The Budget Breakdown Excel Template for College Students offers a straightforward and customizable way to track income and expenses, helping manage finances during college life. It includes categories for tuition, rent, groceries, and entertainment, allowing students to visualize their spending habits and adjust accordingly. This template promotes financial responsibility and helps avoid overspending through easy data entry and automatic calculations.

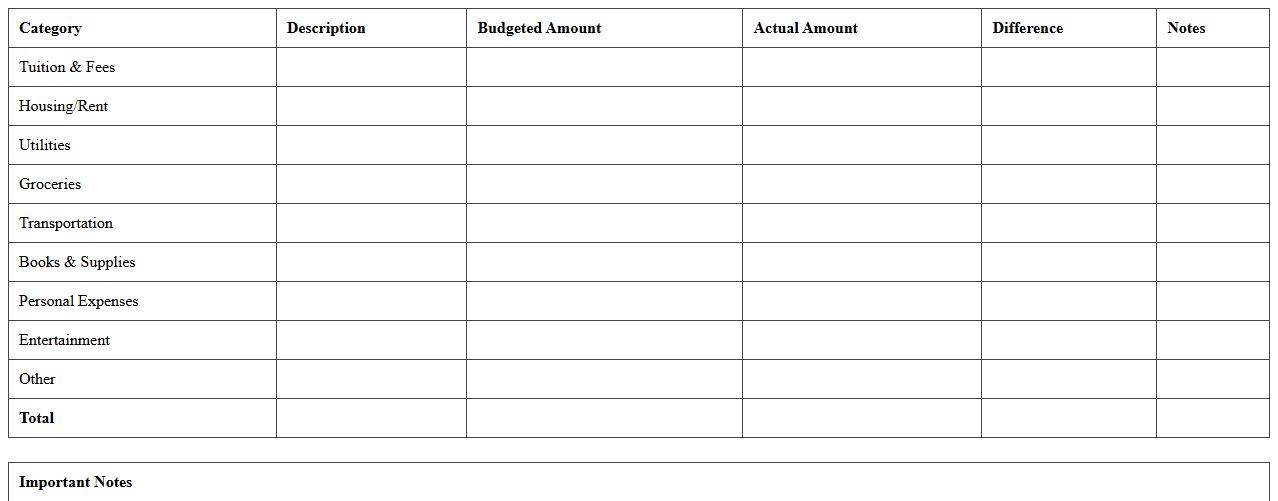

Monthly College Student Expense Tracker Excel Template

The

Monthly College Student Expense Tracker Excel Template is a structured spreadsheet designed to help students monitor and manage their monthly spending efficiently. By categorizing expenses such as tuition, books, food, and transportation, it enables users to maintain a clear overview of their financial habits, reducing the risk of overspending. This tool is essential for fostering budgeting discipline and ensuring that college students can allocate funds effectively throughout the academic year.

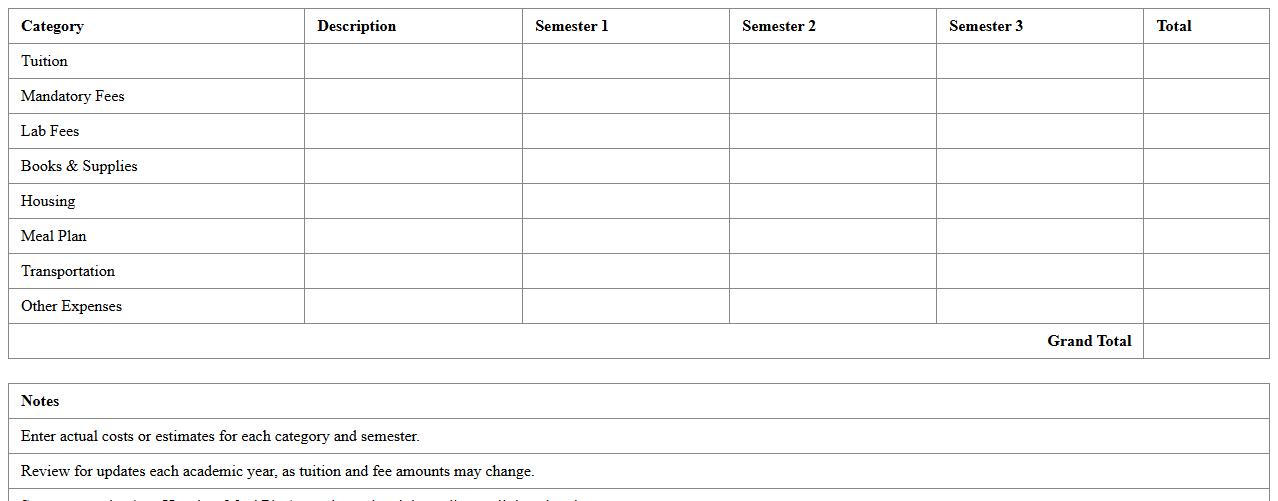

Semester Budget Planning Spreadsheet for Students

A

Semester Budget Planning Spreadsheet for students is a digital tool designed to help track and manage income, expenses, and savings throughout an academic term. It provides a clear overview of tuition fees, housing costs, meal plans, and miscellaneous expenditures, enabling students to maintain financial discipline and avoid overspending. By using this spreadsheet, students can set realistic financial goals, monitor cash flow, and ensure they have sufficient funds for essentials and emergencies during the semester.

College Tuition and Fees Breakdown Excel Sheet

A

College Tuition and Fees Breakdown Excel Sheet is a detailed document that itemizes all costs associated with college education, including tuition, fees, room, board, and other expenses. It helps students and families plan their budget effectively by providing a clear, organized view of all financial obligations throughout the academic year. This tool is essential for comparing costs between institutions, anticipating financial aid needs, and managing personal finances during college.

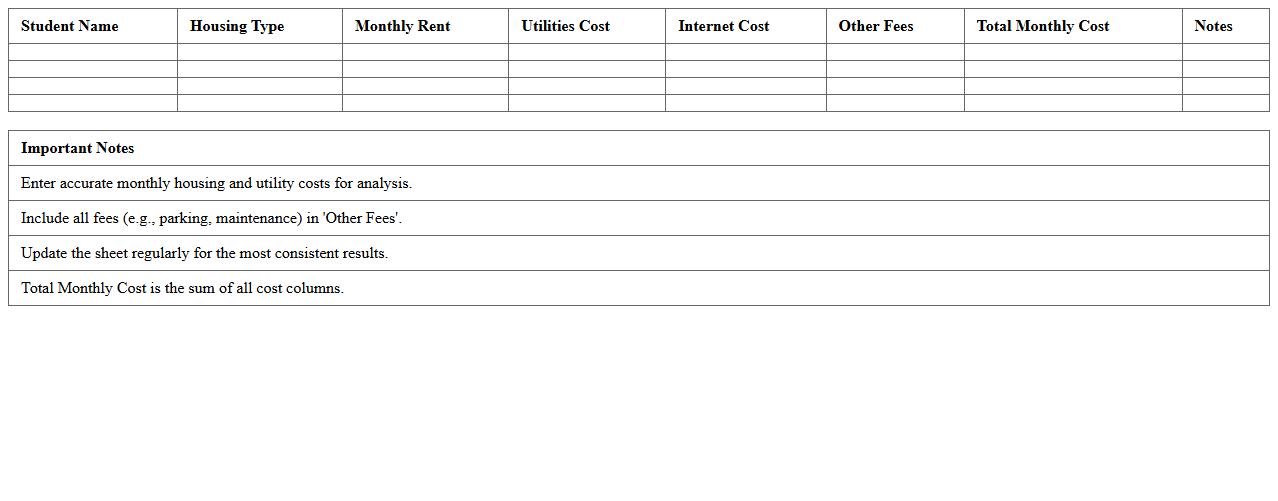

Student Housing Cost Analysis Excel Template

The

Student Housing Cost Analysis Excel Template is a comprehensive tool designed to help users systematically evaluate expenses related to student accommodations. It allows for detailed input of rent, utilities, maintenance, and other fees, providing clear visualizations and summaries for better financial planning. This template is essential for students, parents, and administrators to make informed decisions, optimize budget allocation, and identify cost-saving opportunities in student housing.

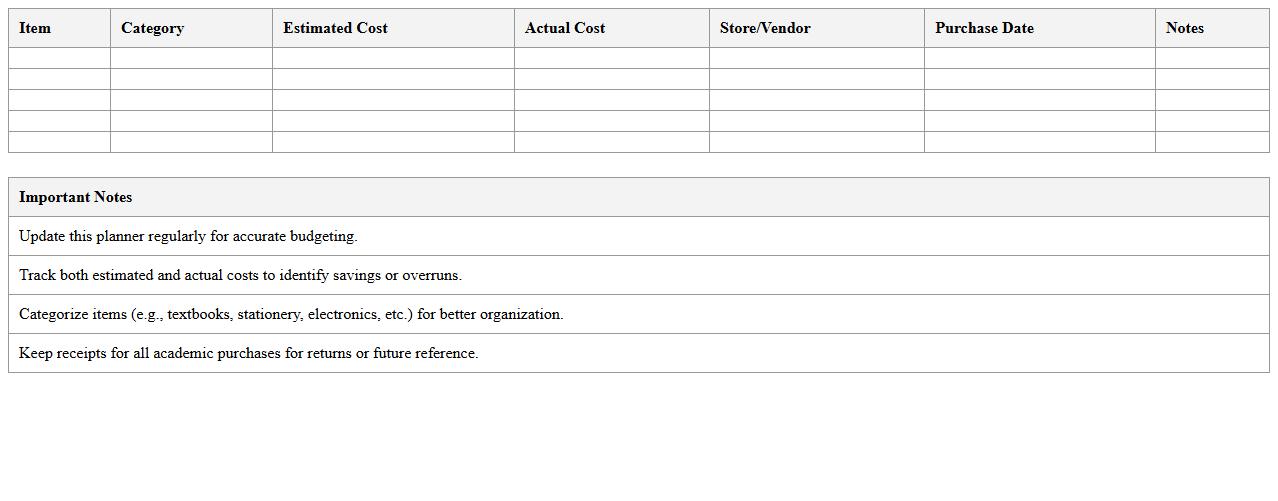

Textbook and Academic Supplies Budget Planner

A

Textbook and Academic Supplies Budget Planner document helps students and educators organize and manage expenses related to educational materials effectively. It tracks costs for textbooks, stationery, and other academic resources, ensuring that spending stays within set financial limits. By using this planner, users can prioritize essential purchases, avoid overspending, and achieve better financial planning for the academic term.

Meal Plan and Grocery Spending Tracker for Students

A

Meal Plan and Grocery Spending Tracker for Students document organizes daily or weekly meal schedules alongside grocery budgets to help students manage their nutrition and expenses effectively. It enables students to monitor food intake, reduce food waste, and maintain financial discipline by tracking spending patterns on groceries. This tool supports healthier eating habits and cost savings, making it easier to balance academic life with personal well-being.

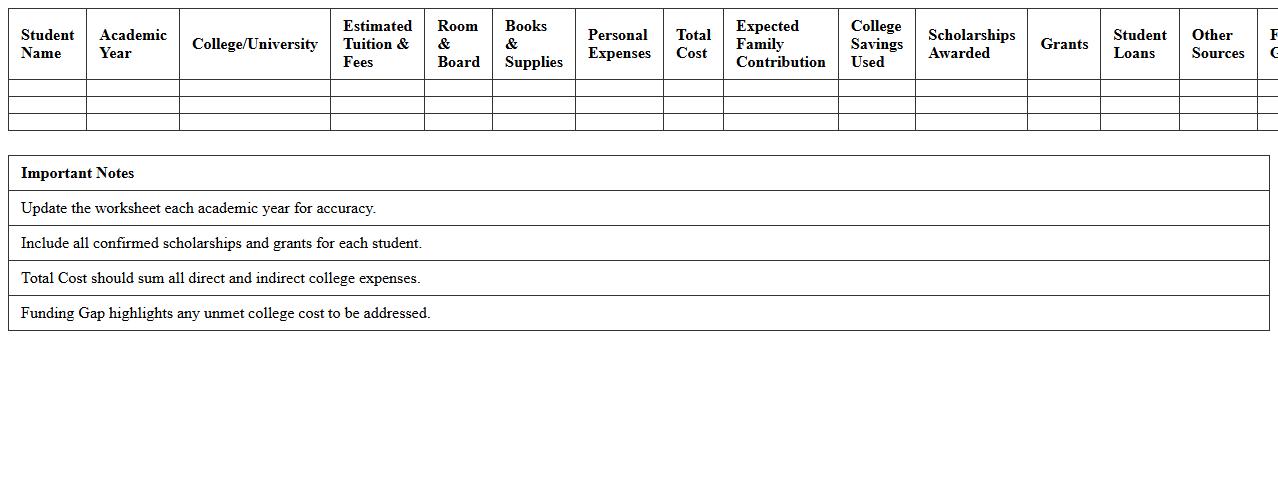

College Savings and Scholarship Allocation Worksheet

The

College Savings and Scholarship Allocation Worksheet is a strategic financial planning tool that helps families organize and manage funds earmarked for college expenses and scholarship distributions. It provides a clear breakdown of available resources versus projected costs, allowing users to allocate savings and scholarship awards efficiently to minimize out-of-pocket expenses. This worksheet is essential for optimizing educational funding, preventing overlaps in financial aid, and ensuring a balanced approach to covering tuition, fees, and related costs.

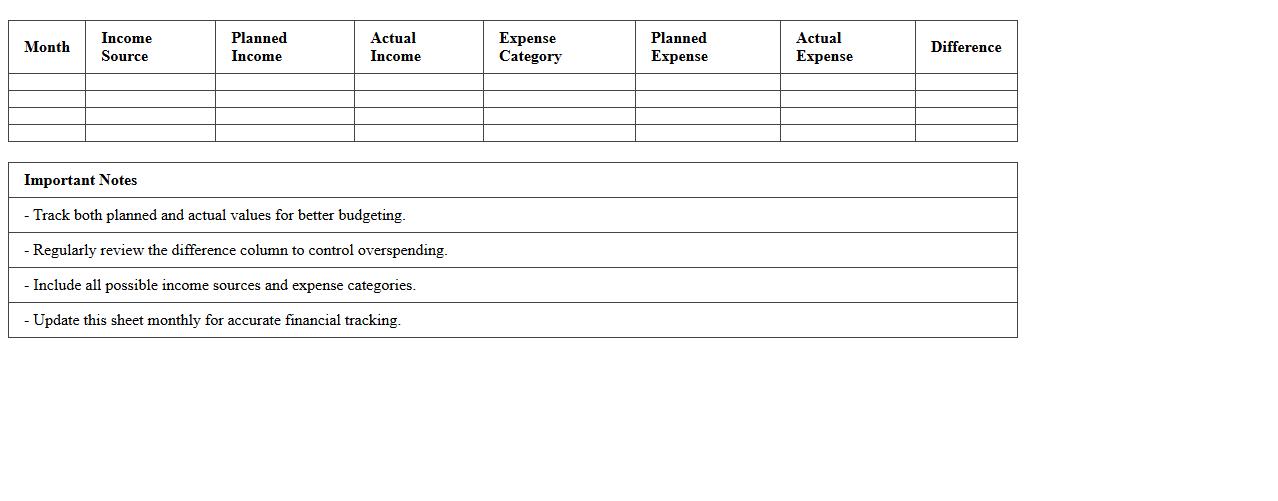

Student Income vs Expenses Excel Budget Sheet

The

Student Income vs Expenses Excel Budget Sheet document is a practical tool designed to help students track and manage their monthly finances effectively. By inputting various sources of income and categorizing expenses, users can gain clear insights into their spending habits and identify areas to save money. This organized approach promotes financial responsibility and aids in avoiding unnecessary debt during academic years.

Personal Entertainment and Lifestyle Budget Tracker

A

Personal Entertainment and Lifestyle Budget Tracker document is a tool designed to monitor and manage expenses related to leisure activities and daily lifestyle choices, including dining, hobbies, and subscriptions. It helps individuals gain clear insights into their spending habits, enabling better financial decisions and identifying areas where costs can be reduced. By maintaining this tracker, users can achieve sustainable budgeting, ultimately leading to improved financial health and more mindful enjoyment of their personal lifestyle.

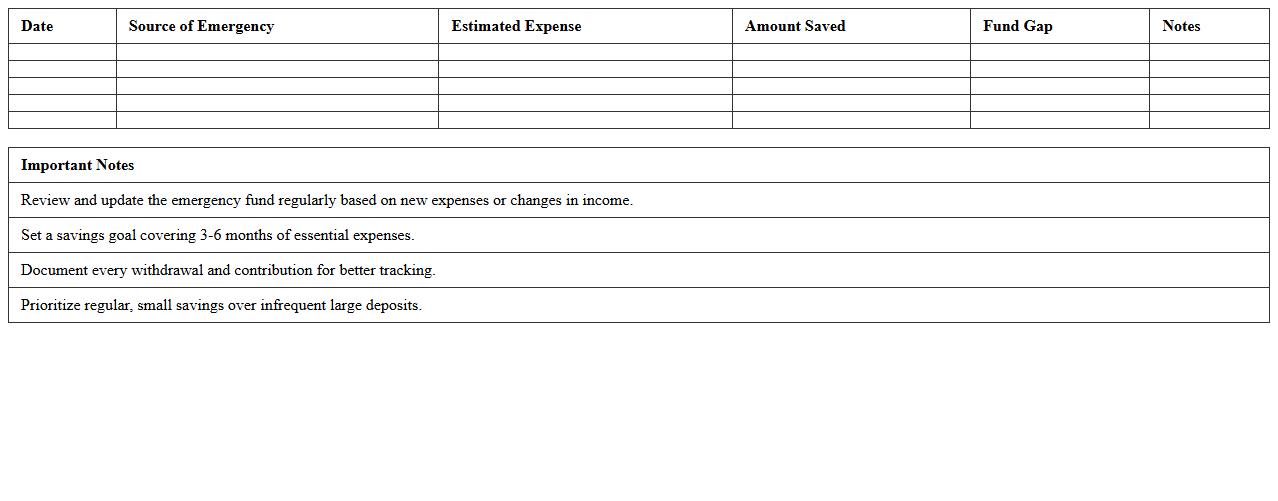

Emergency Fund Planning Excel Template for College Students

The

Emergency Fund Planning Excel Template for college students is a structured financial tool designed to help track and manage unexpected expenses efficiently. It allows users to set realistic savings goals, monitor progress, and adjust contributions based on monthly income and expenditures. This template ensures better financial preparedness, reducing stress during unforeseen situations by providing a clear overview of emergency fund status.

What essential categories should a "Budget Breakdown Excel" include for college students' expenses?

A Budget Breakdown Excel for college students should include key categories such as Tuition & Fees, Housing & Utilities, Food & Groceries, Transportation, and Miscellaneous Expenses. Each category helps students clearly see where their money is allocated monthly. Including both fixed and variable expenses allows for more accurate financial planning.

How can students automate monthly expense tracking in their budget Excel sheet?

Students can automate monthly expense tracking by using Excel tables combined with data validation dropdowns for consistent category inputs. They should also employ Excel features like PivotTables to summarize monthly expenses automatically. Setting up conditional formatting highlights overspending, making the process foolproof for budget management.

Which Excel formulas best calculate recurring and one-time college expenses?

The SUMIF and SUMIFS formulas are ideal for calculating recurring expenses by categorizing transactions over specific periods. For one-time expenses, using basic SUM functions alongside IF statements provides clear totals without affecting recurring calculations. Combining these formulas ensures precise expense tracking tailored to college budgets.

How do students visually represent savings goals in a budget breakdown document?

Students can use Excel charts like progress bars and pie charts to visually track savings goals against monthly income and expenditures. Progress bars display how much of the target amount has been saved, motivating continued budgeting efforts. Pie charts offer a clear snapshot of how savings fit into overall financial health.

What sample templates optimize budgeting for part-time working students in Excel?

Templates optimized for part-time working students include sections for Income Tracking, Work Hours Log, and Expense Categories aligned with fluctuating earnings. These templates often feature automatic balance calculations and cash flow forecasts to help manage irregular income streams. Incorporating these elements ensures comprehensive budgeting adapted to a part-time work lifestyle.

More Budget Excel Templates