Monthly Client Payment Tracker Spreadsheet

A

Monthly Client Payment Tracker Spreadsheet is a document designed to record and monitor client payments on a monthly basis, ensuring accurate financial tracking and improved cash flow management. It allows businesses to easily identify overdue payments, forecast revenue, and maintain organized financial records for accounting purposes. Using this spreadsheet enhances transparency and accountability in client transactions, ultimately supporting better decision-making and financial planning.

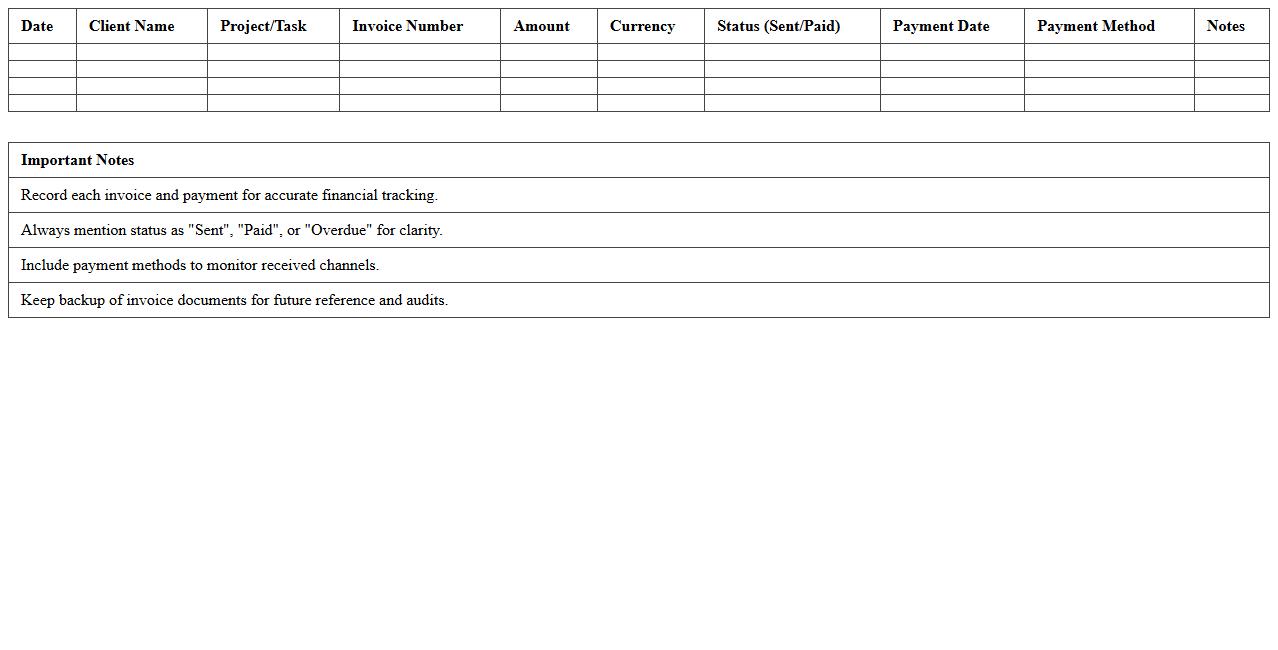

Freelancer Invoice & Payment Log Sheet

A

Freelancer Invoice & Payment Log Sheet is a document that tracks billable hours, invoiced amounts, and payments received from clients. It helps freelancers maintain organized financial records, ensuring accurate billing and timely payment follow-ups. Using this log sheet simplifies income management, improves cash flow visibility, and supports accurate tax filing.

Client Payment Status Monitoring Template

The

Client Payment Status Monitoring Template document is a structured tool designed to track and manage client payments efficiently. It provides clear visibility into outstanding invoices, payment deadlines, and payment history, enabling timely follow-ups and reducing the risk of delayed payments. Using this template enhances cash flow management and strengthens client relationships by ensuring accurate and transparent financial communication.

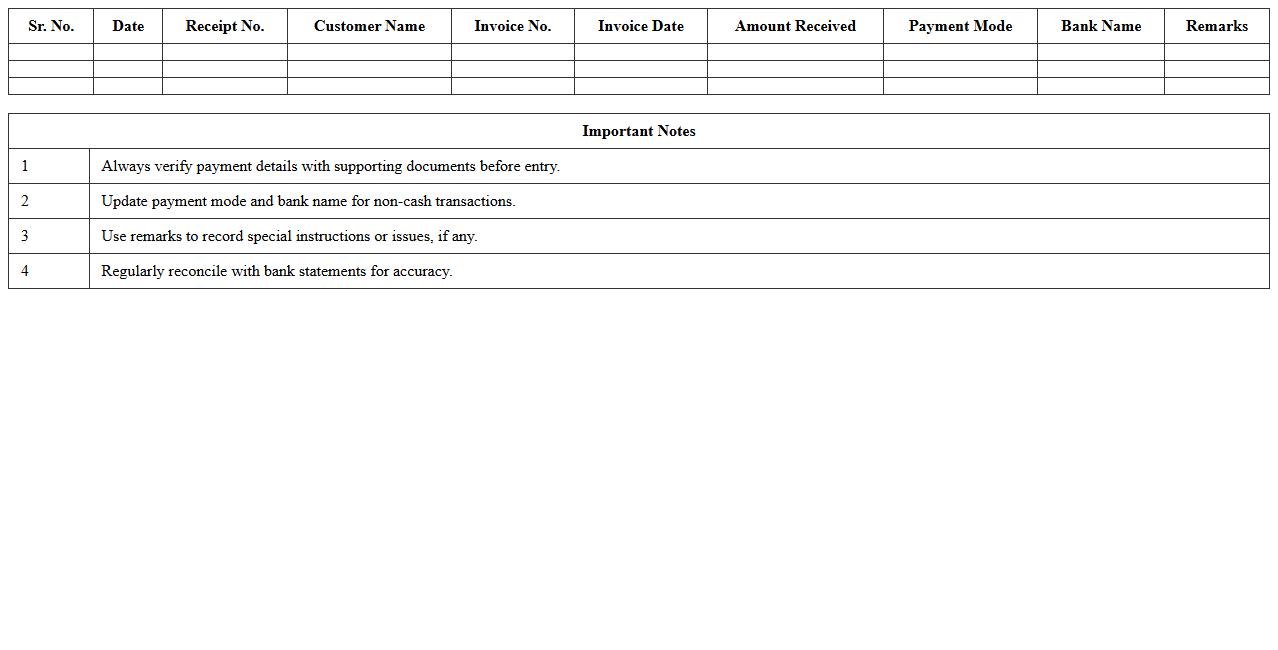

Payment Received Summary Excel Sheet

A

Payment Received Summary Excel Sheet document is a tool used to systematically record and track all payments received from clients or customers. It helps businesses maintain accurate financial records, monitor cash flow, and reconcile accounts efficiently. By summarizing transaction details such as payment date, amount, payer, and method, it streamlines financial reporting and aids in quick decision-making.

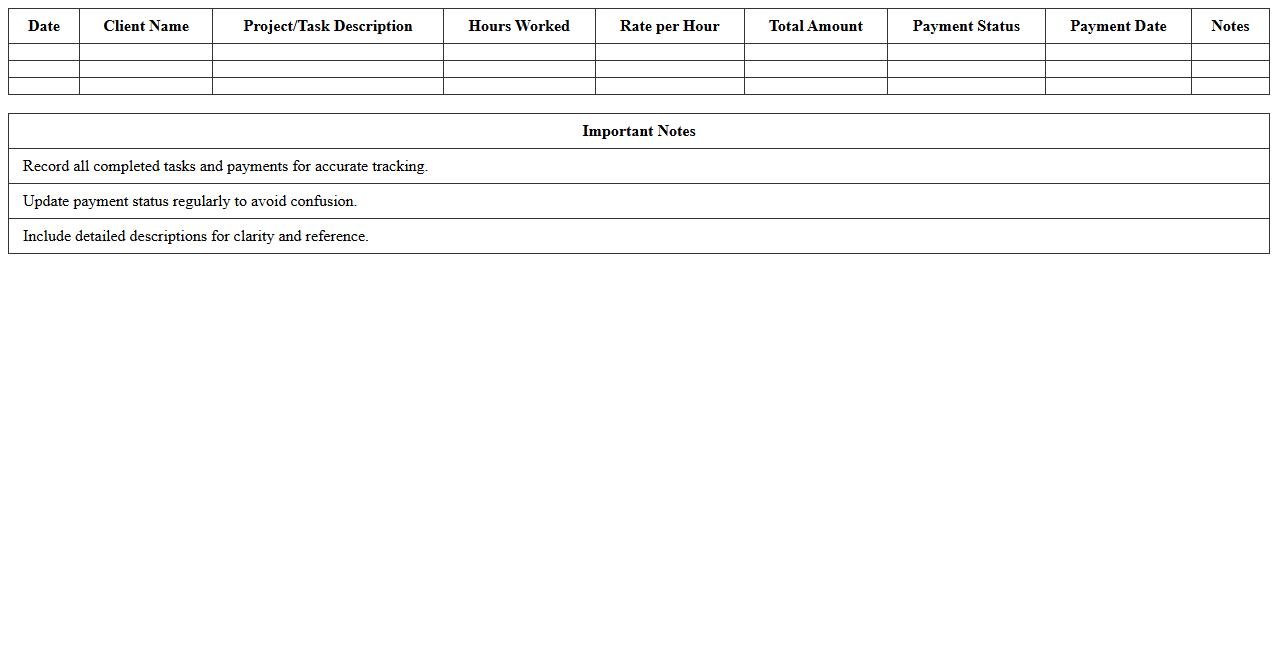

Freelance Work Payment Record Template

A

Freelance Work Payment Record Template is a structured document designed to track payments made to freelance workers, detailing project names, payment dates, amounts, and payment methods. This template helps maintain accurate financial records, ensuring timely and organized payments while simplifying tax reporting and budget management. Using this tool enhances transparency and accountability between clients and freelancers, streamlining the payment process effectively.

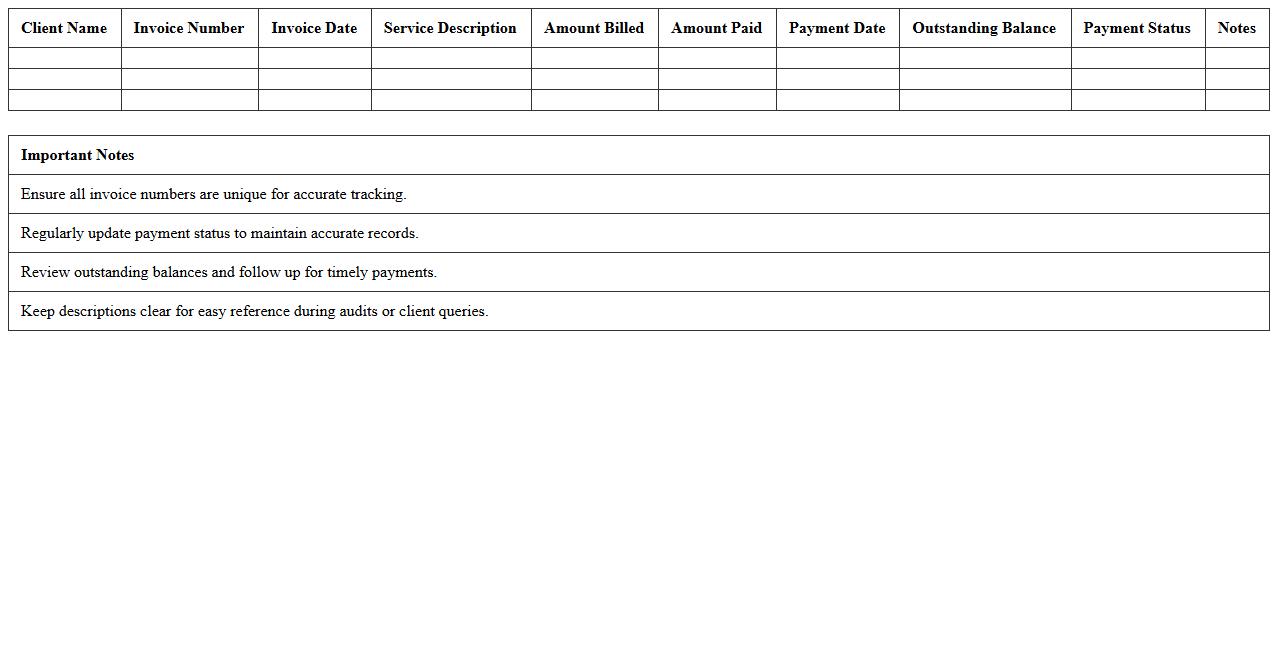

Client Billing and Payment Overview Excel

The

Client Billing and Payment Overview Excel document is a comprehensive tool designed to track and manage client invoices, payment statuses, and outstanding balances efficiently. It consolidates billing data into organized sheets, enabling quick access to financial information, which aids in accurate forecasting and cash flow management. Utilizing this document streamlines account reconciliation processes, reduces billing errors, and improves client relationship management through clear payment tracking.

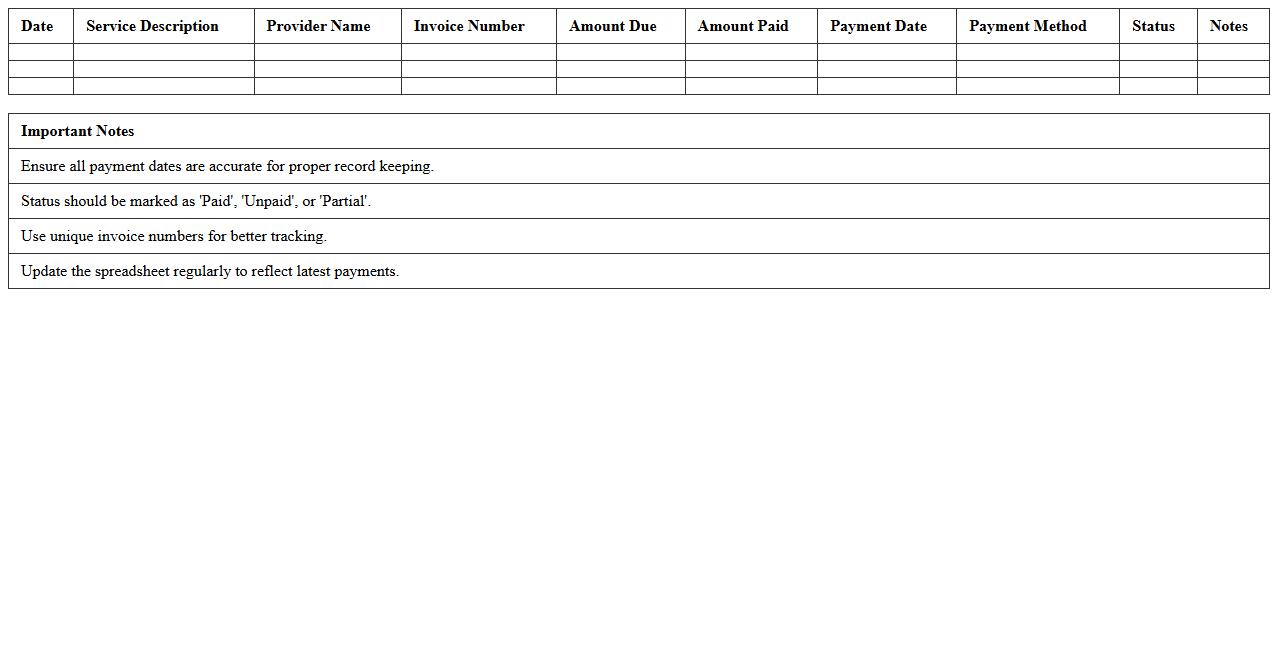

Service Payment History Spreadsheet

A

Service Payment History Spreadsheet is a detailed document that records all past transactions and payments related to services received or rendered. It helps in tracking payment dates, amounts, and outstanding balances, ensuring accurate financial management and easy reconciliation of accounts. This spreadsheet is useful for budgeting, auditing, and maintaining transparency in financial dealings.

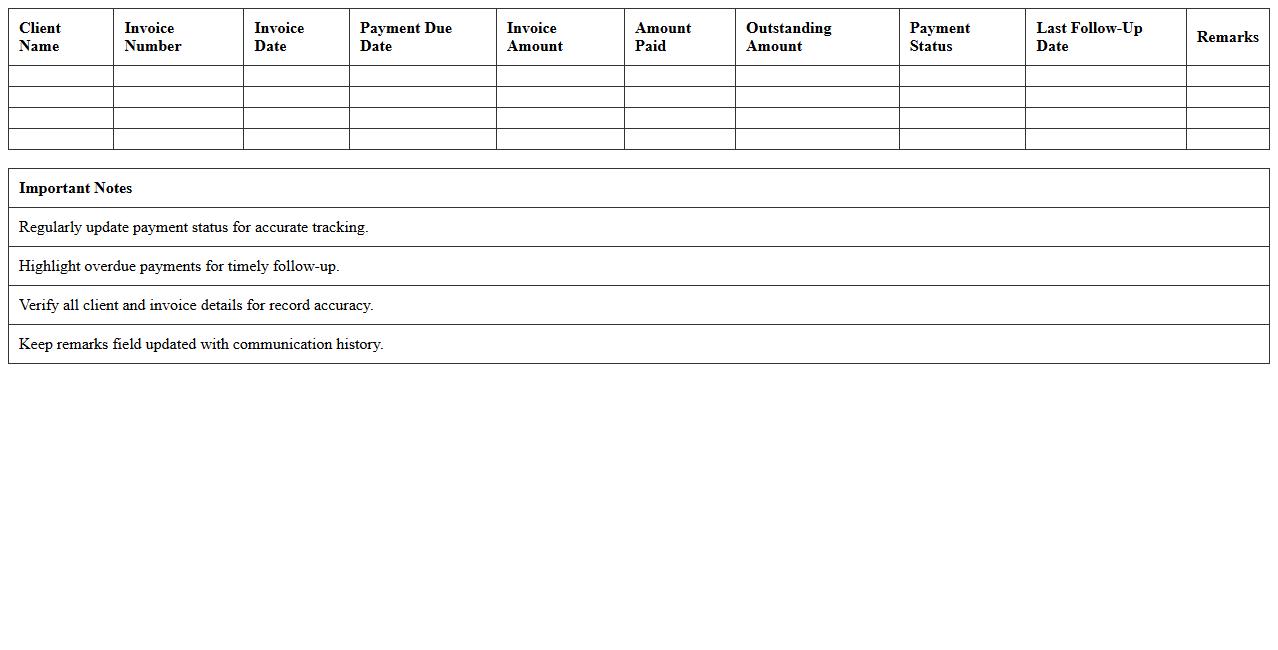

Freelancers’ Payment Due Tracker Sheet

The

Freelancers' Payment Due Tracker Sheet is a detailed document designed to monitor outstanding payments owed to freelancers, ensuring timely follow-ups and accurate financial management. It organizes key data such as invoice numbers, payment due dates, client details, and payment statuses, optimizing cash flow tracking and reducing the risk of delayed payments. Using this tracker enhances accountability and streamlines the payment collection process, making financial oversight more efficient for businesses and independent contractors.

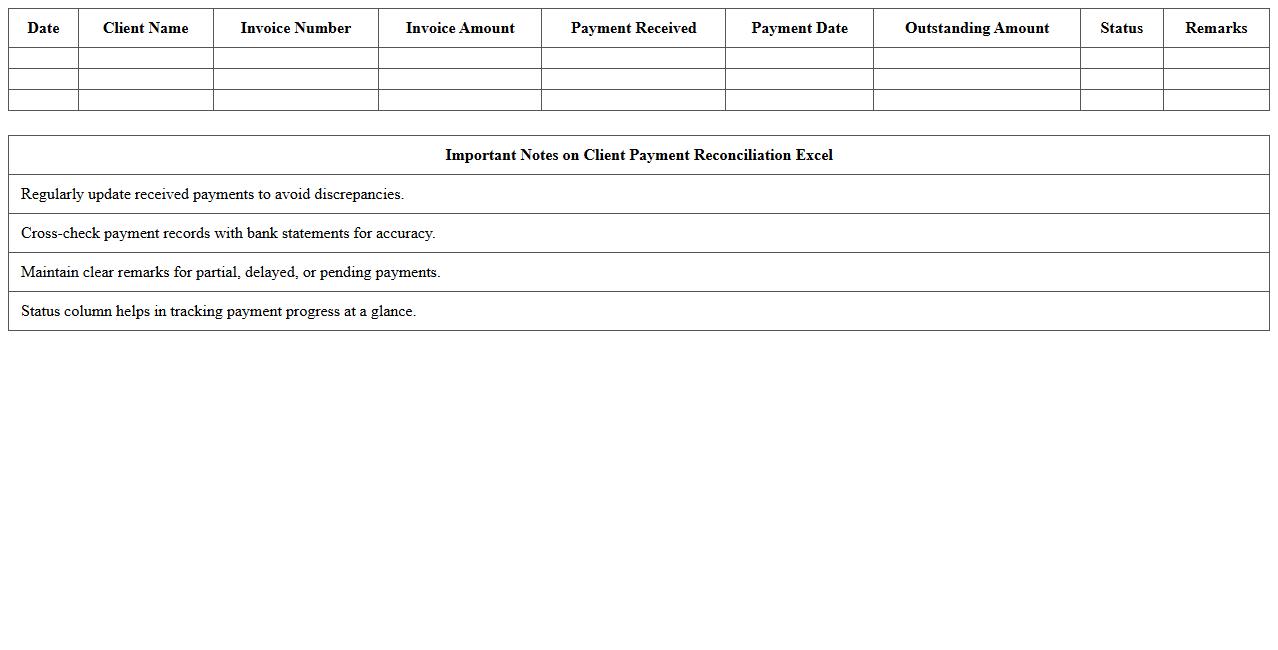

Client Payment Reconciliation Excel

A

Client Payment Reconciliation Excel document is designed to systematically compare and verify client payment records against invoiced amounts, ensuring accuracy and completeness in financial transactions. This tool helps identify discrepancies, prevent payment errors, and streamline the accounts receivable process by consolidating data from multiple sources into a clear, organized format. Using this document improves financial transparency, enhances cash flow management, and supports timely decision-making for accounting and finance teams.

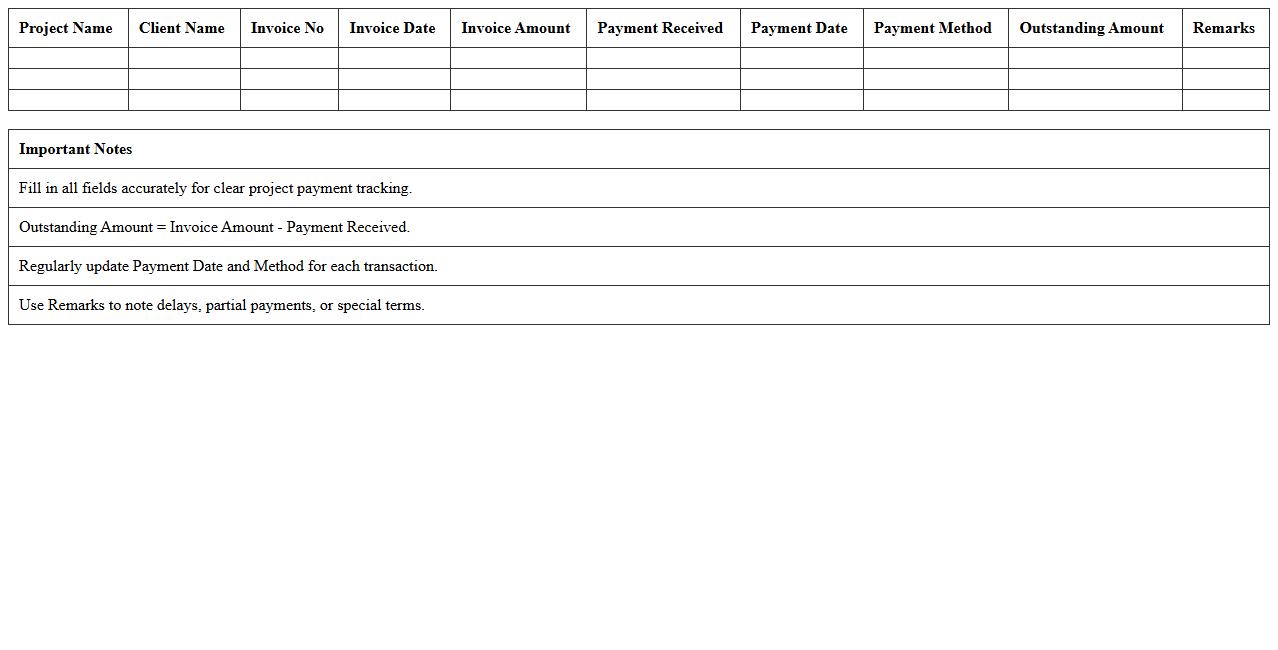

Project-wise Client Payment Summary Template

The

Project-wise Client Payment Summary Template document consolidates all client payments related to specific projects, facilitating clear tracking of financial transactions. It improves budget management by providing detailed insights into payment statuses, amounts received, and outstanding balances for each project. This template enhances transparency and aids in accurate financial reporting, streamlining client communication and payment reconciliation processes.

How do I automate recurring client payment entries in my Client Payment Summary Excel?

To automate recurring client payments in Excel, use the combination of formulas and Excel features like Power Query or VBA macros. Create a schedule table with payment frequencies and use the EDATE function to calculate future payment dates automatically. Triggering macros to insert new rows can help maintain the payment log without manual intervention.

What are the best formulas for tracking unpaid invoices by client in Excel?

The SUMIFS function is excellent for summing unpaid invoice amounts filtered by client and payment status. Coupled with IF statements, you can flag unpaid invoices by comparing payment due dates and payment status cells. Another powerful formula is COUNTIFS, which helps count unpaid invoices for clients dynamically.

How can I visually highlight overdue payments in my payment summary sheet?

Use Excel's Conditional Formatting feature to automatically highlight overdue payments based on the due date and payment status. Apply a rule that formats cells with payment dates less than TODAY() and unpaid status using a distinct color like red. This visual cue helps quickly identify overdue payments in your summary.

Which Excel templates are effective for summarizing multi-currency payments?

Templates with built-in currency conversion tables and summary dashboards provide effective tools for managing multi-currency payments. Look for templates featuring dynamic exchange rate updates via linked data feeds or manual input fields. PivotTables and charts can be included to help visually summarize payments by currency.

How do I integrate client feedback or payment notes within the payment summary Excel file?

Add a dedicated comments or notes column next to each payment entry to capture client feedback or payment remarks. Use Excel's Data Validation or Comments feature to ensure feedback is structured and easily accessible. Integrating these notes enhances communication and helps maintain comprehensive payment records.