The Asset Allocation Excel Template for Financial Advisors is a powerful tool designed to help professionals efficiently manage and diversify client portfolios. This customizable template enables quick analysis of asset distribution across various investment categories, ensuring balanced risk and optimal returns. Financial advisors can easily update data, track performance, and generate detailed reports to support informed decision-making.

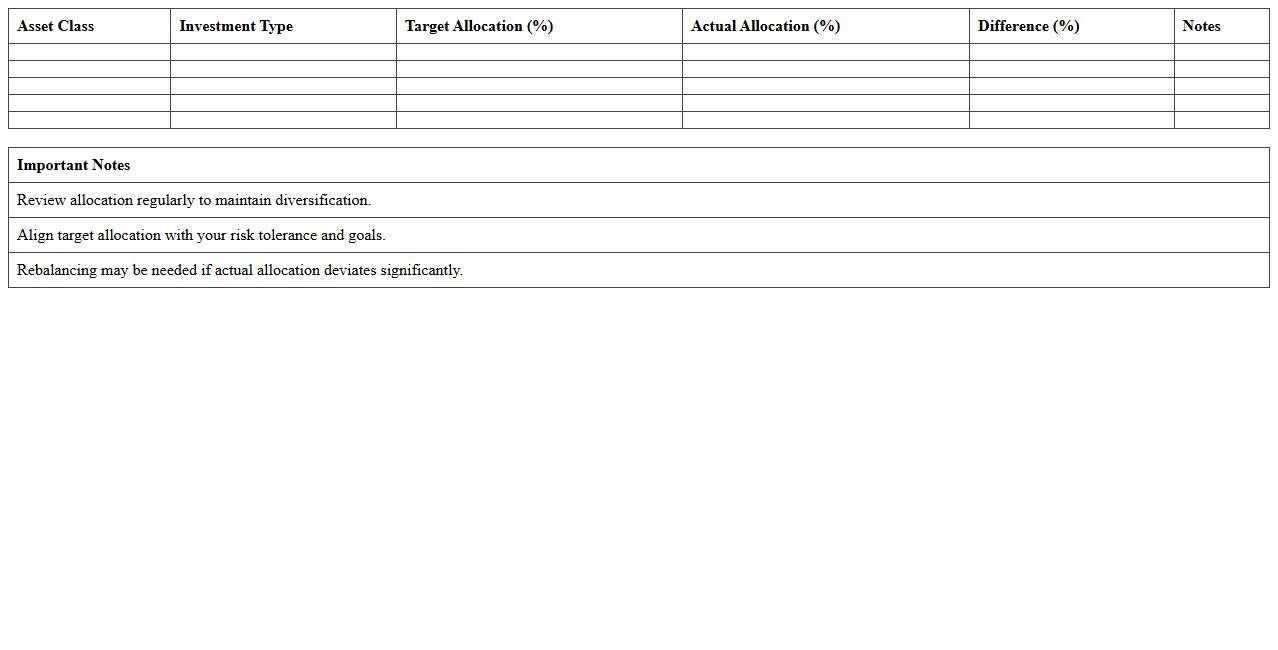

Diversified Portfolio Asset Allocation Excel Template

The

Diversified Portfolio Asset Allocation Excel Template is a powerful tool designed to help investors strategically distribute their investments across various asset classes, balancing risk and return. It enables users to visualize portfolio diversification, track asset performance, and adjust allocations based on market conditions or investment goals. This template is essential for optimizing portfolio management, enhancing decision-making, and maximizing long-term financial growth.

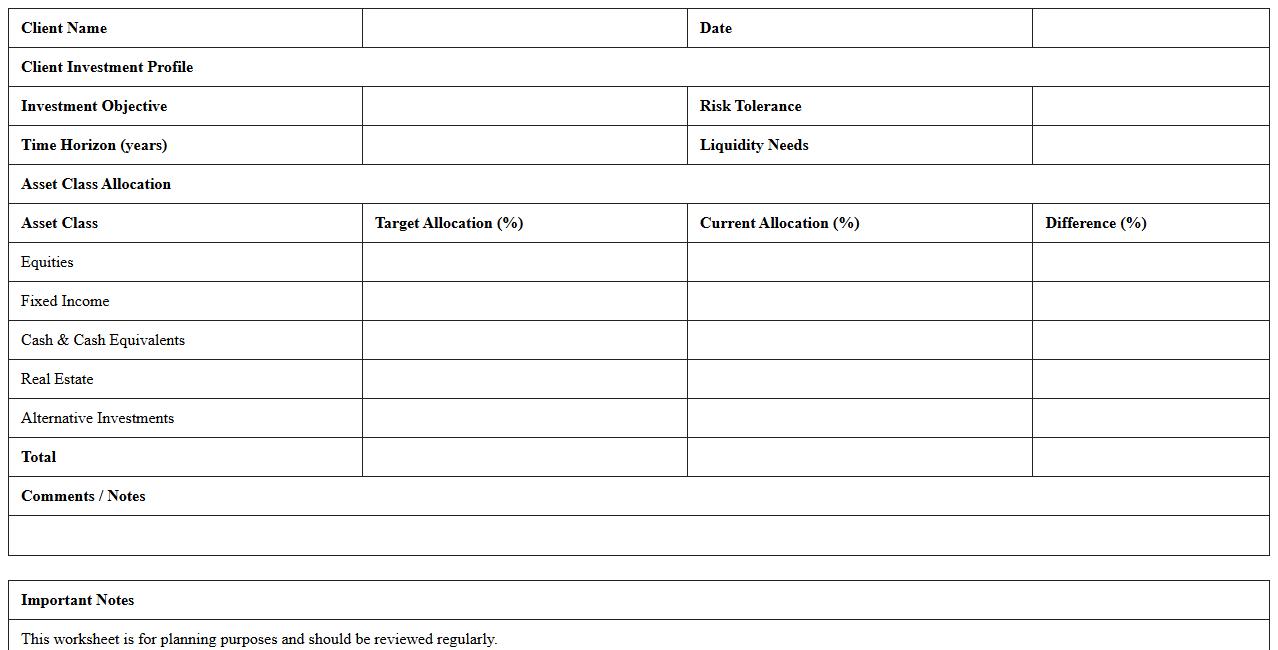

Client-Specific Asset Class Allocation Worksheet

The

Client-Specific Asset Class Allocation Worksheet is a detailed financial tool designed to map out an individual's or institution's investment portfolio across various asset classes such as stocks, bonds, and cash equivalents. It helps in identifying the optimal distribution of assets tailored to the client's risk tolerance, financial goals, and investment timeline, enhancing portfolio diversification and balance. This worksheet is essential for making informed decisions that align with personalized investment strategies and improving the overall effectiveness of portfolio management.

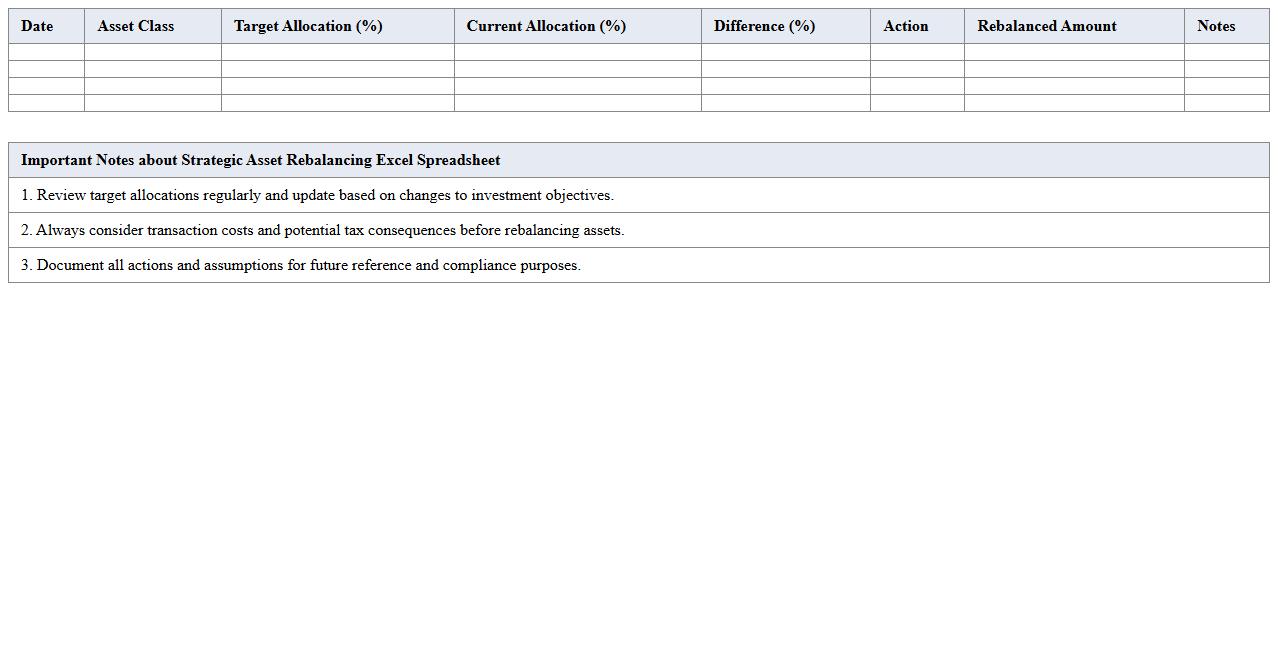

Strategic Asset Rebalancing Excel Spreadsheet

The

Strategic Asset Rebalancing Excel Spreadsheet document is a tool designed to help investors systematically adjust their portfolio allocations to maintain desired risk levels and investment goals. It enables users to track asset performance, identify deviations from target weights, and plan rebalancing actions efficiently. By using this spreadsheet, individuals and financial advisors can optimize portfolio returns while managing risk through disciplined and data-driven decision-making.

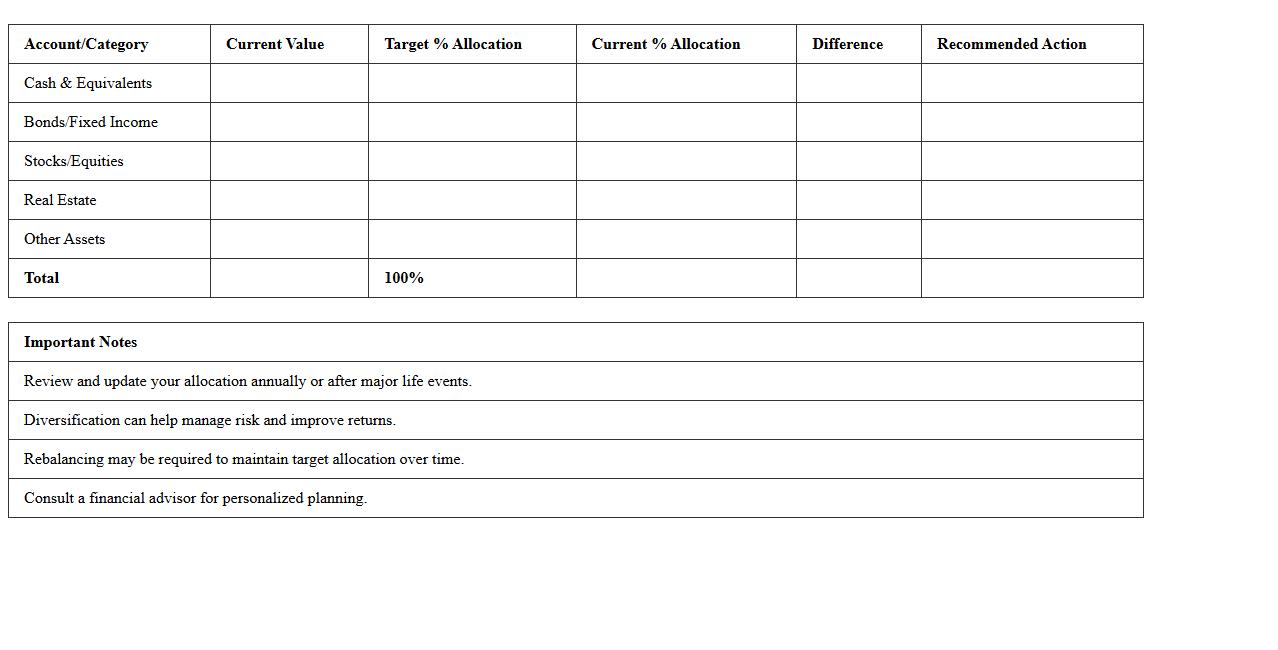

Investment Asset Tracking and Allocation Model

The

Investment Asset Tracking and Allocation Model document provides a comprehensive framework for monitoring the performance, distribution, and risk management of various investment assets within a portfolio. It enables investors and financial managers to make data-driven decisions by offering detailed insights into asset allocation strategies, historical trends, and real-time tracking of investments. This model enhances portfolio optimization, ensuring that assets are aligned with financial goals and risk tolerance levels.

Retirement Asset Allocation Planning Template

A

Retirement Asset Allocation Planning Template is a structured document designed to help individuals strategically distribute their investment portfolio across various asset classes to meet their retirement goals. It enables users to analyze risk tolerance, time horizon, and expected returns, ensuring a balanced approach to preserve capital while seeking growth. Utilizing this template promotes disciplined financial planning, reduces investment guesswork, and enhances the likelihood of achieving a stable and sufficient retirement income.

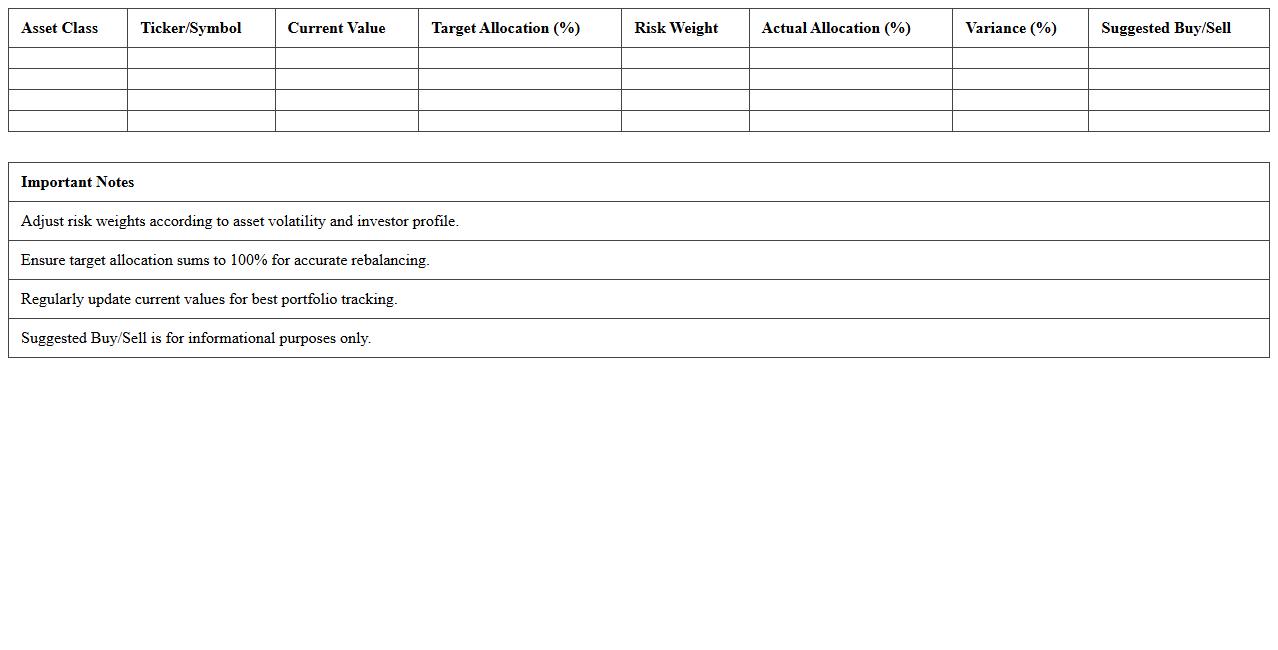

Risk-Based Asset Allocation Excel Tool

The

Risk-Based Asset Allocation Excel Tool document provides a structured framework for evaluating and adjusting investment portfolios according to varying levels of risk tolerance and market conditions. It enables users to input asset details, risk parameters, and expected returns to generate optimized allocation strategies that balance potential gains with acceptable risk exposure. This tool is essential for investors and financial analysts seeking data-driven methods to enhance portfolio performance while managing downside risks effectively.

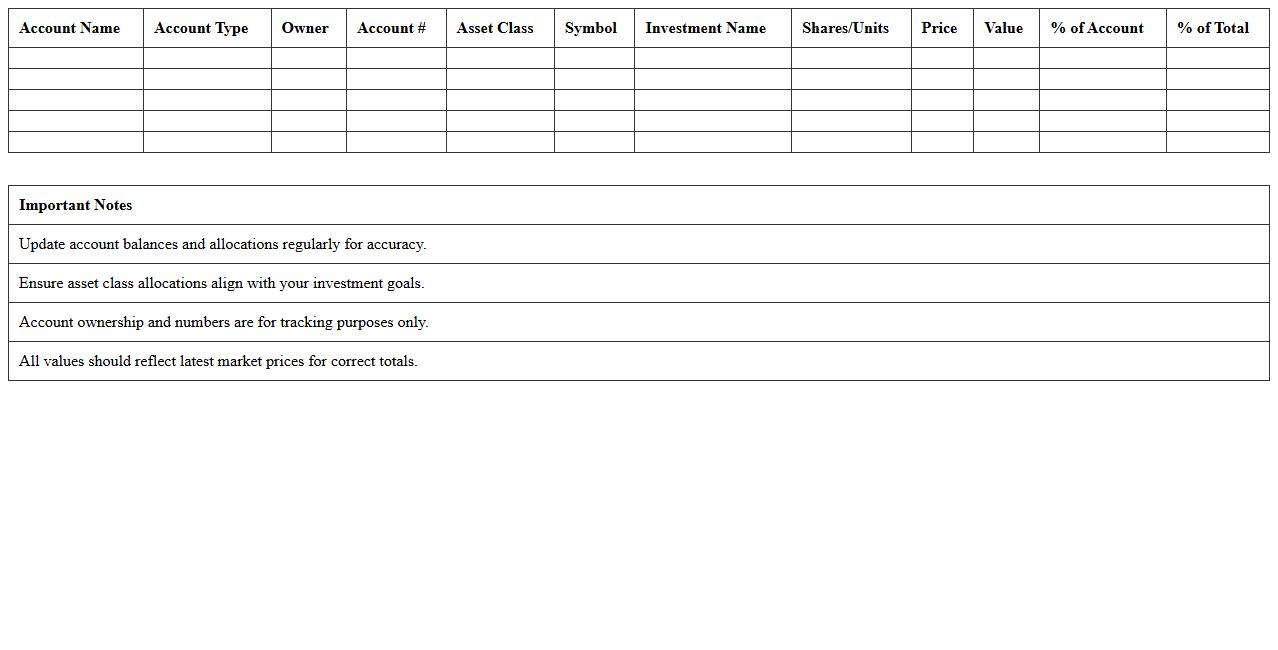

Multi-Account Asset Allocation Summary Sheet

The

Multi-Account Asset Allocation Summary Sheet document provides a consolidated overview of asset distributions across multiple investment accounts, enabling investors to monitor diversification and risk exposure efficiently. It helps identify imbalances by displaying asset classes, allocation percentages, and market values in one centralized report, facilitating informed decision-making. This summary sheet aids portfolio managers and individual investors in aligning investments with financial goals and adjusting strategies to optimize returns.

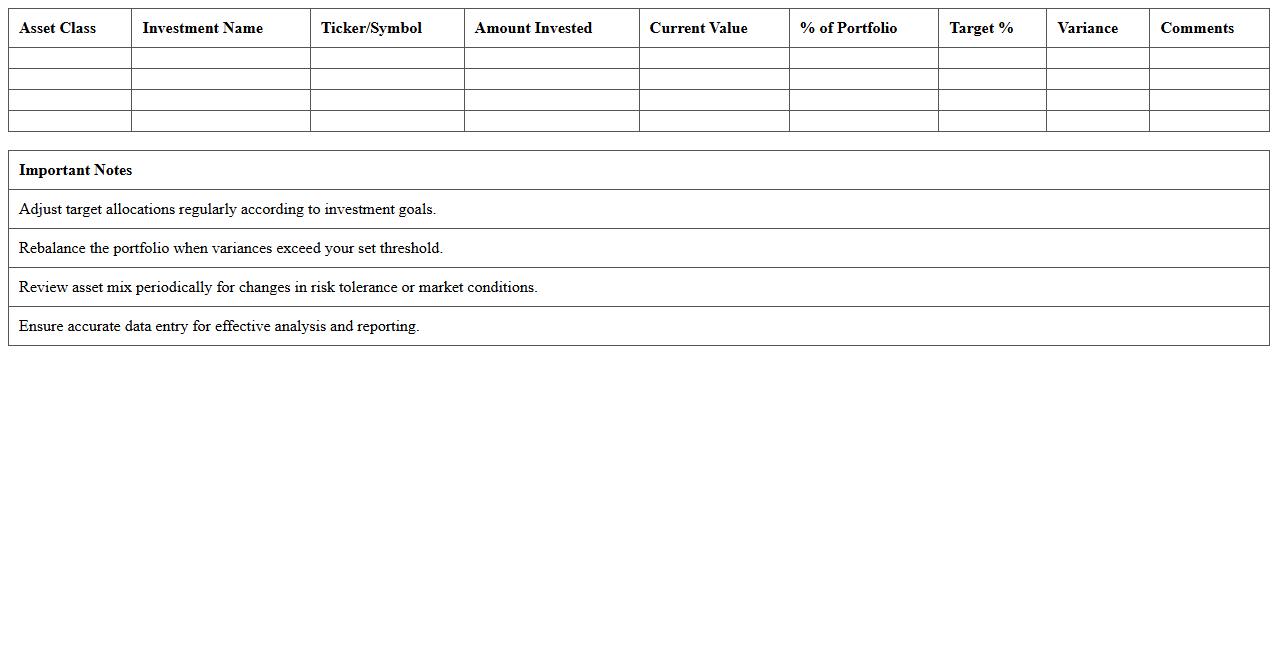

Portfolio Asset Mix Analysis Excel Template

The

Portfolio Asset Mix Analysis Excel Template is a dynamic tool designed to evaluate and visualize the distribution of assets within an investment portfolio. It enables users to systematically analyze asset allocation, risk exposure, and diversification by inputting various financial data points. This template helps investors and financial analysts optimize portfolio performance and make informed decisions by providing clear insights into asset proportions and correlations.

Quarterly Asset Allocation Performance Tracker

The

Quarterly Asset Allocation Performance Tracker document systematically monitors investment distribution across various asset classes, highlighting gains, losses, and overall portfolio performance every three months. It provides investors and portfolio managers with data-driven insights to evaluate the effectiveness of their allocation strategies and make informed adjustments in response to market conditions. This ongoing performance analysis enhances risk management, ensures alignment with financial goals, and supports optimized investment returns over time.

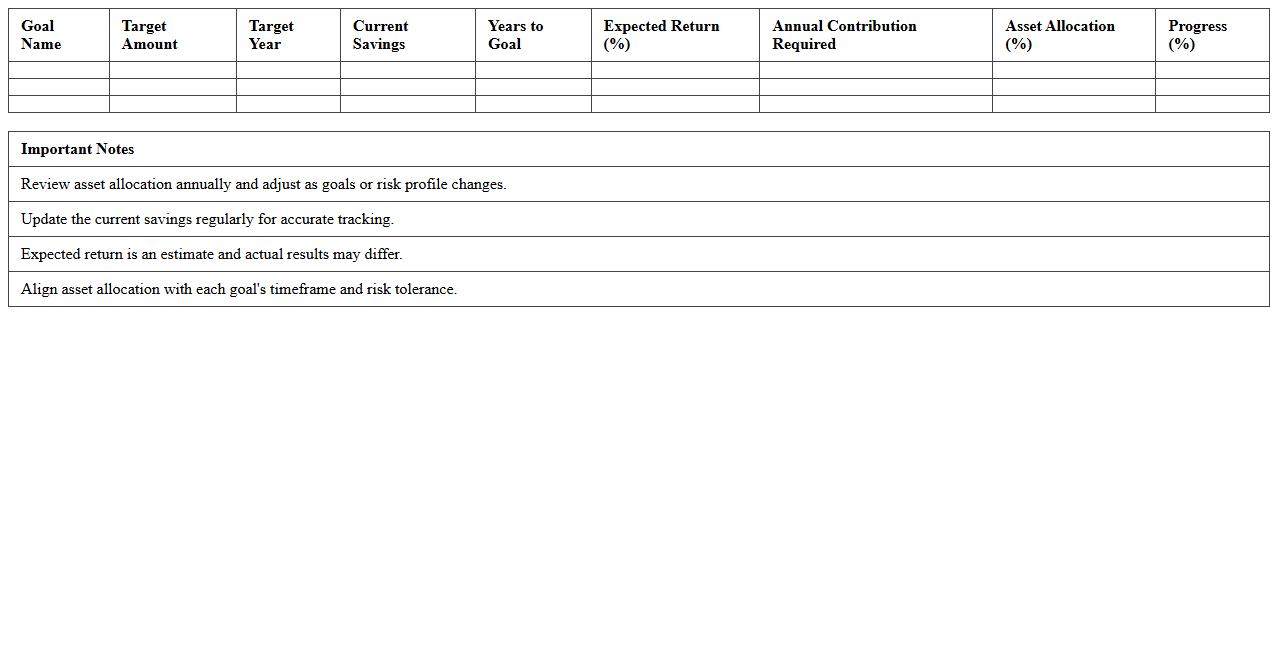

Goal-Oriented Asset Allocation Excel Planner

The

Goal-Oriented Asset Allocation Excel Planner document is a financial tool designed to help users strategically distribute their investments based on specific financial goals. By inputting variables such as risk tolerance, investment horizon, and target returns, the planner provides a customized asset allocation that aligns with the user's objectives. This approach enhances portfolio efficiency, improves decision-making, and aids in tracking progress toward achieving long-term financial targets.

How can I automate rebalancing alerts in an Asset Allocation Excel template for clients?

To automate rebalancing alerts in Excel, use conditional formatting combined with formulas that compare current asset percentages against target allocations. Implement formulas like ABS(Current% - Target%) > Threshold to trigger alerts. These alerts help clients maintain portfolio balance efficiently without manual checks.

What Excel formulas optimize tax efficiency tracking in advisor asset allocation reports?

Excel formulas such as SUMIFS and IFERROR are vital for tracking tax efficiency by aggregating realized gains and losses by asset type or account. Using formulas that calculate after-tax returns and tax drag provides deeper insights into portfolio performance. This automation streamlines advisor reports, highlighting tax-smart investment decisions.

How do I integrate Monte Carlo simulations into my Asset Allocation Excel for risk assessment?

Integrate Monte Carlo simulations by using Excel's RAND and NORMINV functions to generate thousands of randomized returns based on historical asset volatility and correlation. Analyze these simulated outcomes to estimate portfolio risk and probabilities of achieving investment goals. This approach enhances risk assessment within the asset allocation process.

What VBA scripts streamline client-specific asset class customization in advisor spreadsheets?

VBA scripts enable dynamic asset class customization by automating input forms and adjusting calculation ranges based on client preferences. Scripts can validate user inputs and update charts and tables without manual revisions. This tailored automation improves efficiency and client-specific portfolio management.

How can I visualize sector drift over time using dynamic charts in Excel asset allocation letters?

Dynamic charts using Excel's PivotTables and slicers effectively display sector drift by showing changes in sector weights across dates. Combine these tools with line or area charts to visualize trends clearly over time for client reports. This technique provides intuitive insights into portfolio shifts and market movements.

More Allocation Excel Templates