The Compliance Audit Report Excel Template for Financial Advisors streamlines the process of tracking regulatory compliance and identifying potential risks within financial practices. This template offers customizable sections for documenting audit findings, recommendations, and corrective actions, enhancing transparency and accountability. Designed specifically for financial advisors, it ensures adherence to industry standards and simplifies reporting to stakeholders.

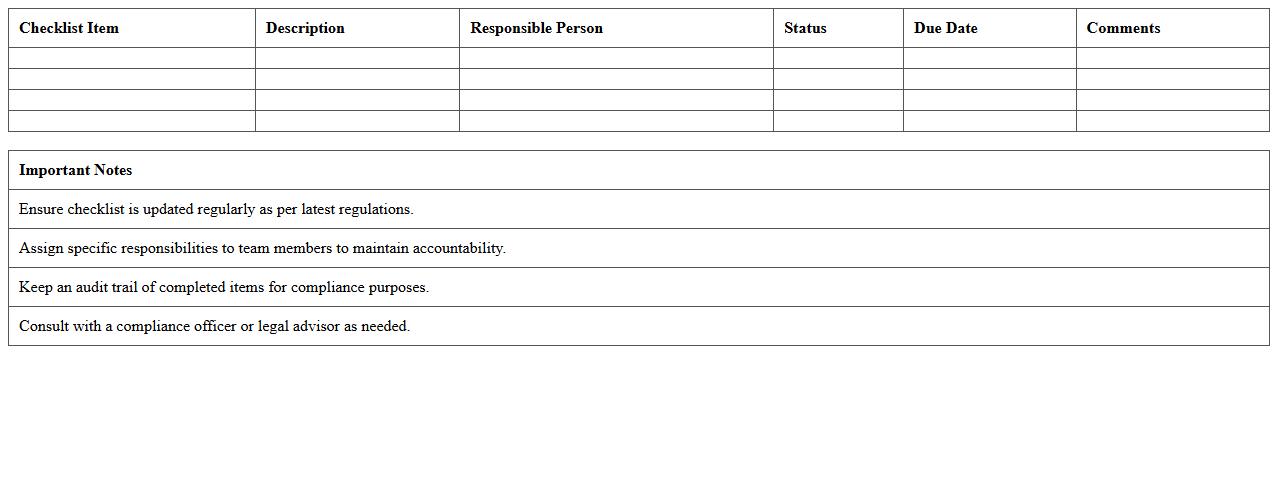

Regulatory Compliance Checklist Excel Template for Financial Advisors

The

Regulatory Compliance Checklist Excel Template for Financial Advisors is a structured tool designed to ensure adherence to industry regulations and standards. It helps financial advisors systematically track compliance requirements, deadlines, and documentation, reducing the risk of violations and penalties. This template improves organizational efficiency by providing a clear overview of regulatory tasks, enabling proactive management of compliance obligations.

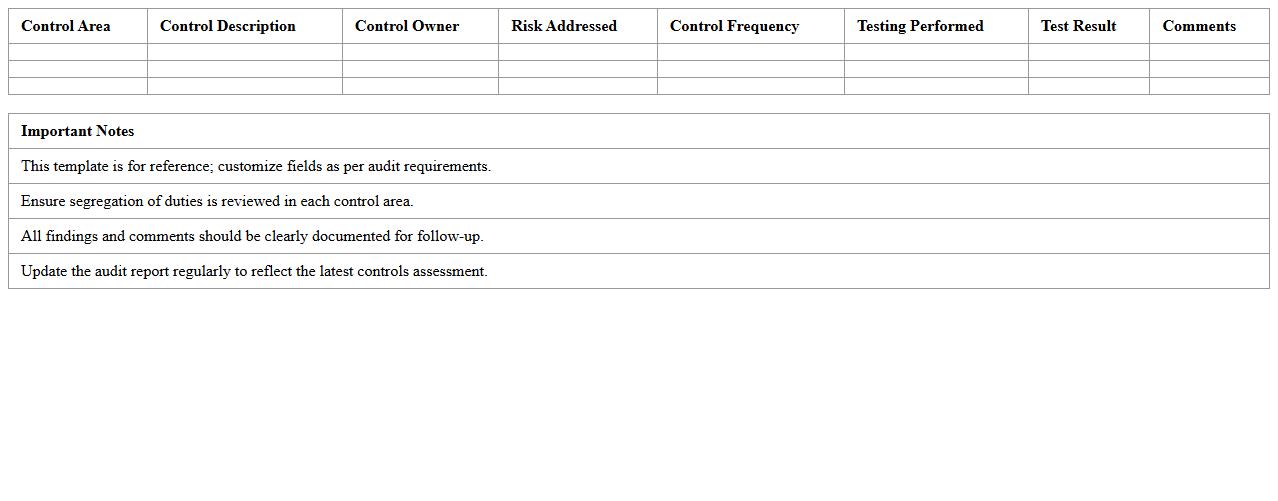

Internal Controls Audit Report Excel Template for Advisors

The

Internal Controls Audit Report Excel Template for Advisors is a structured tool designed to streamline the evaluation of an organization's internal control systems. It provides a comprehensive framework for documenting audit findings, risk assessments, and compliance checks, enabling advisors to deliver precise and actionable insights. This template enhances efficiency by standardizing the audit process and facilitating clear communication of control weaknesses and recommendations.

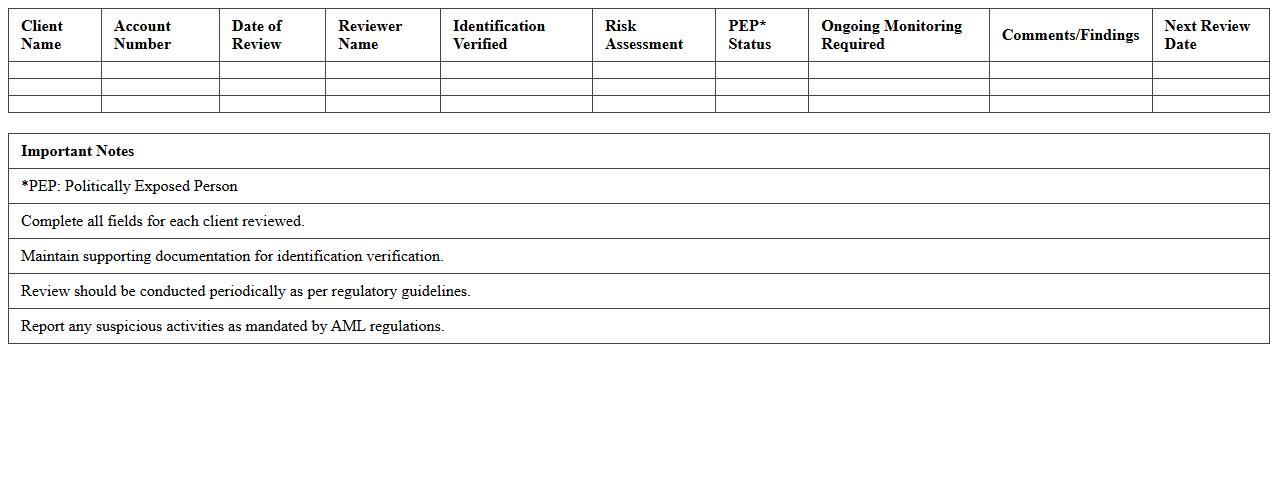

AML/KYC Compliance Review Excel Template for Financial Advisors

The

AML/KYC Compliance Review Excel Template for financial advisors is a structured tool designed to streamline the assessment and documentation of Anti-Money Laundering and Know Your Customer procedures. It facilitates systematic tracking of client information, risk assessments, and regulatory adherence, ensuring comprehensive compliance management. This template improves accuracy and efficiency, reducing the risk of regulatory penalties and enhancing due diligence processes in financial advisory practices.

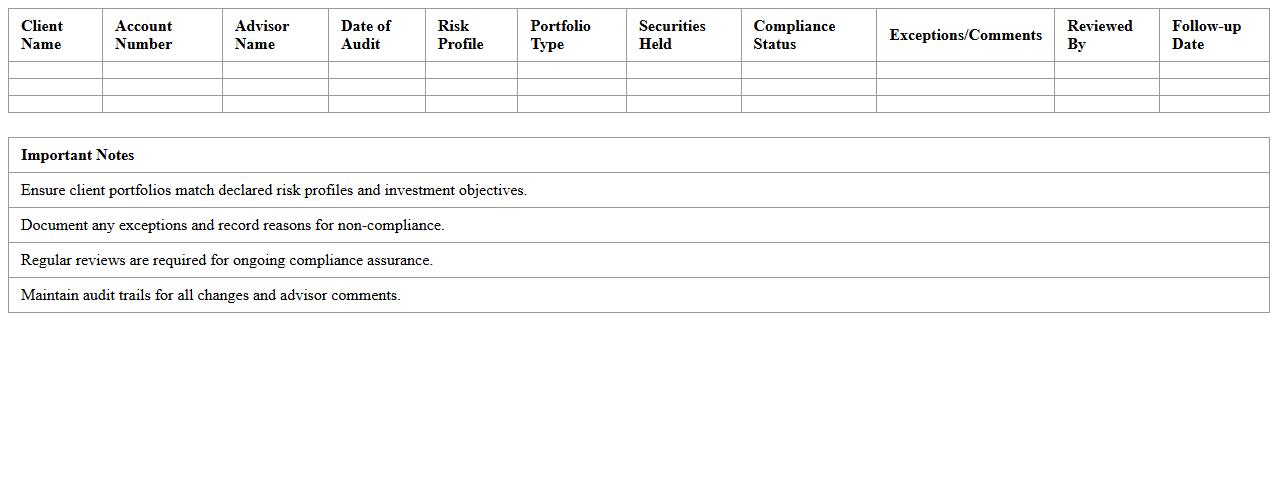

Portfolio Suitability Compliance Audit Excel Sheet

The

Portfolio Suitability Compliance Audit Excel Sheet document serves as a comprehensive tool to evaluate and ensure that investment portfolios align with regulatory standards and client risk profiles. It systematically organizes data to identify discrepancies, assess risk tolerance adherence, and track compliance status efficiently. This document aids financial advisors and compliance officers in maintaining transparent, accurate records while facilitating timely corrective actions to uphold fiduciary responsibilities.

Risk Assessment Compliance Tracker Excel Template

The

Risk Assessment Compliance Tracker Excel Template is a structured document designed to monitor and evaluate compliance with risk management policies and regulatory standards. It helps organizations identify, assess, and mitigate potential risks by providing a centralized platform for tracking risk statuses, deadlines, and corrective actions. Using this template enhances accountability, improves decision-making, and ensures timely response to compliance gaps, ultimately reducing operational vulnerabilities.

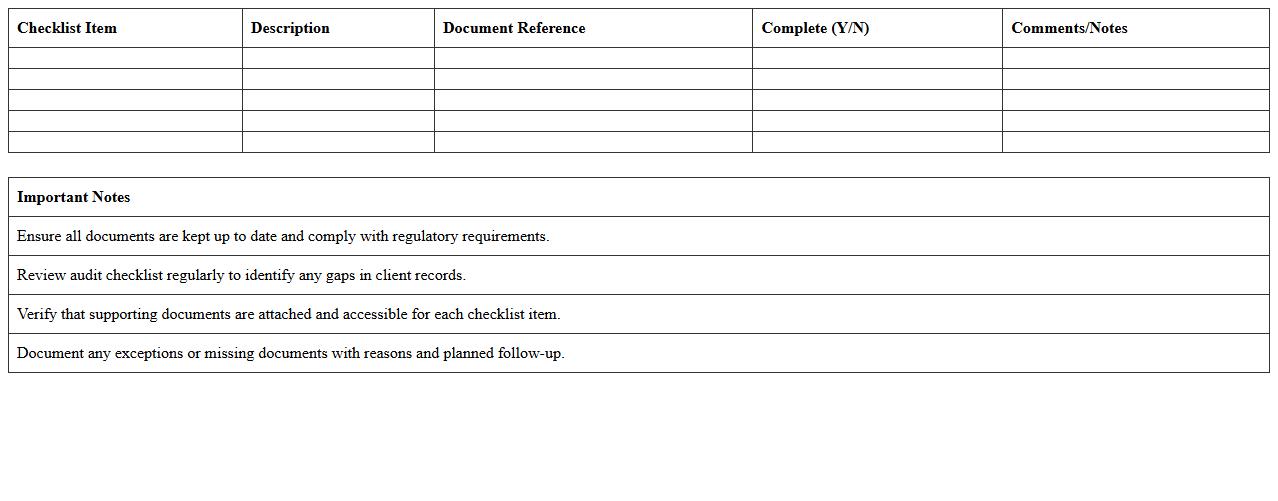

Documentation Review Audit Excel Checklist for Financial Advisors

The

Documentation Review Audit Excel Checklist for Financial Advisors is a structured tool designed to streamline the evaluation of client records, compliance documents, and financial plans. It ensures thorough verification of essential paperwork such as investment statements, risk assessments, and regulatory forms to maintain accuracy and meet industry standards. Utilizing this checklist enhances efficiency, reduces errors, and supports advisors in delivering transparent, compliant financial services.

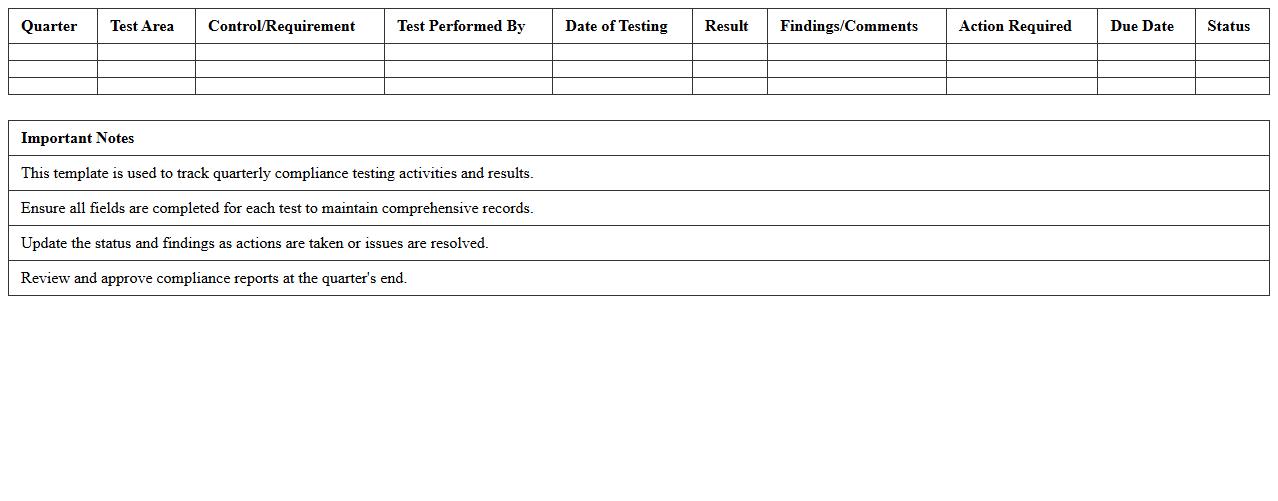

Quarterly Compliance Testing Report Excel Template

The

Quarterly Compliance Testing Report Excel Template is a structured document designed to systematically track and document compliance testing activities on a quarterly basis. It enables organizations to efficiently organize test results, monitor compliance status, and identify areas requiring corrective actions. This template improves accuracy and consistency in reporting, facilitating regulatory adherence and informed decision-making.

Investment Policy Compliance Tracking Excel Template

The

Investment Policy Compliance Tracking Excel Template document is a structured tool designed to monitor and ensure adherence to investment guidelines and regulations. It helps investors and portfolio managers systematically track compliance against predefined criteria such as asset allocation limits, risk parameters, and regulatory requirements. By using this template, users can identify deviations early, maintain transparency, and optimize portfolio performance while minimizing compliance risks.

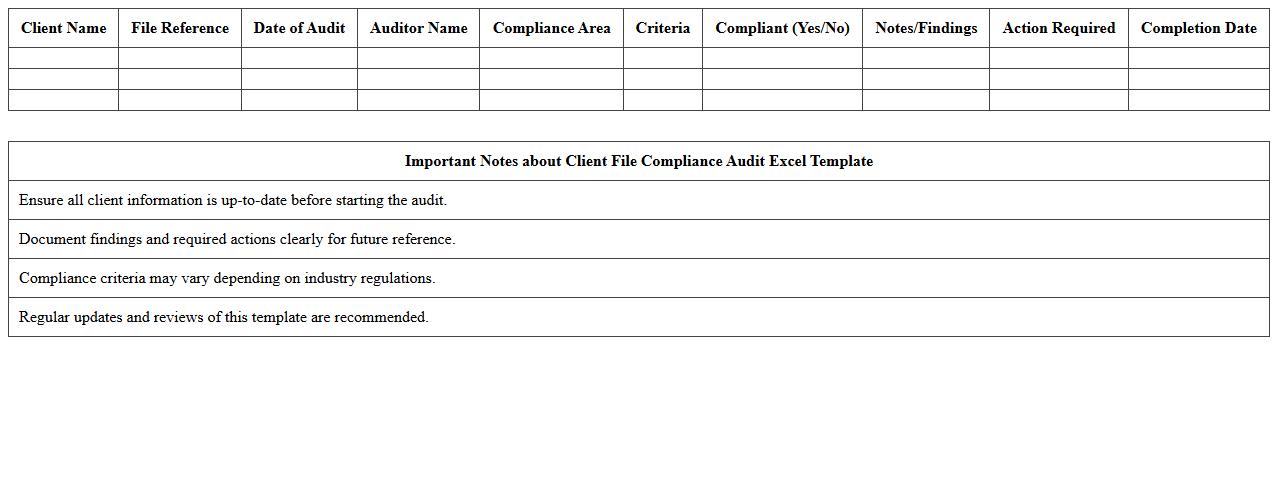

Client File Compliance Audit Excel Template

The

Client File Compliance Audit Excel Template is a structured spreadsheet designed to systematically review and verify client documentation against regulatory standards and internal policies. It enables organizations to efficiently track, assess, and document compliance status, ensuring that all client files meet legal and audit requirements. Using this template enhances accuracy, streamlines audit processes, and reduces the risk of non-compliance penalties.

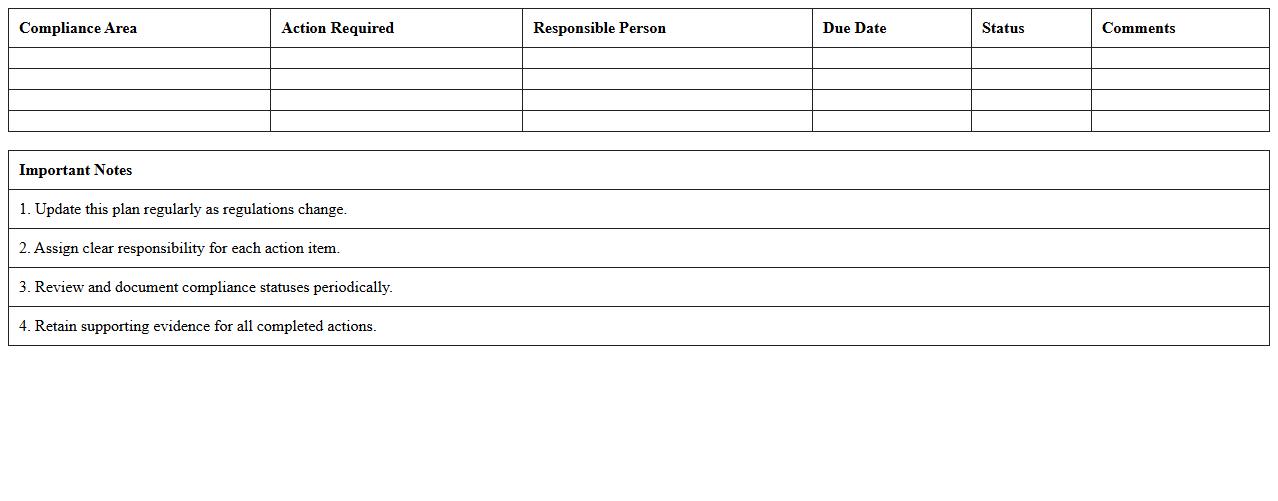

Financial Advisors Compliance Action Plan Excel Template

The

Financial Advisors Compliance Action Plan Excel Template is a structured document designed to help financial advisors systematically track and manage regulatory compliance tasks. It consolidates key compliance requirements, deadlines, and responsible parties into an organized spreadsheet, ensuring timely adherence to industry standards. Using this template enhances accountability, reduces risk of non-compliance, and streamlines the audit preparation process.

Which key compliance metrics are tracked in the audit report Excel for financial advisors?

The audit report Excel for financial advisors primarily tracks compliance adherence rates, client transaction scrutinies, and regulatory filing deadlines. These metrics ensure that every financial activity is reviewed against established policies. Monitoring key metrics supports proactive risk management and upholds fiduciary responsibilities effectively.

How does the template ensure data integrity and audit trail documentation?

The template enforces data integrity by utilizing locked cells and read-only sheets to prevent unauthorized changes. It maintains a comprehensive audit trail with timestamped logs for every data entry and modification. This systematic approach guarantees accountability and traceability throughout the compliance review process.

What specific regulatory frameworks are integrated into the compliance checklist?

The compliance checklist integrates critical regulatory frameworks such as SEC Rule 206(4)-7, FINRA guidelines, and the Investment Advisers Act. This alignment ensures financial advisors meet mandatory federal and industry standards. Incorporating these frameworks helps streamline audit readiness and regulatory reporting.

Are risk grading and mitigation status automated within the Excel report?

Yes, the report features automated risk grading using conditional formatting and formula-driven assessments based on input data. Mitigation status is dynamically updated to reflect ongoing risk resolution activities. Automation facilitates quicker identification of high-risk areas and tracking of compliance improvements.

How does the Excel document support multi-client compliance comparisons?

The Excel document supports multi-client compliance by aggregating data using pivot tables and dynamic dashboards. It offers comparative analytics through customizable filters and trend visualizations across various clients. This enables advisors to benchmark compliance performance efficiently and uncover broader risk patterns.

More Report Excel Templates