The Loan Repayment Ledger Excel Template for Microfinance Institutions is designed to efficiently track borrower payments, outstanding balances, and interest calculations. This template simplifies financial management by organizing loan schedules and repayment history in a clear, easy-to-use spreadsheet format. It enhances accuracy and transparency for microfinance institutions managing multiple loan accounts.

Microfinance Loan Repayment Schedule Tracker Excel Template

The

Microfinance Loan Repayment Schedule Tracker Excel Template is a structured tool designed to monitor loan repayment timelines, track outstanding amounts, and calculate interest for microfinance borrowers. It simplifies financial management by providing clear visibility into repayment status, enabling timely follow-ups and accurate financial forecasting. This template enhances accountability and ensures efficient loan portfolio management for microfinance institutions and individual lenders.

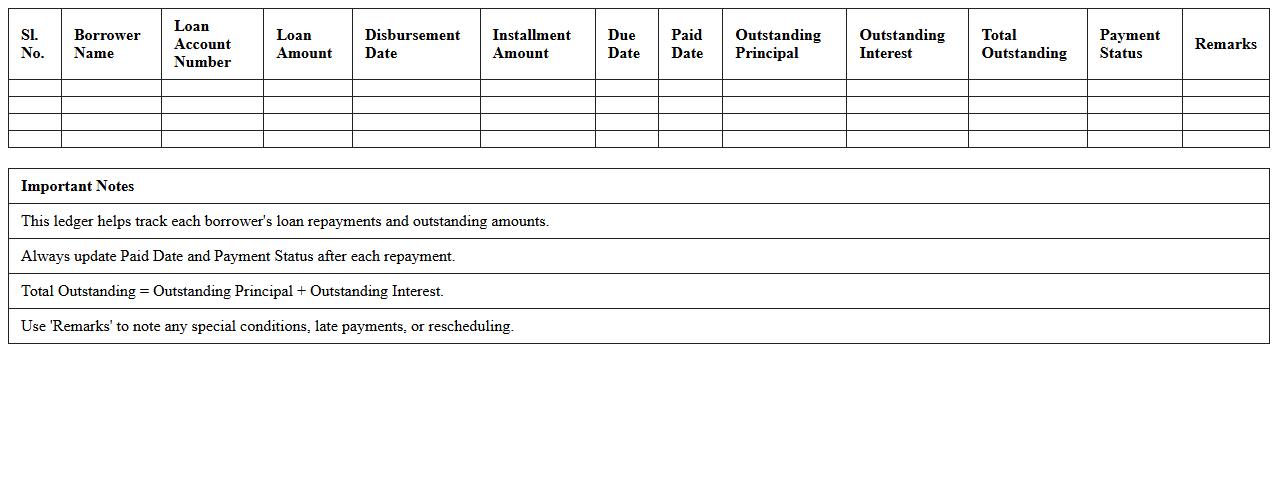

Borrower Repayment Monitoring Ledger Spreadsheet

The

Borrower Repayment Monitoring Ledger Spreadsheet is a financial tracking tool designed to record and analyze repayment schedules, amounts, and outstanding balances for borrowers. It helps lenders maintain organized and up-to-date information on each borrower's payment history, enabling efficient monitoring of loan performance and timely identification of defaults or delays. This spreadsheet enhances decision-making and cash flow management by providing clear insights into repayment patterns and overall loan portfolio health.

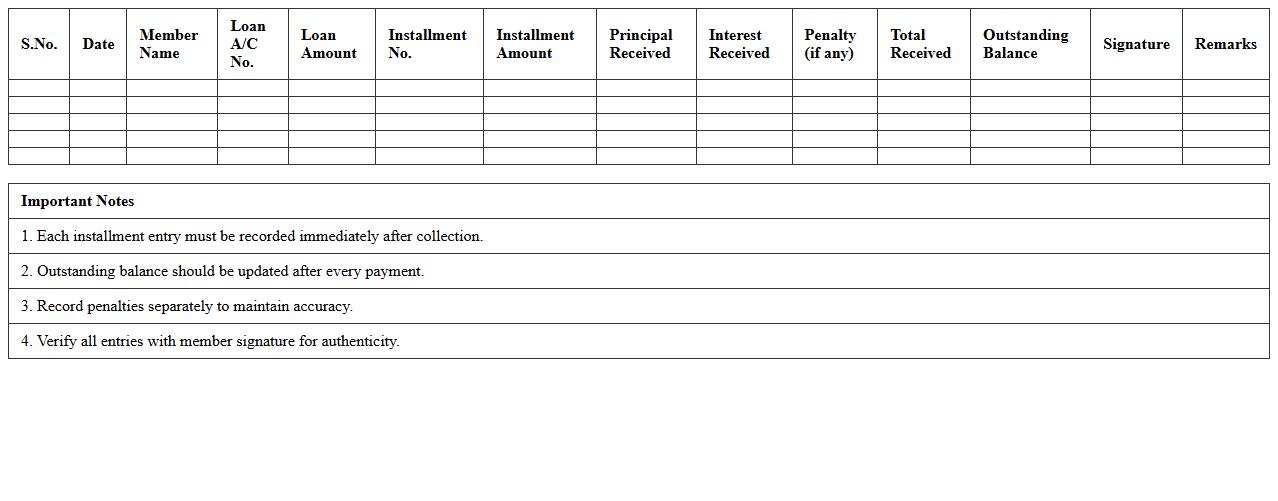

Loan Installment Collection Register Excel Sheet

A

Loan Installment Collection Register Excel Sheet is a structured document used to record and track loan repayments made by borrowers over time. It helps in organizing data such as borrower names, installment amounts, due dates, and payment statuses, enabling efficient monitoring of loan recovery. This tool improves financial management by providing clear visibility into outstanding balances and ensuring timely collection of installments.

Microcredit Payment Tracking & Record Template

The

Microcredit Payment Tracking & Record Template document is a structured tool designed to monitor and record loan repayments systematically. It helps users maintain accurate financial records, ensuring timely tracking of payments, outstanding balances, and borrower information. This template is essential for microfinance institutions and individuals to improve loan management, enhance transparency, and reduce the risk of default.

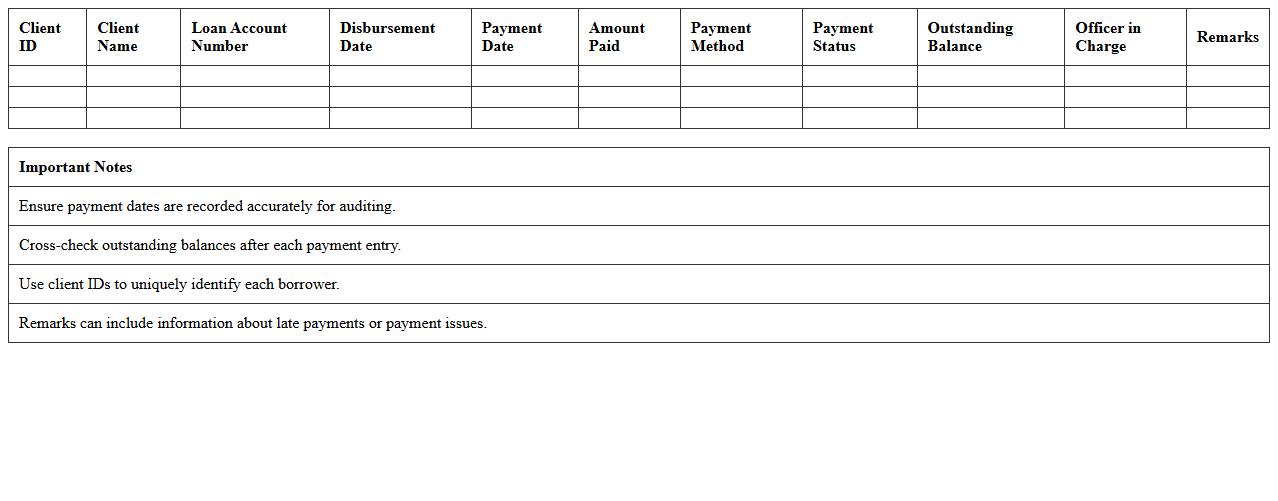

Client Payment History Log for Microfinance Institutions

The

Client Payment History Log for Microfinance Institutions is a detailed record tracking loan repayments, payment dates, and amounts paid by individual clients. This document is essential for monitoring client credit behavior, identifying trends in repayment punctuality, and managing portfolio risk. It enhances decision-making for credit officers by providing transparent, real-time data critical for assessing client reliability and tailoring financial products.

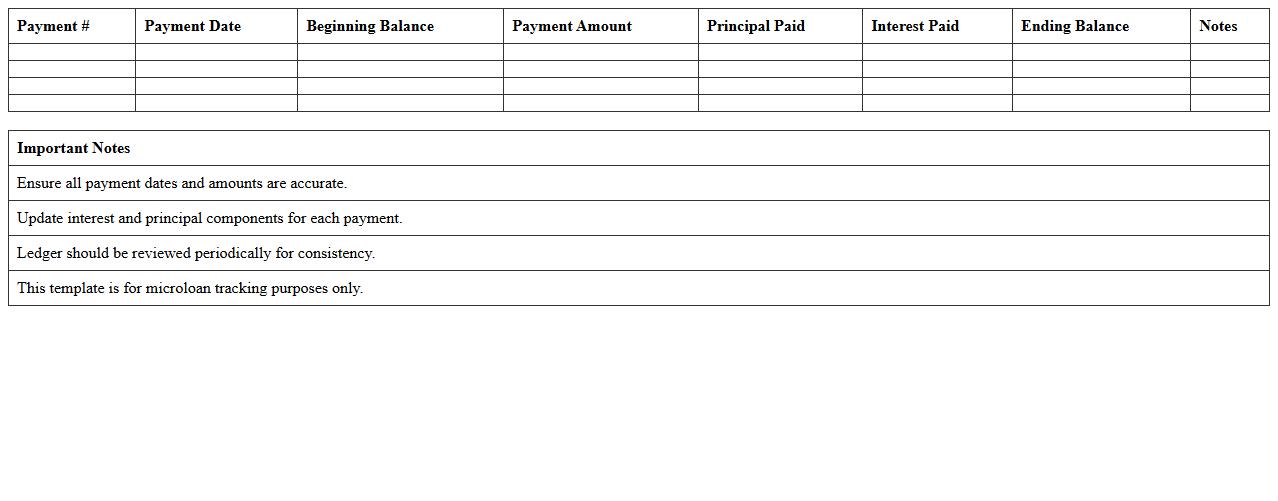

Microloan Amortization Ledger Excel Template

The

Microloan Amortization Ledger Excel Template is a comprehensive financial tool designed to track and manage microloan repayments with precision. It provides detailed schedules of principal and interest payments over the loan term, enabling users to monitor outstanding balances and forecast cash flows effectively. This template is essential for lenders and borrowers alike to ensure transparent, accurate record-keeping and informed decision-making in microfinance.

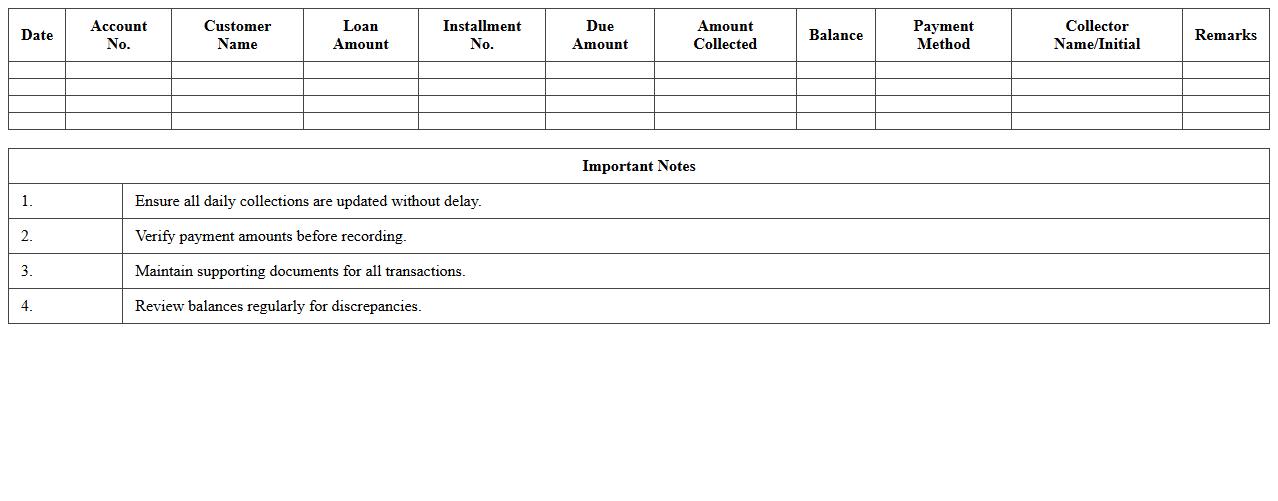

Daily Loan Collection Register Spreadsheet

The

Daily Loan Collection Register Spreadsheet is a detailed document designed to record daily loan repayments, track outstanding amounts, and monitor borrower payment patterns. It enables financial institutions, microfinance organizations, and loan officers to maintain accurate records, ensuring timely follow-ups on overdue payments and improving cash flow management. This spreadsheet simplifies loan tracking by providing organized data that supports decision-making and enhances transparency in loan recovery processes.

Microfinance EMI Repayment Status Tracker

The

Microfinance EMI Repayment Status Tracker document serves as a comprehensive record to monitor Equated Monthly Installment (EMI) payments for microfinance loans, providing clear visibility into repayment timelines, amounts paid, and outstanding dues. This tracker helps borrowers and lenders maintain transparency, ensuring timely repayments and reducing the risk of default through organized financial management. It is a vital tool for promoting accountability and improving loan recovery rates in microfinance institutions.

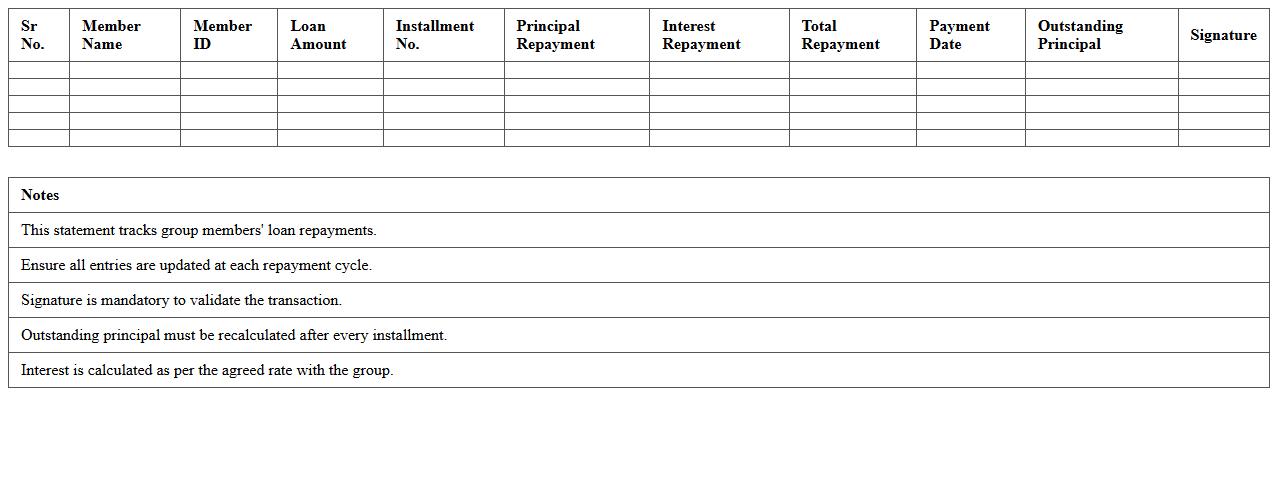

Group Loan Repayment Statement Excel Sheet

The

Group Loan Repayment Statement Excel Sheet is a structured financial document that tracks and records loan repayment activities for a group of borrowers. It consolidates individual payment details, due dates, outstanding balances, and interest calculations, providing clear visibility into the loan status for each member and the entire group. This tool is essential for effective loan management, ensuring timely repayments, accurate financial tracking, and streamlined communication between lenders and borrowers.

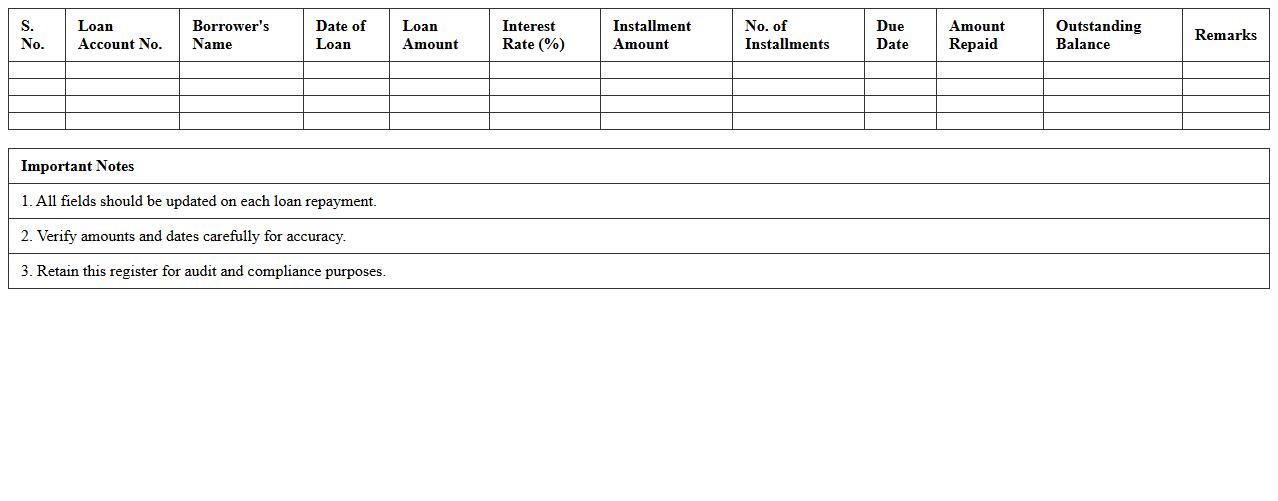

Individual Loan Account Repayment Register Template

The

Individual Loan Account Repayment Register Template document is a structured ledger designed to accurately track loan repayment schedules, amounts paid, outstanding balances, and payment dates for individual borrowers. It provides clear visibility into repayment progress, enabling better financial management, timely reminders for due payments, and minimizing the risk of default. This template is especially useful for personal lenders, financial institutions, and borrowers to maintain organized records and streamline loan repayment monitoring.

How to automate overdue payment alerts in a Loan Repayment Ledger Excel for microfinance clients?

To automate overdue payment alerts in Excel, use conditional formatting combined with formulas that identify payments past their due date. Create a formula comparing the due date and the current date to highlight overdue entries automatically. Additionally, you can use Excel's notification tools like VBA macros or Power Automate to send email reminders.

What formula tracks partial repayments in a Loan Repayment Ledger Excel sheet?

The SUMIF formula is effective for tracking partial repayments by summing payments made against each loan ID. You can use a formula like =SUMIF(range_loanID, loanID, range_payments) to calculate the total amount repaid. This helps in updating the outstanding balance dynamically for accurate loan monitoring.

How to integrate client risk scoring within the Loan Repayment Ledger Excel for microfinance loans?

Integrate client risk scoring by creating a scoring model within Excel using weighted criteria such as repayment history, loan amount, and income. Use formulas like IF and VLOOKUP to assign risk levels to each client dynamically. This approach enhances decision-making with actionable insights directly in your ledger.

Which Excel templates best visualize loan delinquency trends for microfinance institutions?

The best Excel templates for visualizing loan delinquency trends include templates with dashboards that use pivot tables and charts like line graphs or heat maps. Templates with built-in slicers and filtering make it easier to analyze trends by time period or client segment. Specialized financial management templates tailored for microfinance improve data interpretation.

How to secure sensitive client data within a Loan Repayment Ledger Excel used by microfinance teams?

Securing sensitive client data in Excel involves enabling password protection on the workbook and specific sheets to restrict unauthorized access. Use Excel's data encryption features and limit permissions to team members based on roles. Additionally, consider storing files in secure cloud environments with multi-factor authentication.

More Ledger Excel Templates