The Loan Assessment Excel Template for Microfinance Institutions streamlines the evaluation process by providing a structured format to analyze borrower information, financial data, and repayment capacity. This customizable template helps microfinance professionals minimize risk and make informed lending decisions efficiently. With built-in formulas and clear data visualization, it enhances accuracy and speeds up loan processing.

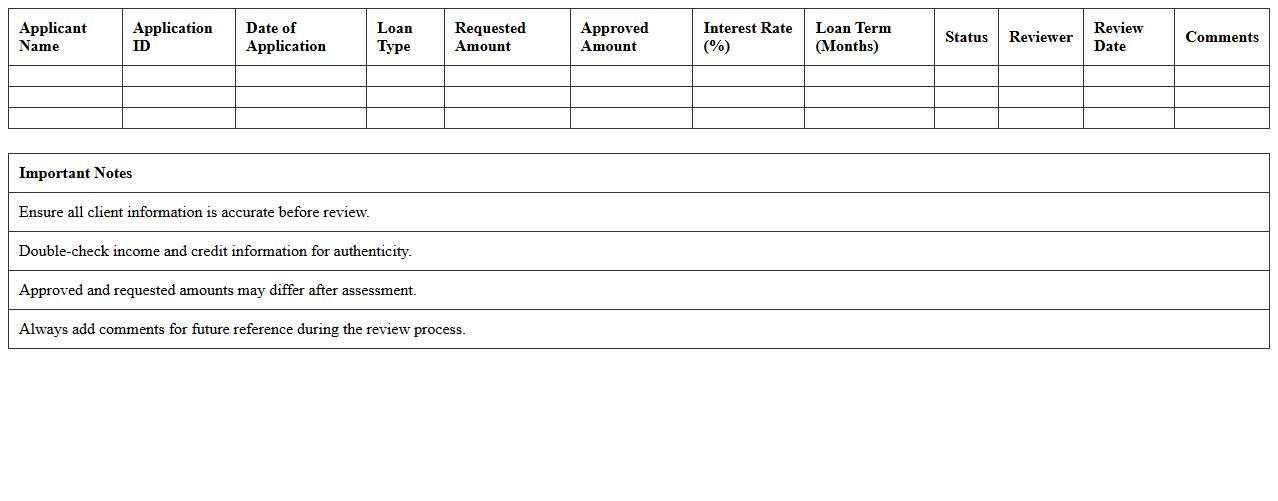

Client Loan Application Review Excel Template

The

Client Loan Application Review Excel Template document is a structured tool designed to systematically evaluate loan applications by organizing key client information, financial data, and loan criteria. It enables users to efficiently assess eligibility, track application status, and ensure compliance with lending policies, reducing errors and speeding up decision-making processes. This template proves invaluable for loan officers and financial institutions seeking to streamline client evaluations and enhance accuracy in loan approval workflows.

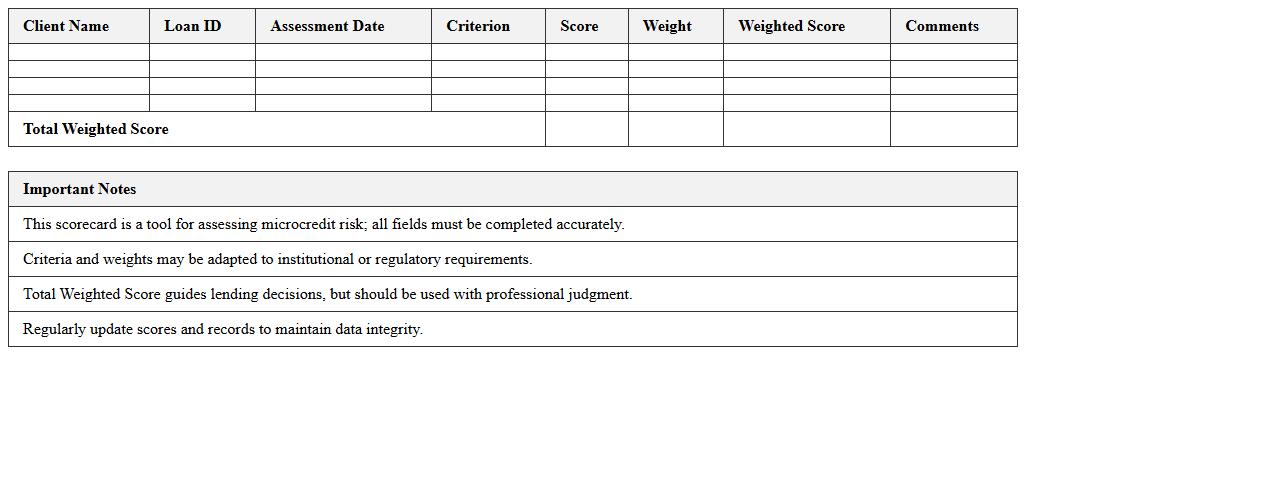

Microcredit Risk Assessment Scorecard Excel Template

The

Microcredit Risk Assessment Scorecard Excel Template document is a structured tool designed to evaluate the creditworthiness of microfinance borrowers by quantifying risk factors through a scoring system. It helps financial institutions systematically analyze borrower data, such as income stability, repayment history, and collateral, to predict the likelihood of default. Using this template enhances decision-making accuracy, reduces loan defaults, and improves portfolio quality in microcredit lending.

Borrower Financial Analysis Tracker Excel Template

The

Borrower Financial Analysis Tracker Excel Template document is a comprehensive tool designed to systematically monitor and evaluate the financial performance of borrowers. It helps lenders and financial analysts assess creditworthiness by organizing financial data such as income, expenses, debts, and repayment history in a clear, structured format. This template improves decision-making efficiency by providing real-time insights and trends, enabling more accurate risk assessment and loan management.

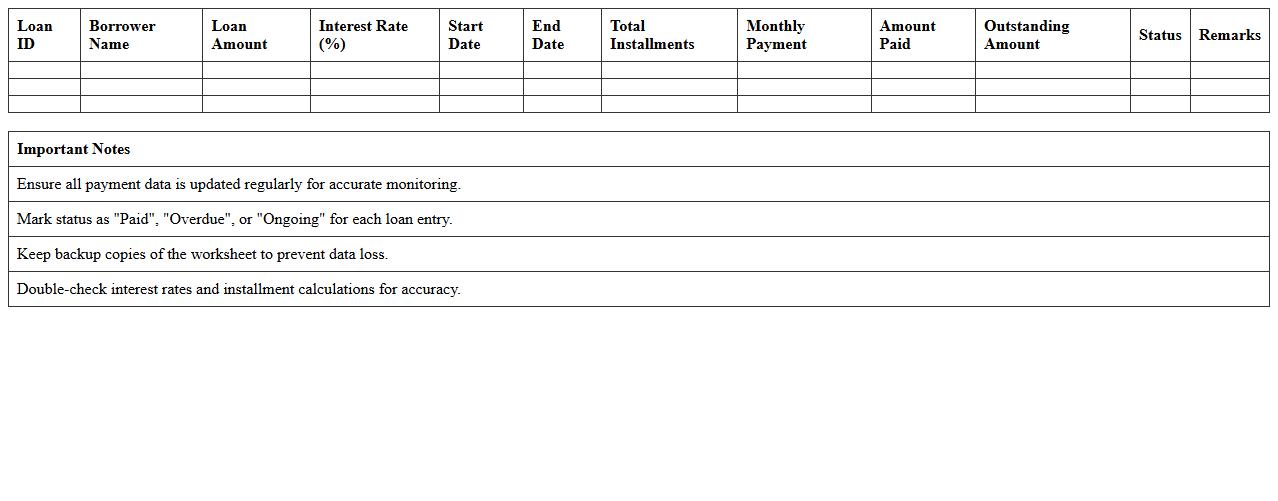

Loan Repayment Monitoring Excel Template

A

Loan Repayment Monitoring Excel Template document is a structured spreadsheet designed to track loan balances, payment schedules, interest rates, and due dates efficiently. It helps users maintain accurate records of outstanding loans, forecast repayment timelines, and manage cash flows by automatically updating payment statuses. This template enhances financial organization, reduces the risk of missed payments, and supports strategic financial planning for both individuals and businesses.

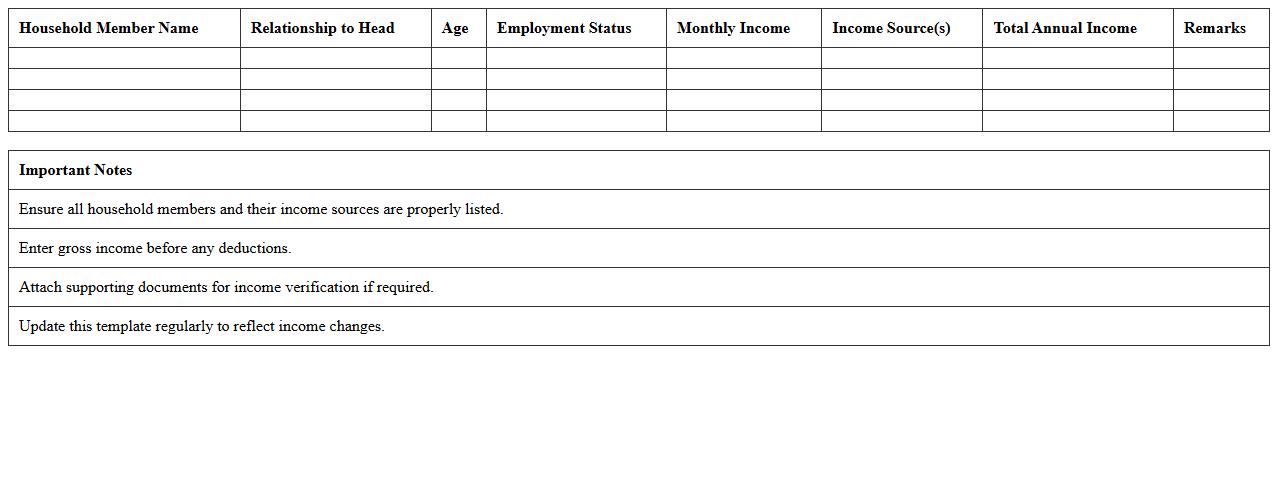

Household Income Verification Excel Template

The

Household Income Verification Excel Template is a customizable spreadsheet designed to accurately document and verify the income of household members for various financial assessments. It simplifies the process of collecting and organizing income data from multiple sources, ensuring compliance with eligibility requirements for programs such as social services, housing assistance, or loan applications. This tool enhances efficiency by reducing manual errors and providing clear, structured records that support transparent decision-making.

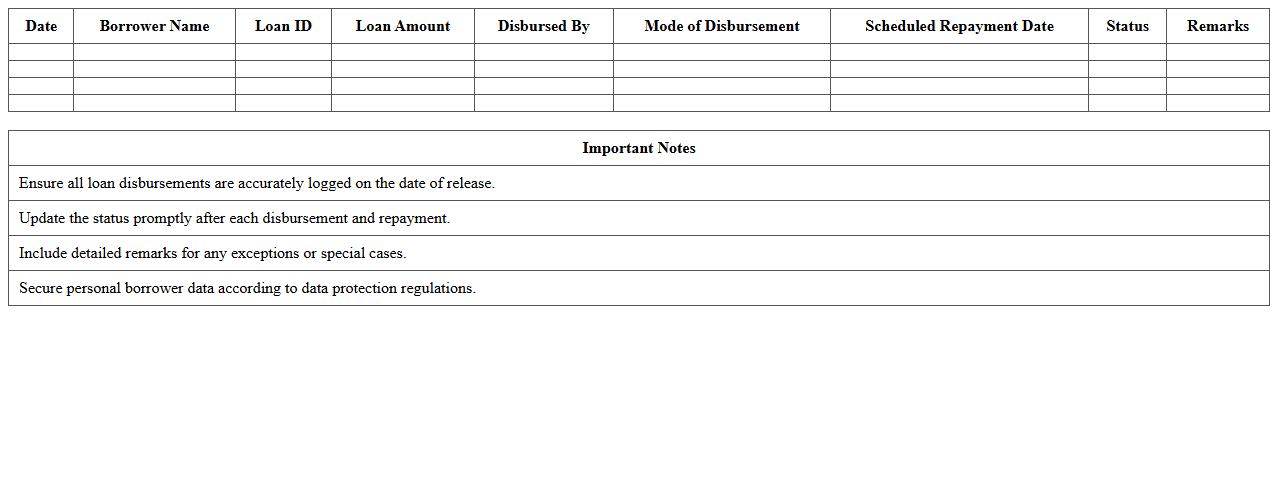

Microfinance Loan Disbursement Log Excel Template

The

Microfinance Loan Disbursement Log Excel Template is a structured spreadsheet designed to track and manage loan disbursements efficiently within microfinance institutions. It helps record borrower details, loan amounts, disbursement dates, and repayment schedules, enabling accurate monitoring of loan portfolios and minimizing errors. This template improves financial transparency, simplifies reporting, and supports informed decision-making by providing clear, organized data for loan management.

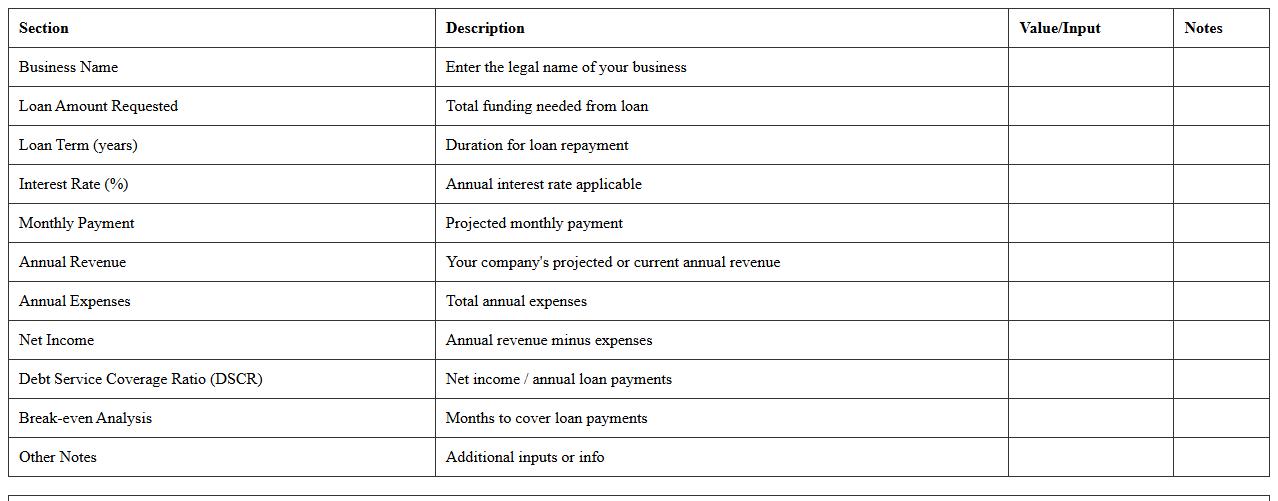

Small Business Loan Viability Analysis Excel Template

The

Small Business Loan Viability Analysis Excel Template is a comprehensive financial tool designed to evaluate the feasibility of securing a loan for small businesses. It helps users input key financial data such as revenue projections, expenses, and loan repayment schedules to determine cash flow viability and repayment capacity. This template is useful in making informed lending decisions, preparing loan applications, and optimizing business financial planning for sustainable growth.

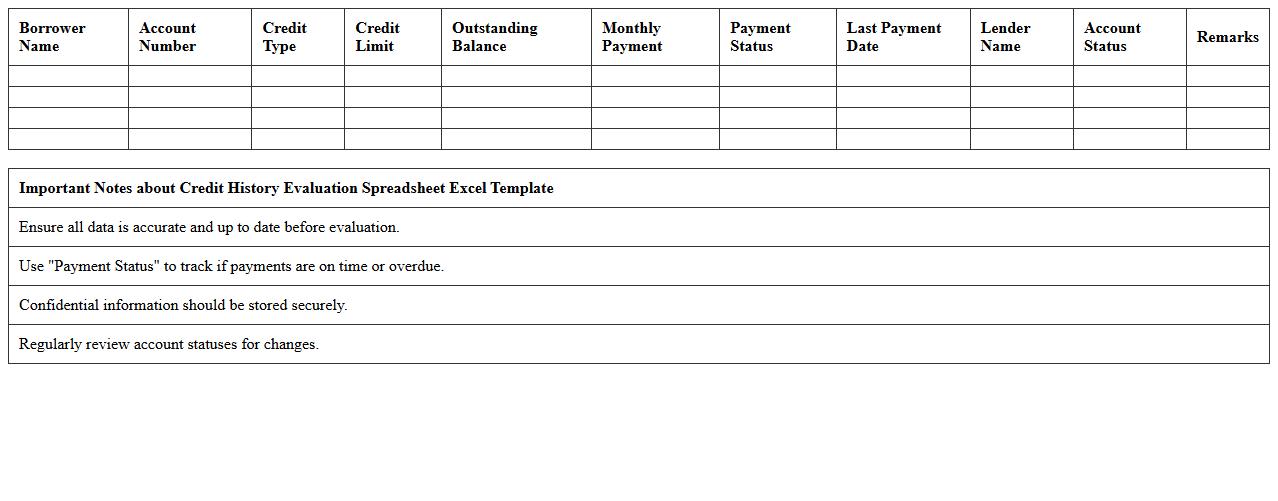

Credit History Evaluation Spreadsheet Excel Template

The

Credit History Evaluation Spreadsheet Excel Template is a structured document designed to organize and analyze an individual's or business's credit data, including payment history, credit limits, and outstanding balances. This template facilitates quick assessment of creditworthiness by providing clear visualizations and comparative metrics, enabling lenders and financial analysts to make informed decisions. The spreadsheet improves accuracy in tracking credit performance over time, streamlining the evaluation process and reducing the risk of financial misjudgments.

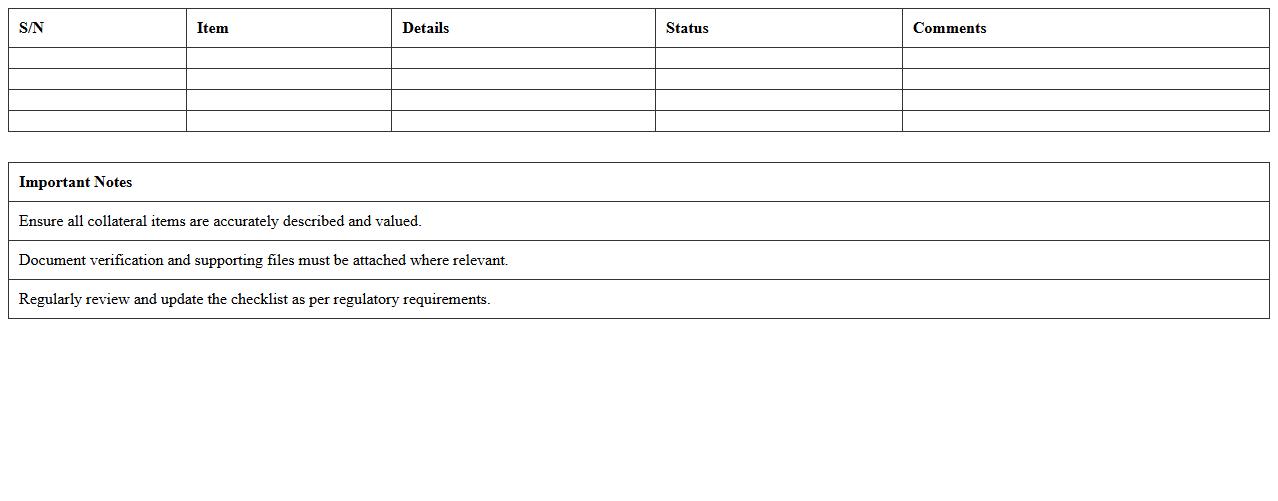

Collateral Assessment Checklist Excel Template

The

Collateral Assessment Checklist Excel Template is a structured document designed to systematically evaluate and manage collateral assets in financial or business contexts. It helps users track essential details such as asset type, condition, value, and compliance requirements, ensuring thorough risk assessment and documentation. By using this template, organizations can streamline collateral review processes, enhance accuracy, and improve decision-making efficiency.

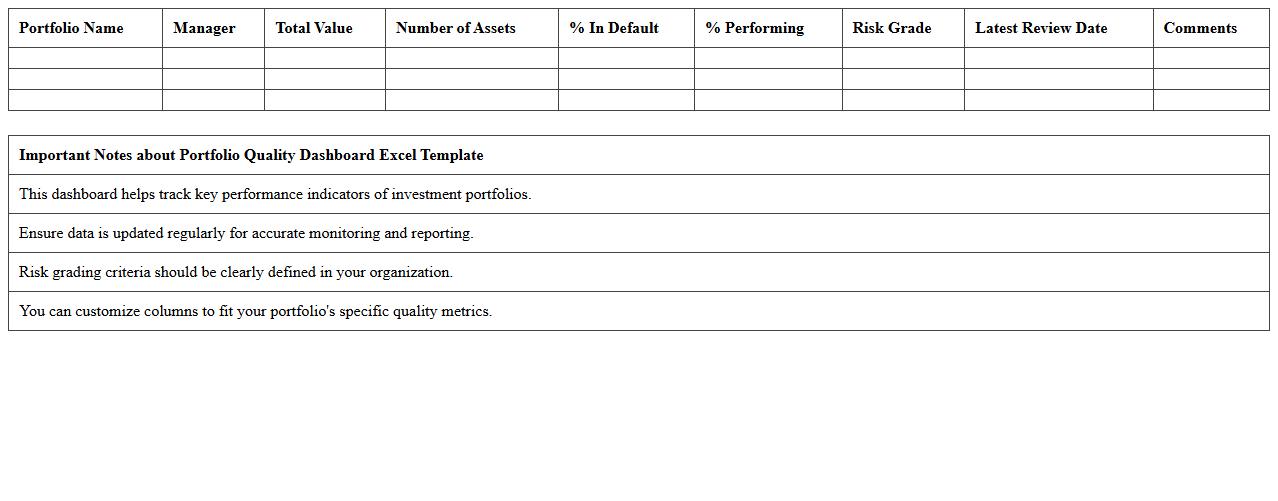

Portfolio Quality Dashboard Excel Template

The

Portfolio Quality Dashboard Excel Template document is a comprehensive tool designed to track, analyze, and visualize the performance metrics and risk factors of various investment portfolios. It enables users to monitor asset allocation, diversification, returns, and volatility through customizable charts and data tables, providing valuable insights for informed decision-making. This template enhances portfolio management efficiency by consolidating critical financial data into an accessible and interactive format, supporting better risk assessment and strategic adjustments.

How can loan risk grading be automated in a Loan Assessment Excel template for MFIs?

Automating loan risk grading in Excel requires setting up conditional formulas based on borrower data such as credit score, repayment history, and collateral. By using IF, AND, and VLOOKUP functions, you can assign categorical risk grades like low, medium, or high risk. This automation increases accuracy and speeds up the loan assessment process for Microfinance Institutions (MFIs).

What key borrower metrics should be included in a microfinance loan application tracker?

An effective loan application tracker must capture borrower metrics including income levels, debt-to-income ratio, repayment history, and loan purpose. Additional critical data involves business type, loan amount requested, and employment status. These metrics help MFIs evaluate creditworthiness and loan suitability accurately.

Which Excel formulas best calculate loan repayment capacity for micro-entrepreneurs?

To calculate loan repayment capacity, Excel formulas like PMT for monthly payments and SUMPRODUCT for income versus expense analysis are essential. Incorporating IF statements helps simulate different repayment scenarios based on fluctuating revenues. These formulas support precise repayment planning customized for micro-entrepreneurs' cash flows.

How can disbursement and collection schedules be dynamically visualized in Excel for microloans?

Dynamic visualization of disbursement and collection schedules can be achieved through Excel charts like Gantt charts or pivot charts linked to schedule tables. Utilizing Excel's conditional formatting and slicers enables interactive filtering by date or loan type. This approach ensures clear and real-time monitoring of microloan cash flows.

What pivot tables help analyze loan portfolio quality by gender or sector in microfinance datasets?

Pivot tables summarizing loan performance metrics by gender and business sector offer insights into portfolio diversification and risk. These tables can cross-reference default rates, average loan size, and repayment punctuality. Such analysis supports targeted strategy development to improve loan outcomes within microfinance portfolios.

More Assessment Excel Templates