The Loan Eligibility Assessment Excel Template for Banks streamlines the evaluation process by allowing financial institutions to efficiently analyze applicants' creditworthiness and repayment capacity. This user-friendly template incorporates key financial metrics and customizable criteria, ensuring accurate and consistent decision-making. Banks can leverage this tool to reduce processing time and enhance the reliability of loan approvals.

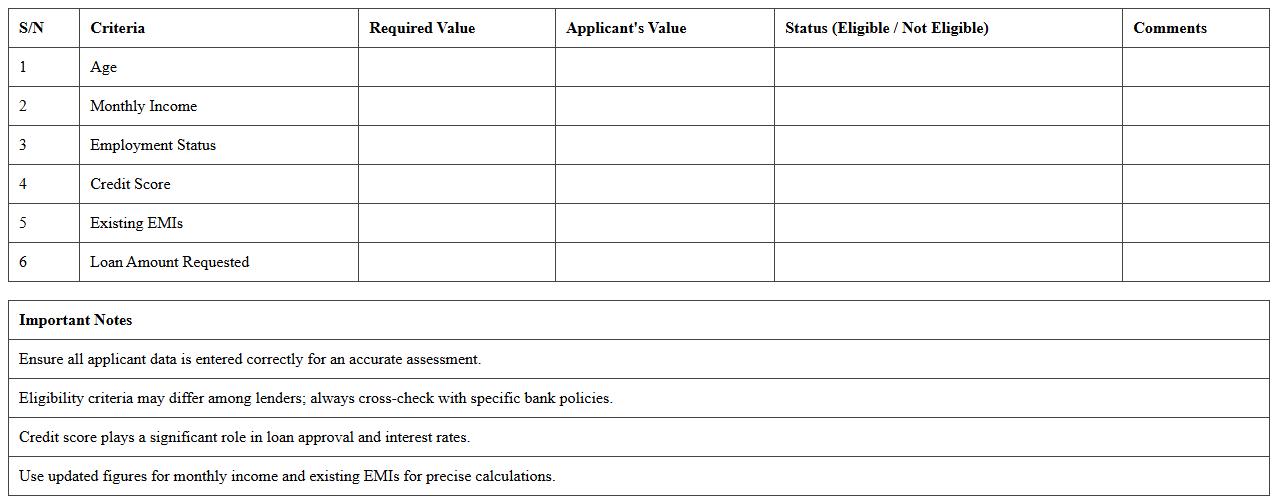

Personal Loan Eligibility Assessment Excel Template

The

Personal Loan Eligibility Assessment Excel Template is a structured financial tool designed to evaluate an individual's qualification criteria for obtaining a personal loan based on income, credit score, and existing debt. It simplifies the decision-making process by providing a clear, quantifiable analysis of loan eligibility, helping users to understand their borrowing capacity before applying. This template is useful for both borrowers and lenders to ensure loan applications meet necessary requirements efficiently and accurately.

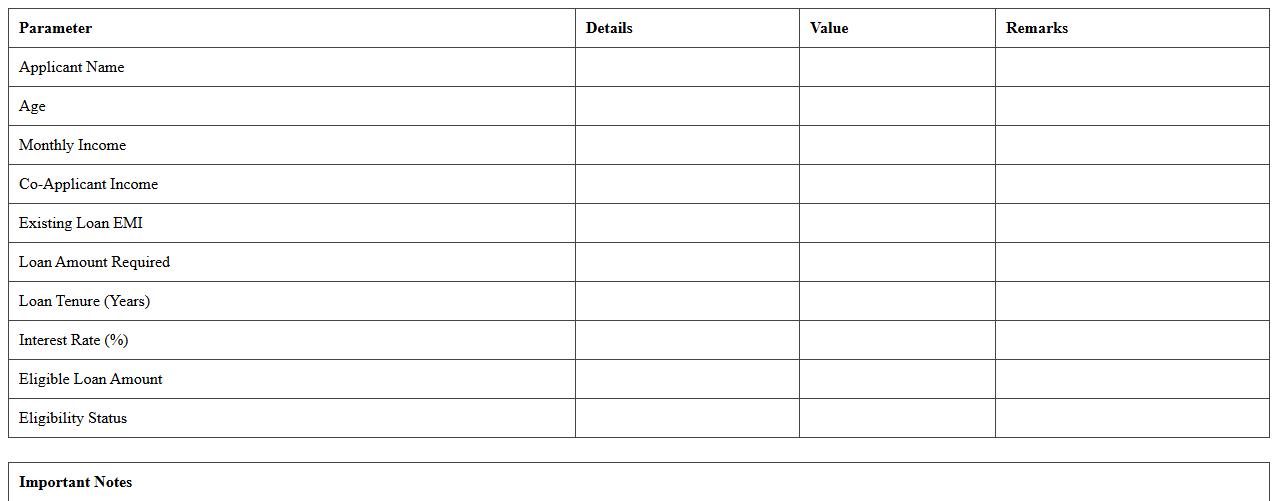

Home Loan Eligibility Evaluation Worksheet

The

Home Loan Eligibility Evaluation Worksheet is a comprehensive document that helps assess a borrower's financial capability to qualify for a home loan based on income, expenses, credit score, and other key factors. It provides a clear, detailed overview of eligibility criteria and assists applicants in understanding their borrowing capacity before applying. This worksheet streamlines the home loan application process by enabling banks and borrowers to make informed decisions efficiently.

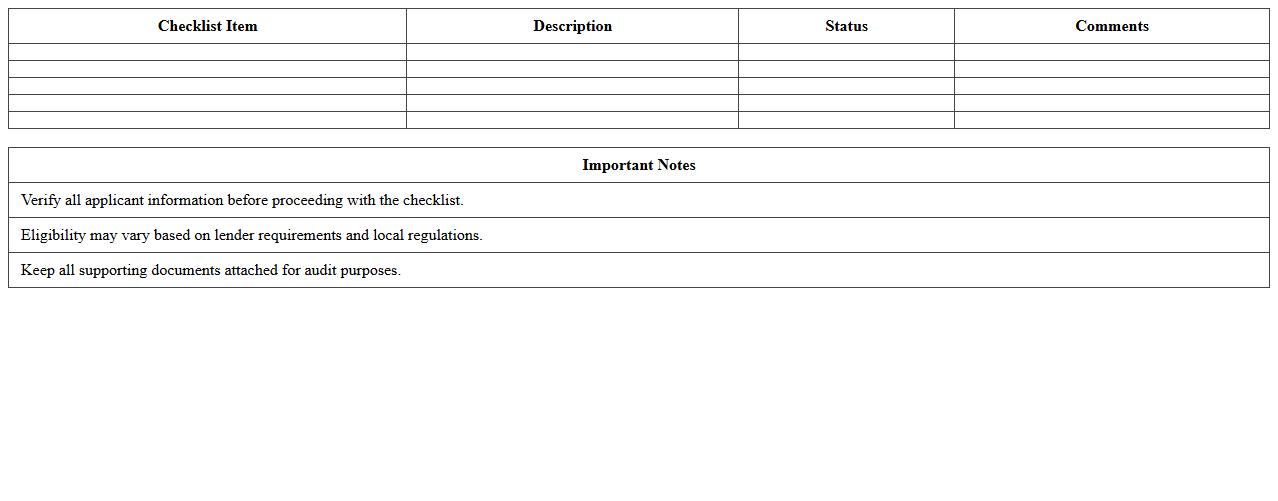

Auto Loan Eligibility Checklist Spreadsheet

An

Auto Loan Eligibility Checklist Spreadsheet is a structured document designed to organize and evaluate all essential criteria for qualifying for an auto loan, including income verification, credit score, employment details, and debt-to-income ratio. This tool simplifies the loan approval process by providing a clear overview of the applicant's financial standing and loan requirements, ensuring no critical detail is overlooked. Using this checklist enhances decision-making efficiency for both borrowers and lenders, helping to streamline loan applications and improve approval chances.

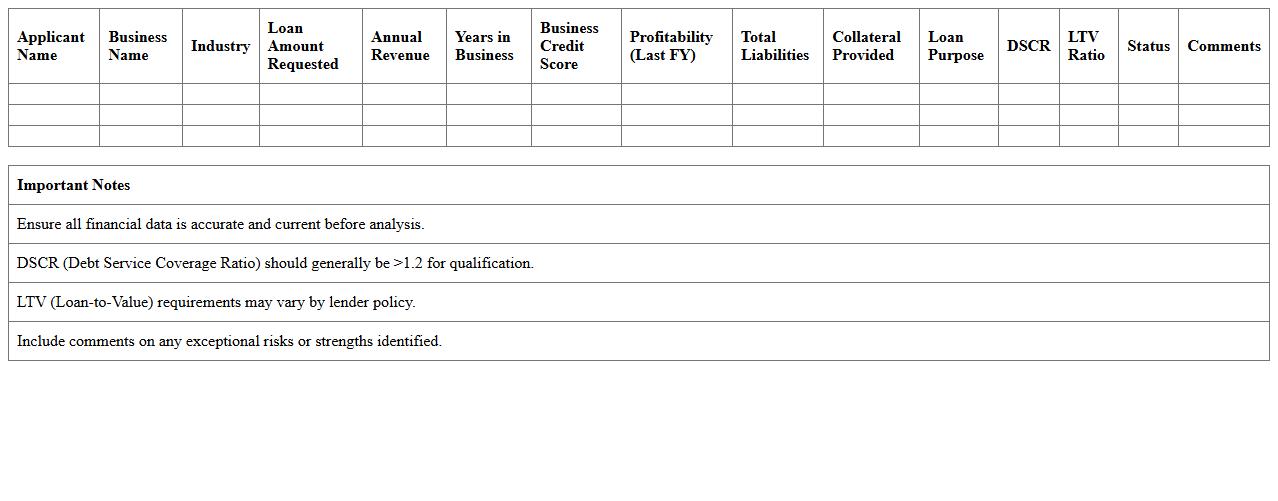

SME Loan Qualification Analysis Excel Template

The

SME Loan Qualification Analysis Excel Template is a structured spreadsheet designed to evaluate the financial health and borrowing capacity of small and medium enterprises. It helps users assess key metrics such as cash flow, debt-to-equity ratio, and profitability to determine loan eligibility with accuracy. This template streamlines the loan qualification process, enabling quicker decision-making and reducing the risk of lending to unqualified businesses.

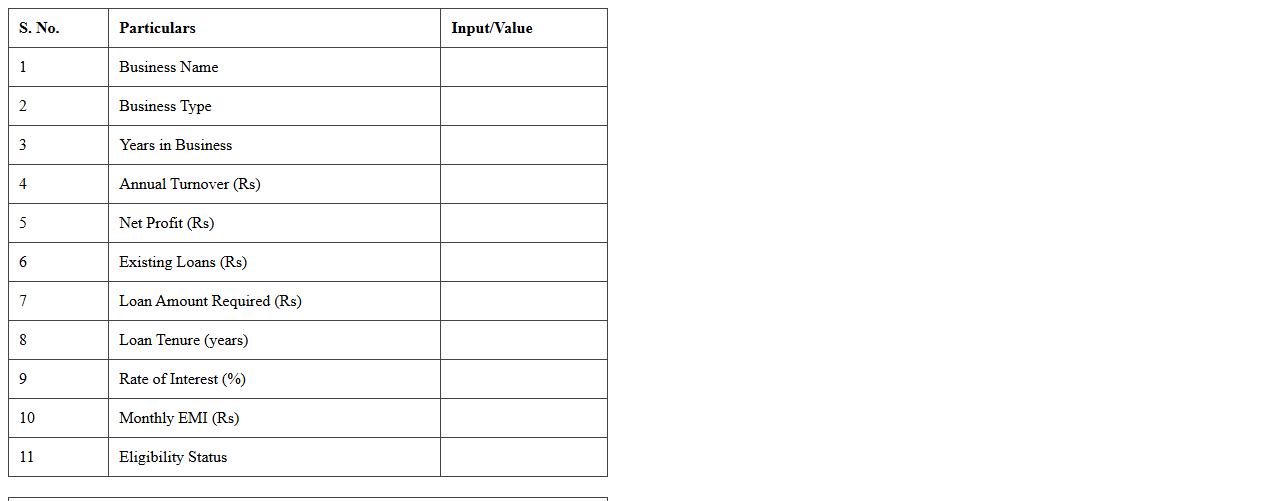

Business Loan Eligibility Calculator Spreadsheet

A

Business Loan Eligibility Calculator Spreadsheet is a digital tool designed to assess your qualification for various business loans by analyzing key financial data such as annual revenue, credit score, and existing debts. This spreadsheet enables entrepreneurs to quickly estimate loan amounts they can qualify for, interest rates, and repayment terms without manual calculations. It helps streamline the loan application process by providing accurate, data-driven insights, improving decision-making for business financing.

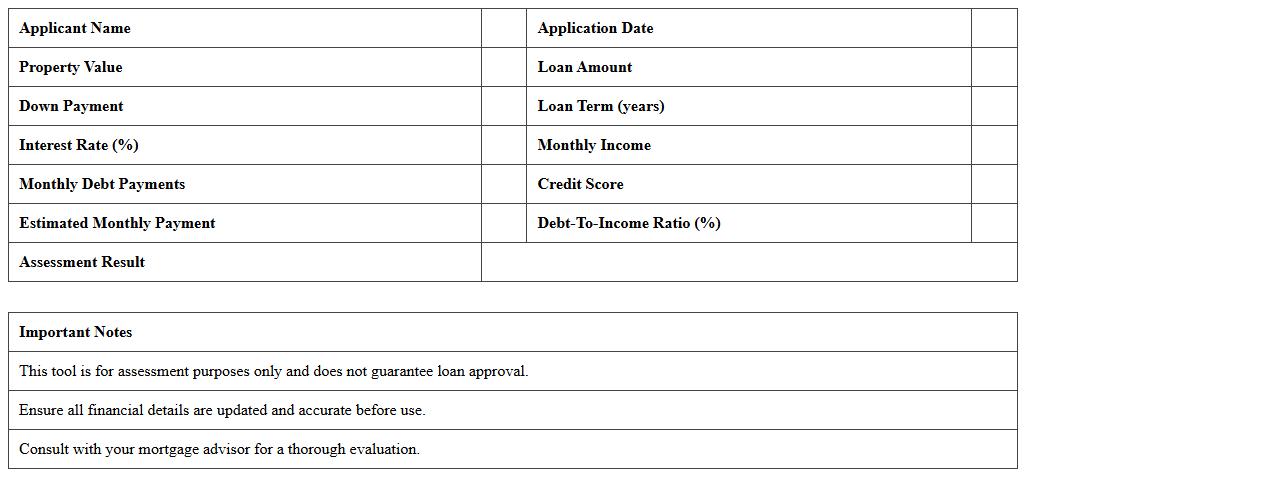

Mortgage Loan Assessment Tool Excel Sheet

The

Mortgage Loan Assessment Tool Excel Sheet document is designed to evaluate the feasibility and affordability of mortgage loans by analyzing income, expenses, interest rates, and loan terms. This tool helps users calculate monthly payments, total interest, and amortization schedules to make informed financial decisions. Utilizing this Excel sheet streamlines the loan qualification process and enhances budgeting accuracy for potential homeowners.

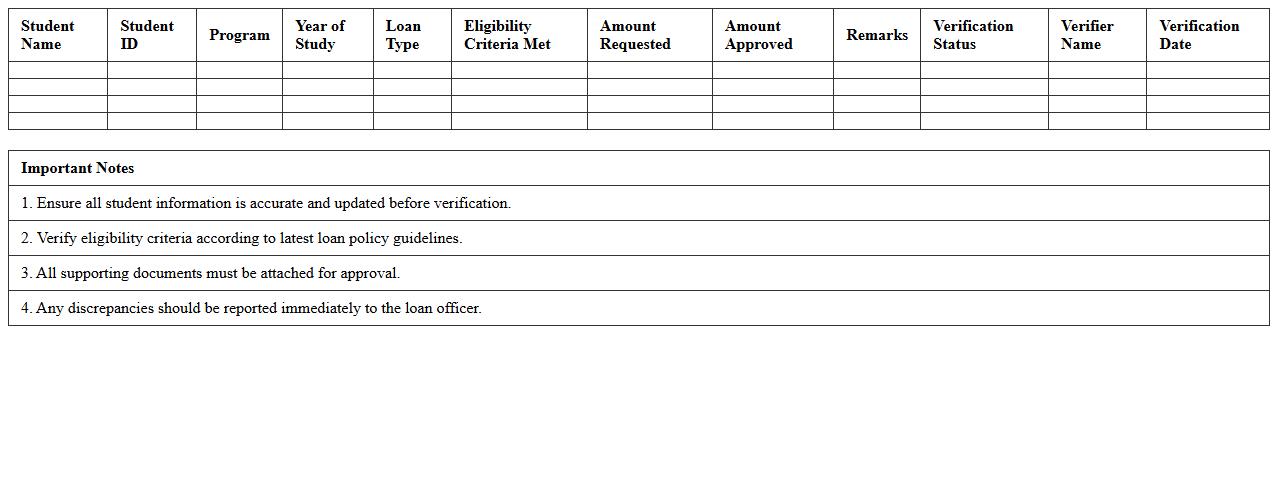

Student Loan Eligibility Verification Template

A

Student Loan Eligibility Verification Template is a structured document used to confirm a borrower's qualification for a student loan by collecting and verifying essential personal, financial, and academic information. This template streamlines the loan approval process by ensuring accuracy and consistency in evaluating eligibility criteria such as enrollment status, income, and creditworthiness. Utilizing this template minimizes errors, expedites decision-making, and helps educational institutions and lenders maintain compliance with regulatory standards.

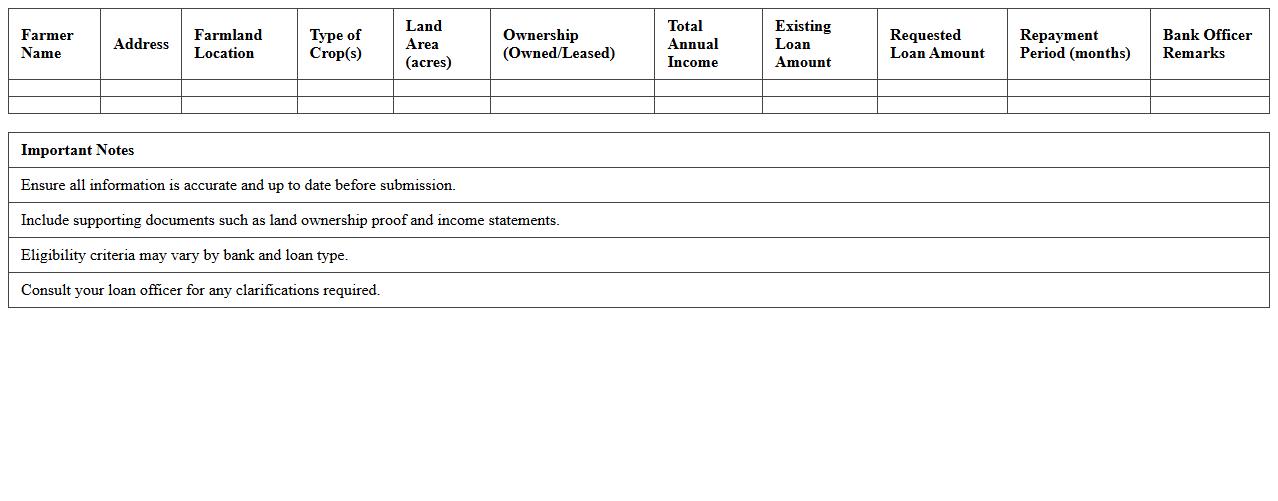

Agriculture Loan Eligibility Worksheet

The

Agriculture Loan Eligibility Worksheet is a crucial document that helps farmers and agricultural businesses assess their qualification for loan approval by detailing income, expenses, assets, and liabilities. This worksheet streamlines the loan application process by providing lenders with a clear financial snapshot, ensuring accurate eligibility evaluation. It aids borrowers in understanding their financial standing, making informed decisions, and preparing necessary documentation to secure agricultural financing efficiently.

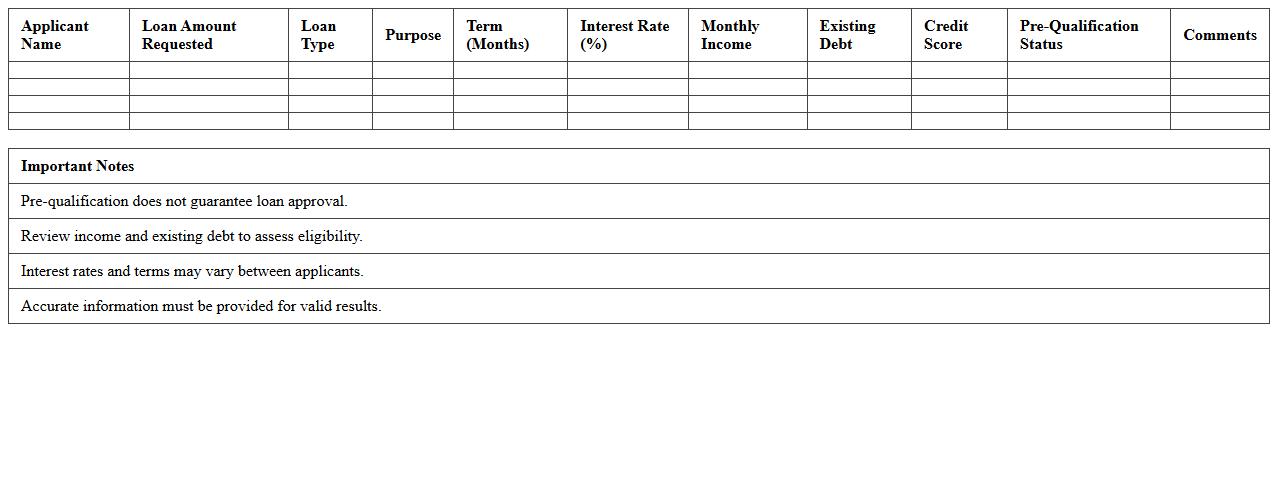

Consumer Loan Pre-qualification Excel Template

A

Consumer Loan Pre-qualification Excel Template document is a structured spreadsheet designed to assess an individual's eligibility for personal loans by calculating key financial metrics such as income, expenses, credit scores, and debt-to-income ratios. This template streamlines the loan pre-qualification process, allowing users to quickly determine their borrowing capacity and improve decision-making before applying to lenders. It is especially useful for consumers and financial advisors seeking a clear, organized method to evaluate loan options and enhance financial planning accuracy.

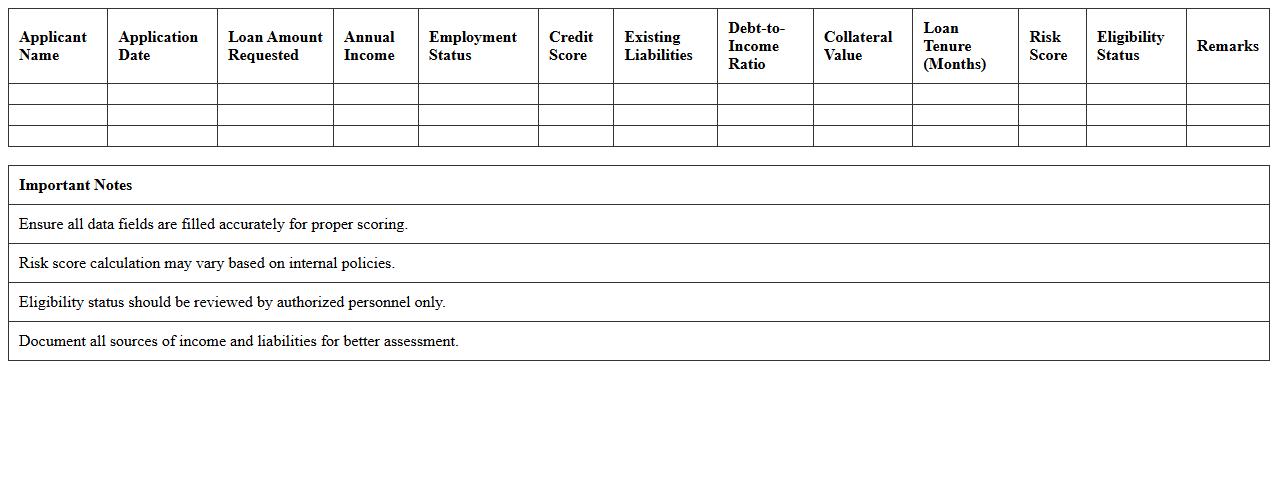

Loan Eligibility Risk Scoring Excel Sheet

A

Loan Eligibility Risk Scoring Excel Sheet document systematically evaluates a borrower's creditworthiness by assigning risk scores based on financial data and repayment history. This tool enables lenders to make informed decisions by quickly identifying high-risk applicants and minimizing default rates. It streamlines the loan approval process, enhances risk management, and supports consistent, data-driven lending practices.

What specific data validation rules are applied to income fields in the loan assessment Excel template?

The income fields in the loan assessment template use data validation rules to ensure only numeric entries are allowed, preventing text or invalid formats. Minimum and maximum thresholds are set, validating the income falls within acceptable ranges based on loan criteria. Additionally, the template restricts input to positive values, ensuring accurate financial data recording for proper assessment.

How does the Excel tool automate DTI (Debt-to-Income) ratio calculations for diverse applicant profiles?

The Excel tool integrates dynamic formulas tailored to individual applicant data to calculate the Debt-to-Income ratio automatically. It extracts total monthly debts and divides them by gross monthly income, adjusting logic for different loan types and applicant categories. This automation ensures consistent DTI computation, improving accuracy in eligibility evaluations.

Which conditional formatting highlights ineligible applicants based on credit score thresholds?

The template applies conditional formatting rules to credit score cells, turning them red when scores fall below the minimum eligibility threshold. This visual cue instantly identifies ineligible applicants by highlighting their scores prominently. The formatting rule is configured to trigger based on predefined credit score cut-off values set by loan policy.

How does the sheet handle variable interest rate scenarios for different loan products?

The worksheet includes flexible input fields for interest rates which update calculations depending on loan product selection. It uses lookup tables and conditional formulas to adjust rates dynamically reflecting variable interest rate scenarios. This ensures that all amortization and repayment schedules remain accurate under changing loan conditions.

What macro functions are used for generating risk-grade summaries within the eligibility document?

The Excel document employs macros that compile risk-grade summaries by aggregating data points such as credit scores, DTI ratios, and income stability. These macros automate the classification logic, producing concise risk categories for each applicant. They enhance operational efficiency by delivering immediate risk assessments upon running the macro.

More Assessment Excel Templates