The Portfolio Analysis Excel Template for Real Estate Investors offers a streamlined way to track and evaluate property performance. It enables investors to analyze key metrics such as cash flow, ROI, and property value changes efficiently. This tool helps optimize investment decisions by providing clear, organized data insights.

Rental Property Portfolio Tracker Excel Template

The

Rental Property Portfolio Tracker Excel Template is a specialized document designed to organize and monitor multiple rental properties' financial performance. It helps investors track income, expenses, occupancy rates, and return on investment efficiently, providing clear insights into cash flow and overall profitability. This tool simplifies decision-making and property management by consolidating critical data in a structured, easy-to-update format.

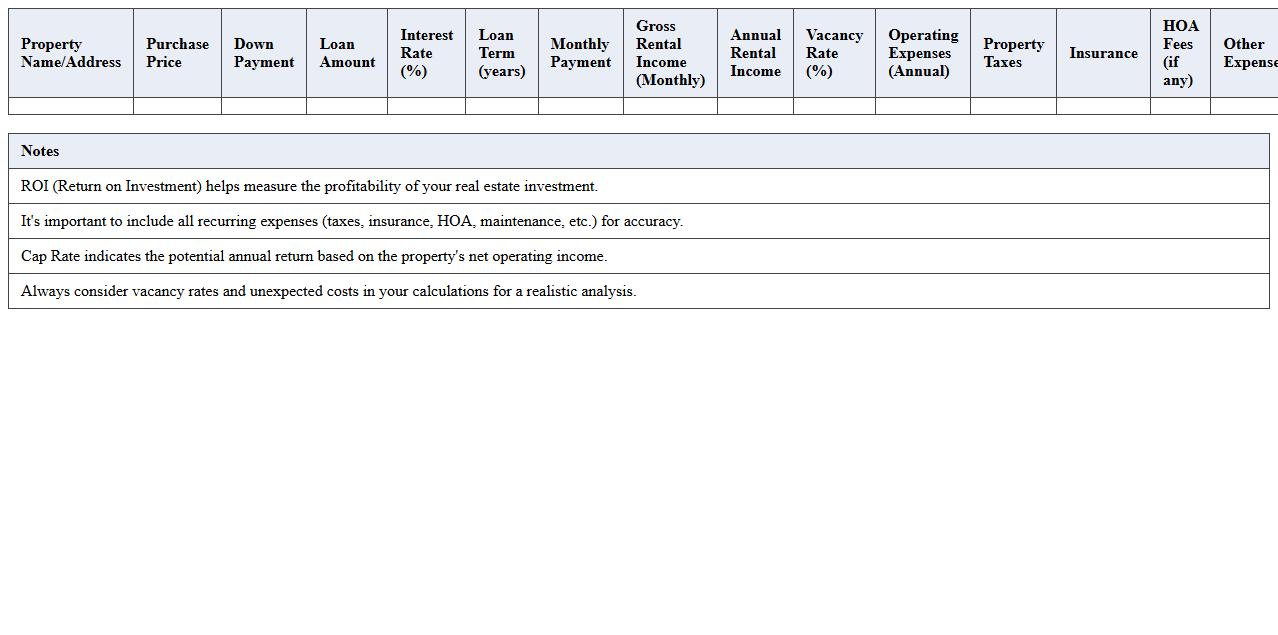

Real Estate ROI Analysis Spreadsheet

A

Real Estate ROI Analysis Spreadsheet is a detailed financial tool designed to calculate the return on investment for property purchases by tracking income, expenses, and cash flow. It helps investors evaluate potential profitability and make informed decisions by organizing data such as purchase price, mortgage details, rental income, operating costs, and tax implications. This document streamlines financial analysis, enabling users to compare multiple properties and optimize investment strategies effectively.

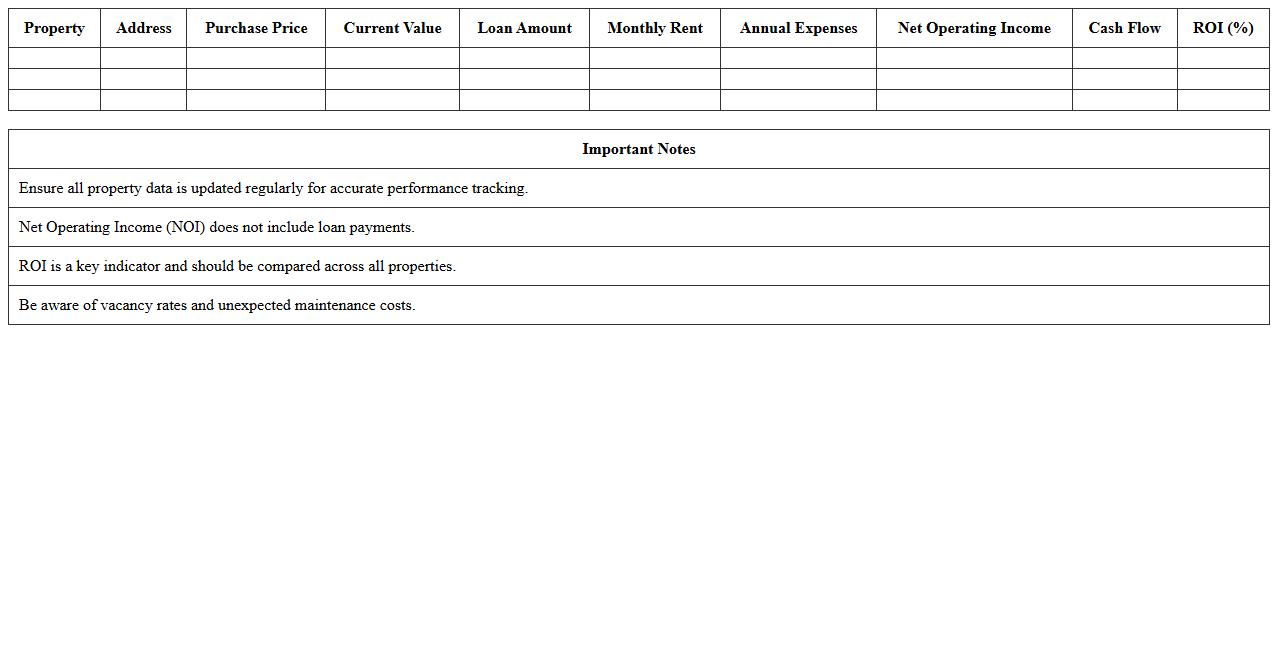

Multi-Property Investment Performance Dashboard

The

Multi-Property Investment Performance Dashboard is a comprehensive tool that consolidates financial and operational data across multiple real estate assets, providing a clear overview of investment returns, occupancy rates, and expense management. This dashboard helps investors and property managers make data-driven decisions by highlighting trends and identifying underperforming properties within a portfolio. Enhanced visibility into key performance indicators ensures optimized portfolio management and maximized profitability.

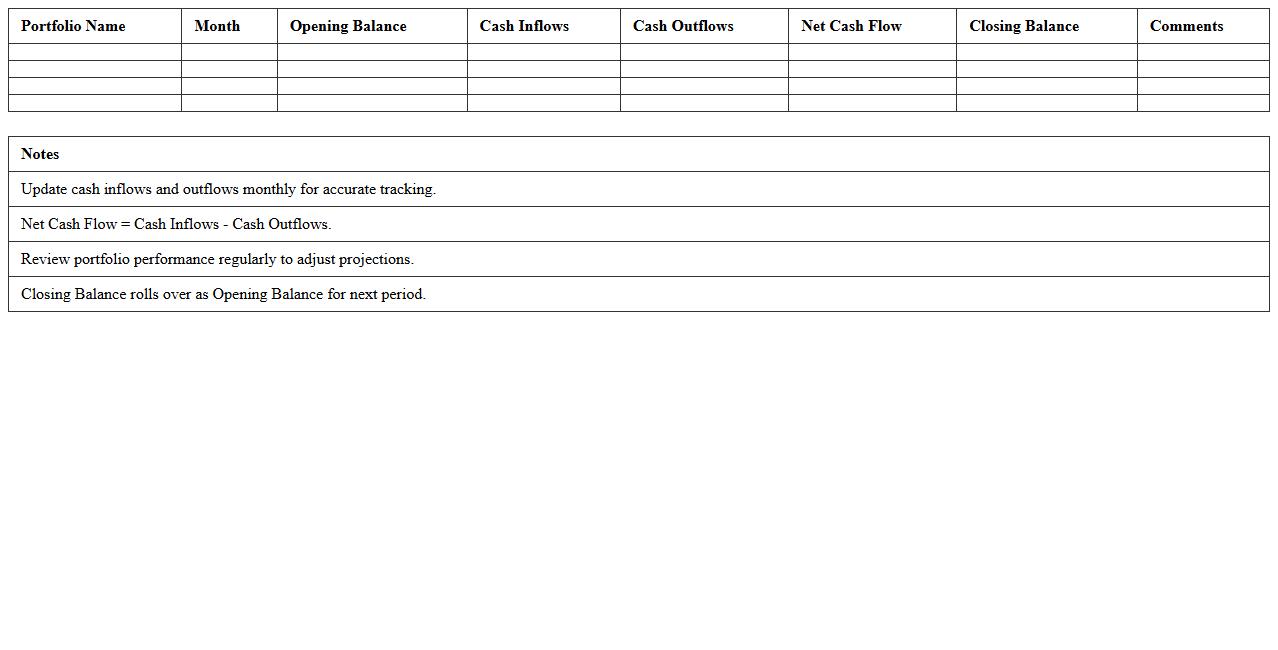

Cash Flow Projection Excel Template for Portfolios

A

Cash Flow Projection Excel Template for Portfolios is a structured spreadsheet designed to estimate future cash inflows and outflows associated with investment portfolios. It helps investors anticipate liquidity needs, plan for reinvestments, and make informed decisions about asset allocation. By providing a clear visualization of expected financial movements, this tool enhances the ability to manage portfolio risk and optimize returns over time.

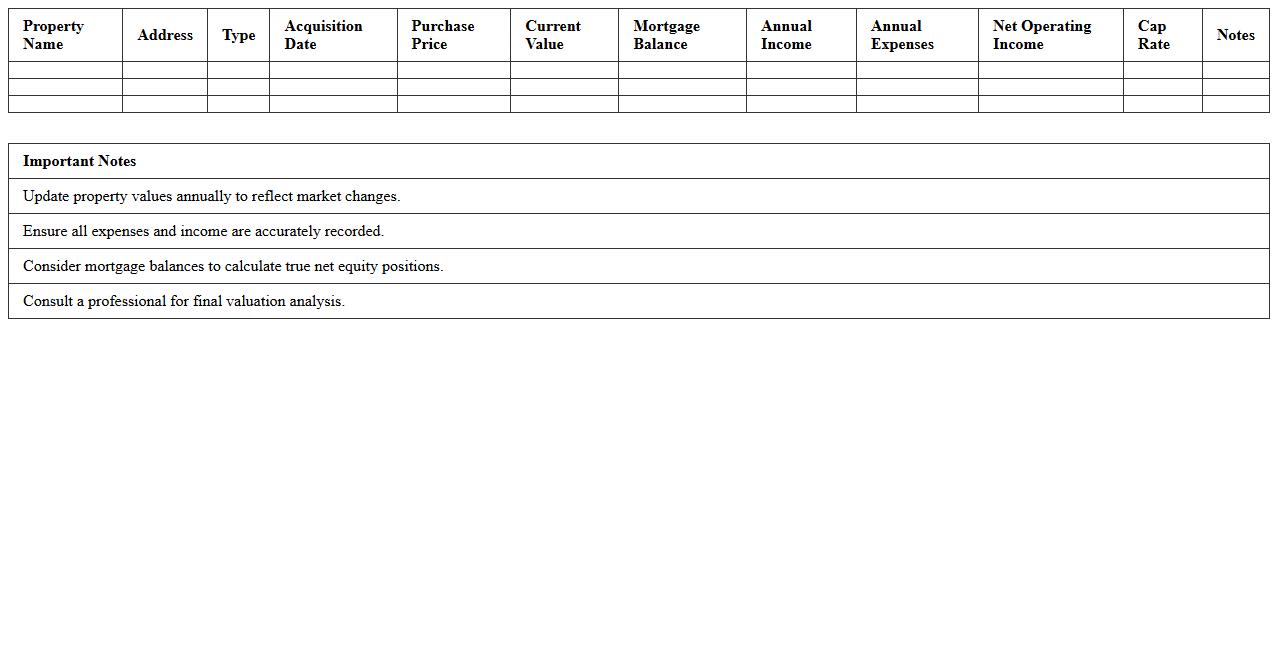

Real Estate Holdings Valuation Workbook

The

Real Estate Holdings Valuation Workbook is a comprehensive tool designed to analyze and estimate the market value of real estate assets through detailed financial modeling and data input. It consolidates key valuation metrics such as cash flow projections, capitalization rates, and comparable property analysis to provide accurate and actionable insights for investors, developers, and portfolio managers. This document streamlines decision-making processes by offering a structured approach to asset performance evaluation and strategic investment planning.

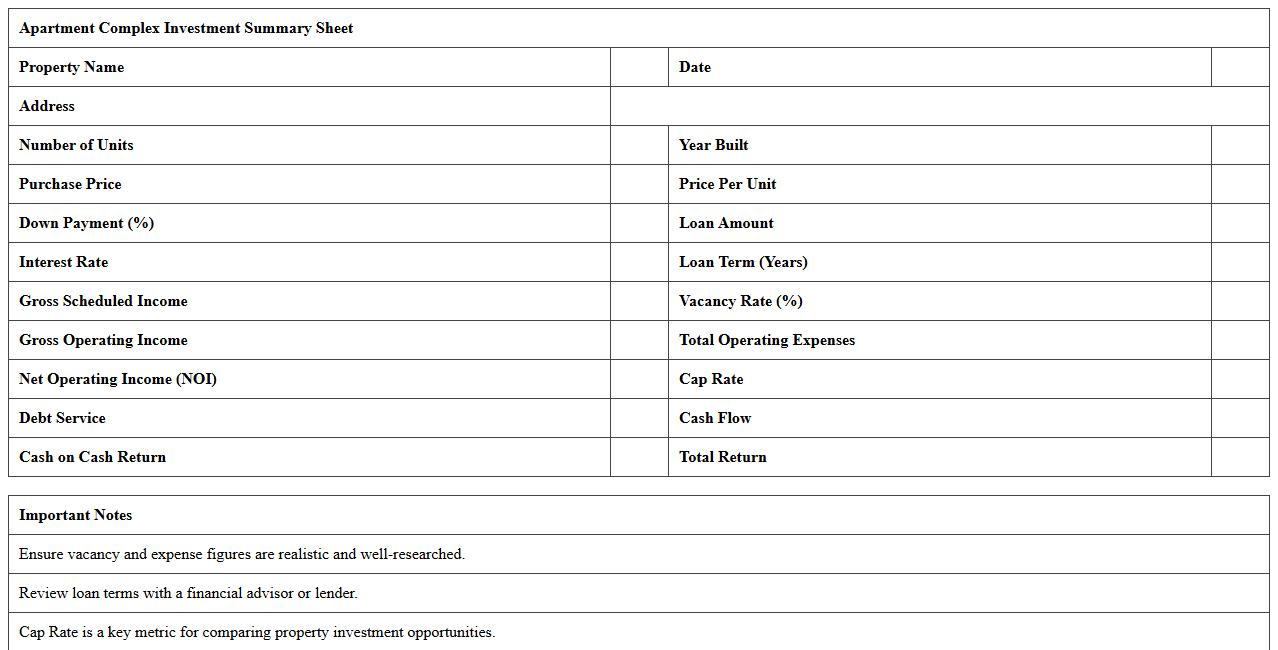

Apartment Complex Investment Summary Sheet

An

Apartment Complex Investment Summary Sheet is a detailed document that consolidates key financial metrics, property details, and investment performance data for a multifamily property. This summary helps investors quickly evaluate the potential return on investment, cash flow projections, and risk factors associated with the apartment complex. By providing a clear snapshot of revenue, expenses, occupancy rates, and market trends, it enables informed decision-making and efficient comparison between multiple investment opportunities.

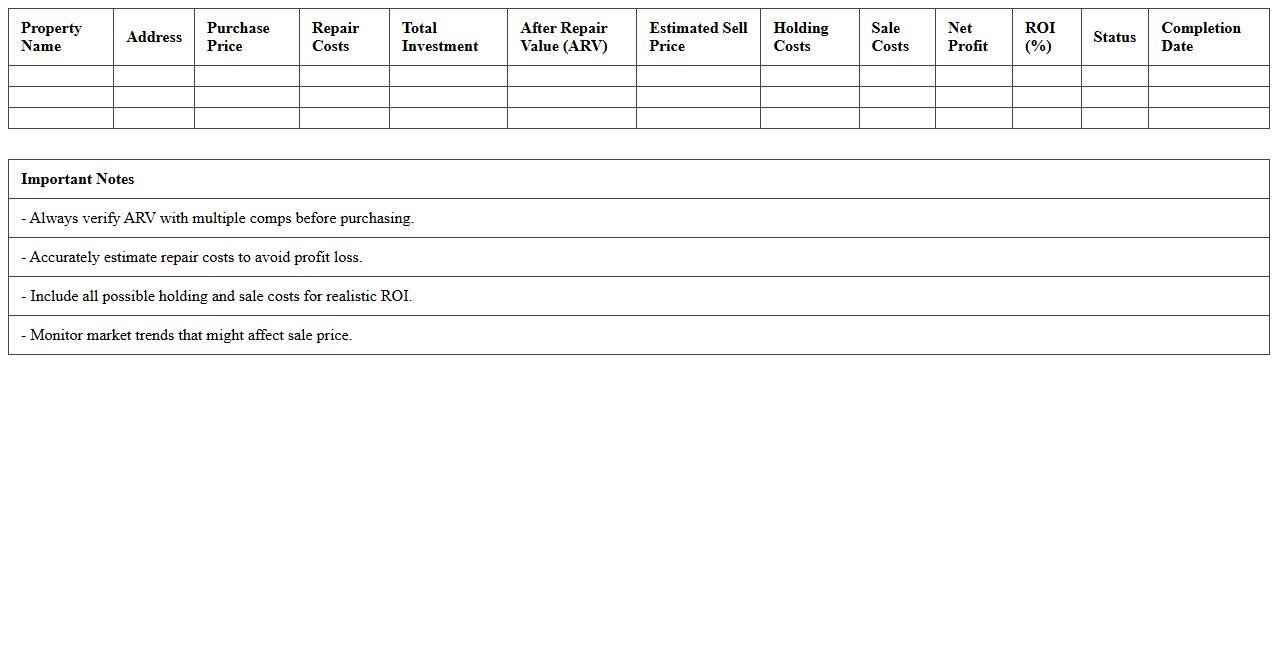

Fix and Flip Portfolio Analysis Template

The

Fix and Flip Portfolio Analysis Template is a comprehensive tool designed to evaluate multiple real estate investment opportunities systematically. It enables investors to assess project costs, timelines, potential profits, and risks, ensuring informed decision-making and efficient capital allocation. By organizing financial data and performance metrics in one place, this template streamlines portfolio management and maximizes return on investment.

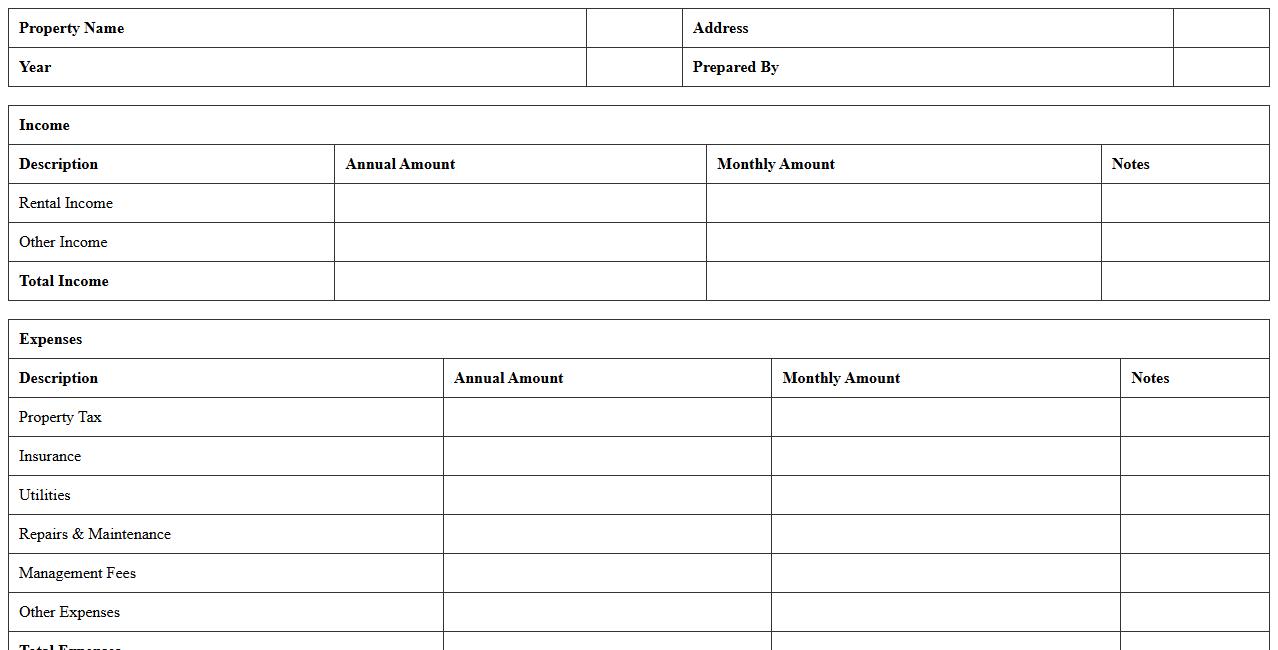

Commercial Property Income & Expense Analyzer

The

Commercial Property Income & Expense Analyzer document is a detailed financial tool used to assess the profitability of commercial real estate investments by tracking all sources of income and itemizing operating expenses. It enables investors and property managers to evaluate cash flow, identify cost-saving opportunities, and make informed decisions regarding property management or acquisition. This analyzer is essential for maximizing returns and ensuring accurate financial forecasting in commercial property ventures.

Real Estate Acquisition & Disposition Tracker

A

Real Estate Acquisition & Disposition Tracker is a detailed document used to monitor and manage the purchase and sale of property assets within a portfolio. It provides critical data such as transaction dates, property details, financial metrics, and status updates, enabling efficient oversight of investment activities. This tool enhances decision-making by offering a centralized record that improves transparency, risk assessment, and strategic planning for real estate investments.

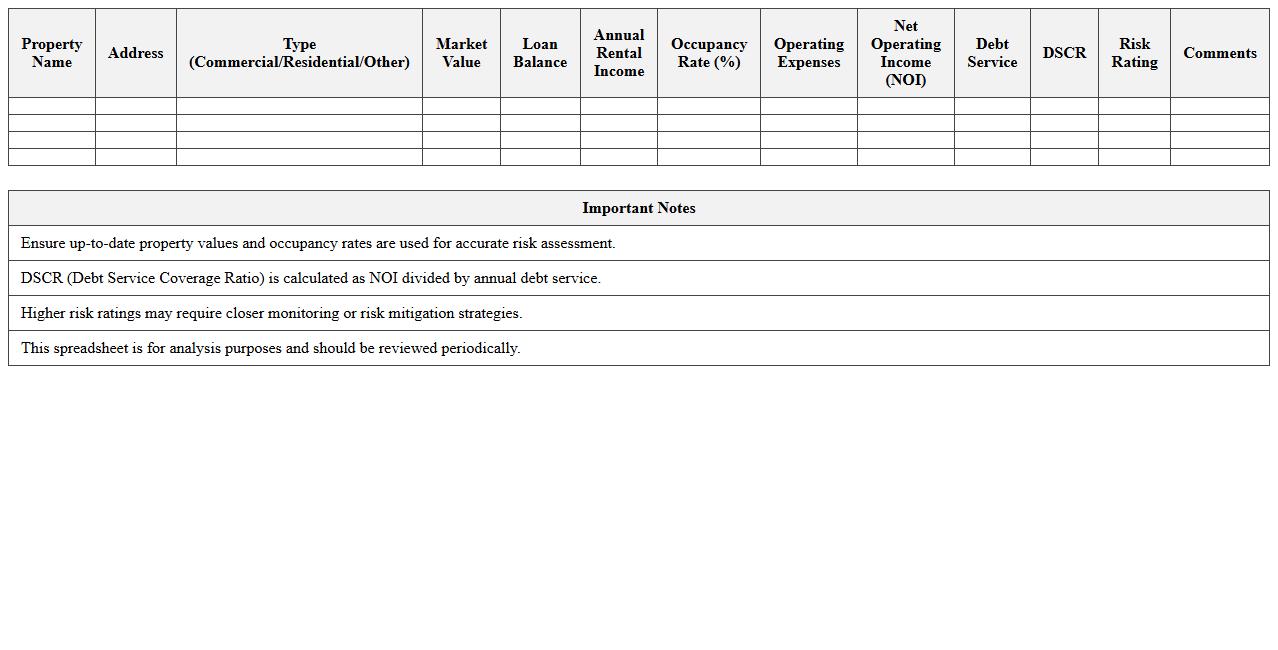

Mixed-Use Portfolio Risk Assessment Spreadsheet

The

Mixed-Use Portfolio Risk Assessment Spreadsheet is a comprehensive tool designed to evaluate and quantify risks associated with diverse property investments, including residential, commercial, and retail components. It enables investors and asset managers to systematically analyze factors such as market volatility, tenant default probabilities, and cash flow variability across multiple asset types within a single portfolio. Utilizing this spreadsheet enhances decision-making by identifying potential risk exposures, optimizing diversification strategies, and improving the overall resilience of mixed-use real estate portfolios.

How can I automate cap rate calculations in a real estate portfolio analysis Excel sheet?

To automate cap rate calculations, use Excel formulas linking net operating income (NOI) directly with property values. Implement dynamic inputs so any changes in income or property price instantly update cap rates. Utilizing named ranges and structured tables can further streamline and automate your portfolio analysis.

What are the best Excel formulas for tenant cash flow forecasting in multifamily properties?

Effective tenant cash flow forecasting leverages IF statements for conditional rent increases and SUMPRODUCT for aggregating cash flows across units. Use time series functions like OFFSET or INDEX to forecast over multiple periods seamlessly. Combining these formulas enables accurate projections tailored to multifamily property dynamics.

How do I structure sensitivity analysis for rent growth in real estate portfolio spreadsheets?

Create a matrix of rent growth assumptions using Data Tables or Scenario Manager to run sensitivity analysis. Link rent growth rates to projected revenues and calculate their impact on key metrics such as NOI and cap rate. This structure highlights how variations in rent growth assumptions influence overall portfolio performance.

What data should I include for a scenario analysis dashboard in an investor's Excel portfolio?

Include key performance indicators like rent growth, vacancy rates, operating expenses, and cap rates in the scenario analysis dashboard. Visual elements such as charts and slicers help investors quickly grasp the impact of different scenarios. Integrating real-time data inputs ensures the dashboard reflects current portfolio status effectively.

How can Excel track and compare ROI across multiple property types in one portfolio workbook?

Employ pivot tables and data models to summarize and compare ROI across multiple property types. Use formulas to calculate ROI consistently and connect data from each asset class within one workbook for holistic analysis. This approach enables efficient performance tracking and cross-property benchmarking.

More Analysis Excel Templates