The Cash Flow Forecast Excel Template for Consultants is designed to help consultants accurately predict their income and expenses over a specific period. This template offers customizable categories, easy-to-use formulas, and clear visualizations for effective financial planning. By using this tool, consultants can ensure they maintain positive cash flow and make informed business decisions.

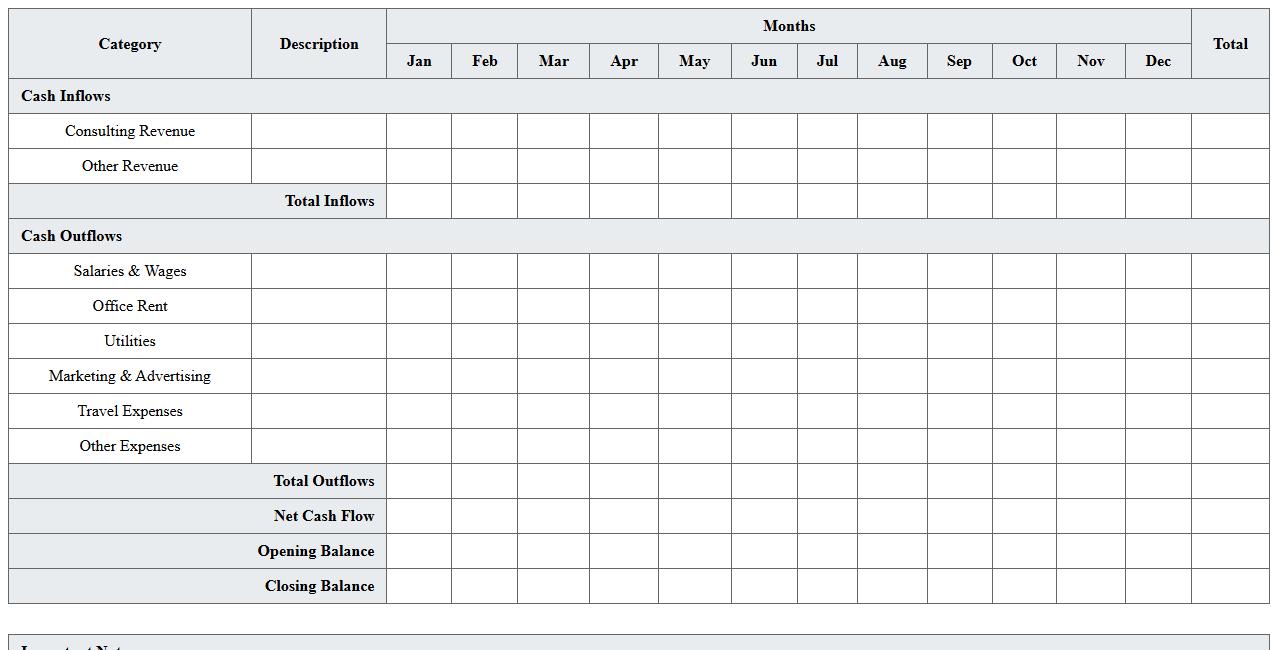

Monthly Cash Flow Projection for Consulting Firms

A

Monthly Cash Flow Projection for consulting firms is a financial document that estimates the inflow and outflow of cash on a month-to-month basis. It helps consulting firms anticipate periods of liquidity surplus or shortage, enabling better decision-making in resource allocation and expense management. This projection is crucial for maintaining operational stability, securing timely payments, and planning strategic growth initiatives effectively.

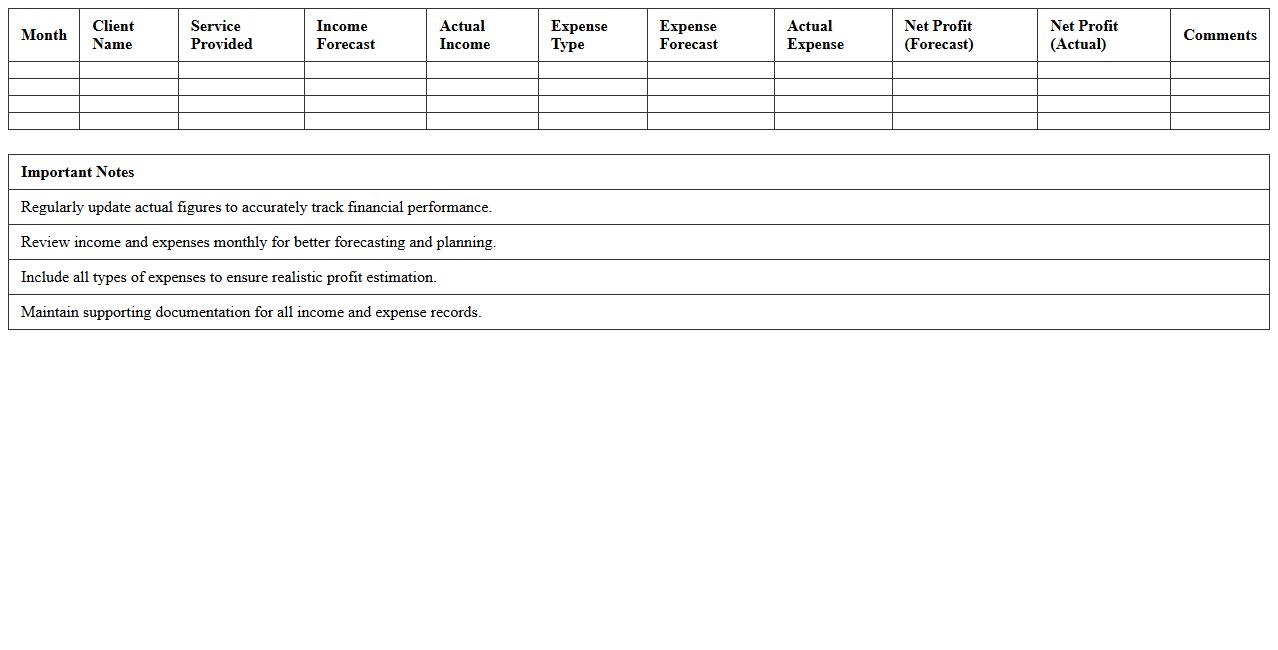

Consultant Income & Expense Forecast Spreadsheet

The

Consultant Income & Expense Forecast Spreadsheet is a financial planning tool designed to help consultants accurately project their earnings and expenses over a specific period. It enables users to input expected income sources and anticipated costs, facilitating detailed cash flow analysis and budget management. This document is useful for optimizing financial decision-making, ensuring profitability, and supporting effective business growth strategies.

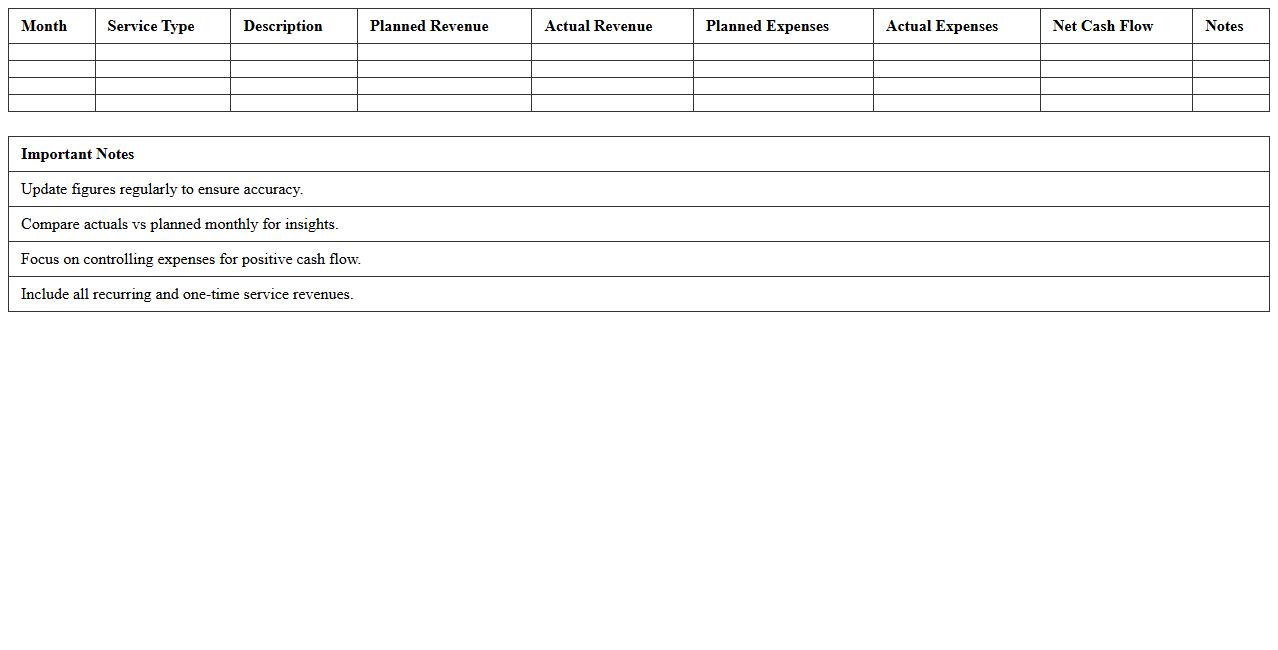

Services-Based Cash Flow Planner Excel

The

Services-Based Cash Flow Planner Excel document is a financial tool designed to track and forecast cash inflows and outflows specifically from service-oriented businesses. It enables users to manage budget estimates, monitor payment schedules, and analyze service revenue streams with customizable templates. This planner improves financial decision-making by providing clear visibility into service cash flow patterns, helping businesses maintain liquidity and optimize operational expenses.

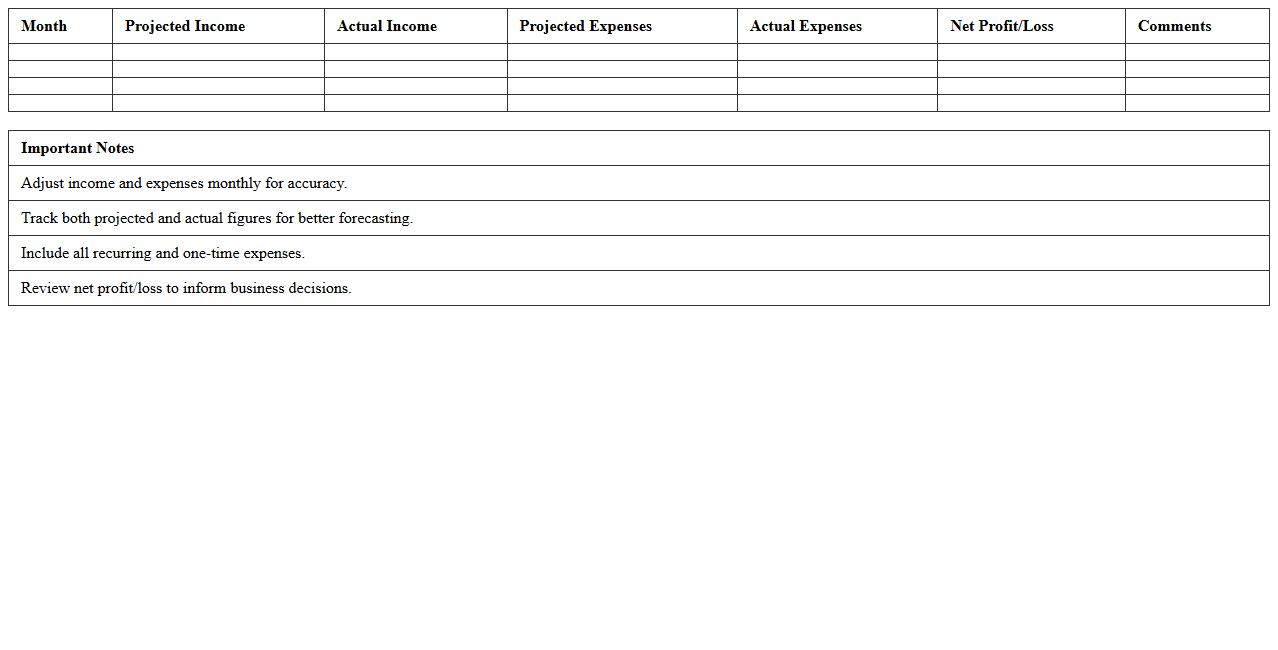

Professional Consultant Cash Flow Budget Tracker

The

Professional Consultant Cash Flow Budget Tracker document is a financial management tool designed to monitor and project cash inflows and outflows for consulting professionals. It helps track client payments, expenses, and budgeted versus actual cash flow, enabling better financial planning and decision-making. Using this tracker improves accuracy in forecasting, ensures timely payment management, and supports maintaining a healthy business cash flow.

Freelance Consultant Financial Forecast Template

The

Freelance Consultant Financial Forecast Template is a structured document designed to project income, expenses, and profitability for freelance financial consultants. It helps users analyze cash flow, set realistic financial goals, and make informed business decisions by providing clear visualizations of expected financial performance. This template streamlines budget planning and allows consultants to track financial progress, ensuring sustainable growth and financial stability.

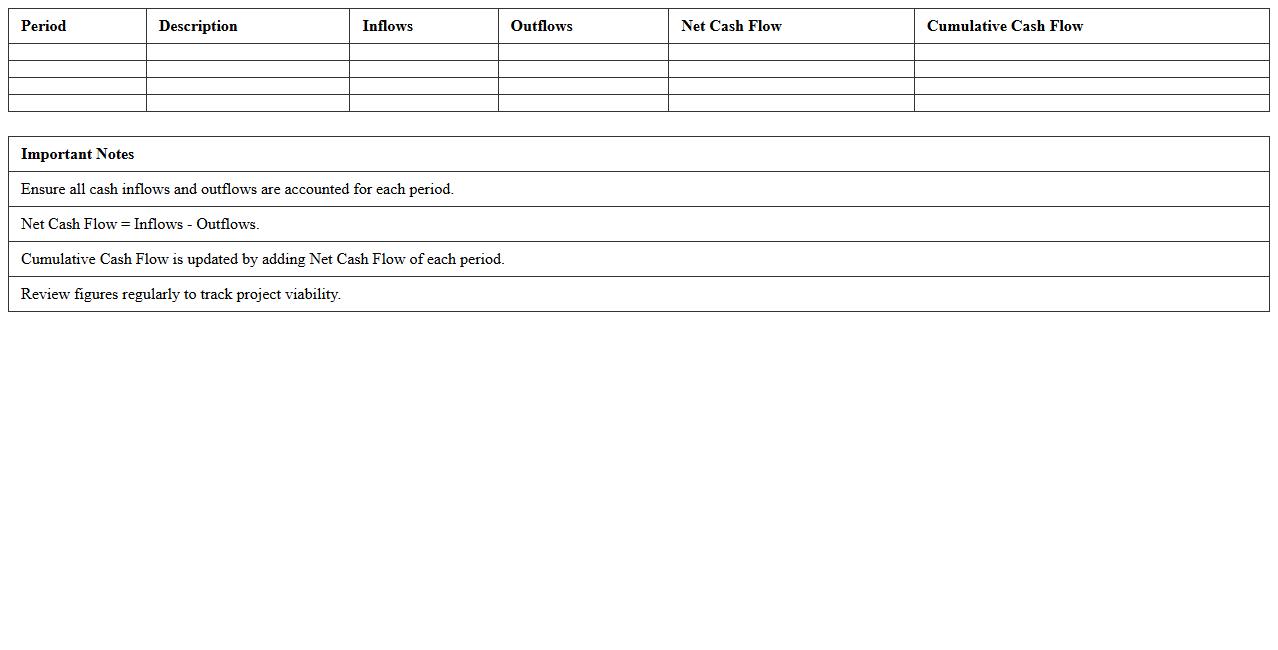

Project-Based Cash Flow Analysis Sheet

A

Project-Based Cash Flow Analysis Sheet is a financial document designed to track and forecast the inflows and outflows of cash specific to a project, allowing for precise management of capital over the project lifecycle. It helps project managers and financial analysts identify funding gaps, optimize resource allocation, and ensure liquidity to meet project milestones without disruptions. This tool is essential for maintaining financial control, improving decision-making, and enhancing the accuracy of budget planning in complex projects.

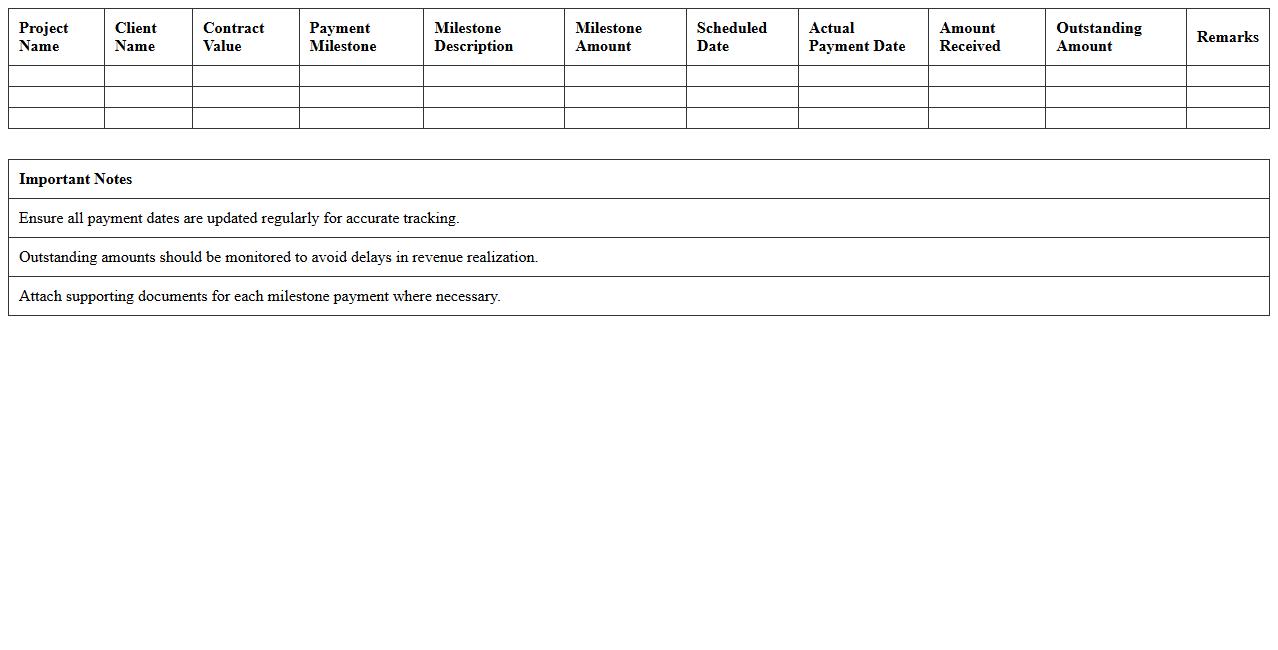

Consultancy Revenue & Payment Schedule Excel

The

Consultancy Revenue & Payment Schedule Excel document is a vital tool for managing and tracking consultancy project finances, detailing expected revenue streams and payment timelines. It helps organizations maintain accurate cash flow forecasts, avoid payment delays, and ensures timely invoicing by clearly outlining payment milestones and client obligations. Using this document enhances financial planning, improves transparency between consultants and clients, and supports efficient budget management throughout the consultancy engagement.

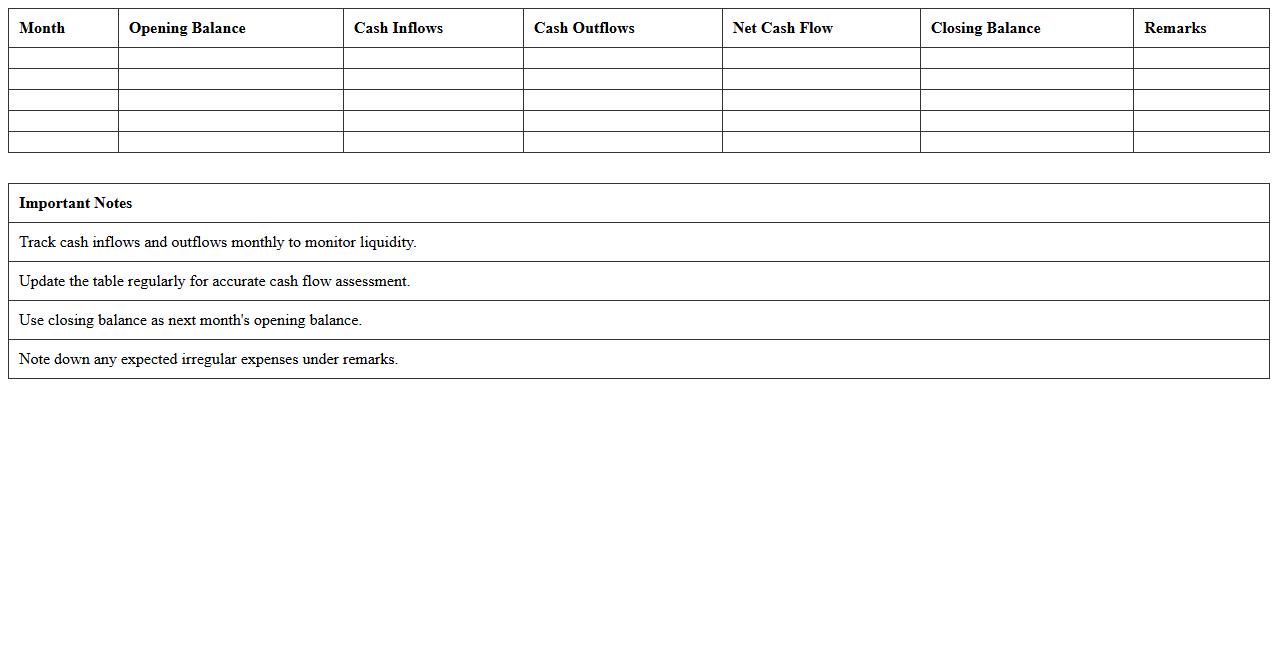

Simple Cash Flow Management Excel for Advisors

The

Simple Cash Flow Management Excel for Advisors is a streamlined financial tool designed to help advisors efficiently track and project client cash flows. This document enables precise budgeting, expense monitoring, and forecasting, empowering advisors to make informed financial decisions and optimize client money management. By simplifying complex cash flow data, it enhances clarity and supports long-term financial planning.

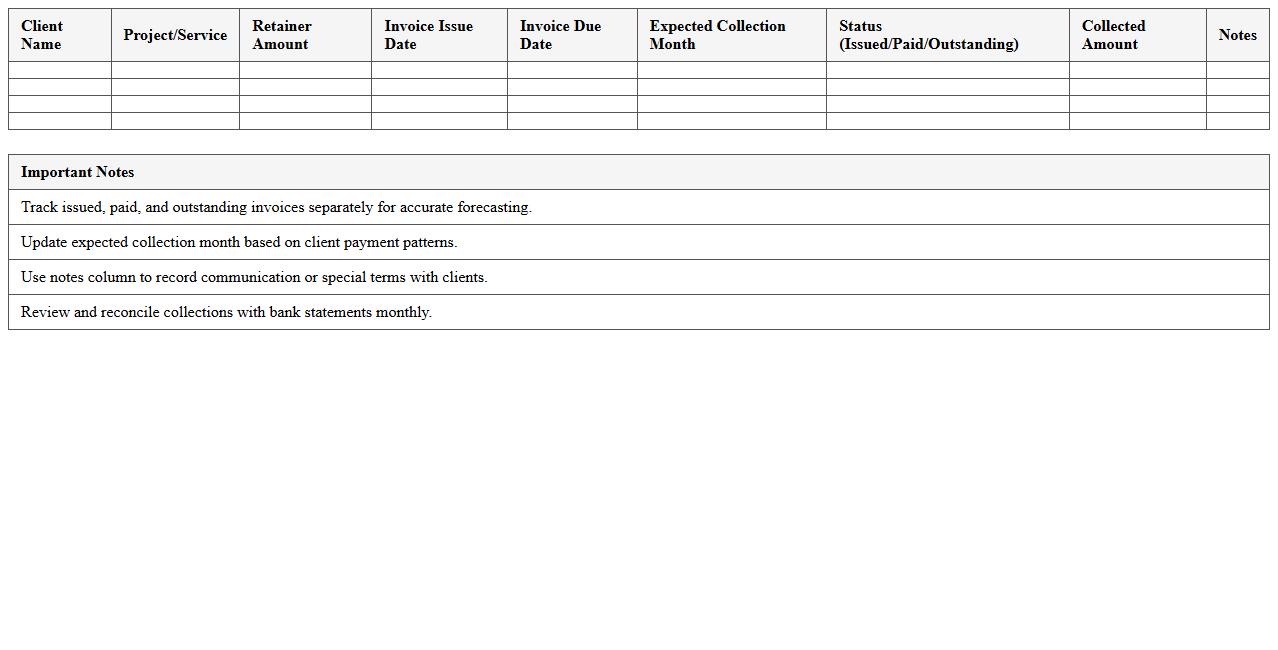

Retainer Invoice & Collection Forecast Template

A

Retainer Invoice & Collection Forecast Template is a financial tool designed to track retainer payments and predict future cash inflows from clients. This template helps businesses manage ongoing contracts by clearly outlining invoiced amounts against actual collections, improving cash flow visibility. It streamlines financial planning and decision-making by providing accurate forecasts of expected payments, reducing the risk of overdue receivables.

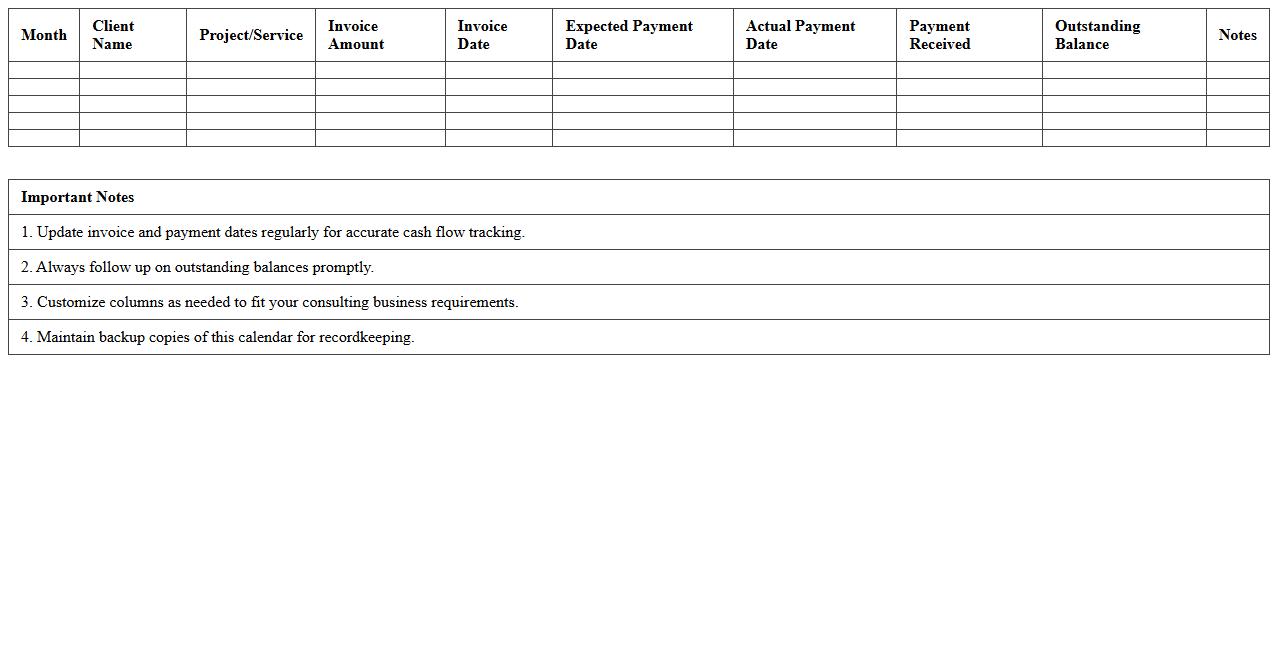

Consulting Services Billing & Cash Flow Calendar

The

Consulting Services Billing & Cash Flow Calendar document tracks invoicing schedules and payment timelines to optimize revenue management and cash flow forecasting. It helps consulting firms anticipate cash inflows, identify potential payment delays, and plan operational expenses effectively. Using this calendar ensures timely billing, improves client payment compliance, and supports strategic financial decision-making.

How to customize Cash Flow Forecast Excel templates for consulting project retainers?

To customize a Cash Flow Forecast Excel template for consulting project retainers, start by defining each client's retainer fee schedule clearly in the sheet. Incorporate columns for project milestones and corresponding payment dates to match contract terms. Use conditional formatting to highlight upcoming payments and overdue amounts for easy tracking.

What key metrics should consultants track in their forecast spreadsheets?

Consultants should focus on tracking net cash inflows, outstanding invoices, and retainer balances to maintain financial clarity. Monitoring the burn rate and projected cash runway helps ensure sustainable operations. Additionally, tracking client payment behavior assists in anticipating cash flow gaps.

How to automate recurring consultant fees in a cash flow model?

Automate recurring consultant fees using Excel's IF and DATE functions to generate payment schedules automatically based on contract start dates. Set up formulas to add recurring fees at specified intervals, avoiding manual entries. Using named ranges for fee amounts improves formula readability and updates.

What Excel formulas are best for projecting variable consulting income?

For variable consulting income, use SUMIFS to aggregate income based on project status or dates dynamically. The FORECAST.LINEAR function can help predict income trends based on historical data. Combining VLOOKUP or XLOOKUP enables retrieval of contract-specific fee rates efficiently.

How to integrate client payment timelines into a consultant cash flow forecast?

Integrate payment timelines by mapping each client's expected payment dates alongside invoice generation in the forecast sheet. Use GANTT chart templates or timeline visualizations to track invoice aging and anticipated receipt dates clearly. Employ COUNTIF and SUMIF formulas to consolidate due payments by period automatically.

More Forecast Excel Templates