Asset Inventory Tracker for Nonprofits Excel Template

The

Asset Inventory Tracker for Nonprofits Excel Template is a structured spreadsheet designed to help nonprofit organizations efficiently catalog and manage their physical and digital assets. It enables users to monitor asset details such as acquisition dates, conditions, locations, and depreciation values, ensuring accurate record-keeping and streamlined audits. This tool supports budget planning and resource allocation by providing clear visibility into the organization's available assets, ultimately improving operational efficiency and accountability.

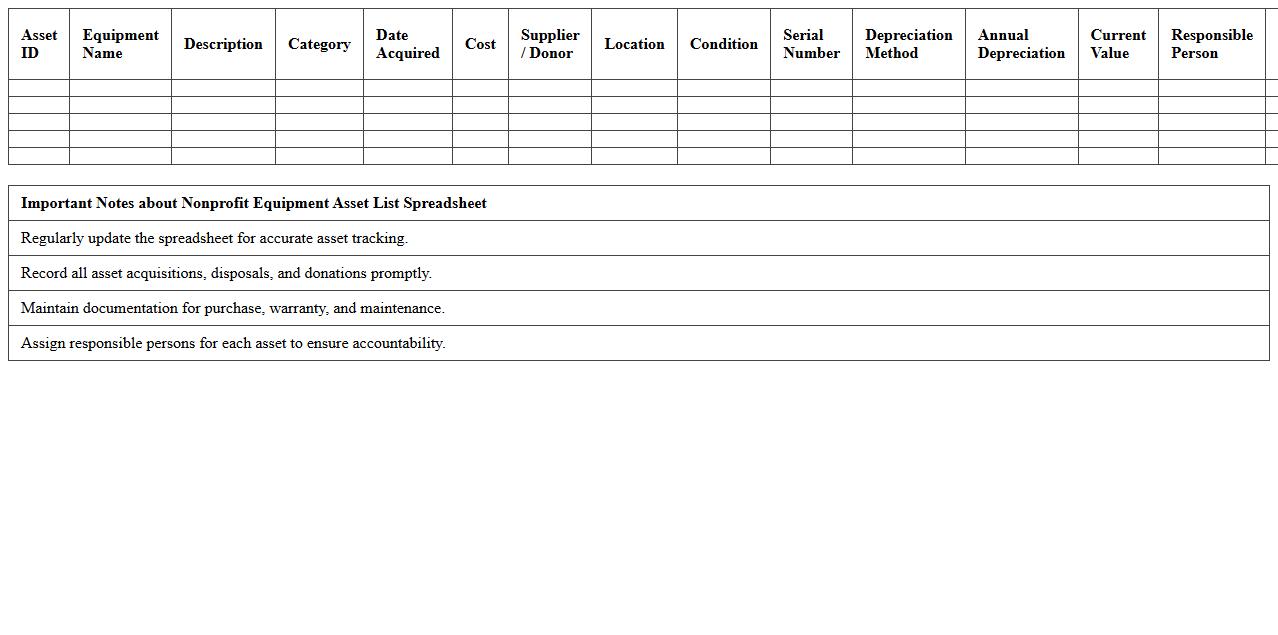

Nonprofit Equipment Asset List Spreadsheet

A

Nonprofit Equipment Asset List Spreadsheet is a detailed record of all physical assets owned by a nonprofit organization, including computers, furniture, and other essential equipment. This document helps track asset acquisition dates, conditions, and depreciation, ensuring effective management and accountability. It streamlines inventory audits and supports financial reporting, enhancing transparency for donors and regulatory compliance.

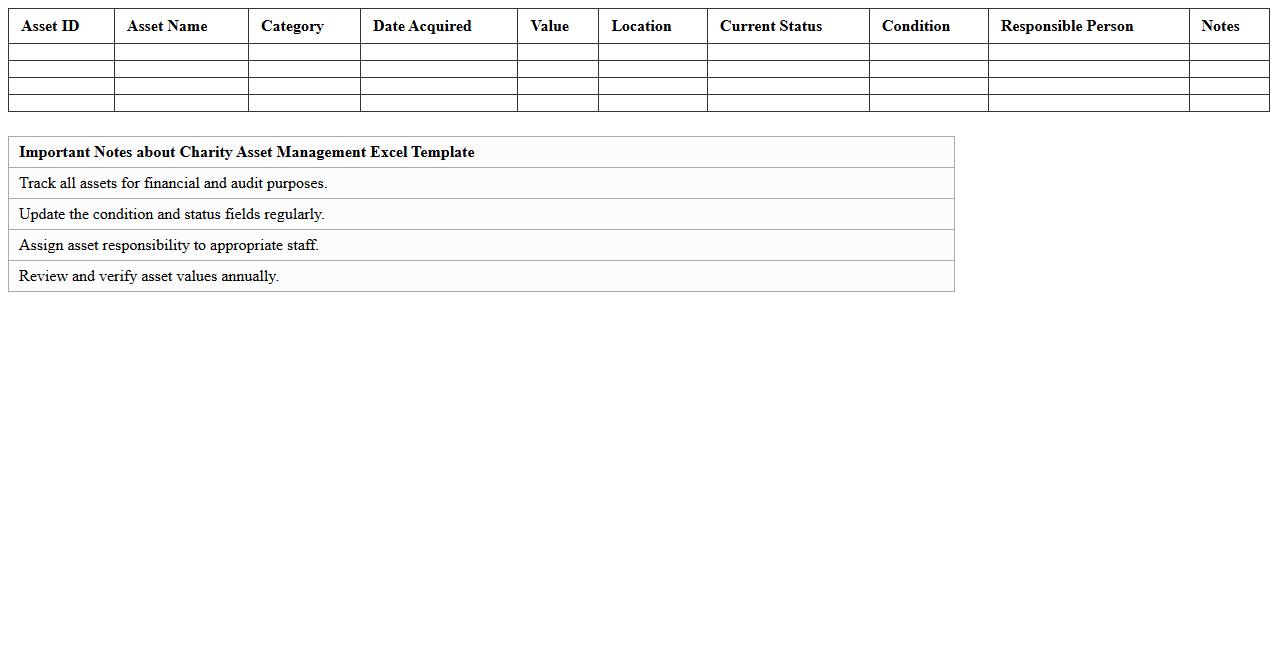

Charity Asset Management Excel Template

The

Charity Asset Management Excel Template is a structured spreadsheet designed to track and manage the assets of nonprofit organizations efficiently. It enables users to organize asset details, monitor depreciation, and maintain accurate records for financial reporting and compliance purposes. Utilizing this template helps charities ensure transparency, streamline asset audits, and optimize resource allocation for better operational management.

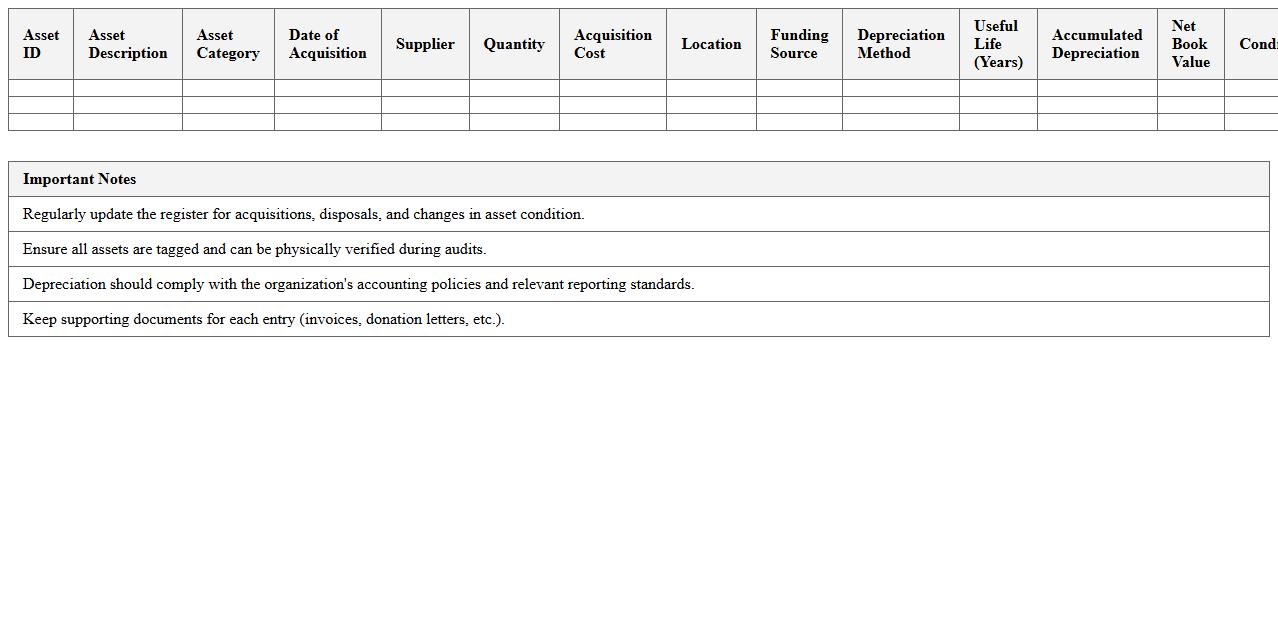

Fixed Assets Register for Nonprofit Organizations

A

Fixed Assets Register for nonprofit organizations is a detailed record of all tangible assets owned by the entity, including equipment, buildings, and furniture. This document helps track asset acquisition, depreciation, maintenance schedules, and disposal, ensuring accurate financial reporting and compliance with accounting standards. Maintaining an updated Fixed Assets Register aids in effective resource management and supports transparency for donors and regulatory bodies.

Nonprofit Asset Tracking Sheet Excel

A

Nonprofit Asset Tracking Sheet Excel document is a tool designed to systematically record, monitor, and manage the physical and financial assets of a nonprofit organization. It helps maintain accurate asset inventories, track depreciation, and ensure compliance with financial reporting requirements. This document enhances transparency, supports efficient resource allocation, and simplifies audits for nonprofit stakeholders.

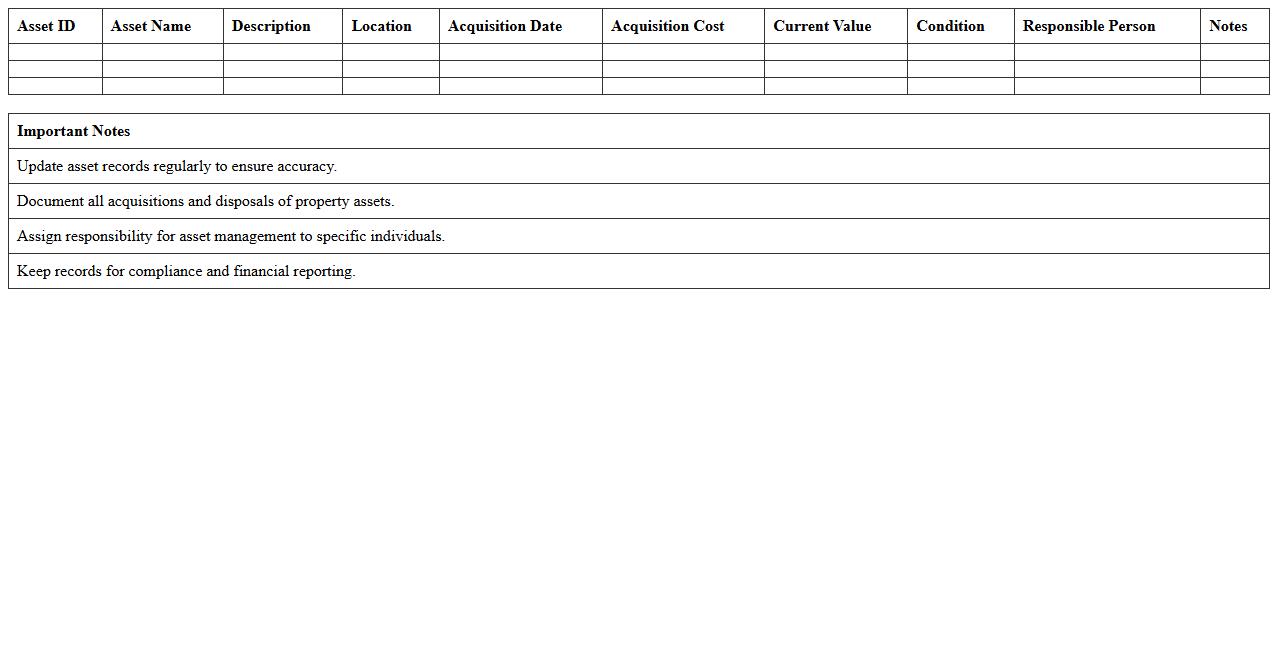

Nonprofit Property Asset List Template

A

Nonprofit Property Asset List Template is a structured document used to catalog and manage all physical assets owned by a nonprofit organization. This template helps track asset details such as location, condition, purchase date, and value, ensuring accurate record-keeping for financial reporting and compliance purposes. Utilizing this tool improves accountability, streamlines asset management processes, and supports strategic planning for resource allocation.

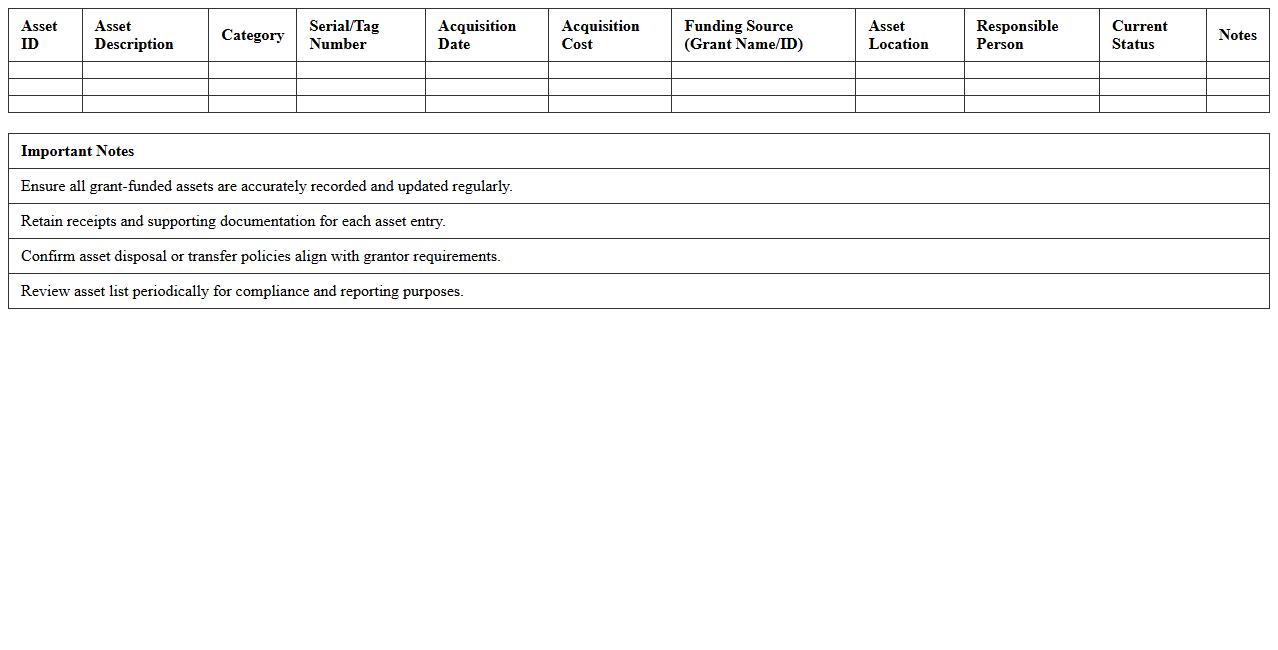

Grant-Funded Asset List Excel Spreadsheet

The

Grant-Funded Asset List Excel Spreadsheet is a comprehensive tool designed to track and manage assets purchased with grant funds, ensuring compliance with funding requirements. It enables organizations to maintain accurate records, monitor asset status, and facilitate efficient reporting during audits or grant reviews. This document supports transparency, accountability, and streamlined financial management in grant-funded projects.

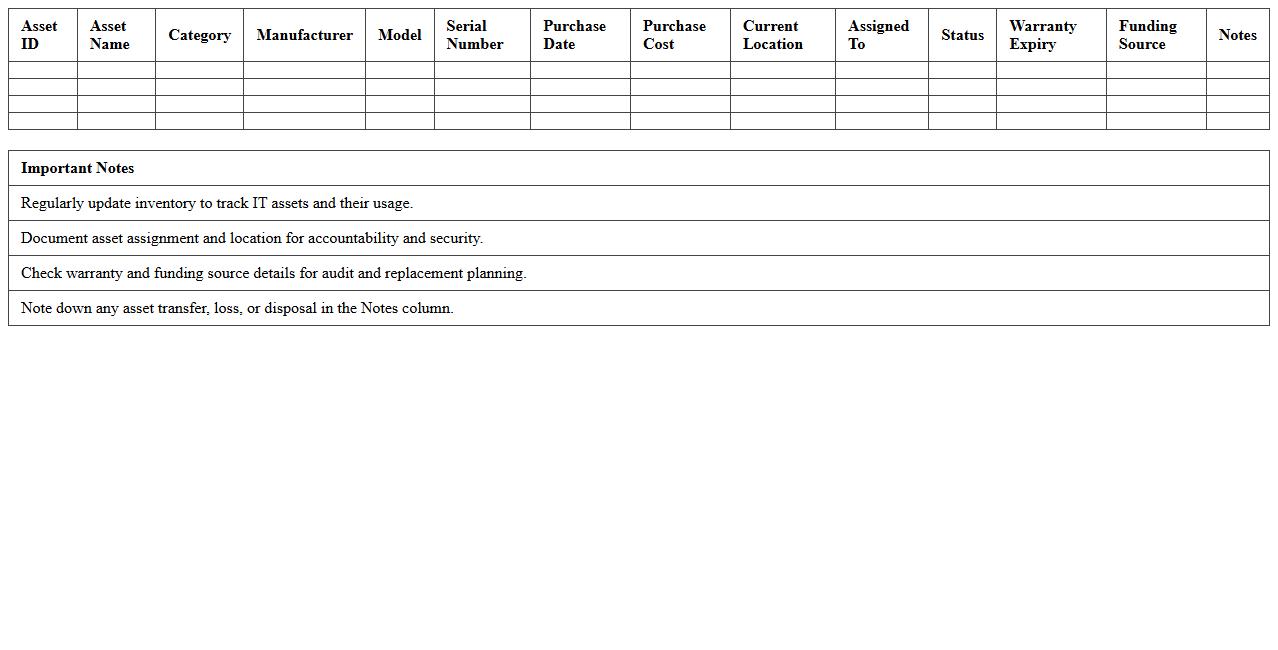

Nonprofit IT Asset Inventory Excel Sheet

A

Nonprofit IT Asset Inventory Excel Sheet document is a structured tool designed to track and manage all technology-related assets within a nonprofit organization, including computers, software licenses, and networking equipment. It helps ensure accurate record-keeping, facilitates timely maintenance and upgrades, and streamlines budgeting for IT resources. This document supports efficient resource allocation and accountability, crucial for maintaining operational effectiveness and transparency.

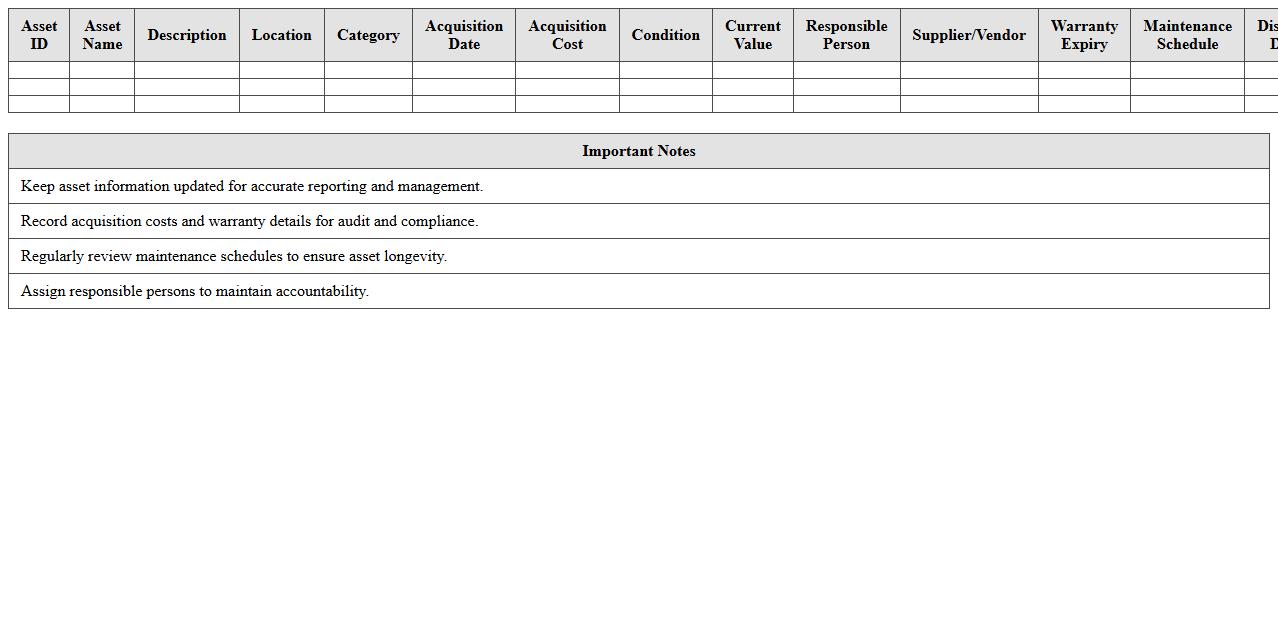

Facility Asset Register Template for Nonprofits

A

Facility Asset Register Template for Nonprofits is a structured document designed to systematically record and track physical assets owned by nonprofit organizations, such as buildings, equipment, and furniture. It helps nonprofits maintain accurate asset details, monitor asset conditions, schedule maintenance activities, and manage depreciation for financial reporting. Using this template enhances operational efficiency, ensures compliance with regulatory standards, and supports transparent asset management and resource allocation.

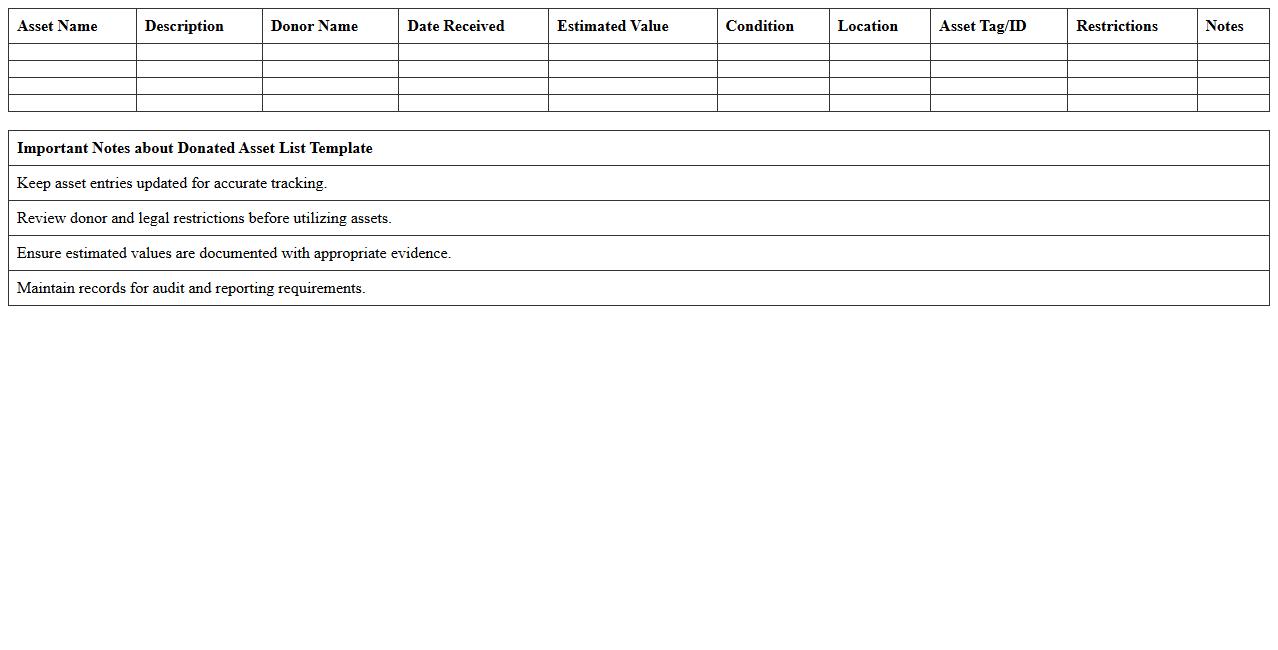

Donated Asset List Excel Template for Nonprofit Use

The

Donated Asset List Excel Template for Nonprofit Use is a structured spreadsheet designed to efficiently track and manage donated items, ensuring accurate record-keeping for tax and inventory purposes. It helps nonprofits organize detailed information such as donor names, asset descriptions, estimated values, and donation dates, which is crucial for transparency and financial reporting. Using this template enhances accountability, simplifies audit processes, and supports compliance with IRS regulations for charitable contributions.

What essential asset categories should be included in a nonprofit's Asset List Excel template?

Including fixed assets such as buildings, vehicles, and equipment is crucial for accurate record-keeping. Additionally, intangible assets like copyrights or trademarks should be listed for comprehensive tracking. Lastly, it is important to itemize current assets such as cash, receivables, and inventory to maintain financial clarity.

How can depreciation of nonprofit assets be tracked efficiently in Excel?

To track depreciation efficiently, set up columns for asset cost, useful life, salvage value, and depreciation method. Use formulas like SLN() for straight-line depreciation to calculate the annual depreciation expense automatically. Finally, maintain a running accumulated depreciation total to monitor asset value changes over time.

What formulas automate asset value updates in a nonprofit's Asset List Excel sheet?

Formulas such as =[Cost] - [Accumulated Depreciation] help calculate the current book value of each asset dynamically. Use the IF() function to control asset status, marking assets as retired or active. Combining SUMIF() formulas allows for automatic aggregation of asset values by category or condition.

How can restricted and unrestricted assets be labeled in Excel for nonprofit compliance?

Use a drop-down list via data validation to categorize assets as either "Restricted" or "Unrestricted." Conditional formatting can visually differentiate these categories for easy compliance checks. Proper labeling ensures transparency in financial reporting and adherence to nonprofit regulations.

What Excel data validations help prevent entry errors in a nonprofit asset register?

Implement data validation rules such as restricting date entries to realistic time frames and ensuring numerical fields only accept positive values. Use drop-down lists to limit input options to predefined asset types or conditions. These features minimize human error and enhance the integrity of the asset register.