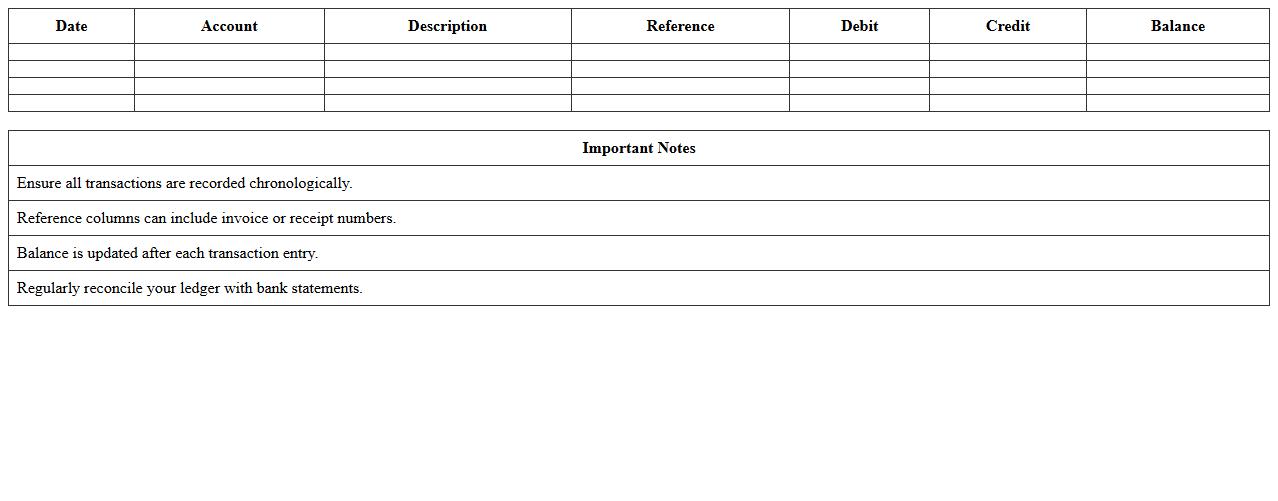

Basic General Ledger Template for Small Businesses

The

Basic General Ledger Template for Small Businesses is a structured document designed to record all financial transactions systematically, ensuring accurate bookkeeping and financial reporting. It helps small business owners track income, expenses, assets, and liabilities efficiently, facilitating better financial management and compliance with accounting standards. Using this template simplifies the process of maintaining organized records, which is essential for making informed business decisions and preparing tax returns.

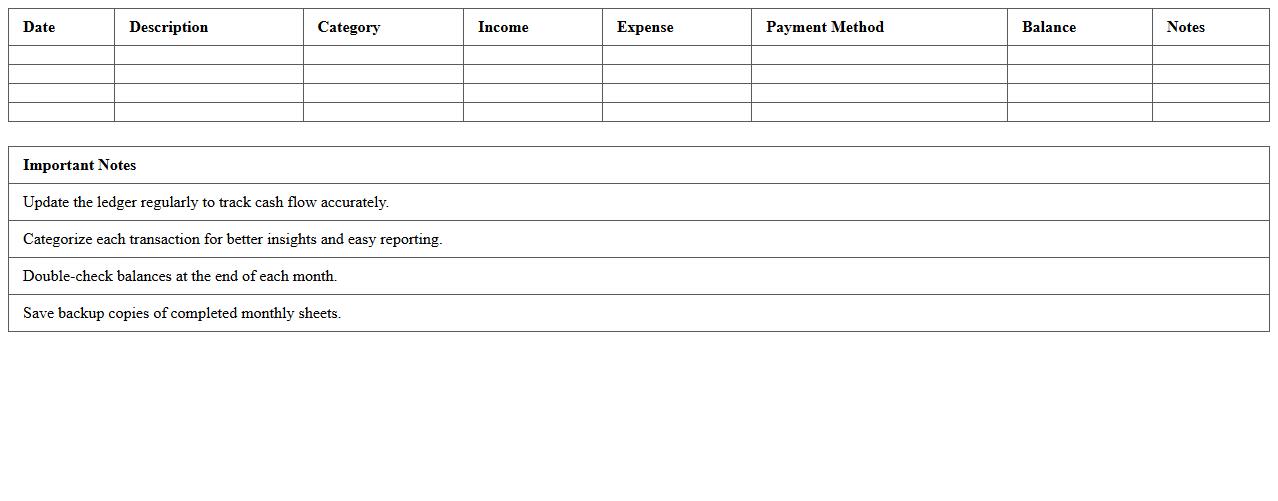

Small Business Monthly Ledger Excel Sheet

The

Small Business Monthly Ledger Excel Sheet document is a structured financial record that tracks all income and expenses over a month, providing a clear overview of cash flow and profit margins. It allows small business owners to monitor their financial health, identify spending patterns, and ensure accurate tax reporting. This tool enhances budgeting efficiency and supports informed decision-making by organizing financial data into easily accessible and analyzable formats.

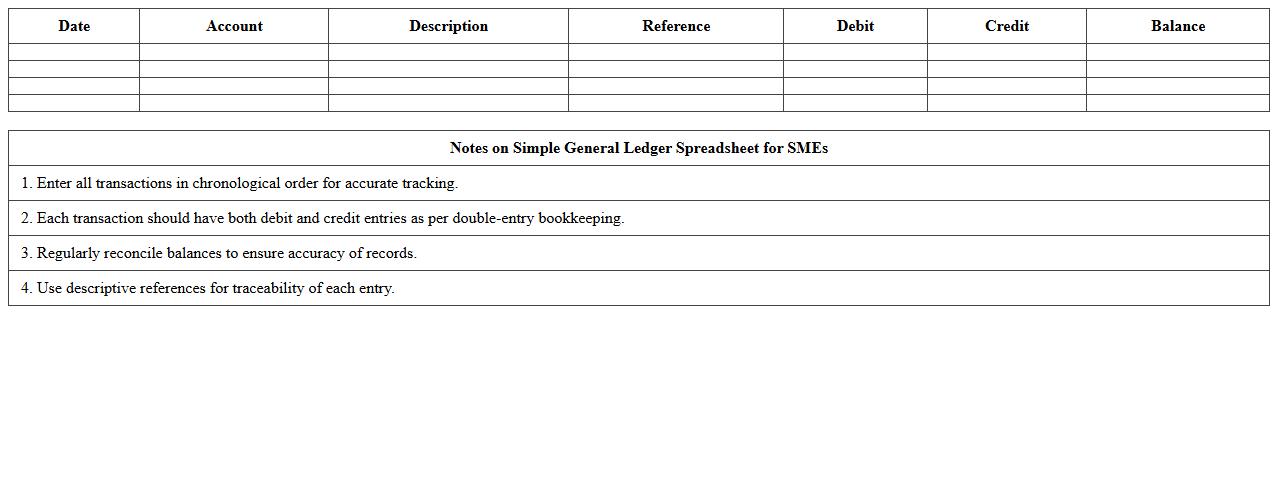

Simple General Ledger Spreadsheet for SMEs

A

Simple General Ledger Spreadsheet for SMEs is a streamlined financial tool designed to record and organize all business transactions efficiently, ensuring accurate tracking of income, expenses, assets, liabilities, and equity. It is useful for small and medium-sized enterprises by simplifying bookkeeping processes, enhancing financial visibility, and aiding in timely decision-making without the need for complex accounting software. By providing a clear and accessible overview of financial data, this spreadsheet supports better budget management and compliance with tax regulations.

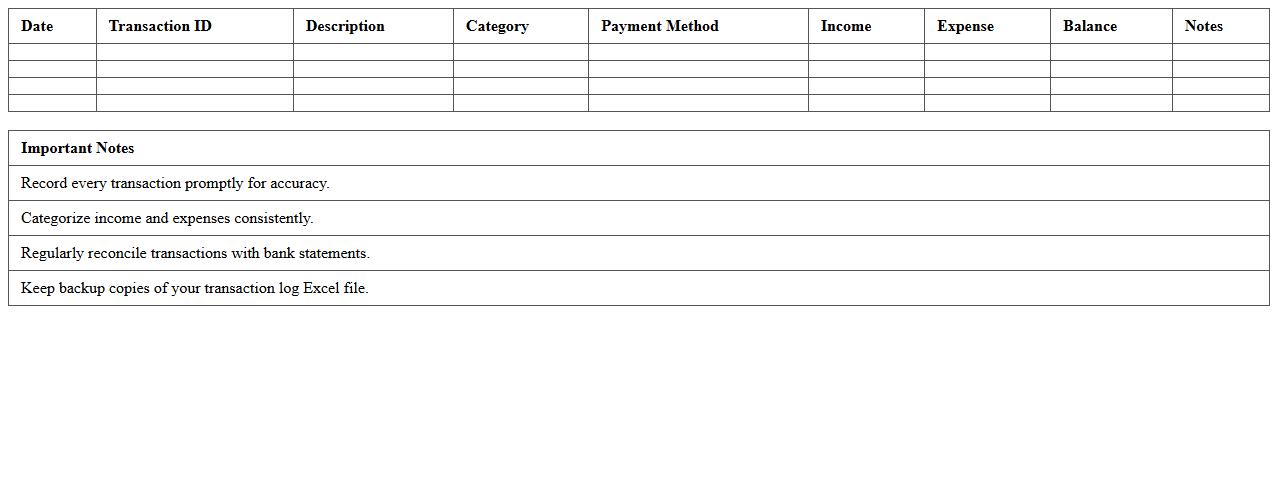

Small Business Transaction Log Excel Template

The

Small Business Transaction Log Excel Template is a structured spreadsheet designed to meticulously record and organize all financial transactions within a small business. This template helps track income, expenses, payment dates, and transaction categories, enabling accurate financial monitoring and analysis. Using this tool boosts efficiency in bookkeeping, simplifies tax preparation, and supports informed decision-making to improve overall business management.

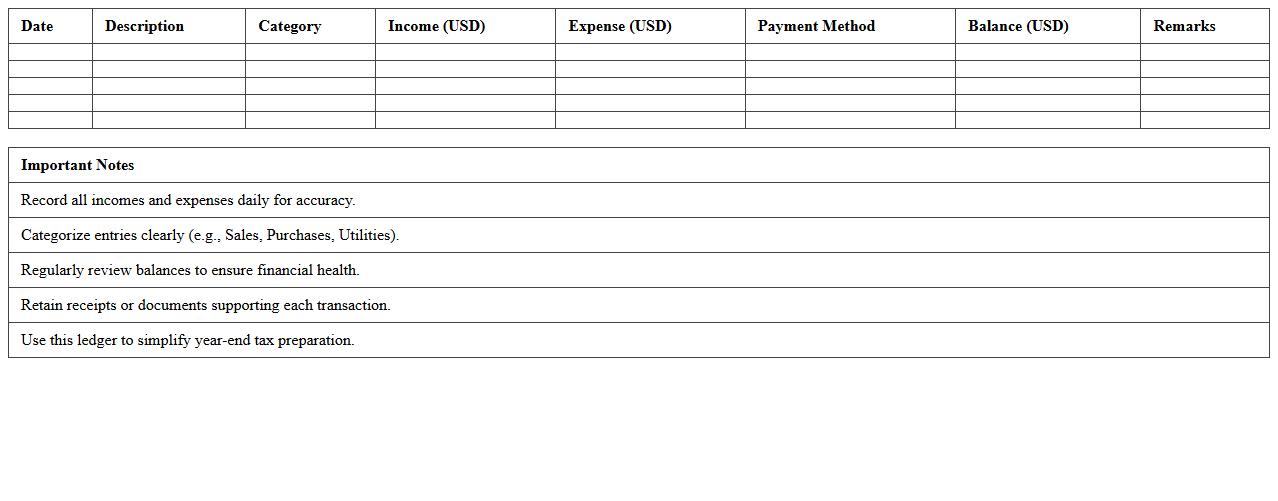

Income & Expense Ledger for Microbusinesses

The

Income & Expense Ledger for microbusinesses is a financial record that systematically tracks all revenue and expenditures, providing a clear overview of cash flow. It helps business owners monitor profitability, manage budgets, and prepare accurate tax filings by organizing transaction data efficiently. This document is essential for maintaining financial discipline and making informed business decisions.

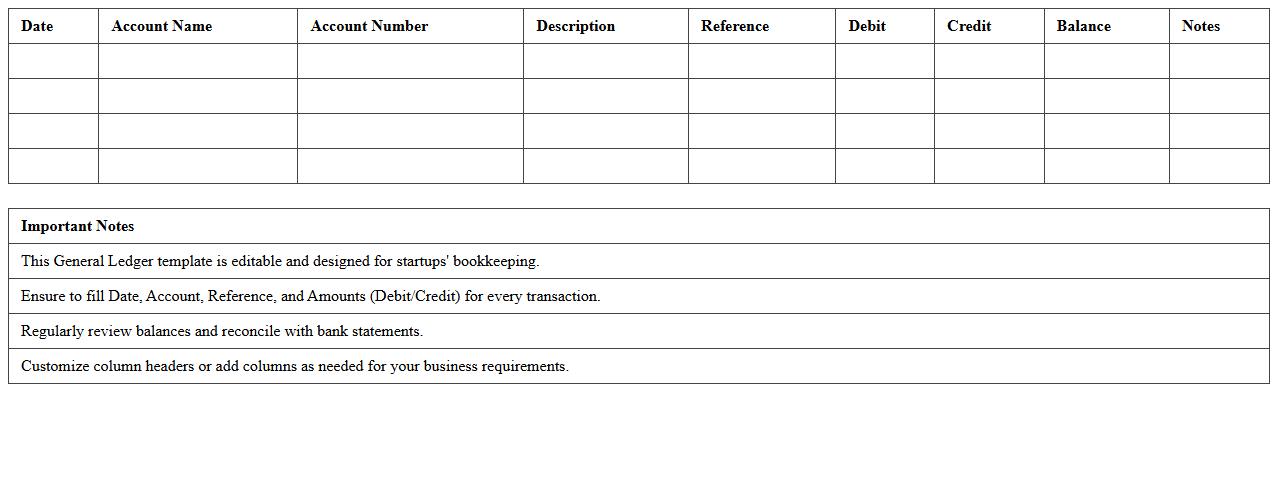

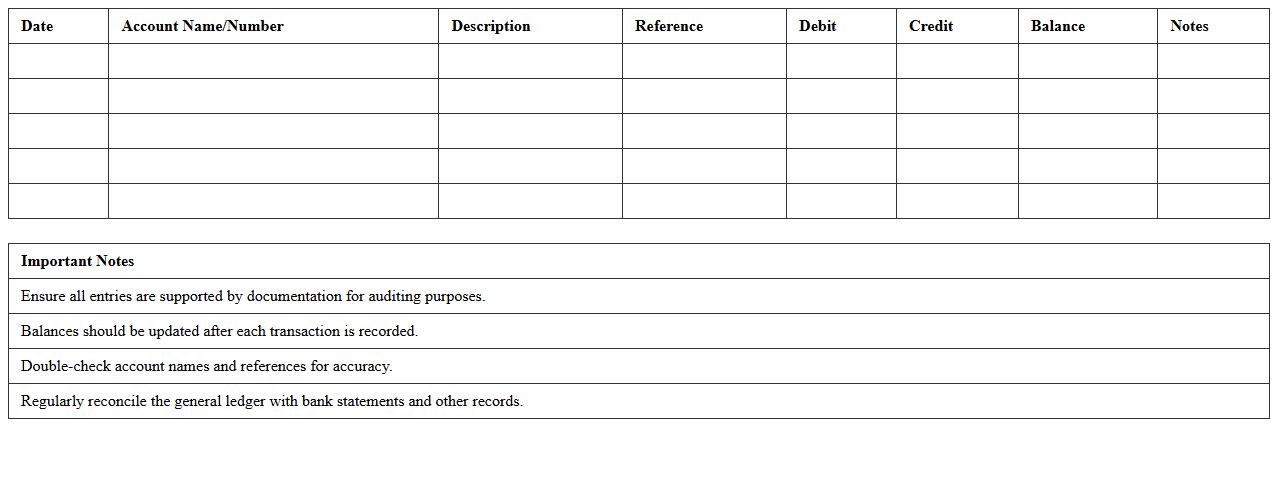

Editable General Ledger Format for Startups

The

Editable General Ledger Format for Startups is a customizable financial document designed to record all transactions systematically, enabling clear tracking of income, expenses, and equity. This format supports accuracy in bookkeeping, simplifies audit preparation, and enhances financial analysis by providing a structured, easy-to-update ledger template. Startups benefit from it by maintaining transparent financial records, ensuring compliance, and making informed business decisions based on real-time financial data.

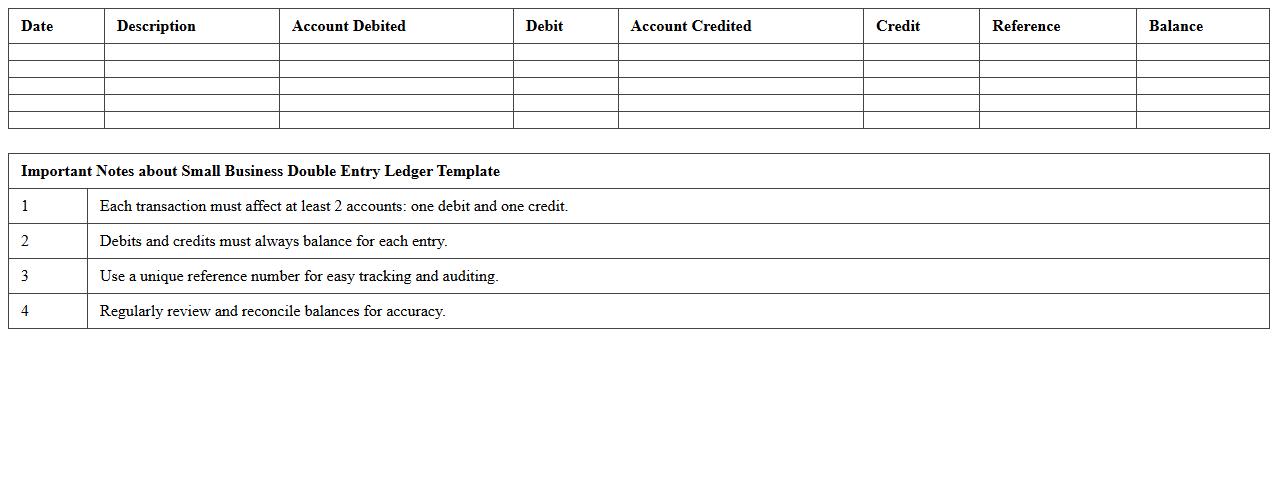

Small Business Double Entry Ledger Template

A

Small Business Double Entry Ledger Template is a structured financial record-keeping tool that tracks all business transactions by recording debits and credits in two corresponding accounts. This template ensures accuracy in accounting, facilitates easy identification of errors, and provides a clear, organized overview of financial activities for budgeting and tax preparation. Using this document helps maintain transparency, supports financial decision-making, and simplifies compliance with accounting standards.

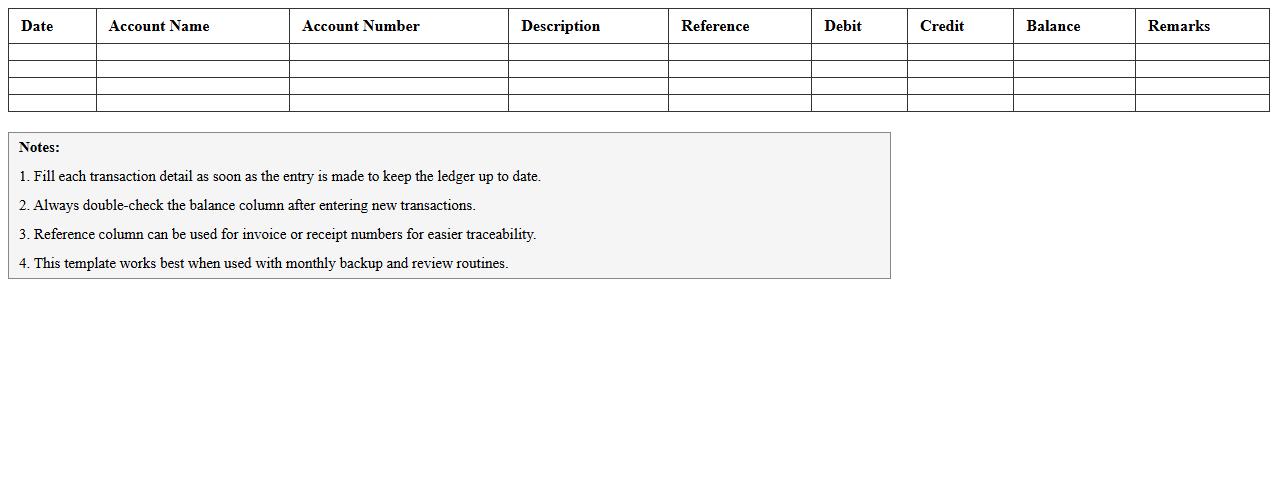

Yearly General Ledger Excel Sheet for Small Enterprises

A

Yearly General Ledger Excel Sheet for small enterprises is a comprehensive financial record that tracks all business transactions over a fiscal year, organized by accounts. This document enables accurate monitoring of income, expenses, assets, and liabilities, facilitating seamless financial analysis and audit preparation. Small businesses benefit from streamlined bookkeeping, improved budgeting, and enhanced compliance with tax regulations by using this tool.

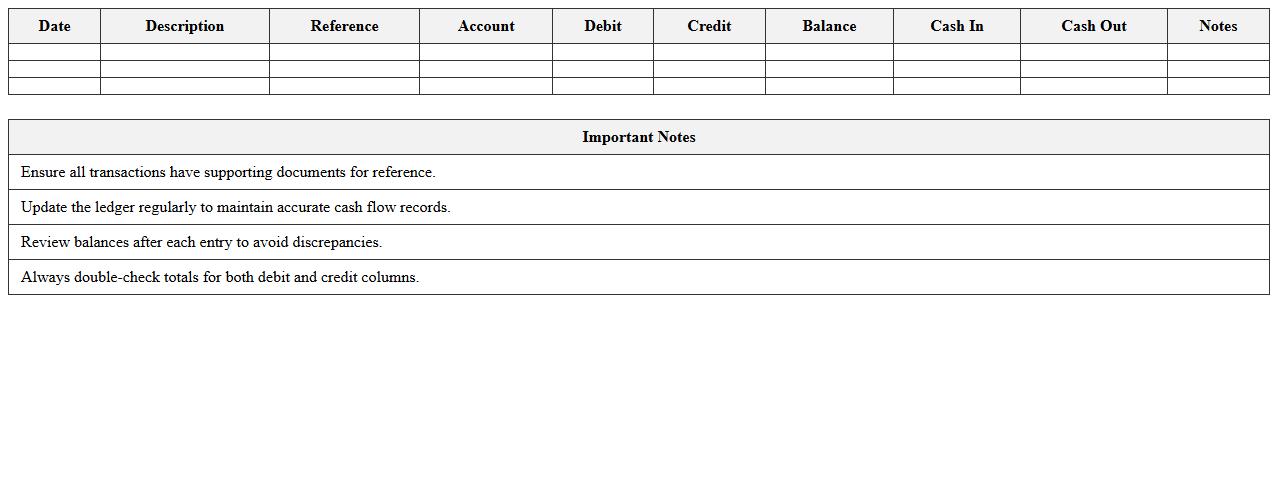

Cash Flow and General Ledger Excel Template

The

Cash Flow and General Ledger Excel Template is a comprehensive financial management tool designed to track income, expenses, and overall cash movement while maintaining detailed ledger entries. It provides clear visibility into financial health by organizing transactions systematically and enabling easy reconciliation of accounts. This template helps businesses and individuals monitor liquidity, manage budgets, and prepare accurate financial reports efficiently.

Printable General Ledger Sheet for Local Businesses

A

Printable General Ledger Sheet for local businesses is a detailed financial record that tracks all transactions, including sales, expenses, assets, and liabilities, organized by account. It enables business owners to maintain accurate bookkeeping, monitor cash flow, and prepare financial statements efficiently. Utilizing this document helps ensure compliance with tax regulations and supports informed decision-making for improving business operations.

How can I automate recurring journal entries in a General Ledger Excel template?

To automate recurring journal entries, use Excel's built-in functions like VBA macros or Power Query. Setting up a macro can automatically input repetitive transactions on specified dates. This method saves time and reduces errors in your General Ledger management.

What Excel formulas efficiently reconcile ledger balances for small businesses?

Excel formulas such as SUMIF, VLOOKUP, and IFERROR efficiently reconcile ledger balances by matching transactions and verifying totals. These formulas help identify discrepancies and ensure the General Ledger remains balanced. Using dynamic named ranges improves accuracy and ease of maintenance.

Which data validation rules prevent entry errors in small business GL Excel sheets?

Applying data validation rules like drop-down lists, date restrictions, and numeric limits ensures clean and accurate entries. Restricting input to predefined account codes or transaction types reduces the chance of error. Consistently validating data enhances the reliability of your General Ledger data.

How do I generate fiscal-year-specific reports from a General Ledger Excel file?

Generate fiscal-year-specific reports by filtering transactions based on dates using the FILTER formula or PivotTables. Group data by fiscal year and customize report layouts to show relevant summaries. This approach helps analyze financial performance within defined periods effortlessly.

What's the best way to track multiple account categories in one General Ledger worksheet?

Track multiple account categories by incorporating a column that specifies the account type or category. Use PivotTables or SUMIFS to summarize balances by category for easy analysis. This organization streamlines reporting and provides clear insight into each account segment.