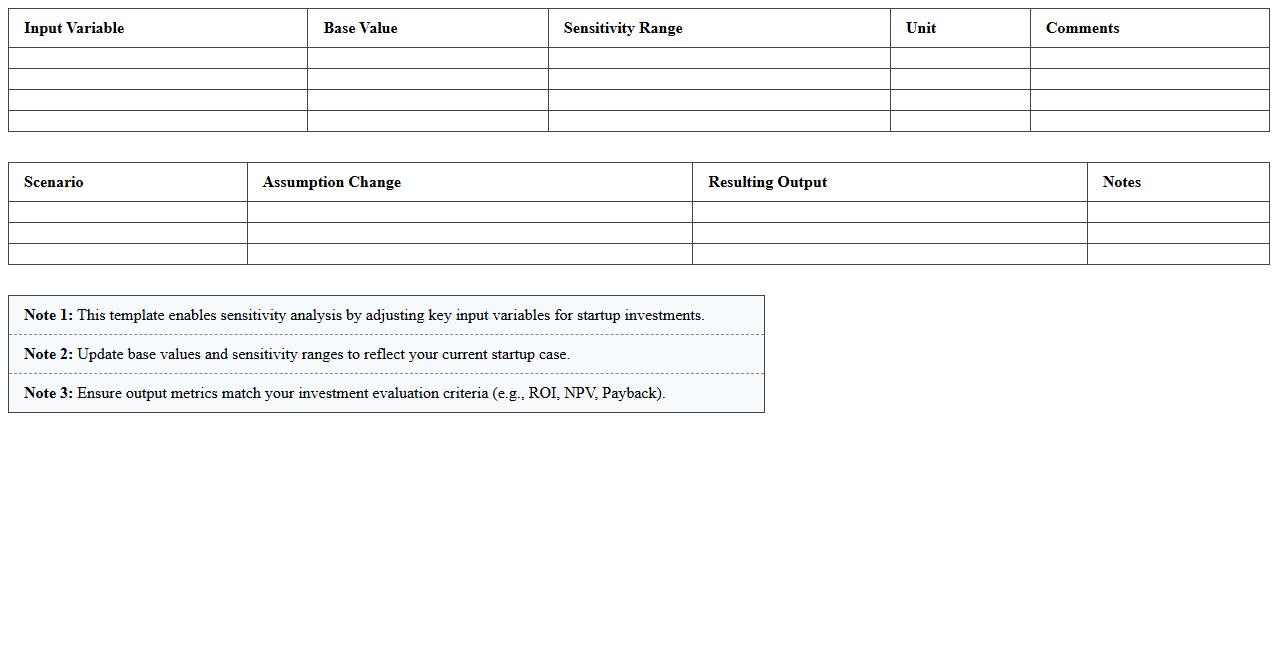

Startup Investment Sensitivity Excel Template

The

Startup Investment Sensitivity Excel Template is a powerful tool designed to analyze the financial impact of various investment scenarios on startup performance. This template allows entrepreneurs and investors to model changes in key variables such as funding amounts, equity stakes, and market growth rates, helping to identify risks and optimize investment strategies. Using this document, stakeholders can make informed decisions by visualizing potential outcomes and preparing for uncertainties in startup funding.

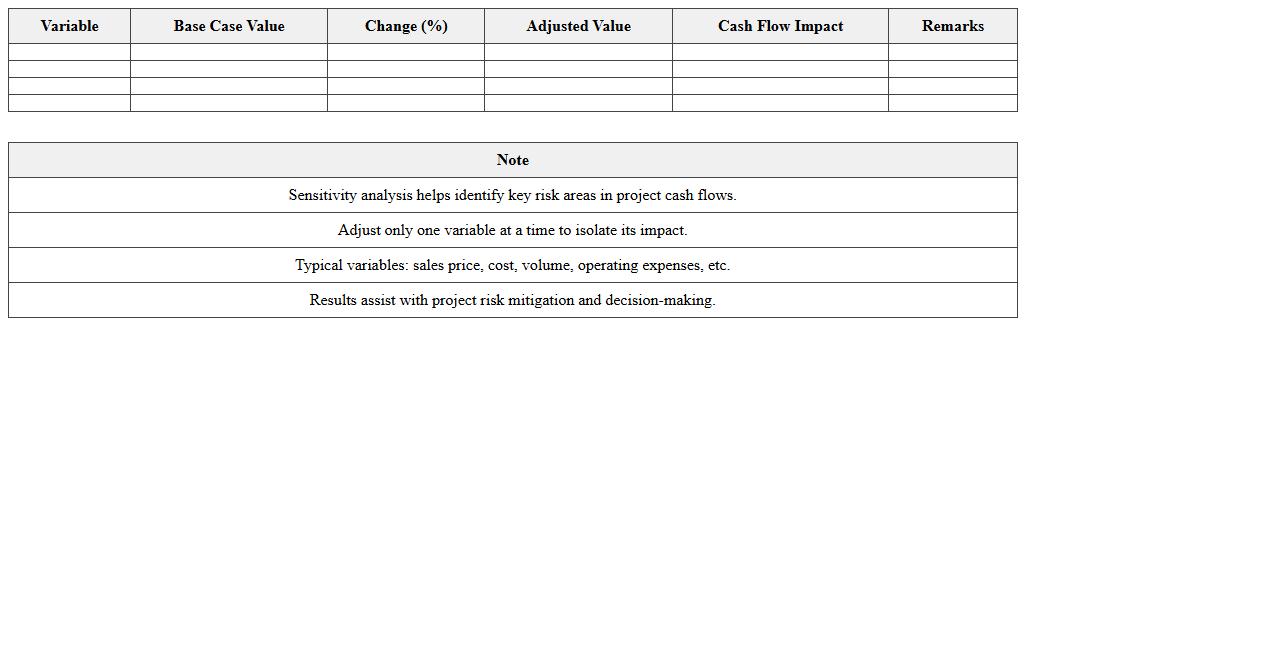

Project Cash Flow Sensitivity Analysis Excel

Project Cash Flow Sensitivity Analysis Excel document is a powerful tool designed to evaluate how varying key financial inputs impact a project's cash flow outcomes. By systematically adjusting variables such as revenue growth rates, cost of goods sold, and capital expenditures, it helps identify potential risks and opportunities within a project's financial model. This analysis enables better decision-making by providing clear insights into the

financial sensitivity of a project under different scenarios, enhancing forecasting accuracy and project management effectiveness.

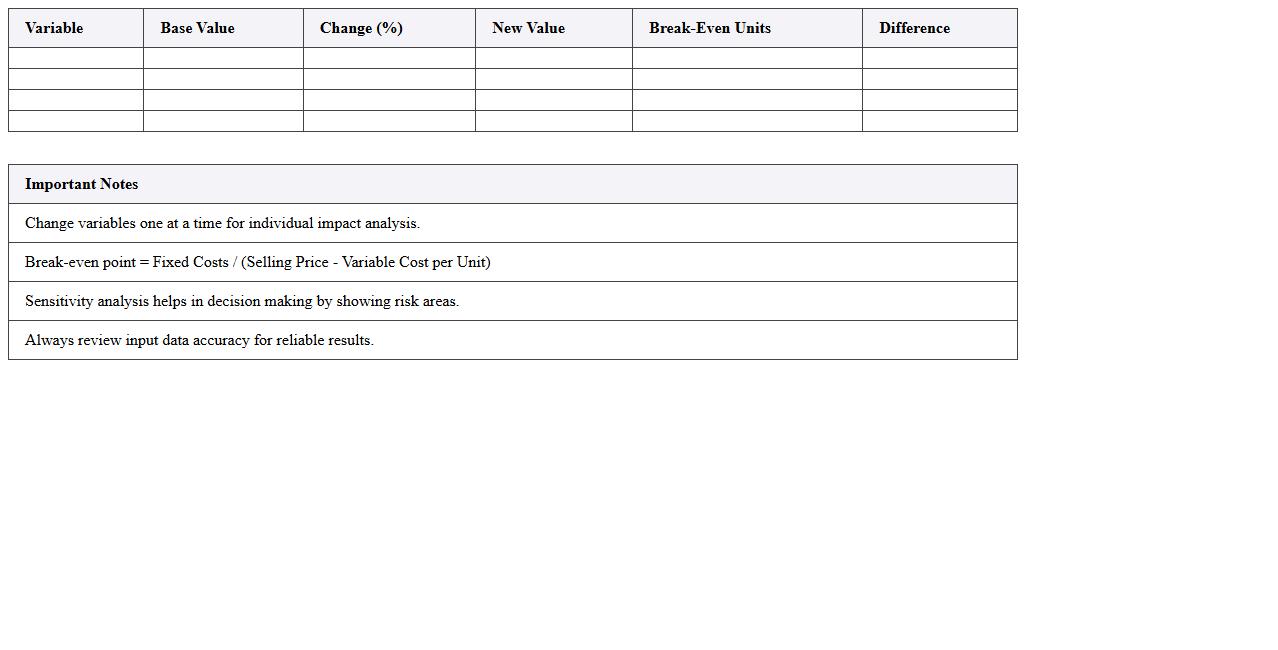

Break-Even Sensitivity Analysis Excel Template

The

Break-Even Sensitivity Analysis Excel Template is a financial modeling tool designed to assess how changes in key variables impact the break-even point of a business or project. It helps users evaluate the sensitivity of costs, prices, and sales volume to determine the minimum performance needed to avoid losses. This template is useful for making informed decisions, optimizing pricing strategies, and managing financial risks effectively.

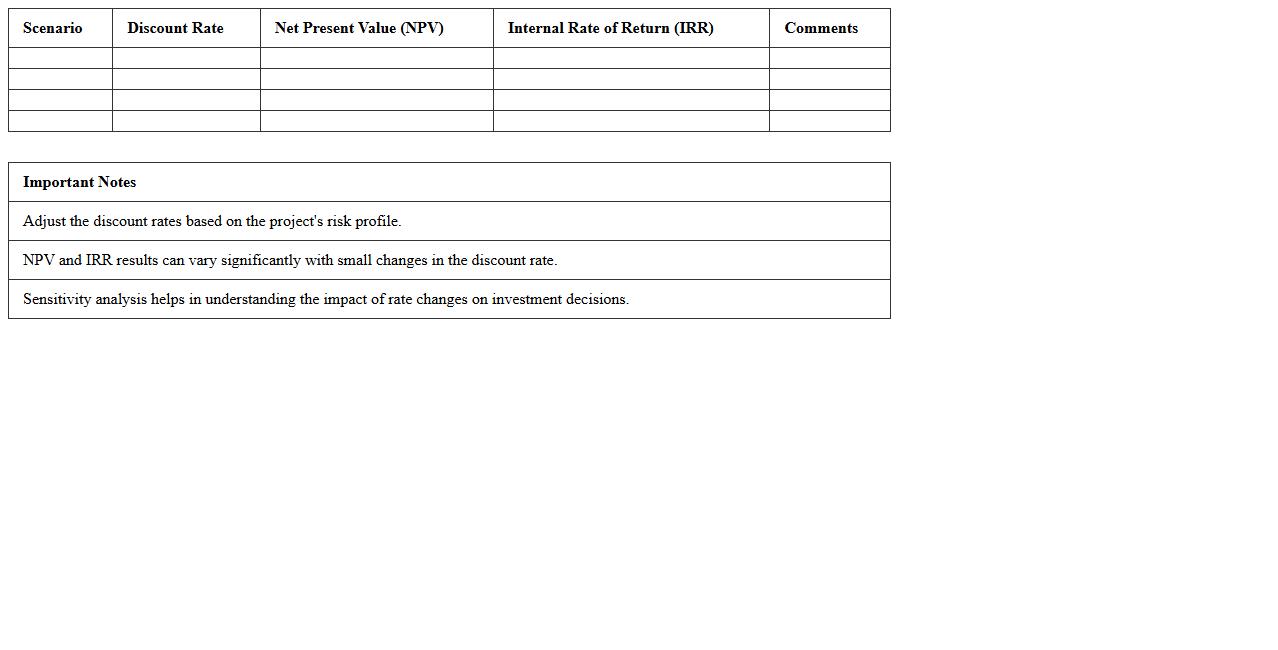

Discount Rate Sensitivity Analysis Excel Sheet

The

Discount Rate Sensitivity Analysis Excel Sheet document evaluates how changes in discount rates impact the net present value (NPV) or internal rate of return (IRR) of investment projects. This tool enables financial analysts and decision-makers to quantify risk by modeling various discount rate scenarios, helping to identify the threshold at which an investment remains profitable. By providing clear insights into rate fluctuations, it supports informed capital budgeting and financial planning processes.

Multi-Scenario Sensitivity Analysis Excel Template

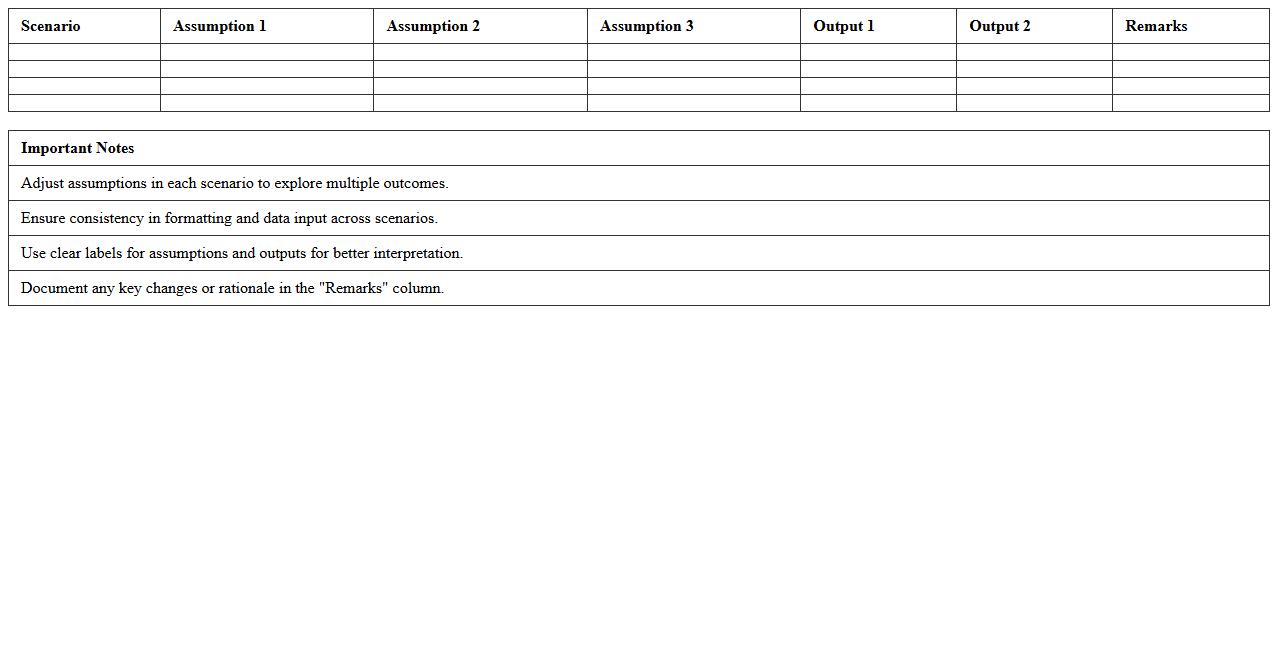

The

Multi-Scenario Sensitivity Analysis Excel Template is a powerful tool designed to evaluate how different variables impact your project's outcomes by analyzing multiple scenarios simultaneously. It allows users to input various parameters and observe potential effects on key performance indicators, enabling data-driven decision-making and risk assessment. This template streamlines complex sensitivity analysis, providing clear visualizations and comprehensive insights that enhance strategic planning and forecasting accuracy.

Construction Project Sensitivity Analysis Spreadsheet

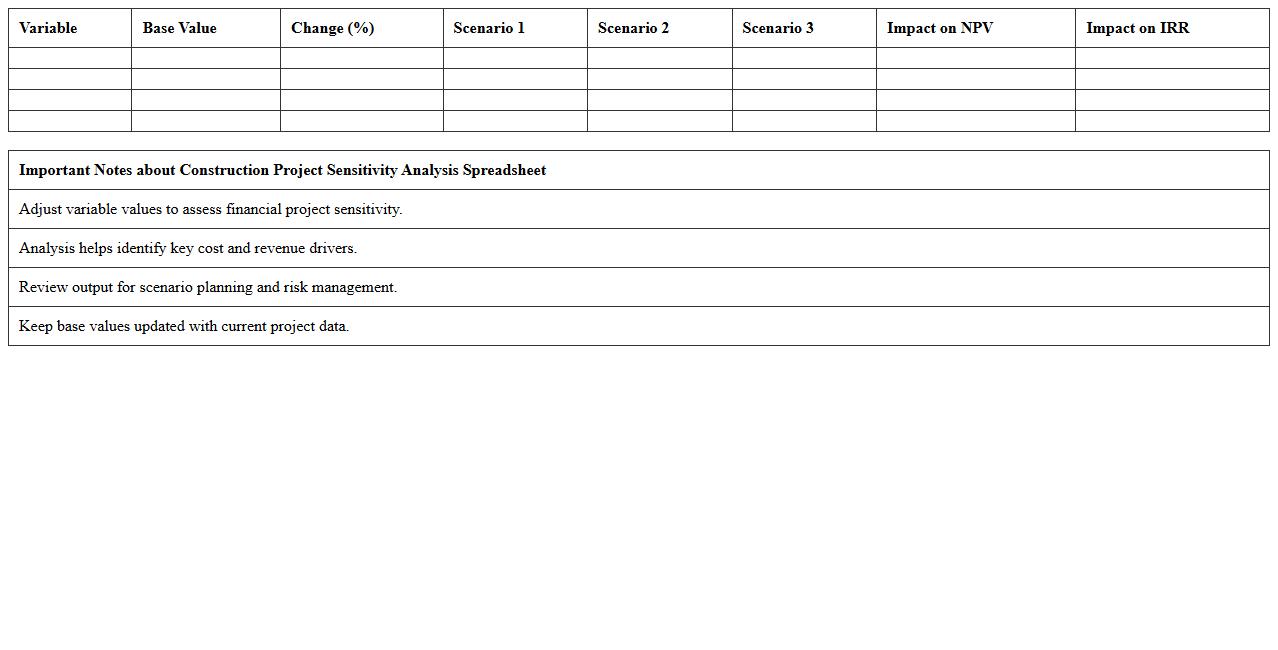

A

Construction Project Sensitivity Analysis Spreadsheet is a tool designed to evaluate how changes in key variables impact the overall project outcomes, such as costs, timelines, and resource allocation. By systematically adjusting factors like labor rates, material costs, and project duration, stakeholders can identify critical risk elements and prioritize mitigation strategies. This spreadsheet enhances decision-making by providing clear, data-driven insights into potential project uncertainties and their effects on profitability and schedule adherence.

Key Variables in Sensitivity Analysis

The letter identifies key variables such as initial investment cost, discount rate, and expected cash flows as critical for evaluating investment viability. These variables are highlighted due to their significant impact on the project's net present value (NPV). By focusing on these factors, the analysis captures the most influential elements affecting the investment outcome.

Quantifying Risk with Scenario Simulations

The letter explains risk impacts through scenario simulations embedded in the Excel file. These simulations model various economic and market conditions to project a range of possible investment results. This approach allows stakeholders to assess how different risk factors can influence financial performance.

Data Sources for Input Assumptions

The input assumptions for the sensitivity analysis are drawn from reliable data sources including historical financial records, market research reports, and industry benchmarks. These sources ensure that the model's assumptions are grounded in realistic and validated information. This reliability enhances the credibility of the investment evaluation.

Communication of Threshold Values

Threshold values crucial for making investment decisions are clearly communicated in the document through decision boundaries and sensitivity charts. These values indicate points at which project outcomes shift from favorable to unfavorable. By defining these thresholds, the letter facilitates informed decision-making under uncertainty.

Limitations of the Excel Sensitivity Model

The letter discloses key limitations of the Excel sensitivity model, such as its reliance on linear assumptions and the exclusion of unforeseen external shocks. It also notes the model's dependency on the accuracy of input data, which may vary over time. Recognizing these constraints helps users interpret the results with appropriate caution.

More Analysis Excel Templates