The Break-even Analysis Excel Template for Small Cafes helps cafe owners calculate the sales volume needed to cover costs and start making a profit. This template includes customizable fields for fixed costs, variable costs, and pricing, enabling precise financial planning. It offers visual charts that simplify understanding of break-even points and support effective decision-making.

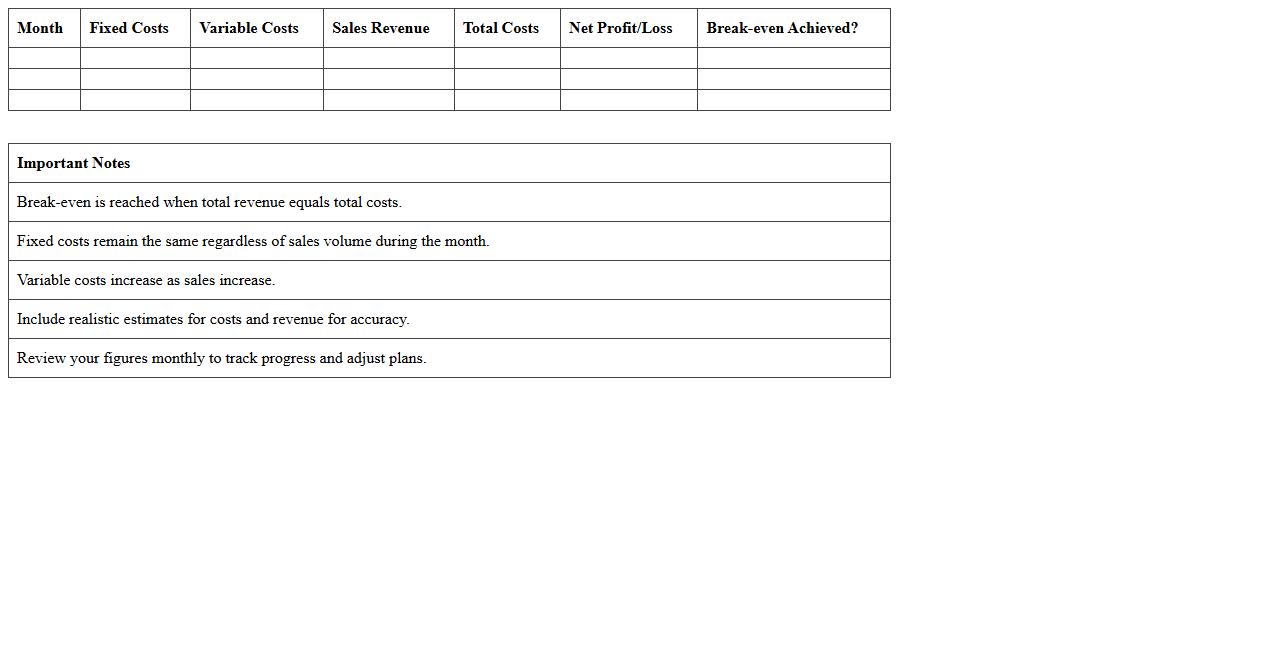

Monthly Break-even Calculator for Startup Cafes

The

Monthly Break-even Calculator for Startup Cafes document is a financial tool designed to determine the exact sales volume needed each month to cover all fixed and variable costs without incurring losses. It helps startup cafe owners identify critical thresholds for revenue generation, enabling informed decision-making on pricing, cost control, and marketing strategies. This calculator is essential for managing cash flow, evaluating financial feasibility, and planning sustainable growth in the competitive cafe industry.

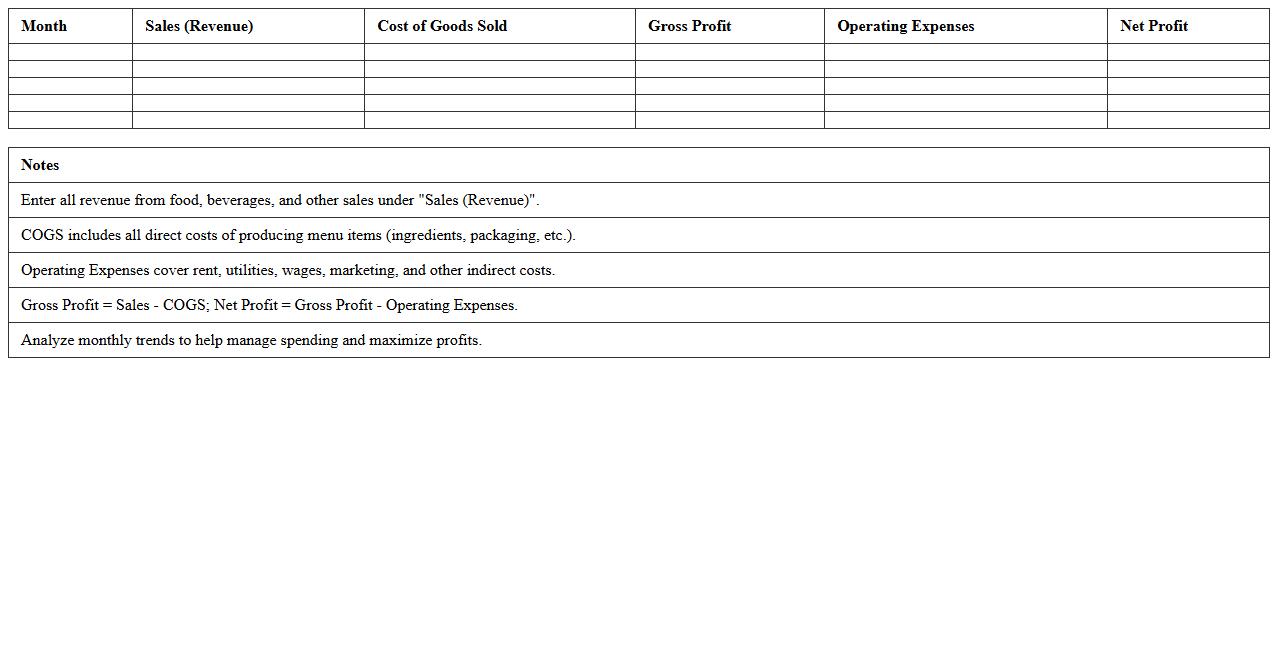

Small Cafe Sales vs. Expenses Analysis Spreadsheet

The

Small Cafe Sales vs. Expenses Analysis Spreadsheet is a financial tool designed to track and compare the revenue generated by a cafe against its operational costs. It allows business owners to identify profit margins, control expenses, and make informed decisions to improve financial health. Using this spreadsheet helps in budgeting, forecasting, and pinpointing areas for cost reduction or sales growth.

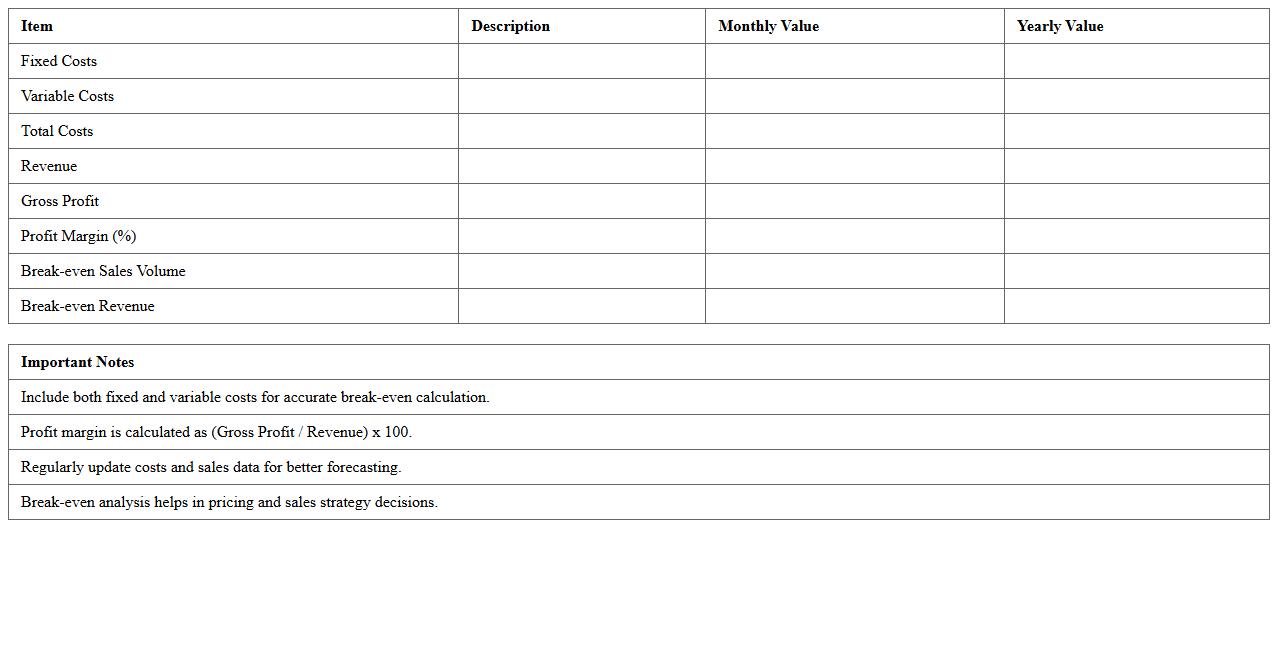

Profit Margin & Break-even Excel Model for Coffee Shops

The

Profit Margin & Break-even Excel Model for coffee shops is a financial tool designed to calculate key metrics such as net profit margin and break-even points accurately. This model helps coffee shop owners analyze costs, pricing strategies, and sales volume needed to cover expenses and generate profits. Using this document enables informed decision-making, budget planning, and optimization of business operations for sustained profitability.

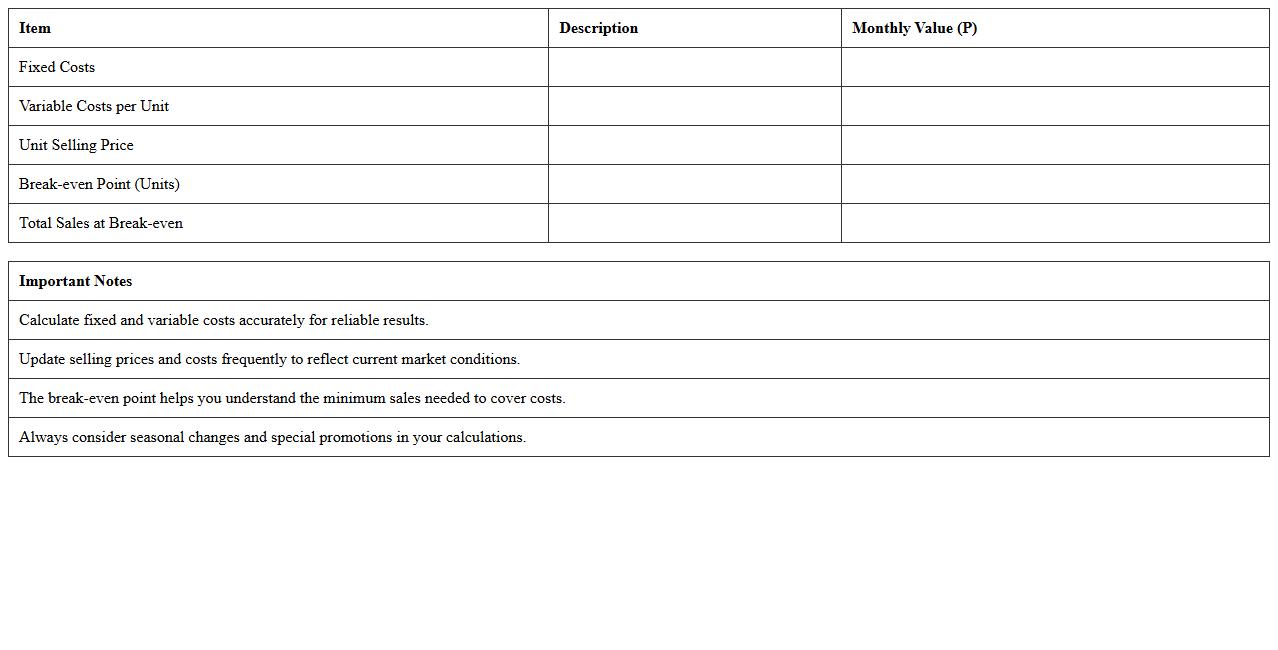

Simple Break-even Point Sheet for Cafe Owners

A

Simple Break-even Point Sheet for cafe owners is a financial tool that calculates the sales volume needed to cover all fixed and variable costs, helping determine when the business will start generating profit. This document enables cafe owners to make informed decisions about pricing, cost control, and sales targets by clearly identifying the minimum revenue required to avoid losses. It is useful for budgeting, forecasting, and assessing the financial viability of the cafe.

Cost Structure and Revenue Tracker for Cafes

The

Cost Structure and Revenue Tracker for Cafes document outlines detailed financial components, including fixed and variable costs, alongside income streams essential for monitoring profitability. It enables cafe owners to identify expense patterns, optimize resource allocation, and ensure sustainable revenue growth. This tool supports informed decision-making by providing clear insights into cost management and revenue generation dynamics.

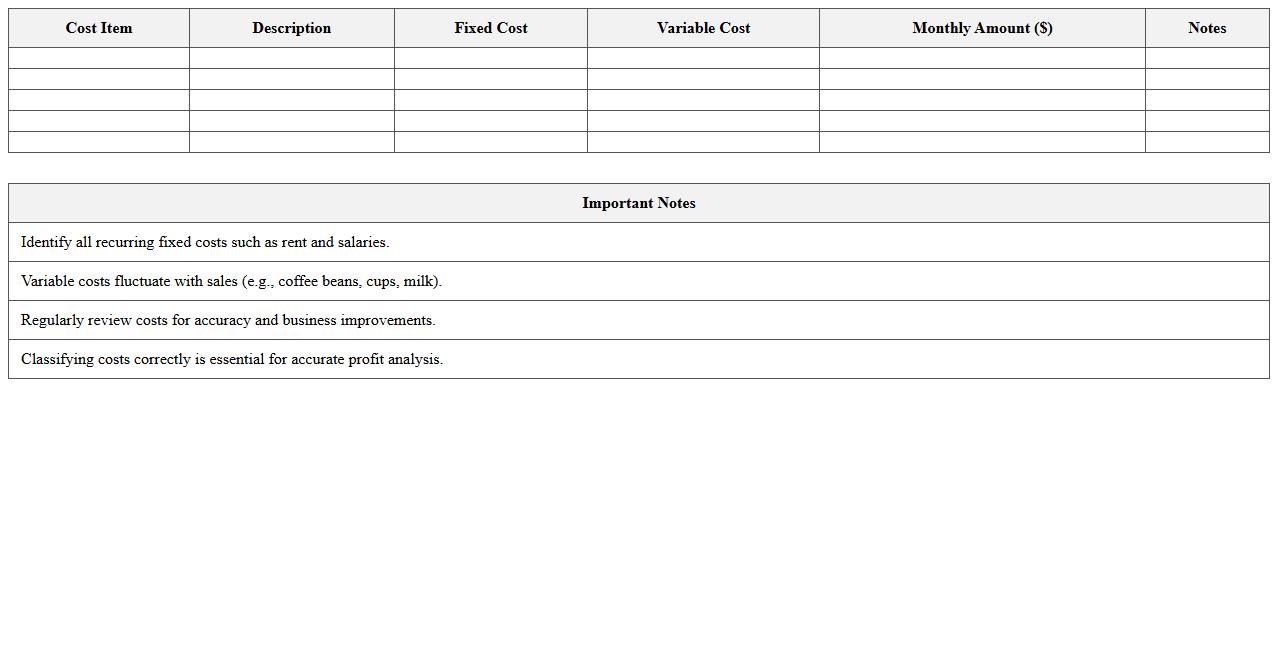

Fixed and Variable Cost Analysis Template for Cafes

A

Fixed and Variable Cost Analysis Template for Cafes is a structured document designed to categorize and track consistent expenses like rent and salaries, as well as fluctuating costs such as inventory and utilities. This template helps cafe owners gain clear insight into their financial obligations, enabling more accurate budgeting and pricing strategies. By distinguishing between fixed and variable costs, cafes can optimize profitability and make informed operational decisions.

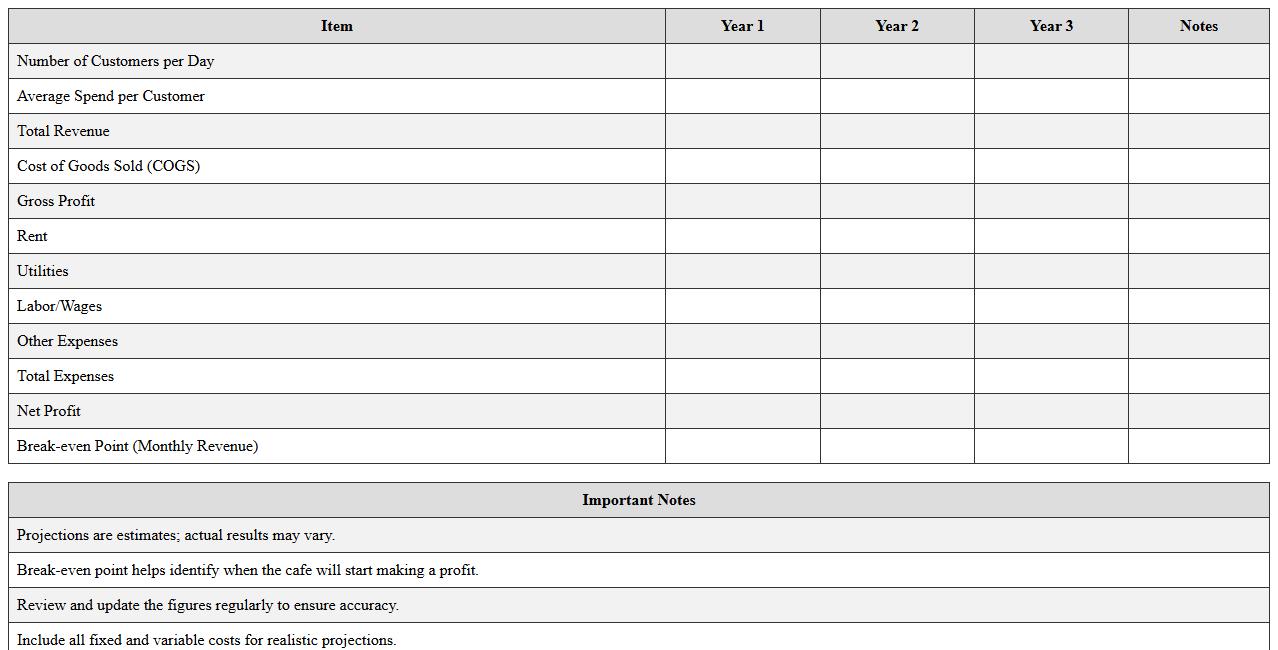

Small Cafe Financial Projections & Break-even Tool

The

Small Cafe Financial Projections & Break-even Tool document provides a detailed forecast of revenue, expenses, and profit margins tailored specifically for small cafe businesses. It helps owners analyze when their cafe will reach the break-even point, ensuring informed decisions about pricing, cost management, and investment. This tool is essential for budgeting, securing funding, and tracking financial performance to maintain long-term sustainability.

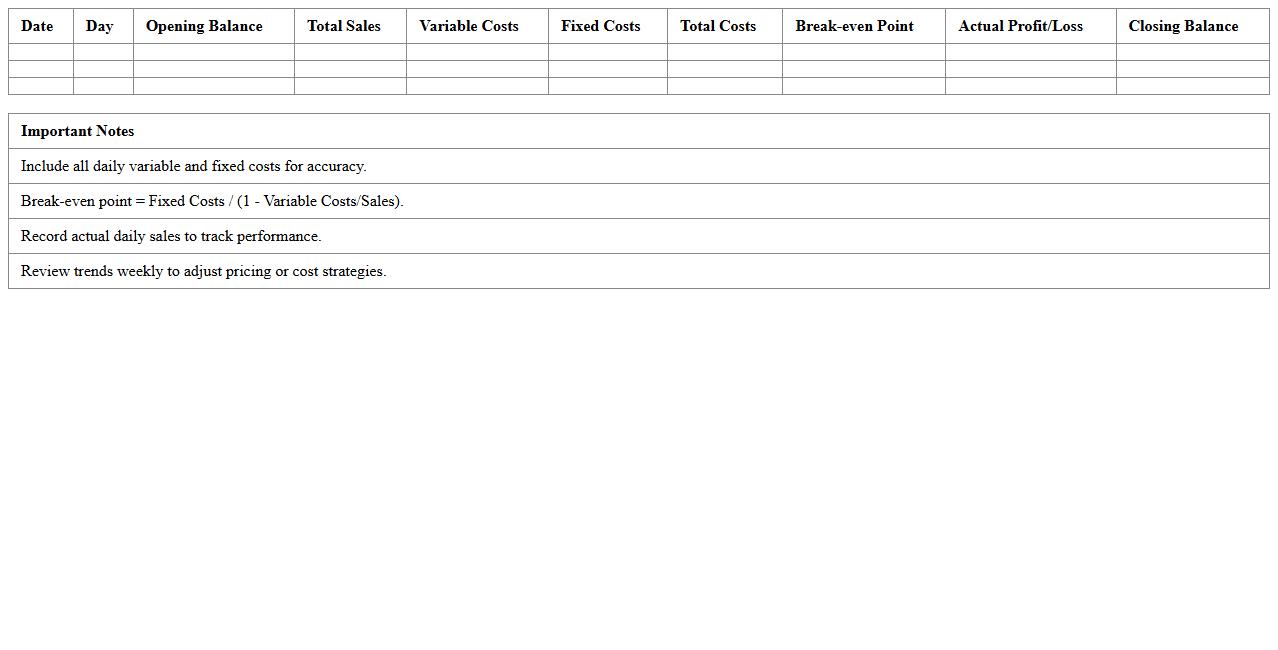

Daily Sales Break-even Worksheet for Cafés

The

Daily Sales Break-even Worksheet for Cafes is a financial tool designed to calculate the minimum daily revenue required to cover all operating costs. It helps cafe owners identify the exact sales targets needed to avoid losses by analyzing fixed and variable expenses. This worksheet enables more informed decision-making for pricing strategies, cost management, and profitability assessment.

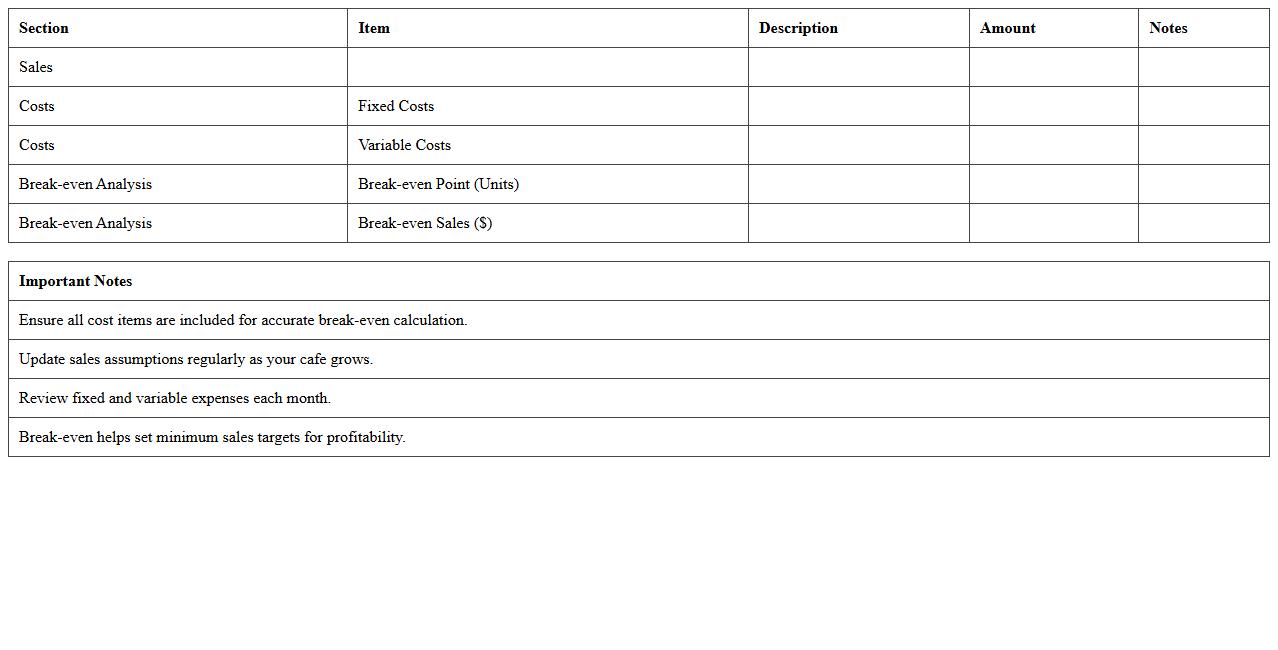

Income Statement & Break-even Analysis for Coffee Bars

An

Income Statement for Coffee Bars provides a detailed summary of revenue, expenses, and profit over a specific period, enabling precise financial performance tracking. Break-even Analysis calculates the sales volume needed to cover fixed and variable costs, helping coffee shop owners determine the minimum revenue required for profitability. Together, these tools support informed decision-making, budget planning, and effective cost management to maximize business sustainability.

Startup Cafe Financial Break-even Formula Sheet

The

Startup Cafe Financial Break-even Formula Sheet document provides a clear and concise framework to calculate the break-even point for new businesses. It includes essential formulas that help entrepreneurs determine when their startup will begin generating profit by covering all fixed and variable costs. This tool is useful for financial planning, budgeting, and making informed decisions to ensure sustainable business growth.

How do I customize break-even formulas for seasonal menu items in my cafe's Excel sheet?

To customize break-even formulas for seasonal menu items, adjust fixed and variable costs according to seasonal fluctuations. Incorporate a separate column for seasonal costs and expected sales volume in your Excel sheet. Use dynamic formulas referencing these cells for accurate break-even calculations throughout the year.

What specific cost variables should small cafes track in a break-even analysis template?

Small cafes should track fixed costs like rent and utilities, and variable costs including food ingredients, packaging, and direct labor. Also, account for indirect costs such as marketing and maintenance that impact profit margins. Accurate tracking of these variables ensures reliable break-even analysis for better financial decisions.

How can I automate daily sales input for break-even updates in Excel?

You can automate daily sales input using Excel tables combined with data entry forms or VBA macros for seamless updating. Link sales data directly to the break-even calculation cells to enable real-time updates. This reduces manual errors and provides instant insights on daily performance.

Which Excel charts best visualize a cafe's break-even point and profit margins?

Line charts effectively show break-even points by illustrating total costs versus total revenue over units sold. Combo charts combining bar and line graphs highlight profit margins alongside break-even analysis visually. These charts provide clear, actionable insights for cafe management.

How do labor costs impact break-even calculations in small cafe Excel spreadsheets?

Labor costs are a significant variable expense that directly affect the break-even point by increasing the total cost base. Accurately incorporating wages, benefits, and overtime into your Excel spreadsheet improves the precision of your profitability analysis. Managing labor efficiency can help lower the break-even threshold and boost overall cafe profitability.

More Analysis Excel Templates