The Scenario Forecast Excel Template for Investment Analysts enables users to model various financial outcomes based on different market conditions and assumptions. This powerful tool supports data-driven decision-making by allowing analysts to adjust key variables and instantly see potential impacts on investment performance. Its user-friendly interface and customizable features make it essential for conducting comprehensive risk assessments and strategic planning.

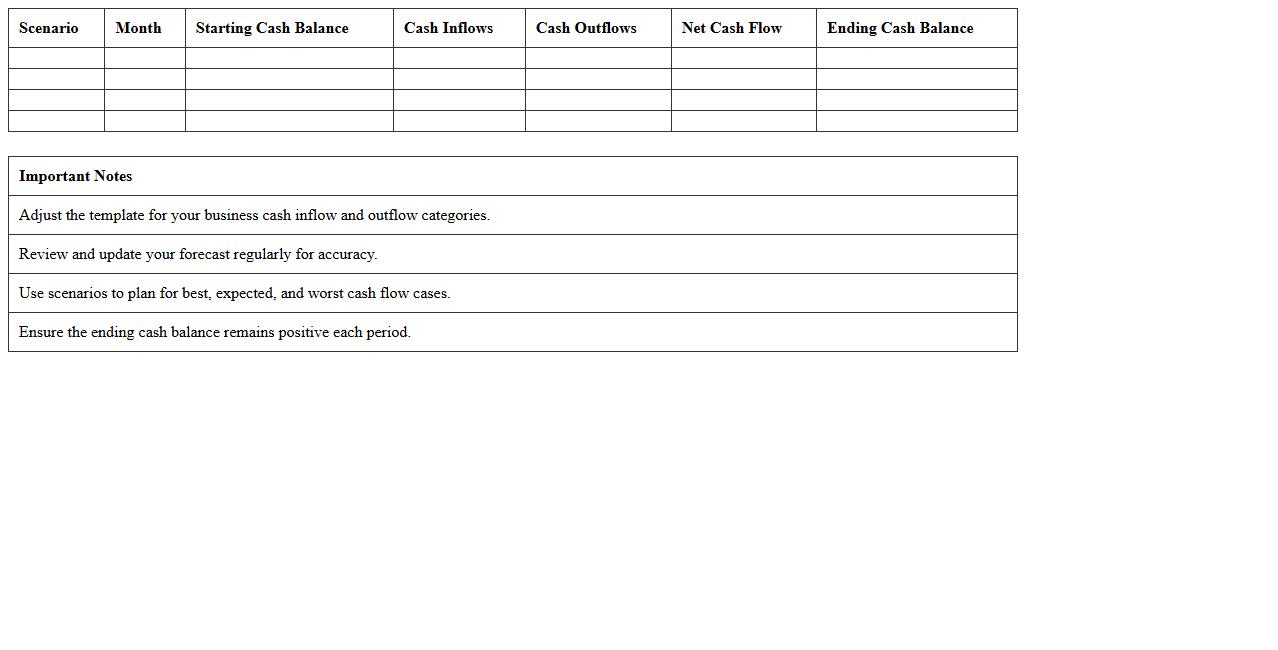

Cash Flow Scenario Forecast Excel Template

The

Cash Flow Scenario Forecast Excel Template document is a dynamic financial tool designed to project and analyze various cash flow outcomes based on different business scenarios. It enables users to input revenue, expenses, and other financial variables to visualize potential cash positions over time, helping in effective budget planning and risk management. By forecasting multiple scenarios, this template supports informed decision-making and ensures better liquidity management for businesses.

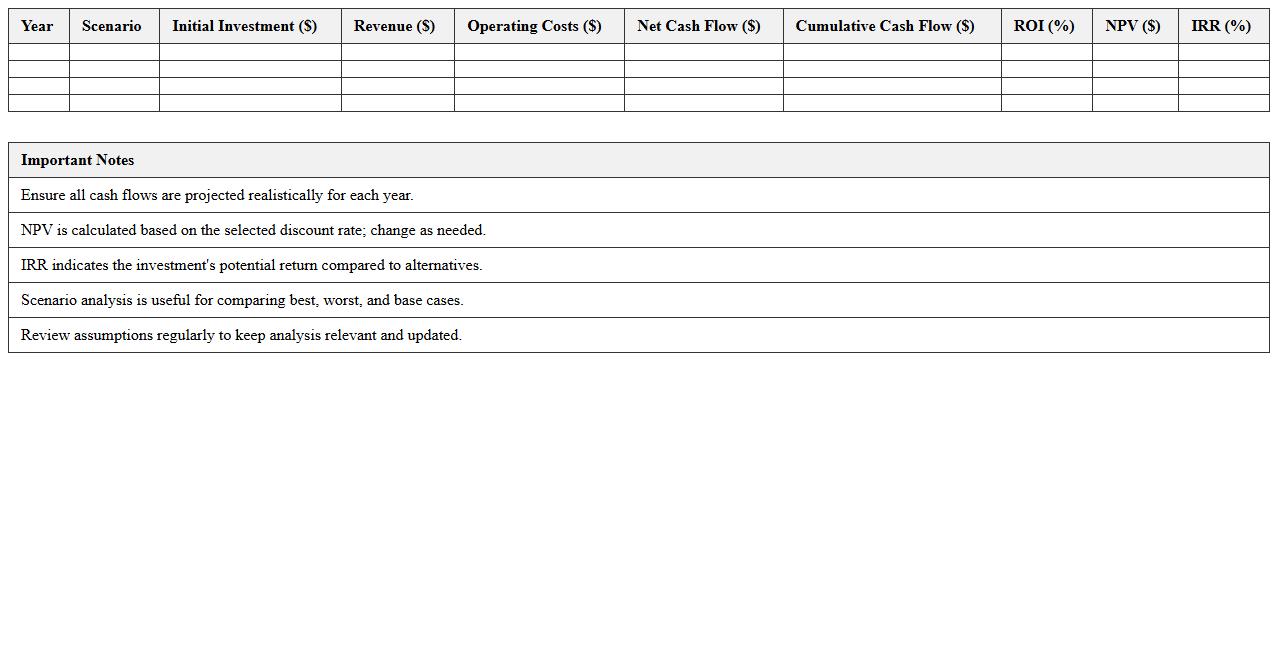

Multi-Year Investment Scenario Analysis Excel Sheet

The

Multi-Year Investment Scenario Analysis Excel Sheet is a financial modeling tool designed to project investment outcomes over several years, helping users evaluate potential risks and returns under various economic conditions. It enables investors and financial planners to simulate different investment scenarios, optimize portfolio allocations, and make informed decisions based on projected cash flows, growth rates, and market trends. This document is essential for strategic planning, ensuring long-term financial goals are met by analyzing the impact of variables such as interest rates, inflation, and market volatility on investments.

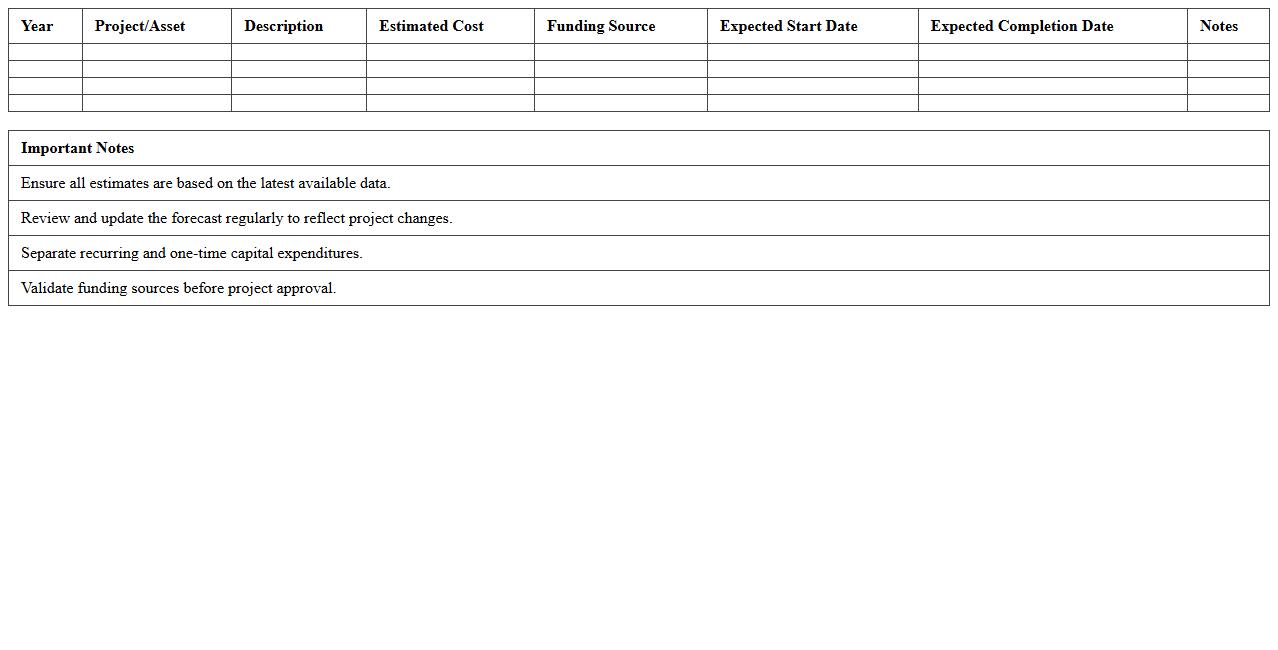

Capital Expenditure Forecasting Excel Model

A

Capital Expenditure Forecasting Excel Model document is a financial tool designed to project future capital investments and related cash flows, allowing businesses to plan and allocate resources effectively. It helps in estimating costs for asset purchases, upgrades, and long-term projects, enabling informed decision-making and budgeting accuracy. By providing detailed forecasts and scenario analysis, it supports strategic planning and risk management in capital-intensive operations.

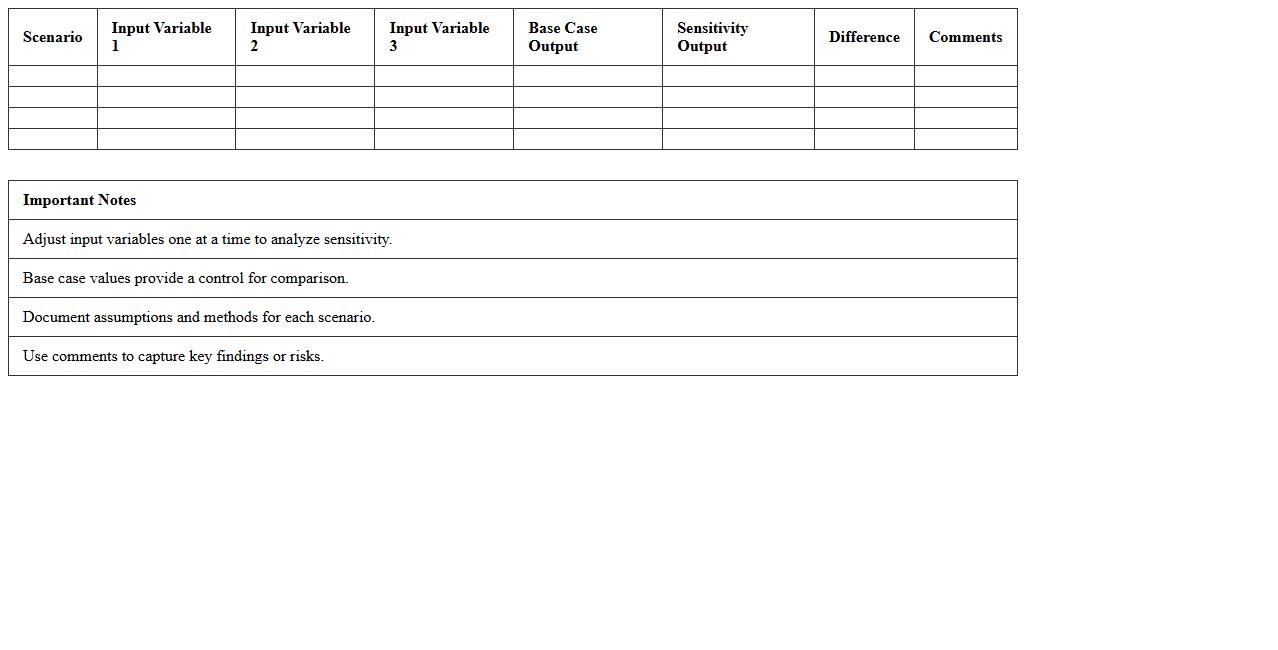

Sensitivity Analysis Scenario Forecast Excel Template

The

Sensitivity Analysis Scenario Forecast Excel Template document is a powerful tool designed to evaluate how changes in key input variables impact financial models and business forecasts. It helps users identify the most critical factors affecting outcomes by systematically adjusting assumptions and observing variations in the results. This template is useful for decision-making, risk assessment, and strategic planning by providing clear insights into potential scenarios and their financial implications.

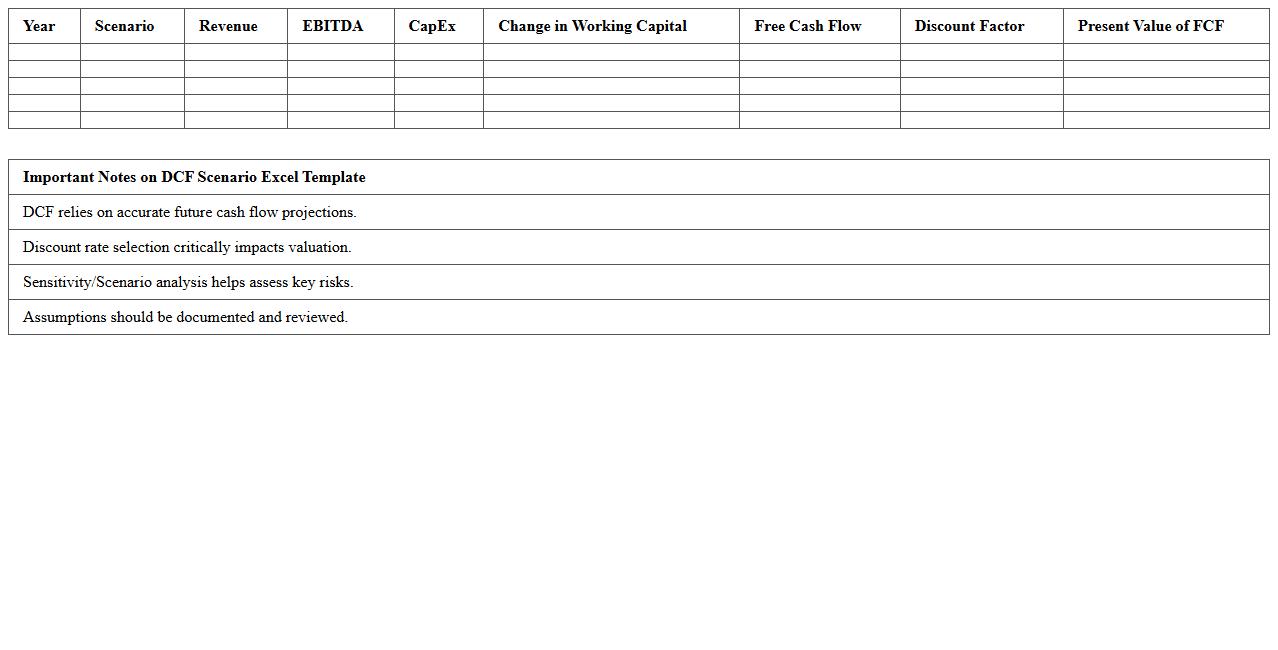

Discounted Cash Flow (DCF) Scenario Excel Template

The

Discounted Cash Flow (DCF) Scenario Excel Template document is a dynamic financial modeling tool designed to estimate the present value of future cash flows by applying discount rates. It enables users to create multiple scenarios by adjusting variables such as revenue growth, operating costs, and discount rates, providing a comprehensive analysis of investment viability and business valuation. This template is essential for investors, financial analysts, and business owners aiming to make informed decisions based on projected financial performance under varying conditions.

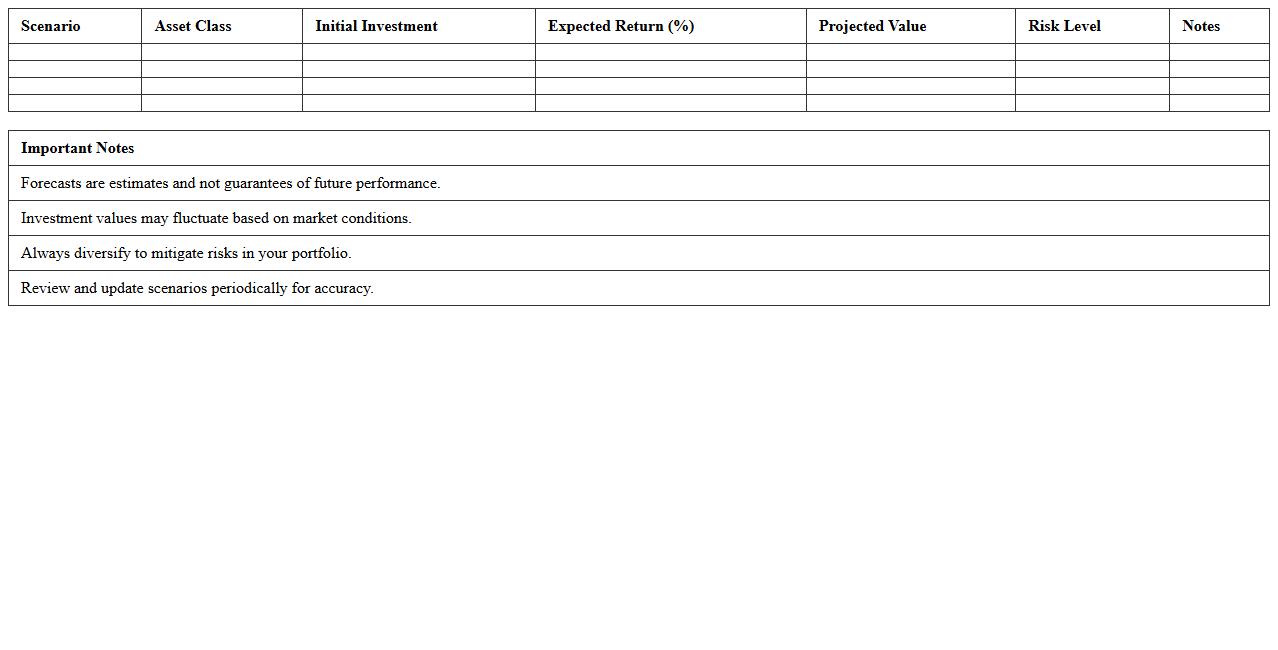

Investment Portfolio Scenario Forecast Spreadsheet

An

Investment Portfolio Scenario Forecast Spreadsheet is a financial tool that models various investment outcomes based on different market conditions and asset allocations. It helps investors analyze potential risks and returns by simulating scenarios such as market growth, downturns, and economic changes. This document is useful for making informed decisions, optimizing portfolio performance, and planning long-term financial goals with greater confidence.

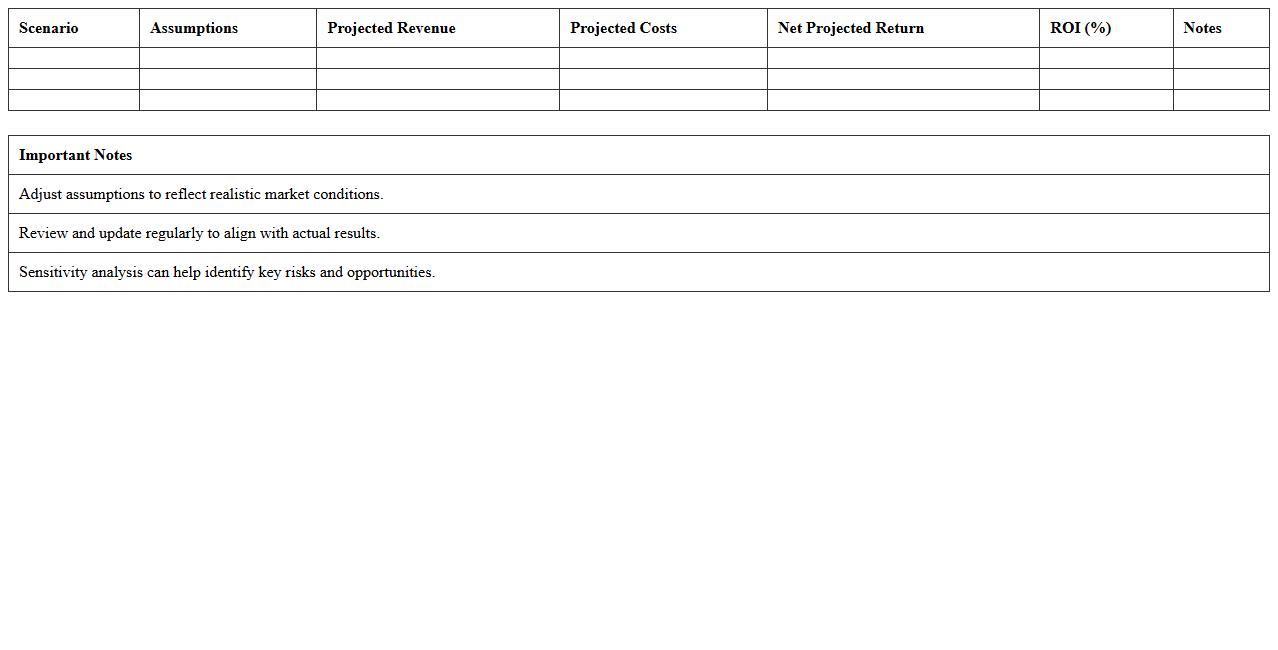

Projected Returns Scenario Planning Excel Template

The

Projected Returns Scenario Planning Excel Template document allows users to model various financial outcomes based on different investment assumptions and market conditions. It helps in visualizing potential returns, assessing risks, and making informed decisions by adjusting variables such as growth rates, inflation, and investment durations. This tool is essential for financial planning, budgeting, and strategizing to optimize investment performance and achieve targeted financial goals.

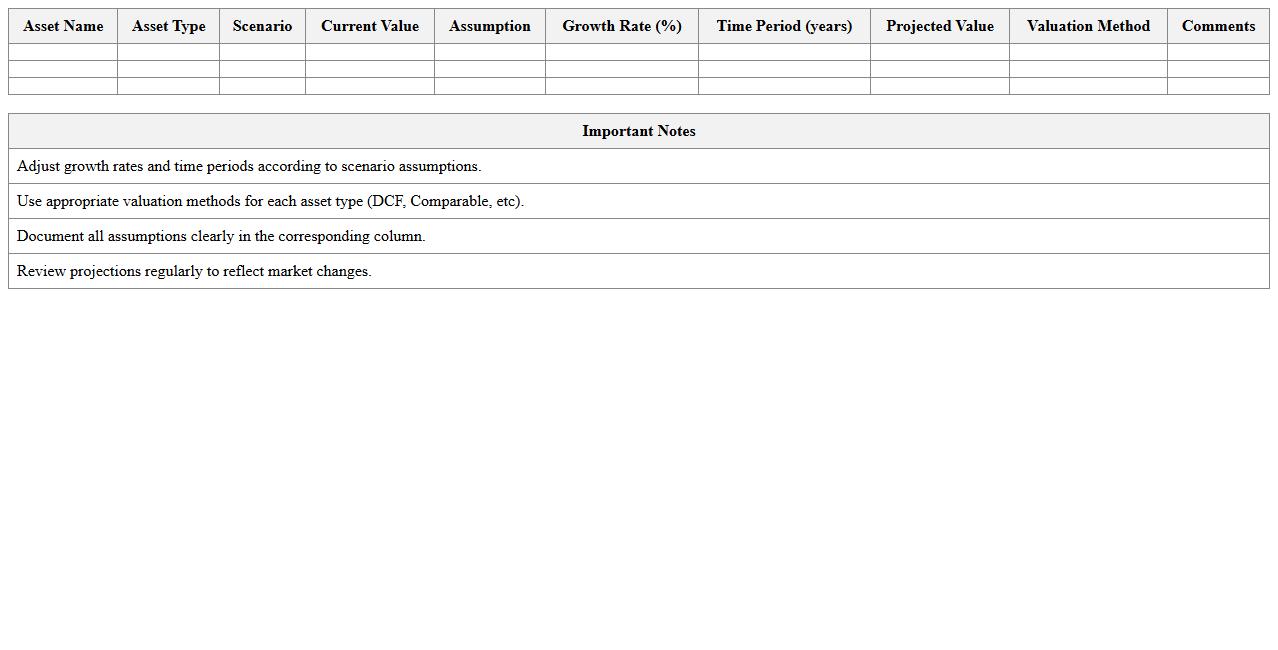

Asset Valuation Scenario Modeling Excel Template

The

Asset Valuation Scenario Modeling Excel Template is a comprehensive tool designed to analyze and predict the value of various assets under multiple market conditions. It allows users to input different financial variables and simulate potential outcomes, aiding in informed decision-making and risk assessment. This template is particularly useful for investors, financial analysts, and portfolio managers seeking to optimize asset performance and forecast future asset valuations accurately.

Equity Investment Scenario Analysis Excel Worksheet

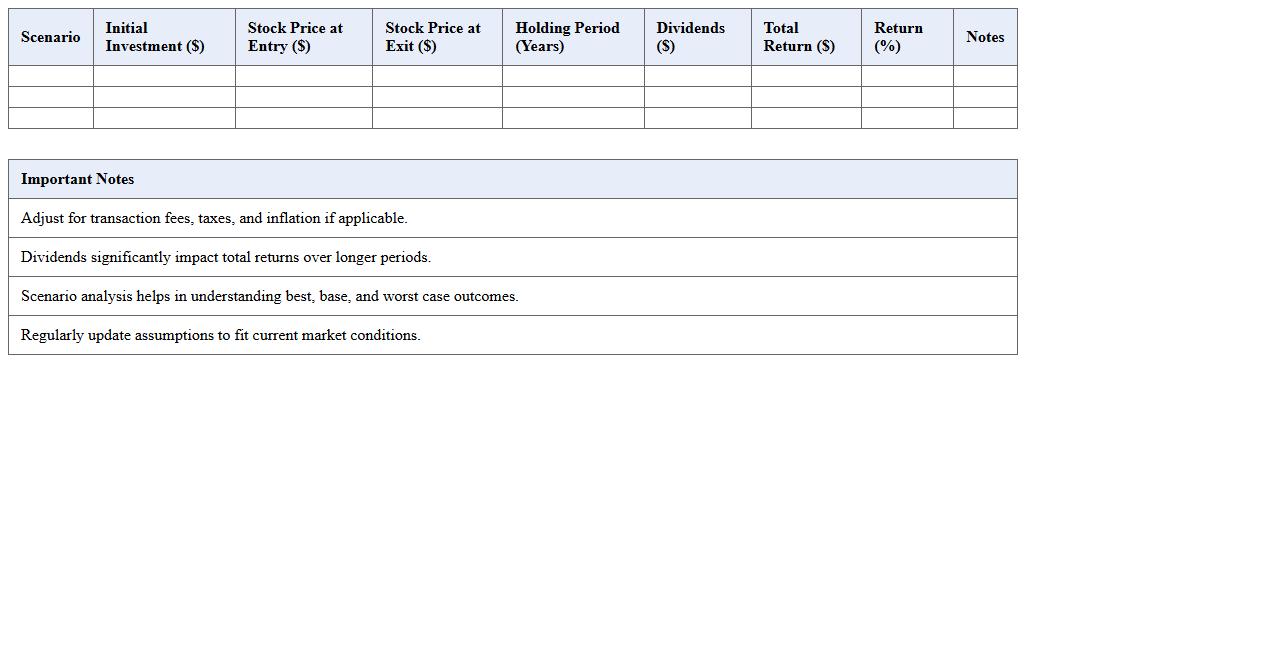

The

Equity Investment Scenario Analysis Excel Worksheet is a financial tool used to evaluate potential outcomes of equity investments under various market conditions and assumptions. It enables investors to model different scenarios such as changes in stock prices, dividend yields, and economic factors, helping to forecast potential returns and risks. This worksheet is useful for making informed investment decisions by providing a structured analysis of how different variables impact the overall profitability and risk profile of equity investments.

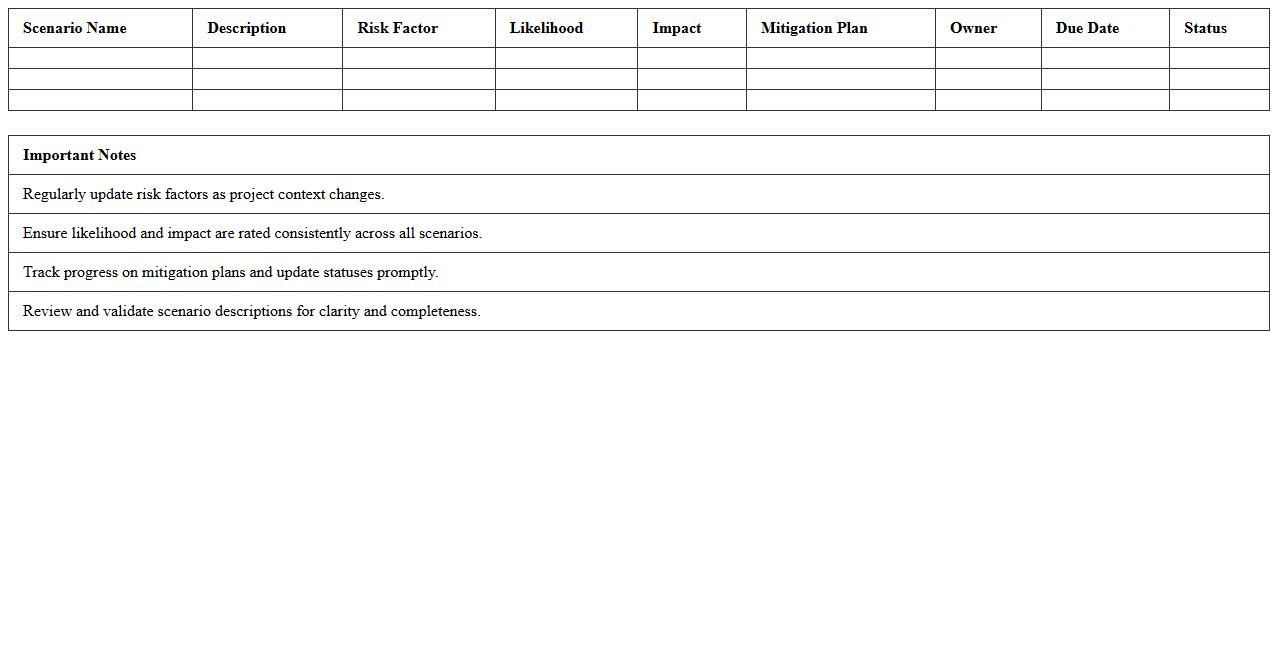

Risk Assessment Scenario Forecast Excel Template

The

Risk Assessment Scenario Forecast Excel Template document is a structured tool designed to identify, evaluate, and predict potential risks within projects or business operations. It enables users to input various risk factors, generate forecast scenarios, and visualize possible outcomes through charts and data tables. By leveraging this template, organizations can make informed decisions, mitigate potential threats, and enhance strategic planning processes.

How do you structure scenario forecast assumptions in an Excel letter for investment analysis?

Start by defining clearly labeled sections for each scenario assumption such as base, optimistic, and pessimistic cases. Include detailed descriptions and quantitative inputs for variables like revenue growth, cost inflation, and market trends. Organize the assumptions logically with consistent formatting to enhance readability and facilitate easy updates.

What formula best links macroeconomic drivers to valuation projections in scenario forecast documents?

The NPV (Net Present Value) formula combined with dynamic inputs like GDP growth rates and interest rates is most effective. Use Excel functions such as SUMPRODUCT to weight different macroeconomic variables against valuation drivers accurately. This approach ensures that macroeconomic assumptions directly impact cash flow projections and overall valuations.

Which Excel visualization tools most clearly summarize scenario changes in an analyst letter?

Excel charts like Waterfall charts and Tornado diagrams are ideal for highlighting scenario impacts on valuations. Conditional formatting and data bars improve visibility of key sensitivity ranges within tables. These tools visually communicate complex changes, making scenario comparisons more intuitive for stakeholders.

How can you automate sensitivity tables for scenario letters using Excel VBA?

Create a VBA macro that dynamically updates sensitivity tables by iterating through predefined input variables and recalculating outputs. Include user forms to allow analysts to input different scenario parameters easily. Automation saves time and enhances accuracy when generating multiple scenario forecasts quickly.

What are best practices for documenting risk factors in forecast scenario letters in Excel?

Clearly itemize each risk factor alongside its potential impact and probability, using structured tables. Link these risks to scenario adjustments with comments or hyperlinks for detailed explanations. Maintain version control and include audit trails to ensure transparency and accountability in your documentation.

More Forecast Excel Templates