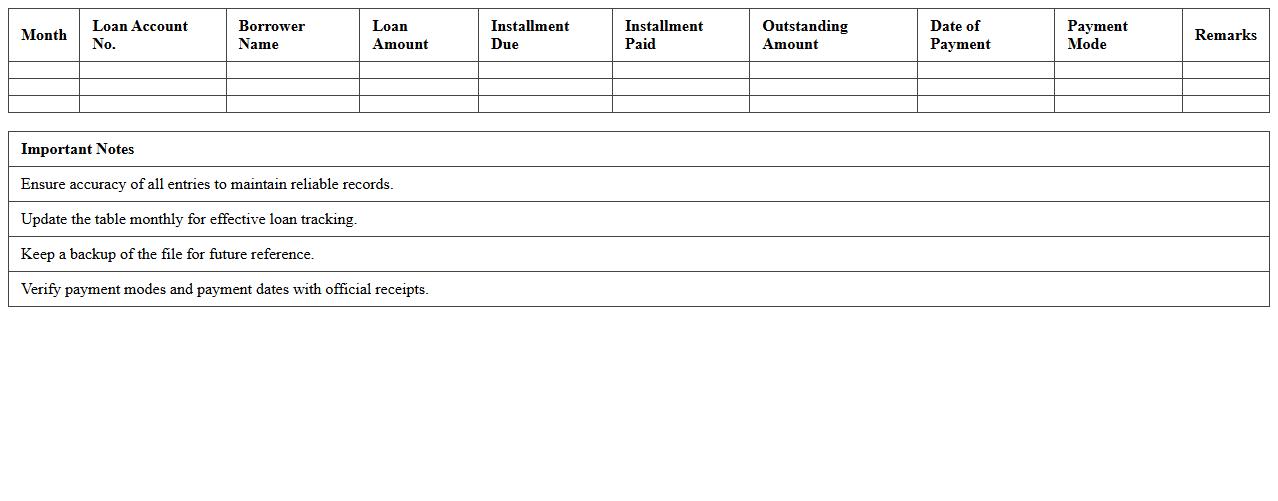

Monthly Loan Recovery Summary Excel Template

The

Monthly Loan Recovery Summary Excel Template is a structured spreadsheet designed to track and analyze loan repayments over a specific month, consolidating data such as borrower details, loan amounts, recovery status, and outstanding balances. This template facilitates efficient monitoring of loan recovery performance, enabling financial institutions and lenders to identify delinquent accounts, assess recovery trends, and generate accurate reports for decision-making. Utilizing this summary tool helps streamline financial workflows, improve debt management, and maintain comprehensive records for auditing and compliance purposes.

Delinquent Loans Tracking Report Excel Worksheet

The

Delinquent Loans Tracking Report Excel Worksheet document is a comprehensive tool designed to monitor and manage overdue loan payments efficiently. It helps financial institutions and loan officers identify delinquent accounts, track payment history, and calculate outstanding balances, enabling proactive risk management and improved cash flow forecasting. By providing clear, organized data, this worksheet supports timely decision-making and enhances loan recovery strategies.

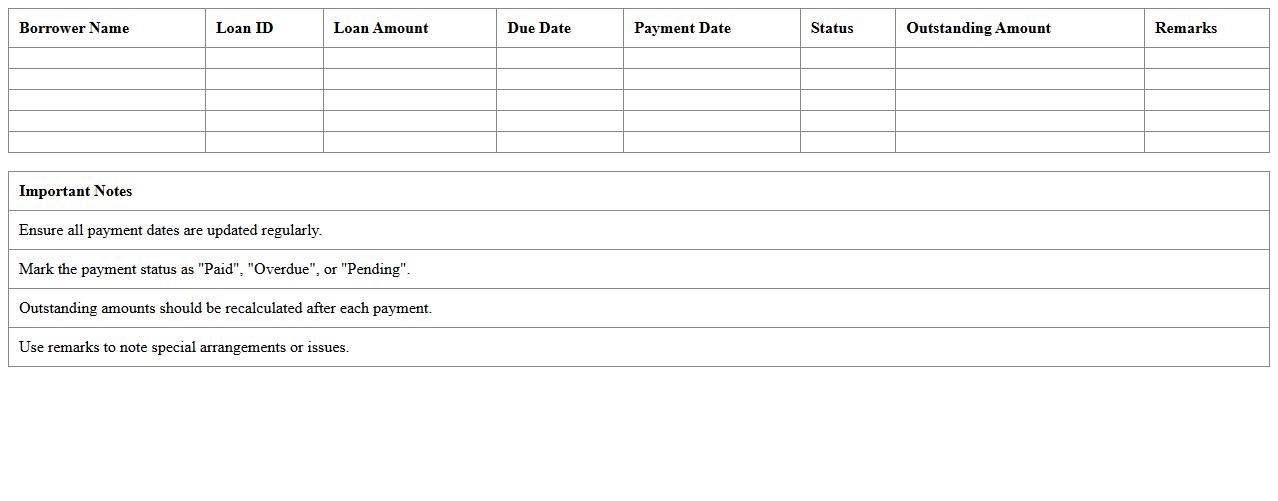

Borrower Payment Status Analysis Excel Template

The

Borrower Payment Status Analysis Excel Template document is designed to track and analyze loan repayments, helping lenders monitor borrower payment behavior effectively. It organizes payment schedules, records timely or delayed payments, and calculates outstanding balances, enabling quick identification of defaulters and timely follow-ups. This template enhances financial management by improving cash flow forecasts and reducing credit risk through detailed payment status insights.

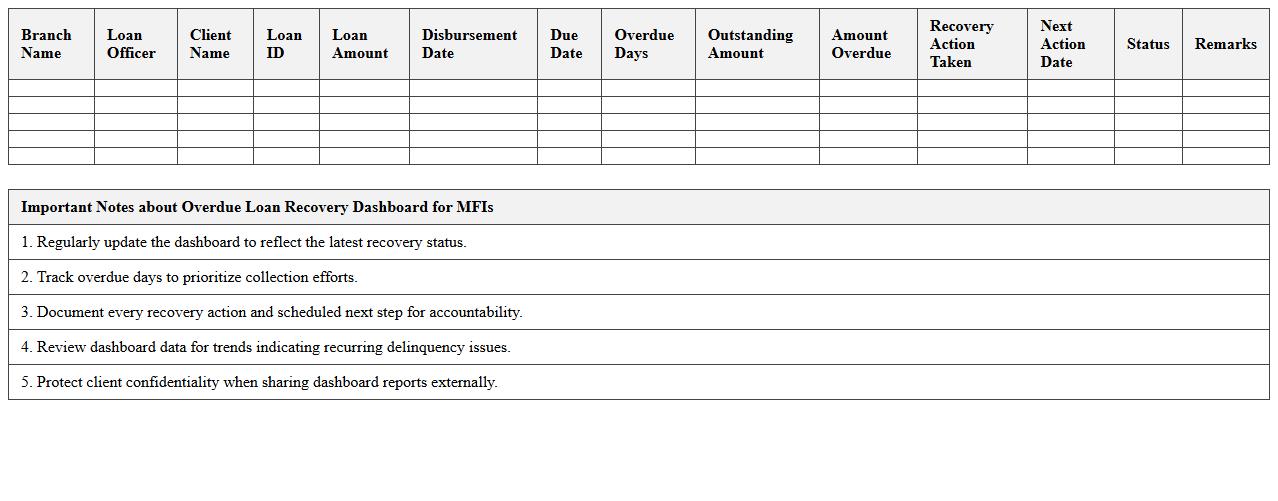

Overdue Loan Recovery Dashboard for MFIs

The

Overdue Loan Recovery Dashboard for MFIs is a comprehensive digital tool designed to monitor and manage delinquent loans effectively. It provides real-time data visualization on overdue amounts, borrower payment history, and recovery progress, enabling financial institutions to identify high-risk accounts and prioritize collection efforts. This dashboard enhances decision-making by streamlining the recovery process, reducing non-performing assets, and improving overall portfolio health.

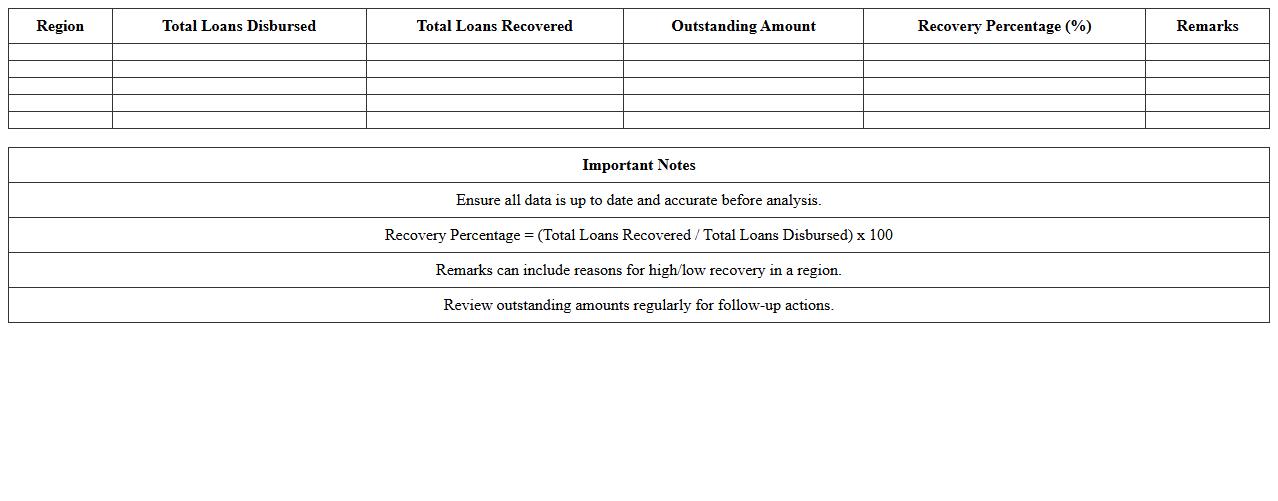

Region-wise Loan Recovery Performance Excel Sheet

The

Region-wise Loan Recovery Performance Excel Sheet is a detailed document that tracks loan recovery metrics across different geographical areas, enabling precise analysis of repayment rates and outstanding balances by region. This sheet helps financial institutions identify underperforming regions, optimize recovery strategies, and allocate resources effectively to improve overall loan portfolio health. By providing clear, region-specific insights, it supports data-driven decision-making to enhance cash flow management and reduce default risks.

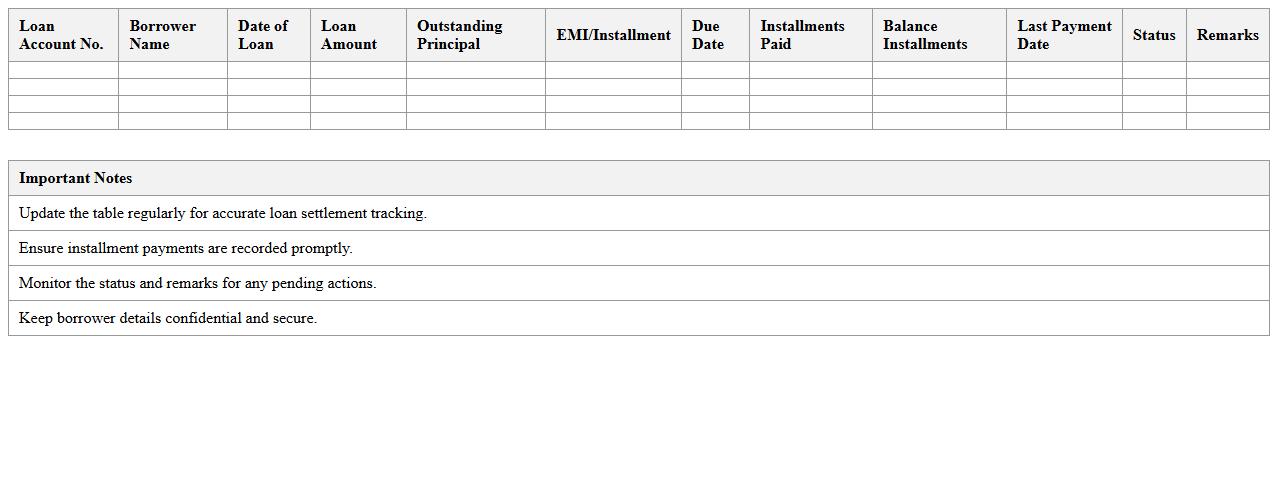

Loan Settlement Progress Monitoring Excel Template

The

Loan Settlement Progress Monitoring Excel Template is a structured tool designed to track and manage loan repayment activities efficiently. It enables users to record payment dates, outstanding balances, interest calculations, and settlement milestones in a clear, organized format. This template helps improve financial planning, ensures timely payments, and provides transparency in loan management processes.

Detailed Recovery Action Plan Tracker Excel File

A

Detailed Recovery Action Plan Tracker Excel File is a comprehensive tool designed to monitor, organize, and manage recovery tasks systematically. It allows users to track progress, assign responsibilities, set deadlines, and ensure accountability for each recovery step, enhancing project management efficiency. This document is essential in minimizing recovery time and improving resource allocation during incident resolution or operational setbacks.

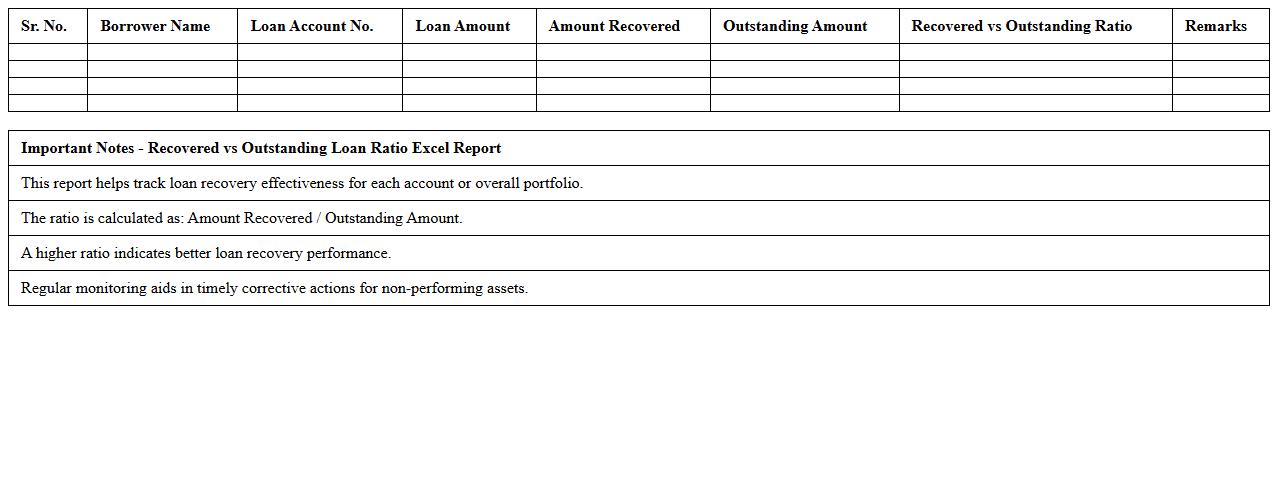

Recovered vs Outstanding Loan Ratio Excel Report

The

Recovered vs Outstanding Loan Ratio Excel Report is a financial document that tracks the proportion of loan amounts recovered against those still outstanding. This report enables lenders and financial analysts to evaluate loan recovery performance, identify trends in repayments, and make informed decisions about credit risk management. By offering a clear comparison of recovered versus outstanding loans, the report helps optimize debt collection strategies and improves overall portfolio health.

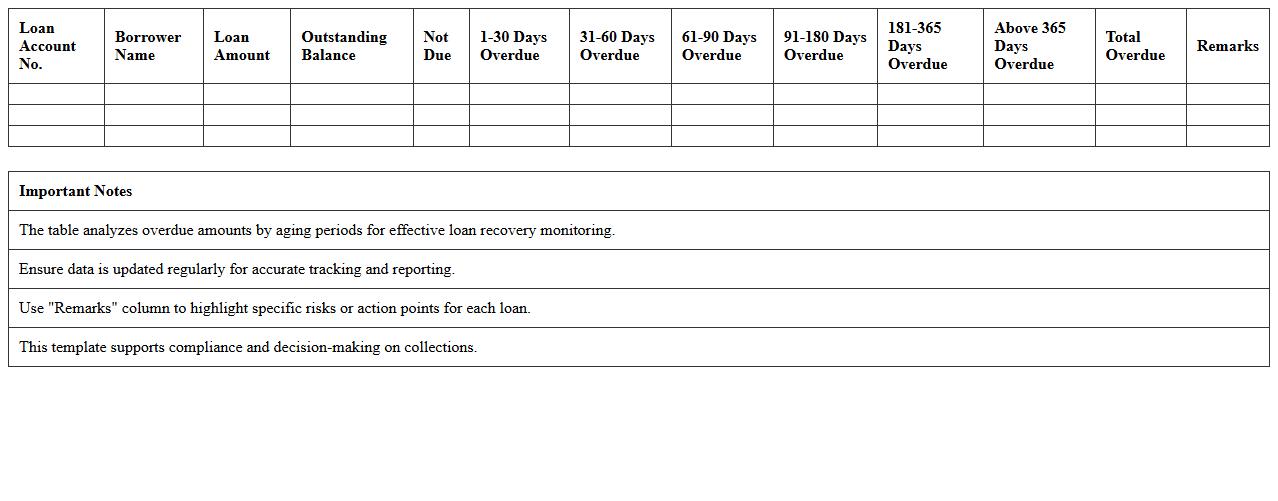

Loan Recovery Aging Analysis Excel Template

The

Loan Recovery Aging Analysis Excel Template is a specialized financial tool designed to track and categorize outstanding loan recoveries based on the period they remain unpaid. This document allows users to efficiently monitor overdue loans, prioritize collections, and assess the effectiveness of recovery strategies by providing clear aging buckets such as 30, 60, 90, and 120+ days. Financial institutions and businesses benefit from its ability to enhance cash flow management, reduce bad debts, and improve overall loan portfolio performance through timely and data-driven decision-making.

Field Officer Recovery Performance Excel Tracker

The

Field Officer Recovery Performance Excel Tracker document systematically records and analyzes recovery efforts by field officers, enabling efficient monitoring of collection targets versus actual recoveries. It provides clear insights into individual officer performance, helping management identify areas needing improvement and allocate resources effectively. This tool enhances accountability and supports data-driven decision-making, ultimately improving overall recovery rates.

How to automate NPA account classification in a Loan Recovery Report Excel for microfinance?

Automating NPA account classification requires setting conditional formulas based on days overdue thresholds to categorize accounts. Use Excel's IF, AND, and DATEDIF functions to dynamically assign statuses like "Standard," "Substandard," or "NPA." This reduces manual errors and speeds up loan portfolio analysis for microfinance institutions.

What Excel formulas best track overdue installments by borrower segment?

To track overdue installments by borrower segment, utilize the SUMIFS formula to sum overdue amounts filtered by specific segments. Combine this with COUNTIFS to count the number of overdue installments per segment. These formulas create a segmented view of overdue portfolios for targeted recovery efforts.

How to visualize recovery rates by loan officer within the report?

Visualize recovery rates by loan officer using Excel's Pivot Charts or Bar and Column Charts. Link recovery data aggregated by loan officer to clearly identify performance differences. Conditional formatting may further highlight top and low performers visually.

Which pivot table layouts highlight trends in PAR (Portfolio at Risk) data?

Use a Pivot Table layout that displays loan vintage along with overdue days grouped in ranges for effective PAR trend analysis. Set row labels by loan segment and columns by aging buckets to detect risk concentrations. Adding slicers enables interactive filtering of time periods or geographic regions.

How to integrate daily repayment updates from field agents into the recovery tracker?

Automate data integration by linking an Excel recovery tracker file with a shared cloud source or using Power Query to pull daily repayment updates. This ensures real-time synchronization from field agents, maintaining up-to-date recovery statuses. Scheduled refreshes improve accuracy for management reporting without manual data entry.