The Loan Payment Record Excel Template for Microfinance Organizations streamlines tracking borrower repayments with easy-to-use spreadsheets designed specifically for small-scale lending institutions. This template helps maintain accurate payment histories, calculate outstanding balances, and generate detailed financial reports efficiently. By organizing loan data systematically, microfinance organizations can improve loan management and enhance decision-making processes.

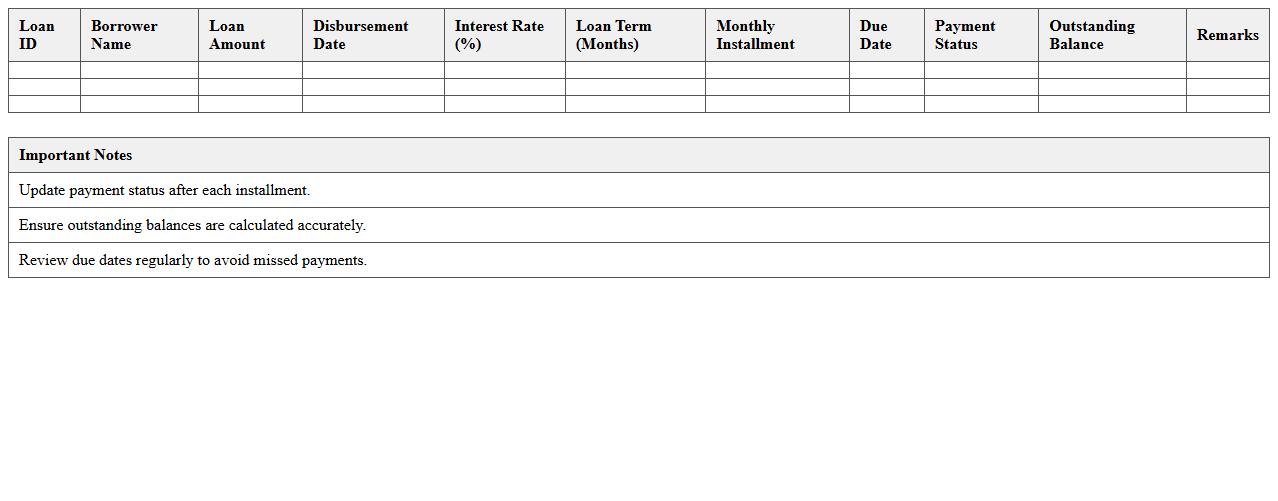

Microfinance Loan Disbursement Tracker Excel Template

The

Microfinance Loan Disbursement Tracker Excel Template is a structured spreadsheet designed to monitor and record loan distributions efficiently within microfinance institutions. It allows users to track borrower details, loan amounts, disbursement dates, and repayment statuses, enhancing financial transparency and accountability. This tool supports better loan portfolio management, reduces errors, and streamlines reporting for microfinance lenders and stakeholders.

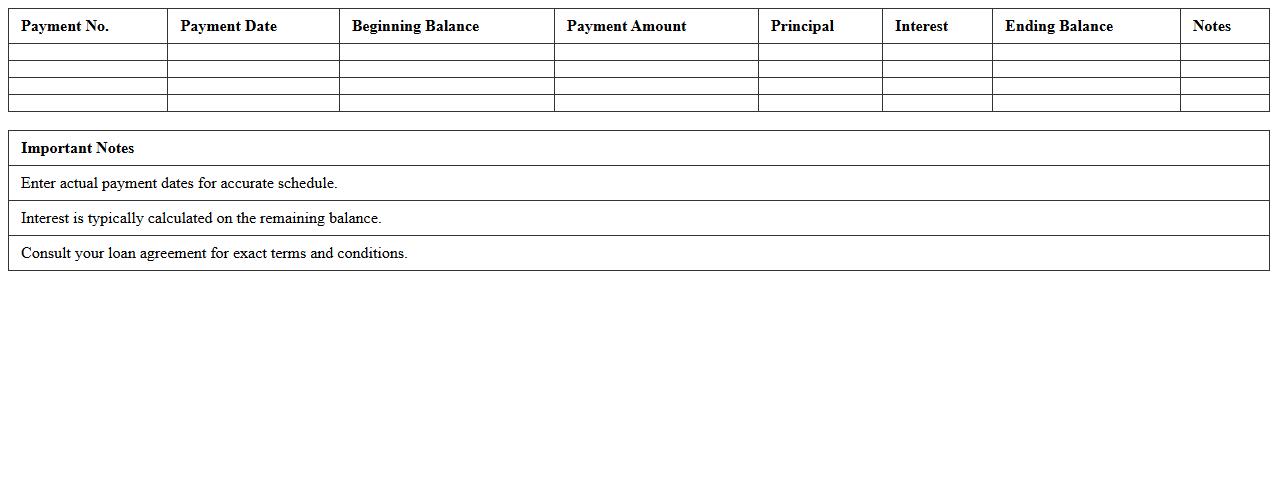

Borrower Loan Payment Schedule Spreadsheet

A

Borrower Loan Payment Schedule Spreadsheet document is a detailed record that outlines the timing and amounts of loan repayments for a borrower, including principal and interest components. It helps users track payment due dates, monitor outstanding balances, and forecast future payments, ensuring effective loan management. This spreadsheet is essential for financial planning, budgeting, and avoiding missed payments that could lead to penalties or credit score damage.

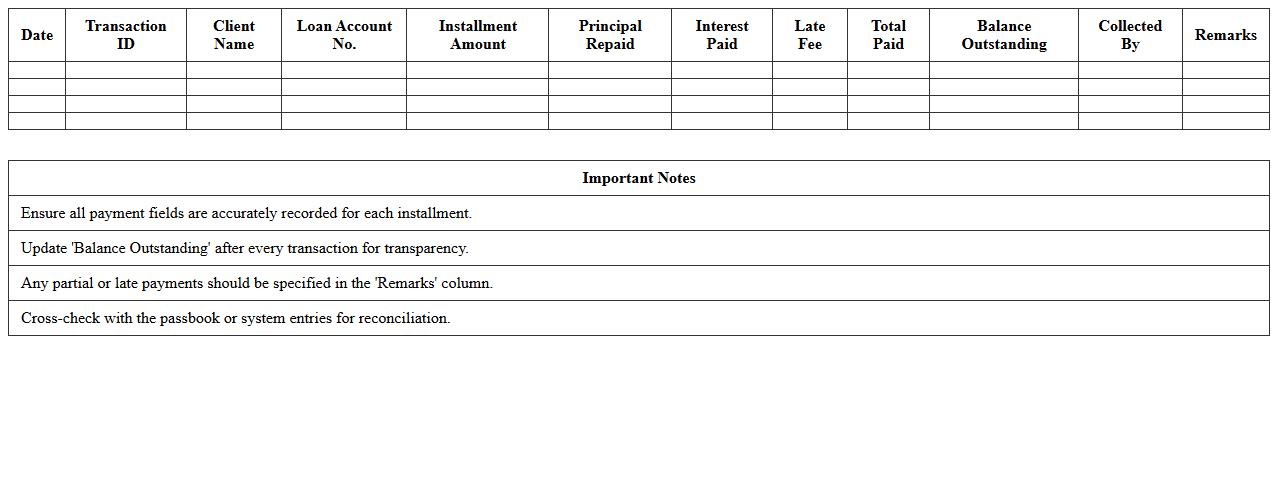

Microfinance Installment Payment Log Sheet

A

Microfinance Installment Payment Log Sheet is a detailed record used to track loan repayments made by borrowers in scheduled installments. This document helps financial institutions monitor payment history, ensure timely collections, and manage outstanding balances efficiently. Using this log sheet enhances transparency, reduces the risk of default, and supports accurate financial reporting for microfinance operations.

Loan Repayment Monitoring Excel Template

The

Loan Repayment Monitoring Excel Template is a structured document designed to track and manage loan payments efficiently. It helps users record payment schedules, outstanding balances, interest accrued, and due dates in a clear, organized manner, enabling accurate financial oversight. This template proves useful for individuals and businesses by simplifying loan management, preventing missed payments, and ensuring timely tracking of repayment progress.

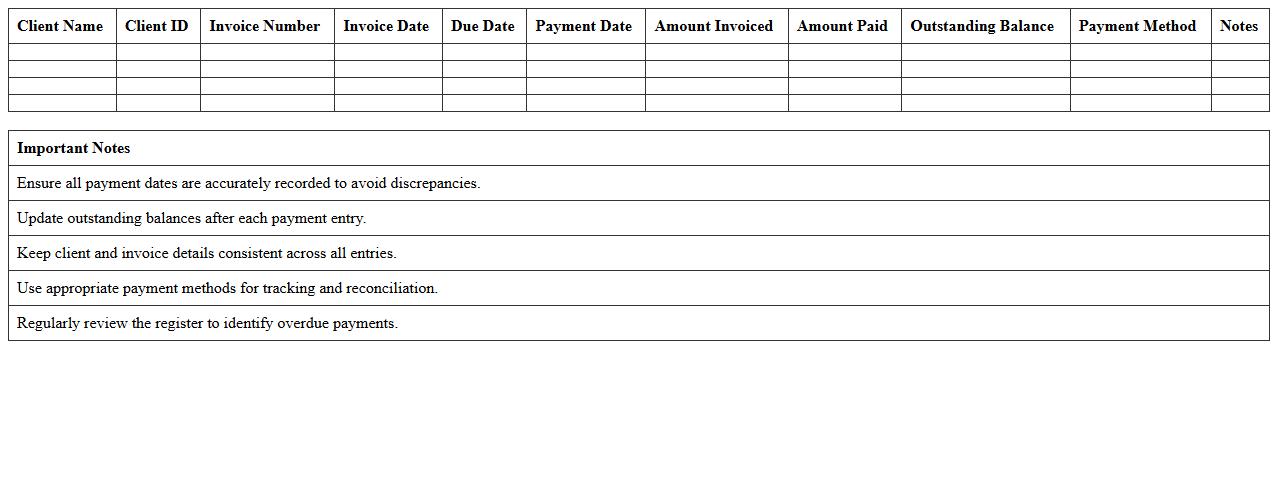

Client Payment History Register Spreadsheet

The

Client Payment History Register Spreadsheet document tracks all financial transactions between clients and a business, detailing dates, amounts, and payment methods. This organized record helps monitor outstanding balances, ensures timely payments, and supports transparent financial reporting. Maintaining this spreadsheet enhances cash flow management and strengthens client relationship by providing clear payment histories.

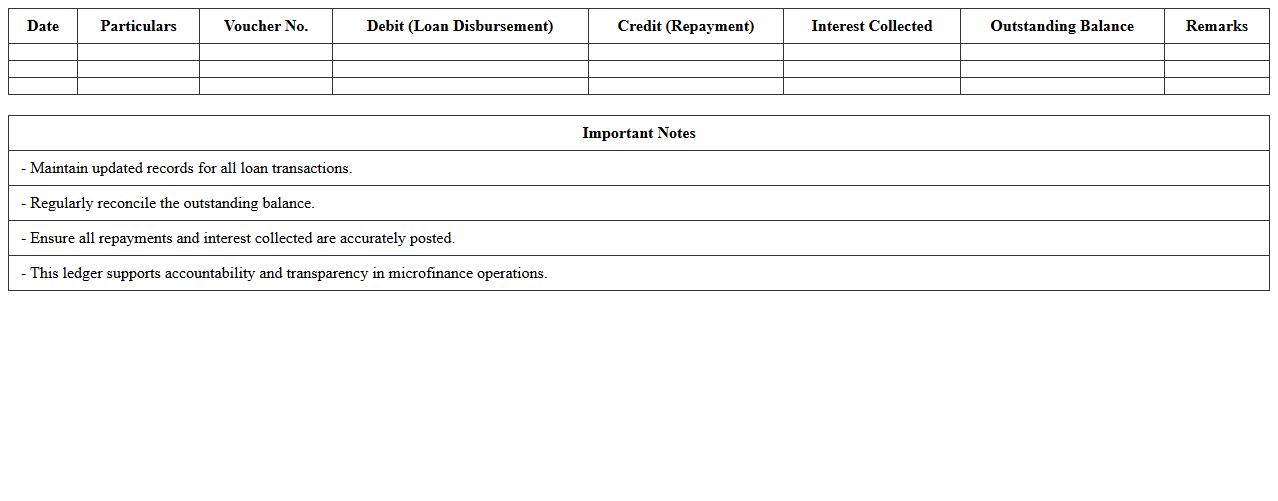

Loan Account Ledger for Microfinance

A

Loan Account Ledger for Microfinance is a detailed financial document that records all transactions related to a borrower's loan, including disbursements, repayments, interest calculations, and outstanding balances. This ledger is essential for maintaining transparency and accuracy in tracking loan performance, enabling both lenders and borrowers to monitor payment schedules and financial obligations effectively. It supports risk management, compliance with regulatory requirements, and informed decision-making in microfinance operations.

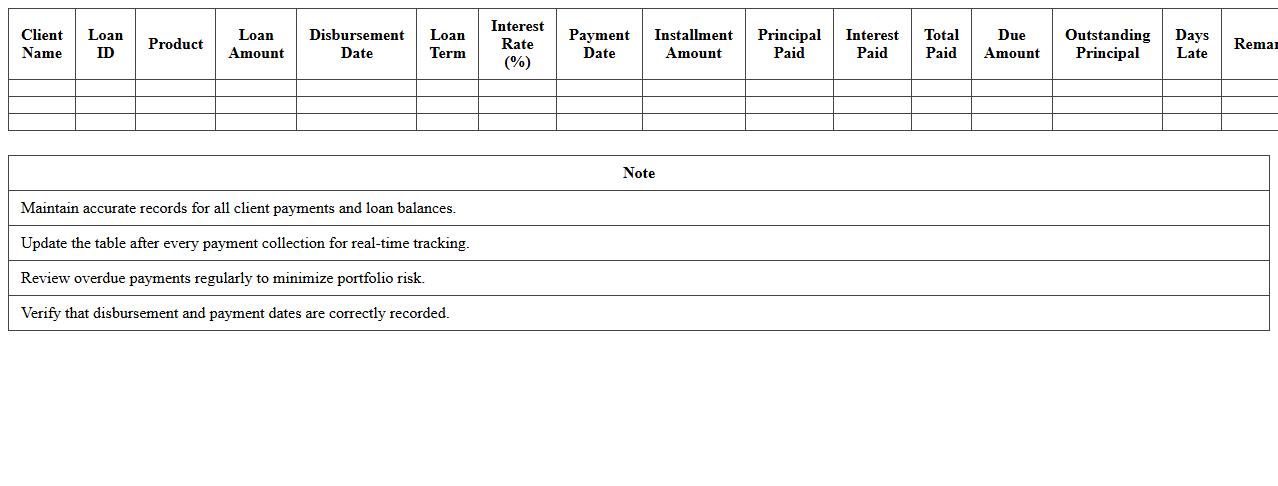

Microfinance Portfolio Payment Record Sheet

The

Microfinance Portfolio Payment Record Sheet is a detailed document used to track loan repayments and payment history for clients in microfinance institutions. It helps in monitoring borrowers' financial behavior, ensuring accurate record-keeping, and facilitating effective portfolio management to minimize defaults. By providing transparent payment data, this sheet aids in risk assessment and improves decision-making for future lending activities.

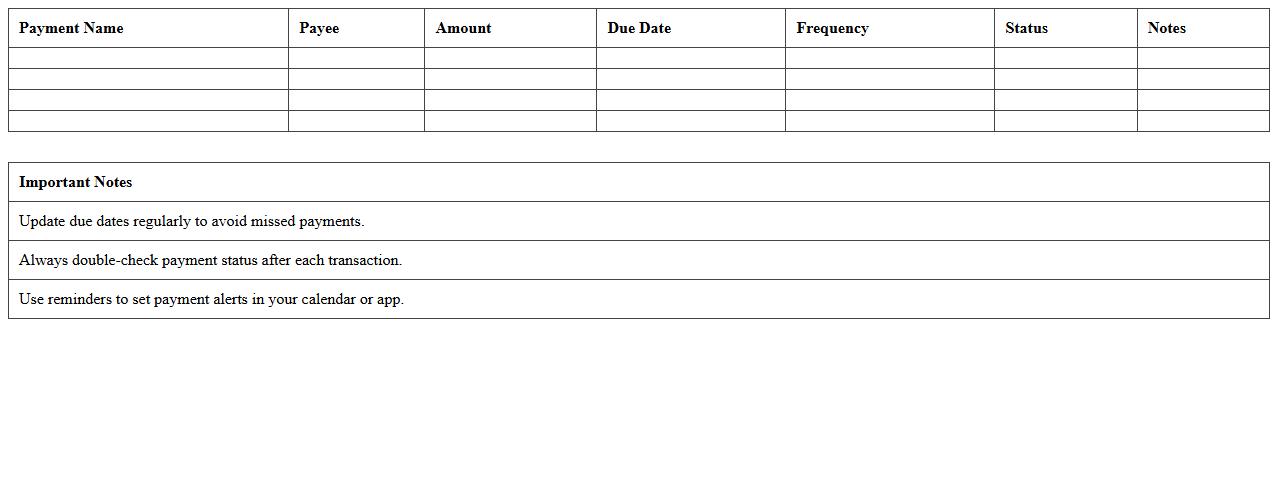

Scheduled Payment Reminder Excel Template

The

Scheduled Payment Reminder Excel Template is a structured document designed to track and manage upcoming payments efficiently, ensuring timely settlements. It helps users organize payment dates, amounts, and recipient details, reducing the risk of missed or late payments that could impact financial health. Utilizing this template improves budgeting accuracy and enhances financial discipline by providing clear visibility of all scheduled financial obligations.

Active Loan Payment Tracking Template for MFI

The

Active Loan Payment Tracking Template for Microfinance Institutions (MFIs) is a structured tool designed to monitor and record ongoing loan repayments efficiently. It helps track payment schedules, outstanding balances, and overdue amounts, ensuring timely follow-ups and minimizing default risks. This template enhances financial management and decision-making by providing clear, real-time loan performance data critical for sustainable lending operations.

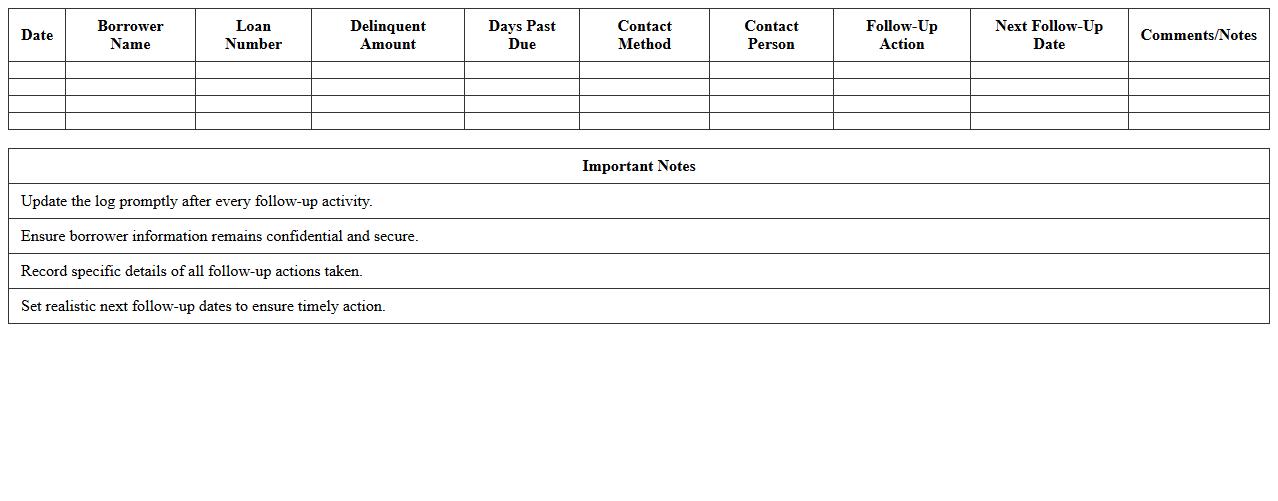

Delinquent Loan Payment Follow-Up Log Excel

A Delinquent Loan Payment Follow-Up Log Excel document is a structured tool designed to track overdue loan payments and monitor borrower communication. It allows financial institutions or loan officers to systematically record payment statuses, contact dates, and follow-up actions, ensuring timely management of delinquent accounts. Using this log enhances recovery efforts by prioritizing high-risk accounts and maintaining organized records for compliance and reporting purposes.

Delinquent Loan Payment Follow-Up Log streamlines the collection process and improves overall loan portfolio performance.

How can Loan Payment Record Excel track individual microloan repayment schedules?

Loan Payment Record Excel can track individual microloan repayment schedules by creating a detailed schedule table for each borrower. It records the payment dates, amounts due, and amounts paid in corresponding columns, allowing clear visualization of each loan's progress. Conditional formatting can highlight missed or partial payments, enhancing monitoring accuracy.

What formulas accurately calculate overdue payments in microfinance loan sheets?

Accurate calculation of overdue payments involves using formulas like =IF(TODAY()>DueDate, AmountDue - AmountPaid, 0) to identify outstanding balances past due. Another useful formula is =MAX(0, AmountDue - AmountPaid), which ensures negative values are avoided. Combining these formulas with logical functions helps give precise overdue payment figures.

Which data validation rules prevent entry errors in microfinance loan records?

Data validation rules such as restricting date entries to a valid range using date limits prevent incorrect repayment dates. Numeric validation ensures payment amounts entered are positive and within expected loan parameters. Dropdown lists for payment methods and loan statuses reduce input errors and maintain data consistency.

How do you automate late fee calculations in microfinance loan Excel templates?

Automating late fee calculations involves using formulas to check if payments are made after due dates, like =IF(PaymentDate>DueDate, LateFeeRate*OutstandingAmount, 0). This approach dynamically calculates fees based on delay, helping streamline the fee assessment process. Integrating such formulas into summary tables updates fee charges automatically when data changes.

What columns are essential for compliance reporting in microfinance payment records?

Essential columns for compliance reporting include Loan ID, Borrower Name, Payment Date, Payment Amount, Due Date, Outstanding Balance, and Late Fees. Capturing Repayment Status and Notes on any irregularities also supports regulatory audits. These fields ensure transparency and accurate reporting to meet compliance standards.

More Record Excel Templates