The Loan Forecast Excel Template for Mortgage Brokers streamlines financial projections by providing customizable fields for interest rates, loan amounts, and payment schedules. This tool enables mortgage brokers to accurately estimate future loan performance and cash flow, enhancing decision-making and client presentations. With built-in formulas and clear visualizations, it simplifies complex data into actionable insights for improved mortgage management.

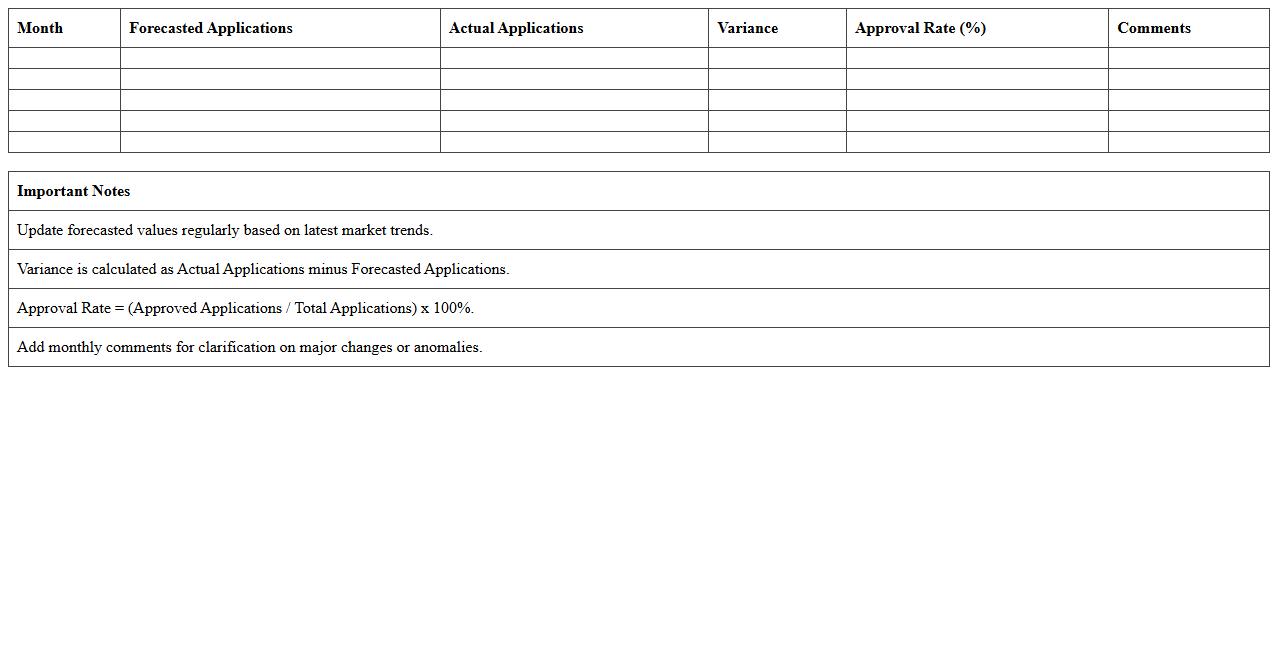

Monthly Loan Forecast Tracker for Mortgage Brokers

The

Monthly Loan Forecast Tracker for mortgage brokers is a crucial tool that helps predict and monitor upcoming loan applications and approvals on a month-to-month basis. This document enables brokers to manage pipeline volume accurately, anticipate cash flow, and identify trends in borrower demand. By using the tracker, mortgage professionals can optimize resource allocation, improve client communication, and enhance overall business planning.

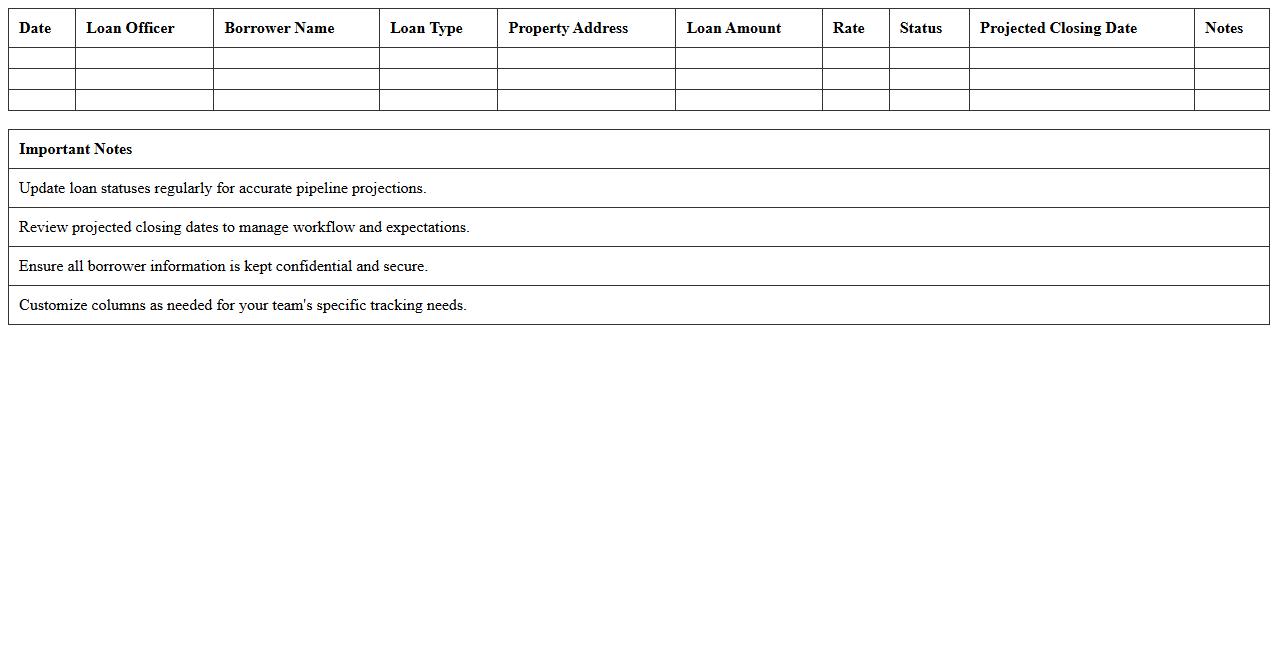

Mortgage Pipeline Projections Excel Template

The

Mortgage Pipeline Projections Excel Template is a powerful financial tool designed to forecast loan origination volumes, track pending applications, and estimate revenue over specific timeframes. It helps mortgage professionals visualize the flow of loans through various stages, enabling accurate capacity planning and cash flow management. By leveraging this template, organizations can streamline decision-making, optimize resource allocation, and improve overall pipeline efficiency.

Loan Application Volume Forecast Spreadsheet

A

Loan Application Volume Forecast Spreadsheet document is a data-driven tool used to predict future loan application trends by analyzing historical application data and market factors. It helps financial institutions optimize resource allocation, anticipate workload fluctuations, and improve decision-making in loan processing and marketing strategies. By leveraging accurate forecasts, organizations can increase operational efficiency and better meet customer demand.

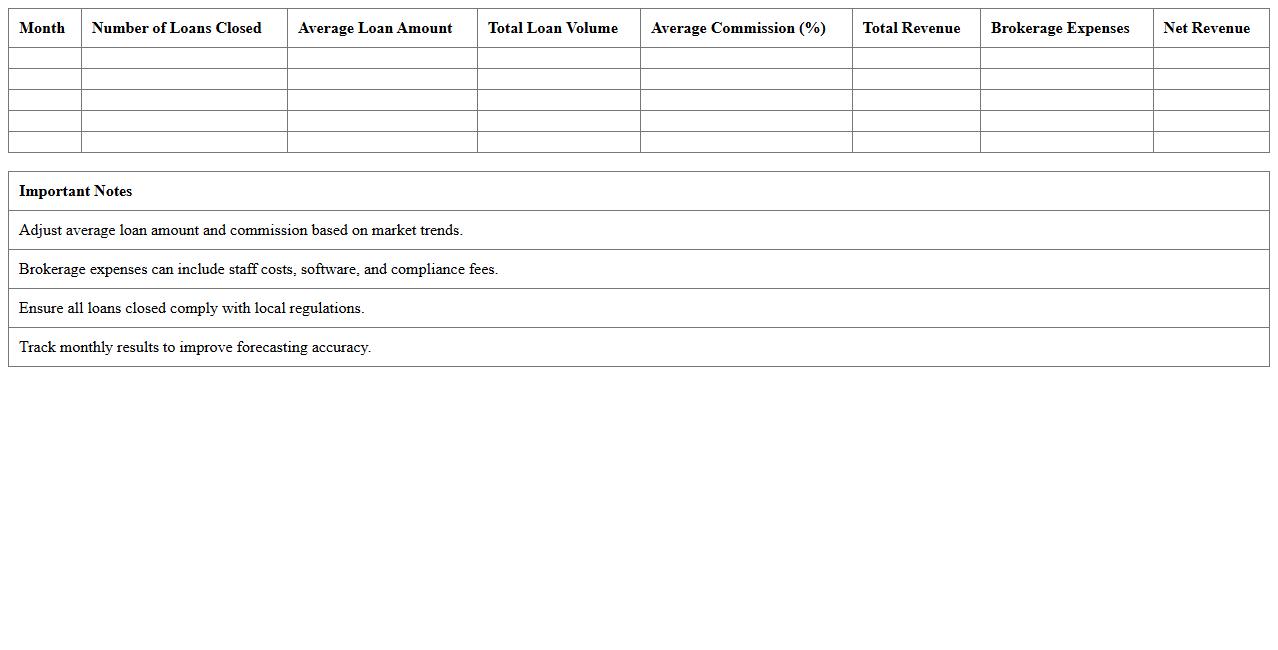

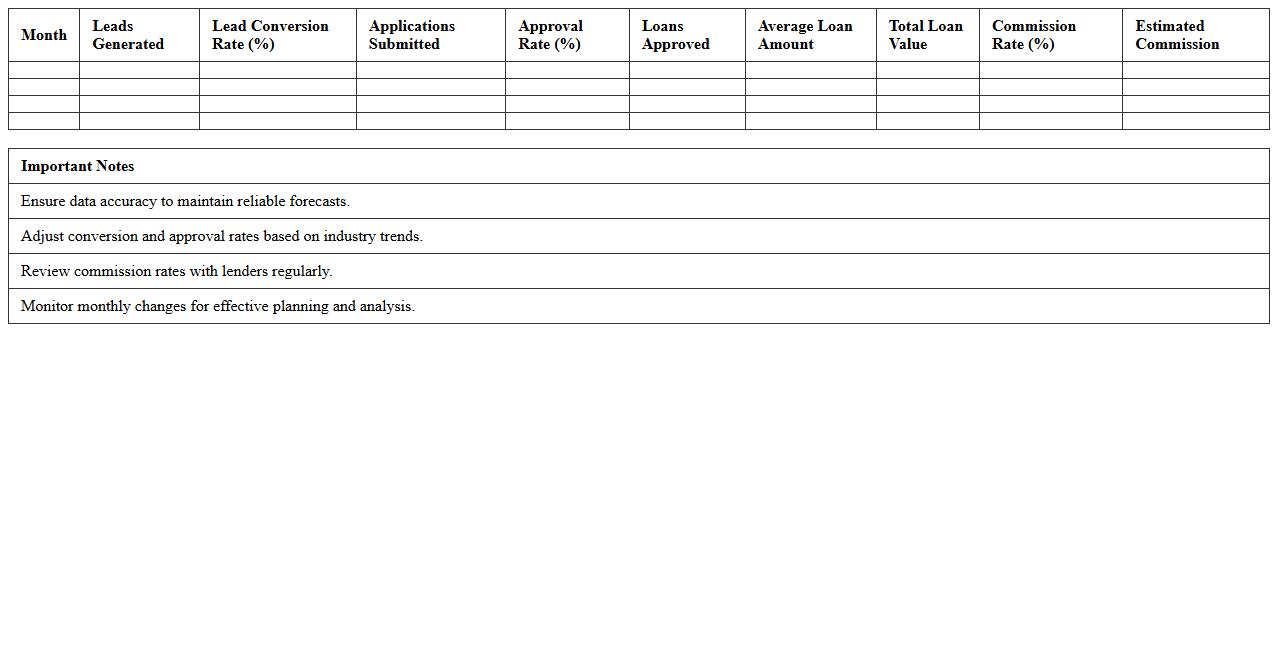

Mortgage Broker Revenue Forecast Worksheet

The

Mortgage Broker Revenue Forecast Worksheet document is a crucial financial planning tool that estimates future income for mortgage brokers by analyzing loan volumes, commission rates, and market trends. It helps brokers make informed decisions, set realistic sales targets, and manage cash flow effectively. Using this worksheet enhances strategic planning and supports sustainable business growth by providing clear revenue projections.

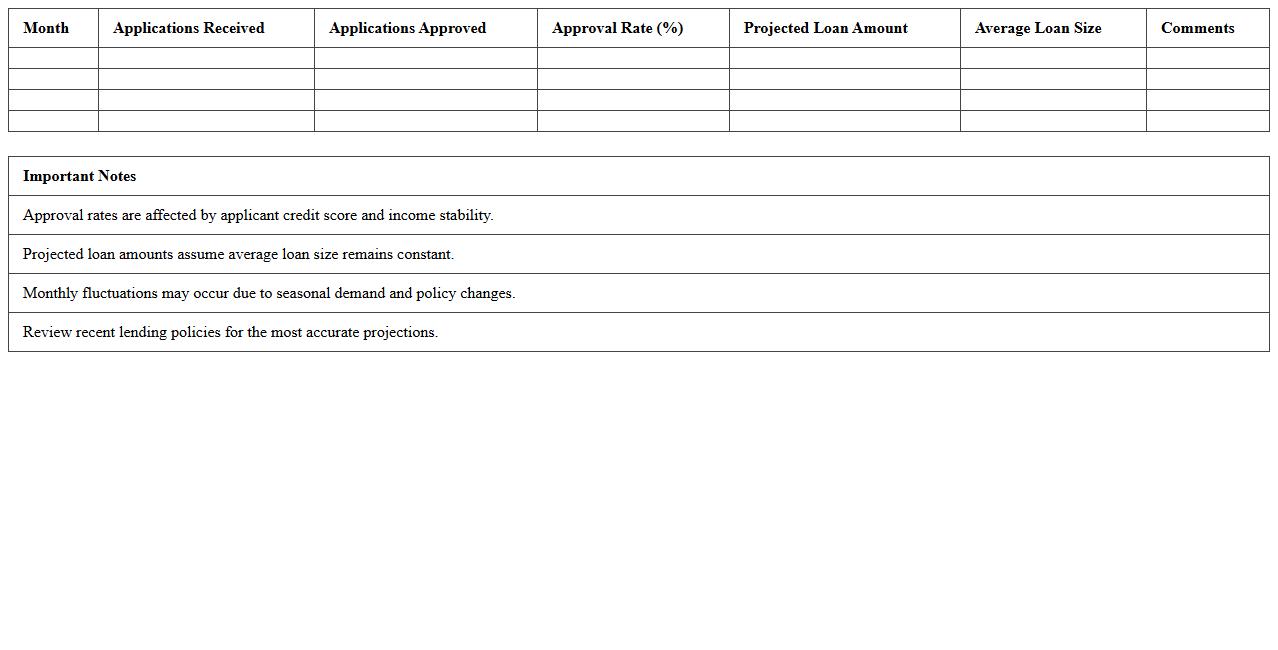

Home Loan Approval Rate Projection Template

A

Home Loan Approval Rate Projection Template document is a tool designed to estimate the likelihood of loan approvals based on historical data, borrower profiles, and current market conditions. It helps lenders and financial analysts forecast approval rates, identify trends, and make informed decisions regarding risk management and loan portfolio growth. Utilizing this template enhances accuracy in credit assessment and improves strategic planning for home loan programs.

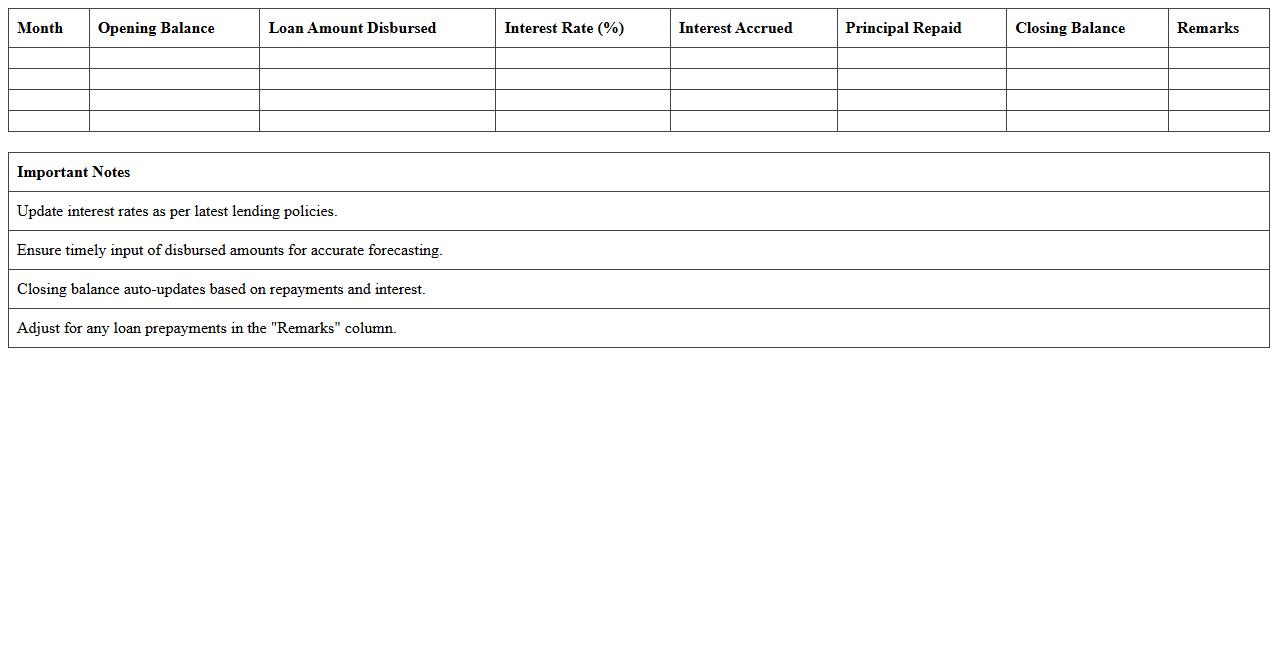

Loan Disbursement Forecasting Excel Sheet

A

Loan Disbursement Forecasting Excel Sheet document is a financial tool designed to predict the timing and amounts of loan releases based on scheduled repayments and funding availability. It helps lenders and financial institutions optimize cash flow management, ensuring funds are allocated efficiently and reducing the risk of liquidity shortages. By analyzing historical data and repayment patterns, this forecasting sheet supports informed decision-making in loan portfolio management and budgeting.

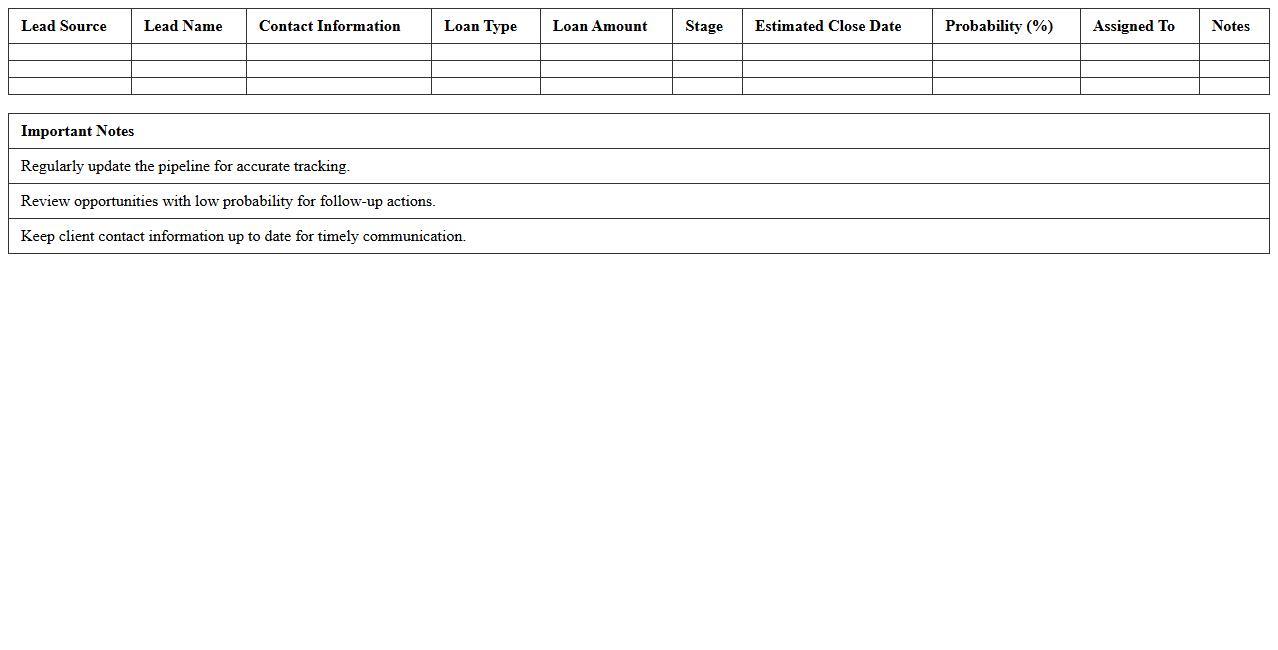

Mortgage Sales Pipeline Analysis Template

A

Mortgage Sales Pipeline Analysis Template is a strategic tool designed to track and evaluate each stage of the mortgage sales process, from lead generation to loan closure. It helps identify bottlenecks, measure conversion rates, and forecast revenue by organizing key client data and sales activities in a structured format. Utilizing this template enhances sales team efficiency, improves decision-making, and ultimately drives higher mortgage loan approvals and business growth.

Loan Origination Forecast Planner for Brokers

The

Loan Origination Forecast Planner for brokers is a strategic document that outlines projected loan volume, application timelines, and key performance metrics to optimize lending operations. It enables brokers to anticipate market demand, allocate resources efficiently, and set realistic goals for client acquisition and loan processing. By providing a clear roadmap, this planner enhances decision-making and drives consistent growth within the competitive mortgage industry.

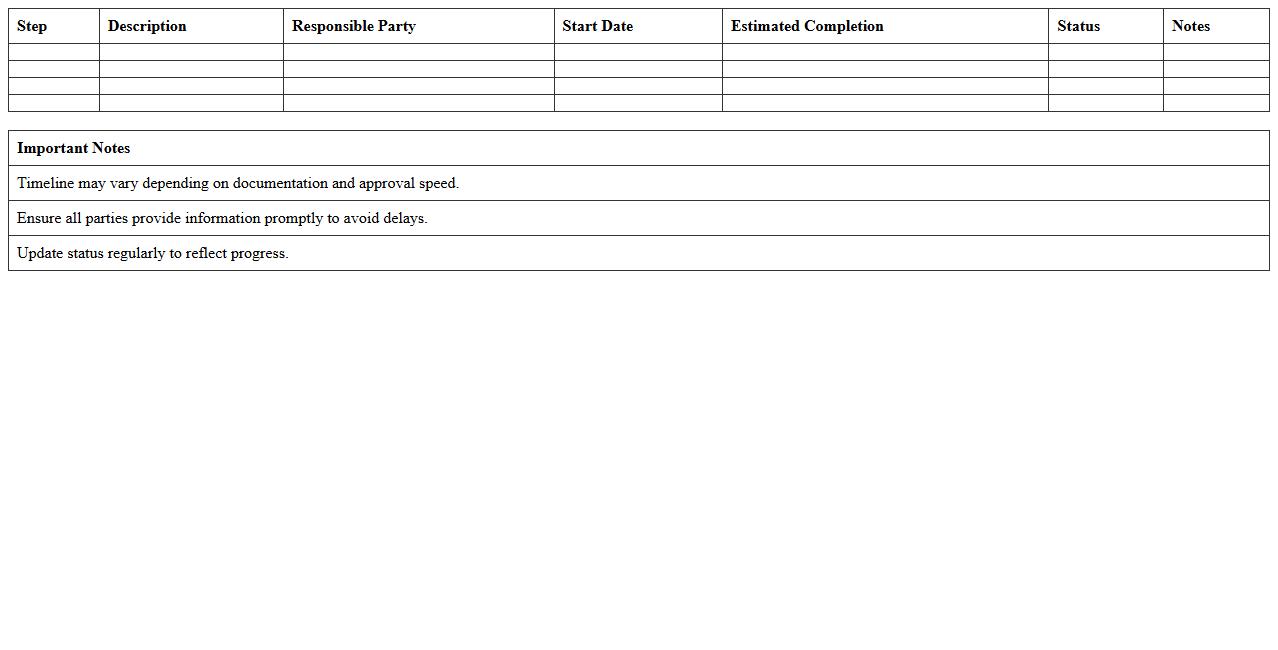

Mortgage Closing Timeline Forecast Excel

The

Mortgage Closing Timeline Forecast Excel document is a detailed tool designed to track and predict key milestones in the mortgage closing process, from application to final approval. It allows users to monitor deadlines, manage tasks efficiently, and anticipate potential delays to ensure a smooth closing experience. By providing clear timelines and status updates, this document enhances communication between borrowers, lenders, and real estate agents, helping to avoid last-minute surprises.

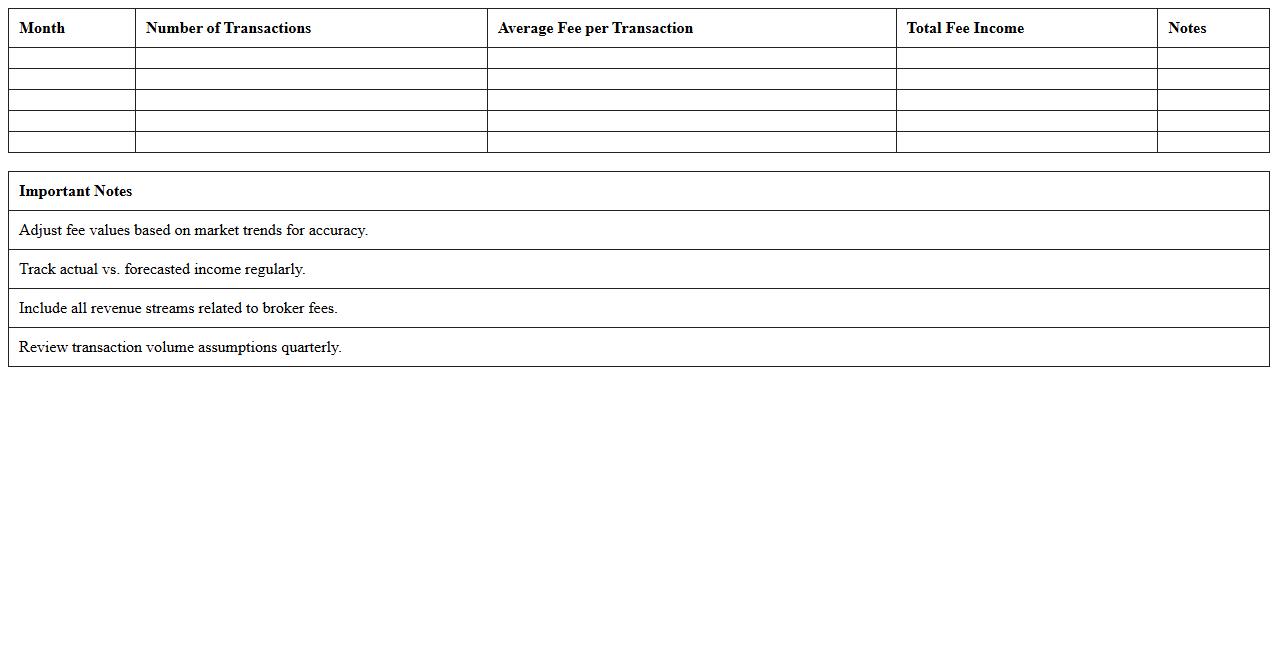

Broker Fee Income Forecast Excel Template

The

Broker Fee Income Forecast Excel Template document is a financial tool designed to project income generated from broker fees over a specified period. It helps users analyze expected revenue streams by inputting variables such as transaction volumes, fee rates, and commission structures. This template is useful for financial planners and brokerage firms to optimize fee strategies and make informed budgeting decisions.

How can mortgage brokers automate loan forecasting in Excel using VBA macros?

Mortgage brokers can use VBA macros to automate repetitive tasks such as data entry, loan calculations, and report generation in Excel. By writing scripts that update loan status and perform dynamic calculations, brokers can save time and reduce errors. Integrating VBA enhances the flexibility and efficiency of the loan forecasting process.

What formulas best estimate borrower default risk in a Loan Forecast Excel sheet?

Formulas like logistic regression or weighted scoring models based on credit score, debt-to-income ratio, and loan-to-value ratio provide strong default risk estimates. Excel's IF, VLOOKUP, and statistical functions can help categorize borrowers into risk bands. Incorporating these formulas allows brokers to systematically assess and forecast borrower default probabilities.

How to integrate real-time interest rate updates into a mortgage broker's loan forecast template?

Real-time interest rate updates can be integrated via Excel's WEBSERVICE and FILTERXML functions or by linking VBA macros to external APIs. This provides dynamic fetching of current rate data, ensuring loan forecasts reflect up-to-date market conditions. Automating these updates improves accuracy and responsiveness in the broker's loan forecast model.

What are the key KPIs for tracking loan pipeline health in Excel for brokers?

Key KPIs include loan conversion rate, average loan processing time, pipeline volume, and delinquency rate. Tracking these metrics in Excel dashboards helps brokers identify bottlenecks and optimize workflow. Presenting KPI trends visually enhances decision-making and pipeline performance management.

How do you structure a dynamic amortization schedule for multiple loans in a broker's forecast sheet?

A dynamic amortization schedule uses structured tables with loan principal, interest rate, term, and payment frequency as inputs. Employing Excel formulas like PMT, IPMT, and PPMT allows calculation of interest and principal split per period for each loan. Using named ranges and VBA can automate updates across multiple loans for a consolidated and flexible forecasting sheet.

More Forecast Excel Templates