The Income Comparison Report Excel Template for Freelancers provides an organized way to track and compare earnings from multiple clients or projects over time. It features customizable columns for income sources, dates, and categories, enabling freelancers to analyze trends and identify their most profitable work. This template simplifies financial management and supports strategic decision-making for freelance professionals.

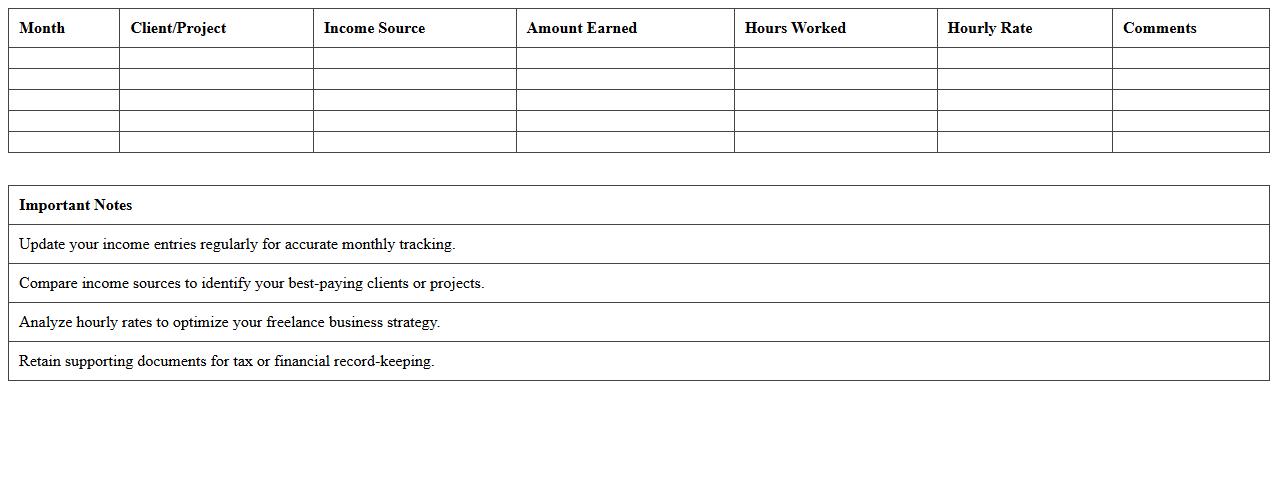

Monthly Income Comparison Spreadsheet for Freelancers

A

Monthly Income Comparison Spreadsheet for Freelancers is a practical tool designed to track and compare income sources over different months, helping freelancers monitor financial growth and fluctuations effectively. It organizes income data from various clients or projects, enabling better budgeting and tax preparation. This spreadsheet enhances decision-making by providing clear insights into earning patterns, supporting improved financial management.

Yearly Freelance Income Analysis Excel Sheet

The

Yearly Freelance Income Analysis Excel Sheet document is a comprehensive tool designed to track, organize, and analyze freelance earnings throughout the year. It helps freelancers monitor income streams, identify trends, and optimize financial planning by providing clear visualizations and detailed breakdowns of monthly and yearly revenues. This document enhances budgeting accuracy and supports informed decision-making to improve overall financial stability for independent professionals.

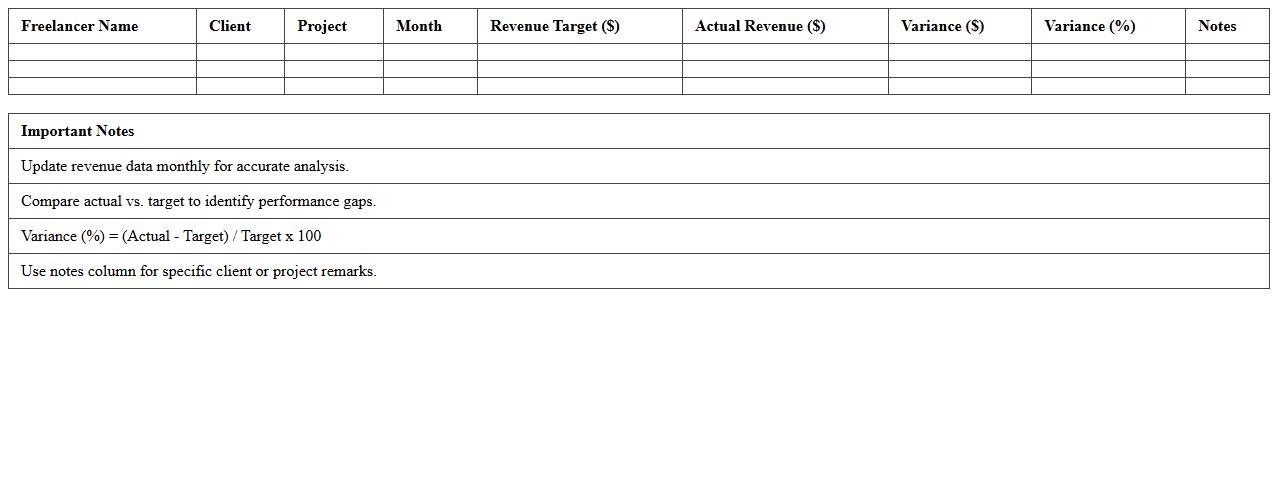

Freelance Revenue Comparison Report Template

The

Freelance Revenue Comparison Report Template document systematically organizes and analyzes income data from various freelance projects, enabling clear visualization of revenue trends and sources. It helps freelancers assess their financial performance over specific periods, identify the most profitable clients or services, and make informed decisions to optimize earnings. Utilizing this template enhances budget planning, tax preparation, and strategic business growth for independent professionals.

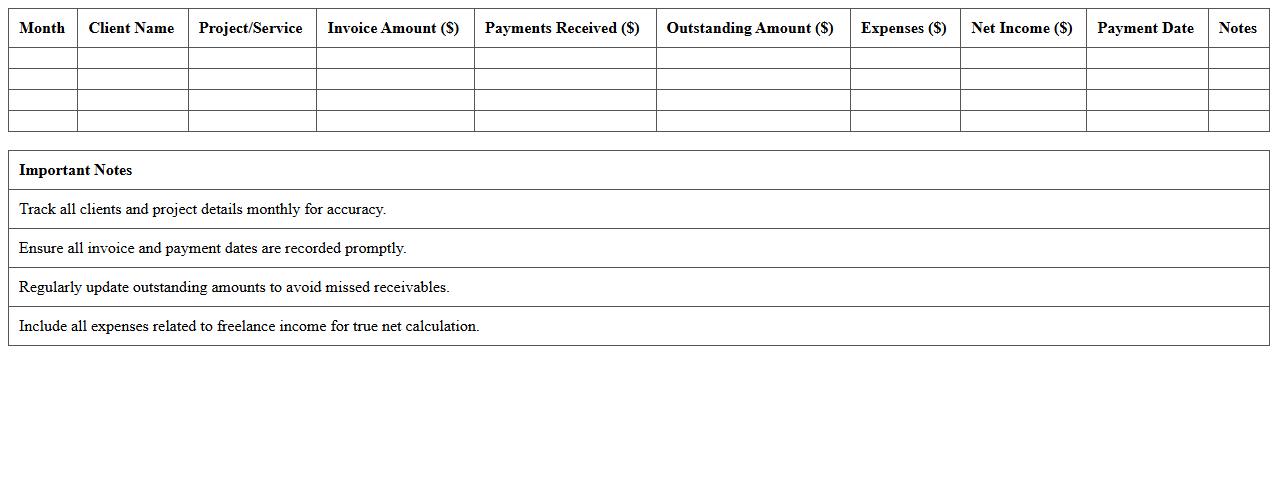

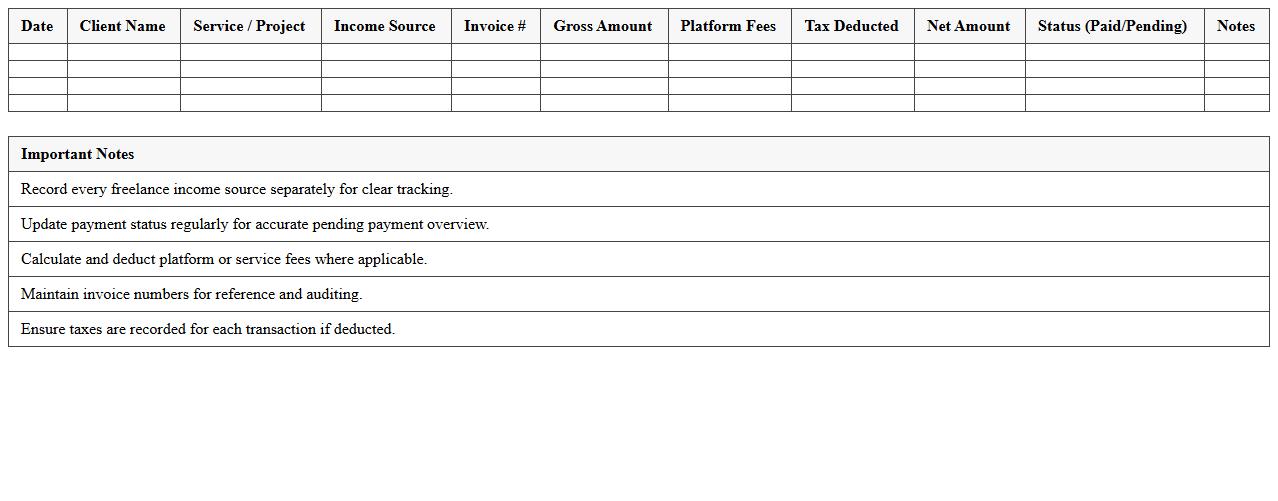

Client Income Tracker Excel for Freelancers

The

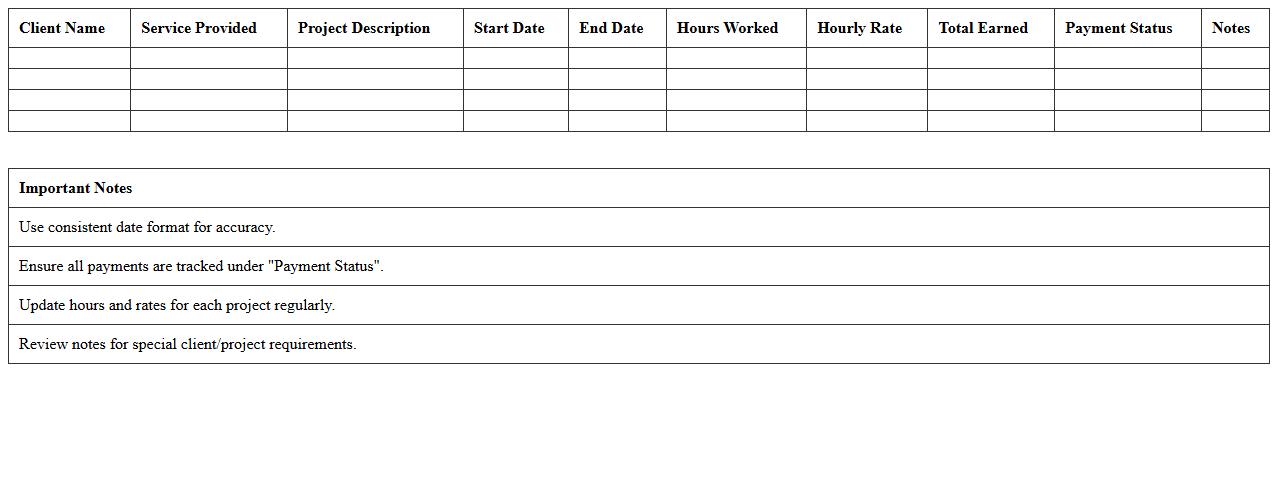

Client Income Tracker Excel for Freelancers is a specialized spreadsheet designed to help freelancers efficiently monitor their earnings from various clients. This document enables accurate tracking of payment dates, amounts, and outstanding invoices, simplifying financial management and improving cash flow visibility. Using this tracker helps freelancers stay organized, prepare for taxes, and make informed decisions regarding their income streams.

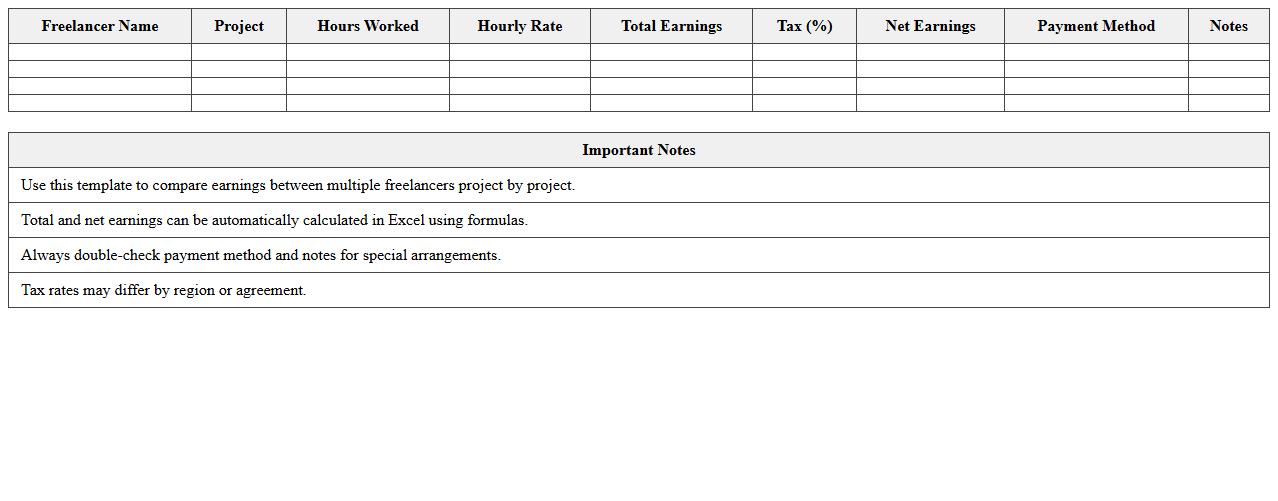

Side-by-Side Freelancer Earnings Comparison Excel

The

Side-by-Side Freelancer Earnings Comparison Excel document is a powerful tool that enables freelancers to systematically compare income from multiple projects or clients in one consolidated view. By organizing earnings data into easy-to-read columns and rows, it helps users identify the most profitable opportunities and track payment consistency over time. This comparison aids in making informed decisions about prioritizing work, negotiating rates, and optimizing financial growth.

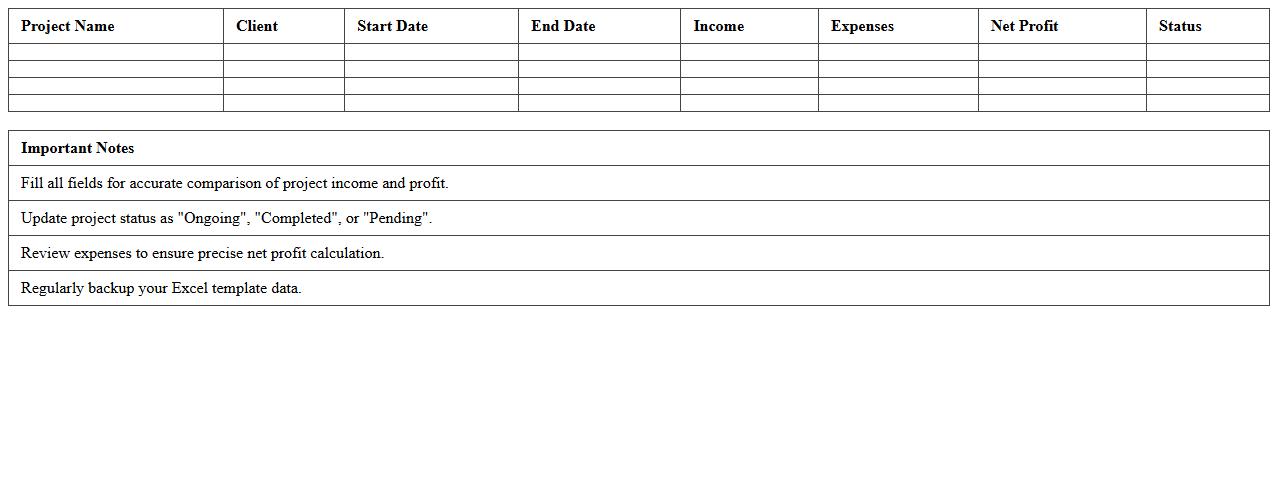

Project-Based Income Comparison Excel Template

The

Project-Based Income Comparison Excel Template is a specialized spreadsheet designed to analyze and compare income streams from various projects efficiently. It enables users to input financial data from multiple projects, automatically calculating and presenting a clear overview of profitability, cash flow, and return on investment. This tool is invaluable for businesses and freelancers seeking to optimize resource allocation and make informed financial decisions based on project performance metrics.

Multiple Source Freelance Income Report Sheet

The

Multiple Source Freelance Income Report Sheet is a comprehensive document designed to track and organize earnings from various freelance projects and platforms in one place. This tool helps freelancers maintain accurate financial records, streamline tax preparation, and gain insights into income patterns for better budgeting and growth strategies. By consolidating income data, it reduces the risk of missed payments and simplifies financial management across multiple revenue streams.

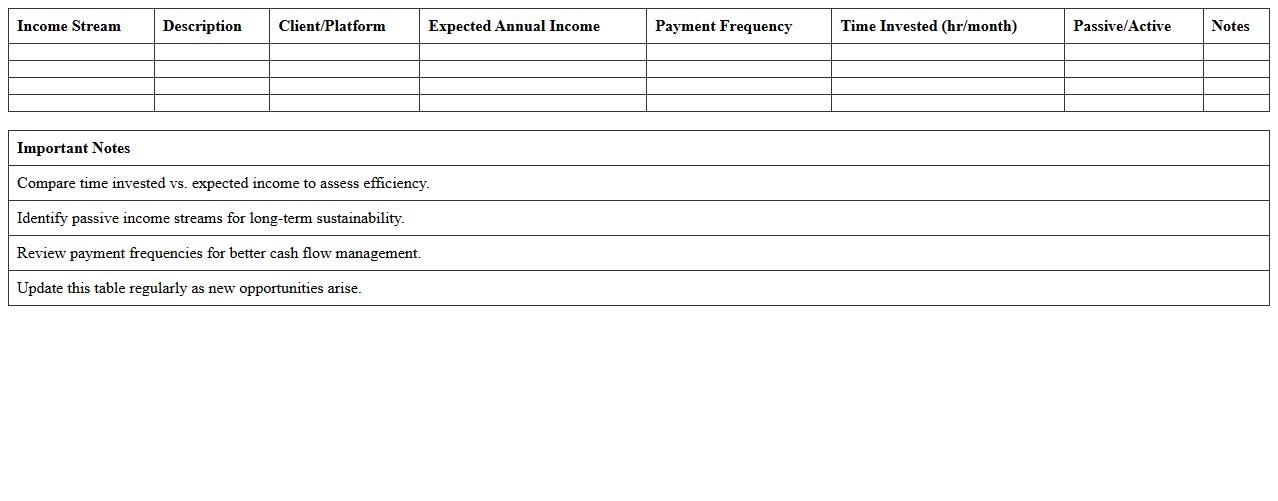

Income Stream Comparison Excel for Freelancers

The

Income Stream Comparison Excel for Freelancers document is a powerful tool designed to help freelancers analyze and compare multiple sources of income effectively. It enables tracking of earnings from different projects, clients, or platforms in one organized spreadsheet, facilitating better financial decisions and budget planning. This tool aids in identifying the most profitable income streams, optimizing revenue strategies, and managing freelance finances with greater clarity and accuracy.

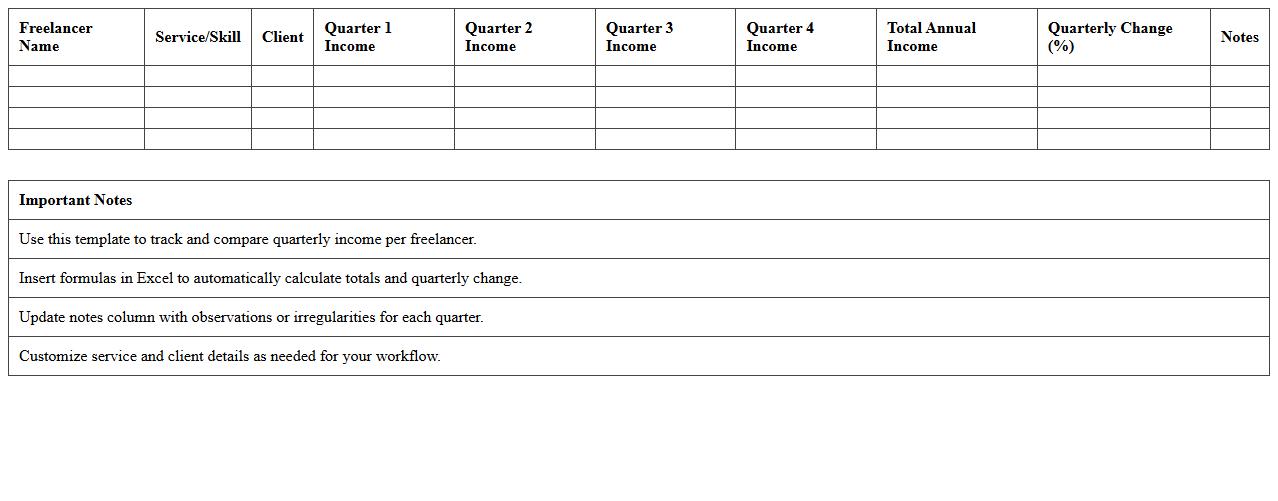

Freelancers' Quarterly Income Comparison Template

The

Freelancers' Quarterly Income Comparison Template is a structured document designed to track and analyze income variations over multiple quarters, helping freelancers identify trends and growth opportunities. By consolidating earnings data from diverse projects and clients, this template enables clearer financial insights and aids in effective budget planning. Utilizing this tool enhances financial decision-making, ensuring a more stable and predictable freelance income stream.

Service-Based Freelance Income Comparison Spreadsheet

The

Service-Based Freelance Income Comparison Spreadsheet is a practical tool designed to track and analyze earnings from multiple freelance projects across different service categories. This spreadsheet allows freelancers to compare income streams, identify high-paying clients, and optimize pricing strategies by organizing detailed financial data in a clear, accessible format. Using this document enhances financial decision-making and helps in planning sustainable freelance career growth.

How do I customize tax deduction categories in the Income Comparison Report Excel for freelancers?

To customize tax deduction categories in the Income Comparison Report Excel, navigate to the tax settings tab where you can add, edit, or remove categories based on your needs. Use the dropdown menus to select predefined categories or create new ones that reflect your specific deductible expenses. This customization ensures your financial report accurately matches your freelance tax requirements.

Can the report automatically compare monthly income trends across multiple clients?

The report features an automatic monthly income trend comparison functionality that compiles data from all clients into a consolidated view. It uses pivot tables and dynamic charts to visualize income fluctuations over time, providing clear insights into client-specific earnings. This automation helps freelancers track financial performance and identify key income drivers efficiently.

What formulas should be used for net income calculation in the freelancer version?

Net income in the freelancer version is typically calculated using the formula: =SUM(Income) - SUM(Expenses + Tax Deductions + Fees). This formula ensures all relevant costs, including operational and tax-related deductions, are subtracted from total revenue. Implementing this calculation through Excel's SUM functions guarantees accuracy and real-time updates as new data is entered.

How can I integrate payment platform fees into the income summary?

Payment platform fees can be integrated into the income summary by adding a dedicated column or expense category labeled Platform Fees. Input the fees per transaction, and use the SUM function to deduct these from gross income automatically. This integration helps maintain a clear view of net earnings after all intermediary costs.

Is there a template section for tracking late payments or outstanding invoices?

The Income Comparison Report Excel includes a template section for tracking late payments and outstanding invoices that allows freelancers to monitor payment statuses easily. This section can be customized with columns for due dates, payment status, and notes to follow up with clients promptly. Using this tool helps manage cash flow and reduce payment delays effectively.

More Report Excel Templates