The Tax Deduction Summary Excel Template for Freelancers helps track business expenses and manage tax deductions efficiently. It simplifies expense categorization and calculates deductible amounts to maximize tax savings. Freelancers can easily organize financial data for accurate tax filing and better financial planning.

Freelance Tax Deduction Tracker Spreadsheet

A

Freelance Tax Deduction Tracker Spreadsheet is a digital tool designed to organize and record deductible expenses specific to freelance work, such as equipment costs, travel expenses, and home office deductions. This spreadsheet helps freelancers accurately track their tax-deductible expenses throughout the year, ensuring they maximize deductions and reduce taxable income. Using this document can simplify tax filing, improve financial organization, and prevent missed opportunities for tax savings.

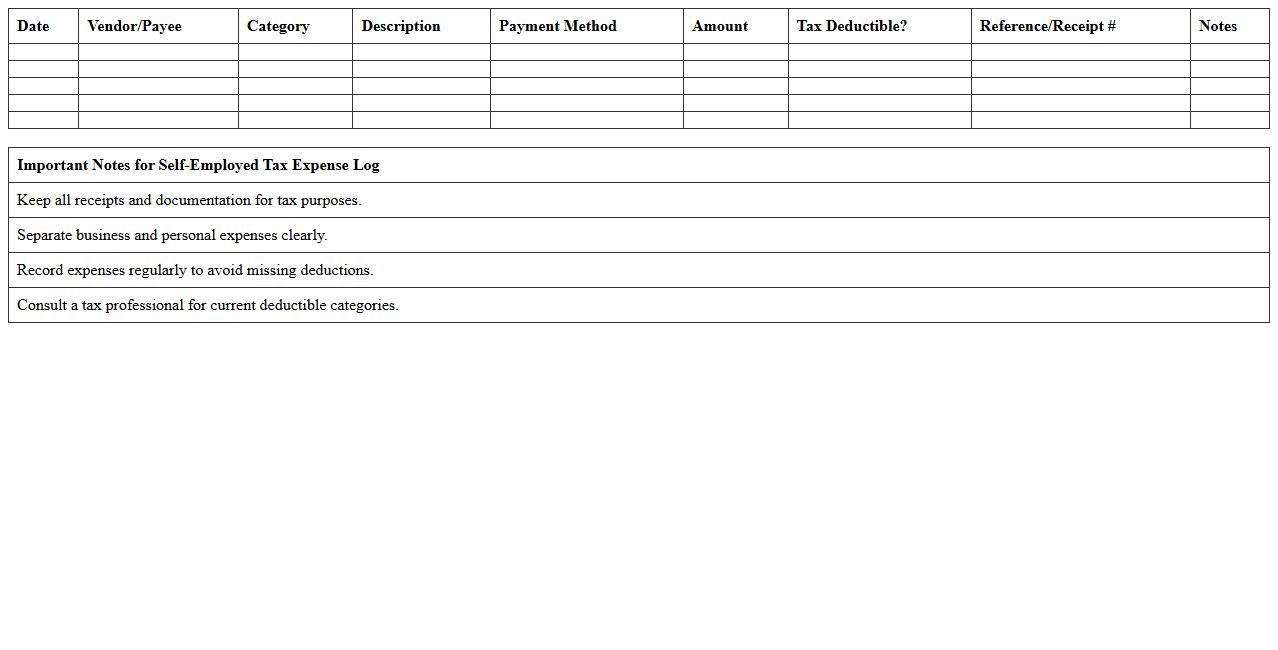

Self-Employed Tax Expense Log Excel

The

Self-Employed Tax Expense Log Excel document is a structured tool designed to help individuals track and categorize their business expenses throughout the tax year. By systematically recording deductible expenses such as office supplies, travel costs, and professional fees, it ensures accurate tax reporting and maximizes potential deductions. Using this log simplifies tax preparation, reduces errors, and supports compliance with IRS regulations for self-employed taxpayers.

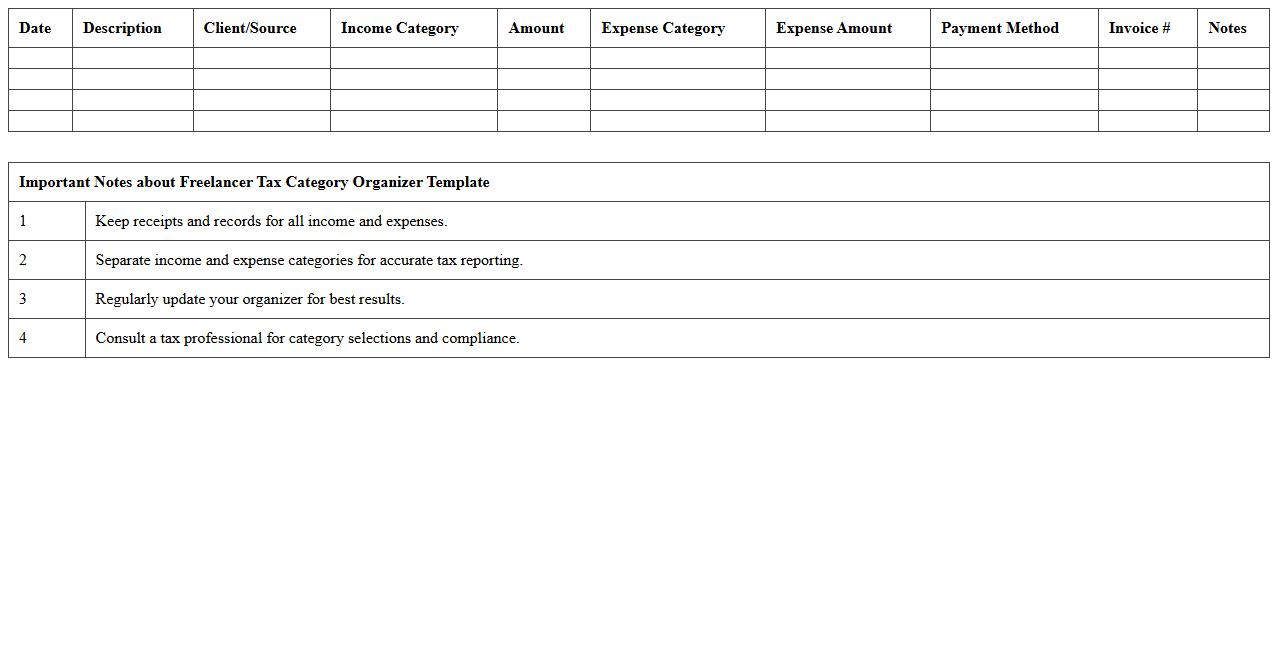

Freelancer Tax Category Organizer Template

The

Freelancer Tax Category Organizer Template is a structured document designed to help freelancers categorize and track their income and expenses for tax purposes efficiently. It organizes financial data into specific tax categories, making it easier to identify deductible expenses and prepare accurate tax filings. This template minimizes errors, saves time during tax season, and ensures compliance with tax regulations by maintaining detailed and organized records.

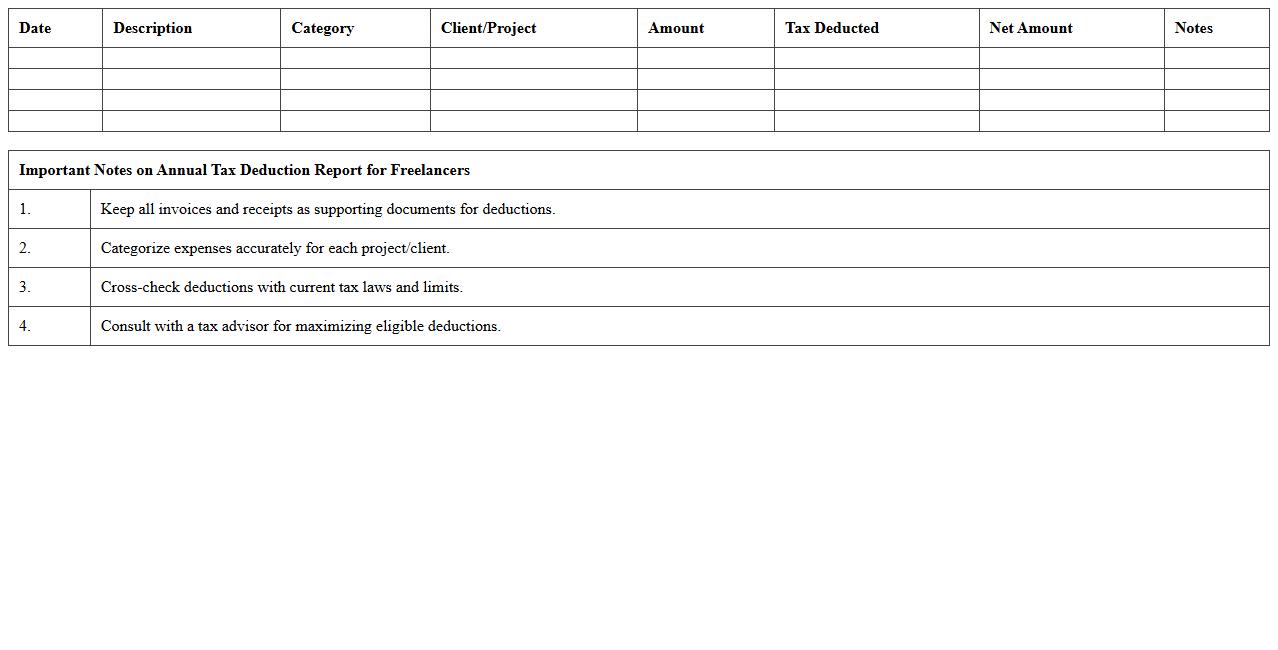

Annual Tax Deduction Report for Freelancers

The

Annual Tax Deduction Report for Freelancers is a detailed document summarizing all tax deductions applied to a freelancer's income over a fiscal year. This report provides essential data for accurate tax filing, ensuring freelancers claim eligible deductions and avoid penalties for underreported income. It serves as a reliable reference for managing finances, planning taxes, and maintaining compliance with tax authorities.

Itemized Tax Deduction Worksheet for Freelancers

The

Itemized Tax Deduction Worksheet for Freelancers is a detailed document that helps self-employed individuals track and organize deductible expenses related to their freelance work. By systematically categorizing expenses such as office supplies, travel costs, and professional services, freelancers can accurately report itemized deductions on their tax returns. This worksheet ensures maximized tax savings and simplifies the process of tax filing by providing clear documentation for potential audits.

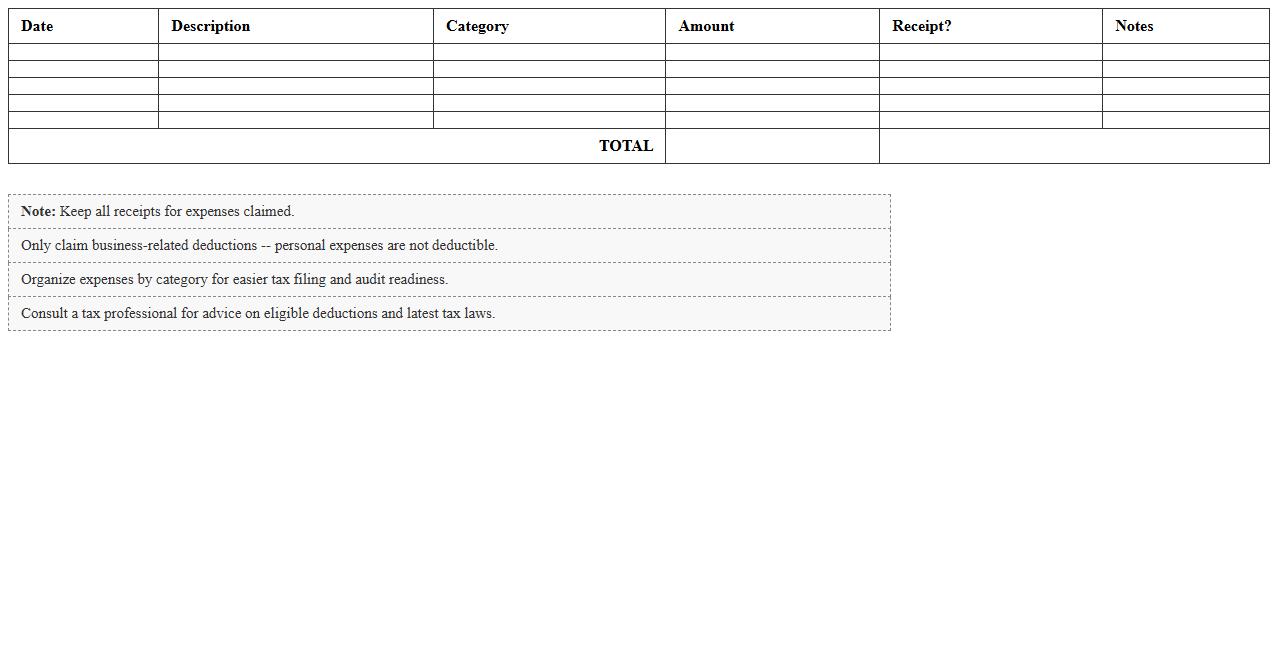

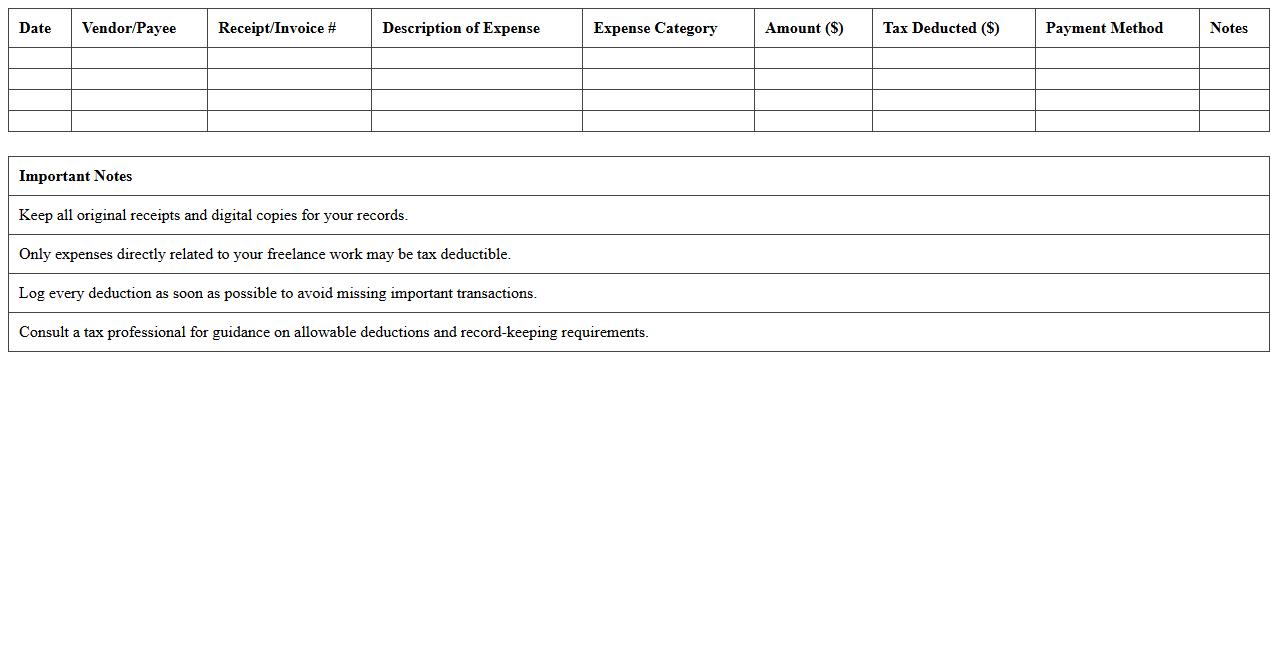

Tax Deduction Receipt Log for Freelancers

The

Tax Deduction Receipt Log for Freelancers is a detailed document that tracks all receipts related to tax-deductible expenses incurred during freelance work. It helps freelancers organize and verify their deductions accurately when filing taxes, ensuring compliance with tax regulations and maximizing eligible savings. Maintaining this log simplifies record-keeping, supports audit readiness, and enhances financial management by providing clear evidence of deductible transactions.

Freelance Income & Deduction Tracker Template

The

Freelance Income & Deduction Tracker Template is a structured document designed to help freelancers accurately record and categorize their earnings and business-related expenses. It simplifies financial management by organizing income streams and deductible costs, ensuring comprehensive tracking for tax preparation and budget analysis. Using this template enhances financial accuracy, reduces the risk of missed deductions, and supports better cash flow management for independent professionals.

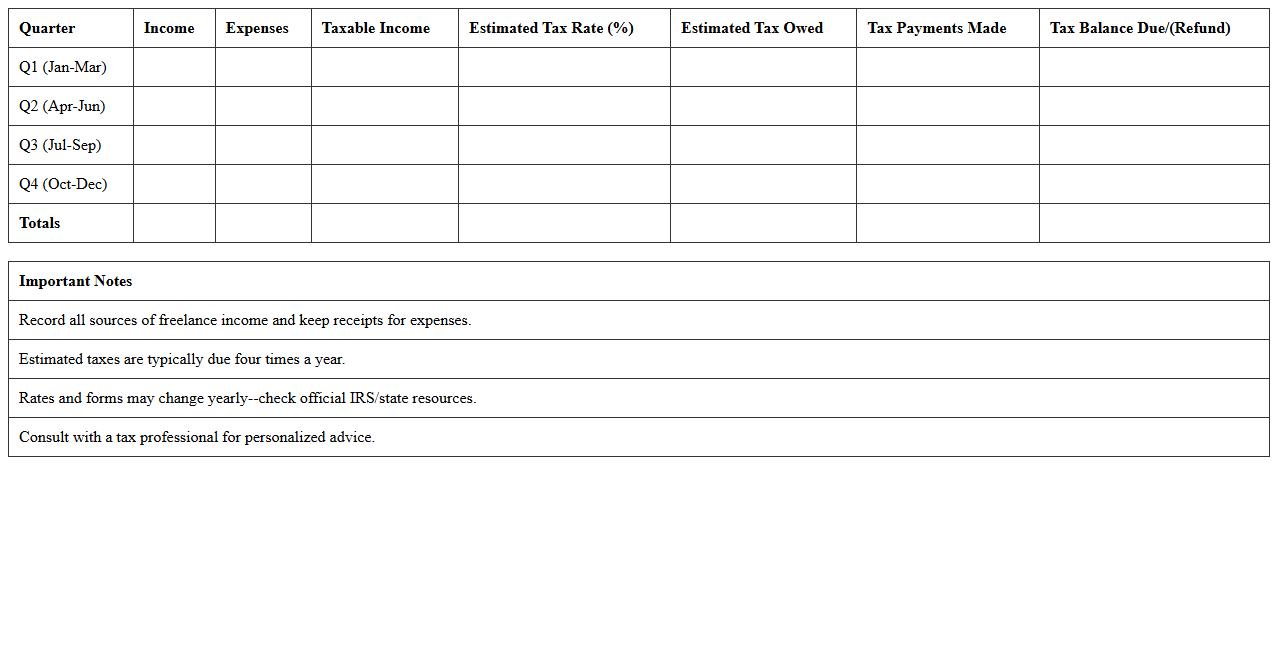

Quarterly Freelancer Tax Summary Spreadsheet

The

Quarterly Freelancer Tax Summary Spreadsheet is a detailed financial tool designed to track income, expenses, and tax obligations for freelancers over three-month periods. It helps simplify the complex process of tax calculation by organizing data systematically, ensuring accurate quarterly tax filings and preventing penalties from underpayment. Using this spreadsheet enhances financial management, enabling freelancers to monitor cash flow, optimize deductions, and plan for tax liabilities efficiently.

Home Office Deduction Tracker Excel

The

Home Office Deduction Tracker Excel document is a systematic tool designed to help individuals and small business owners accurately track expenses related to their home office space. It organizes data such as utility bills, rent, maintenance costs, and office supplies, ensuring precise calculation of deductible amounts for tax purposes. This document simplifies tax preparation, maximizes eligible deductions, and supports compliance with IRS regulations by maintaining detailed and organized financial records.

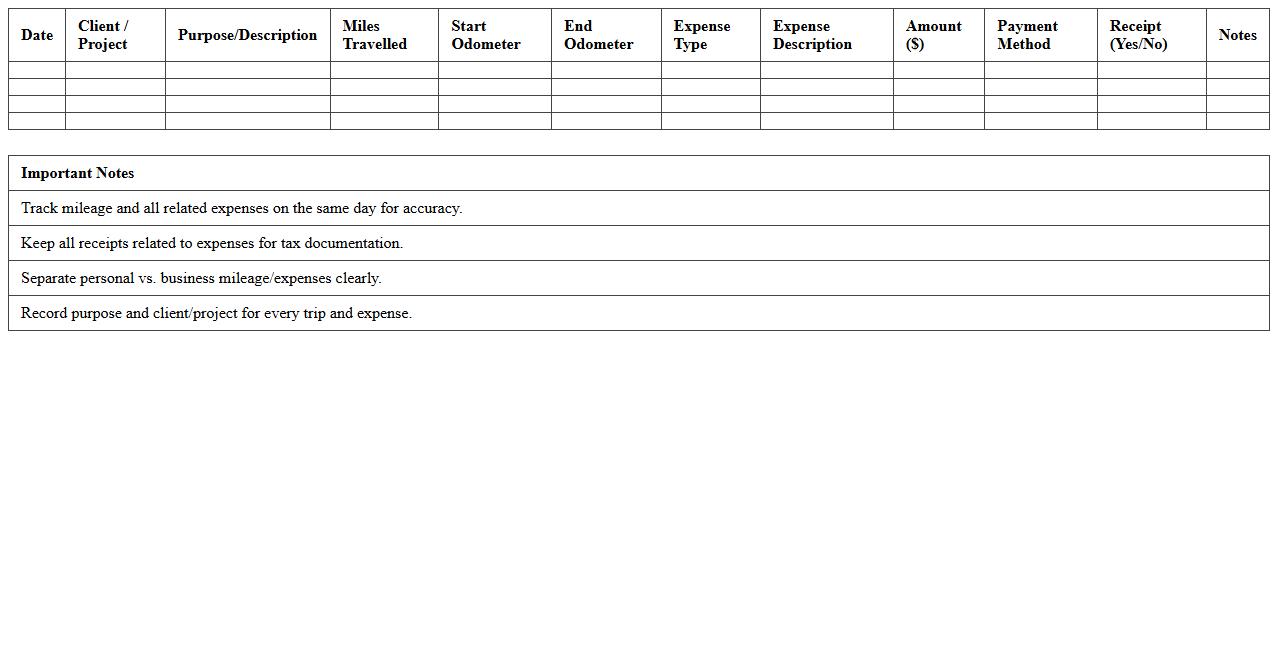

Freelancer Mileage & Expense Tax Log Sheet

A

Freelancer Mileage & Expense Tax Log Sheet is a detailed record-keeping document that tracks business-related mileage and expenses for tax deductions and reimbursement purposes. It helps freelancers accurately document costs, ensuring compliance with tax regulations and maximizing deductible expenses. This log sheet simplifies financial management by organizing trip data, expense receipts, and mileage calculations in one comprehensive format.

What are the essential columns to include in a tax deduction summary Excel sheet for freelancers?

An effective tax deduction summary for freelancers should include columns like Date, Expense Description, and Category. These columns help keep track of when and what type of expenses were incurred. Including Amount and Receipt Attached columns ensures accuracy and proper documentation for tax claims.

How to automate receipt matching to expenses in a freelancer's tax deduction summary?

Automating receipt matching can be achieved by using Excel's data validation and hyperlink features to link scanned receipts directly to expense entries. Employing VBA macros or Excel add-ins can further streamline this process, reducing manual effort. This automation improves accuracy and ensures that every expense has corresponding proof.

Which Excel formulas best calculate category-wise deductible totals for freelance income?

The SUMIF and SUMIFS functions are ideal for calculating totals based on expense categories. These formulas sum amounts that meet specific criteria, such as all expenses in 'Travel' or 'Office Supplies'. Using these correctly helps freelancers efficiently analyze deductible amounts by category.

How to segregate business vs. personal expenses in a freelancer's deduction summary sheet?

Creating a Category column with dropdown options like 'Business' and 'Personal' enables easy segregation. Using filters or conditional formatting can then visually distinguish these expenses. This ensures clear separation to comply with tax reporting standards.

What are the top tax-deductible items freelancers often miss logging in Excel summaries?

Many freelancers overlook home office expenses, software subscriptions, and internet costs in their tax summaries. These items, though small, add significant deductible value when correctly tracked. Regularly reviewing and updating Excel sheets helps capture these frequently missed deductions.

More Summary Excel Templates