The Asset Allocation Excel Template for Investment Portfolios offers a streamlined way to diversify investments by categorizing assets into stocks, bonds, and cash. It enables precise tracking and rebalancing of portfolio weights to optimize returns and manage risk effectively. This template simplifies complex data analysis, making it accessible for both novice and experienced investors.

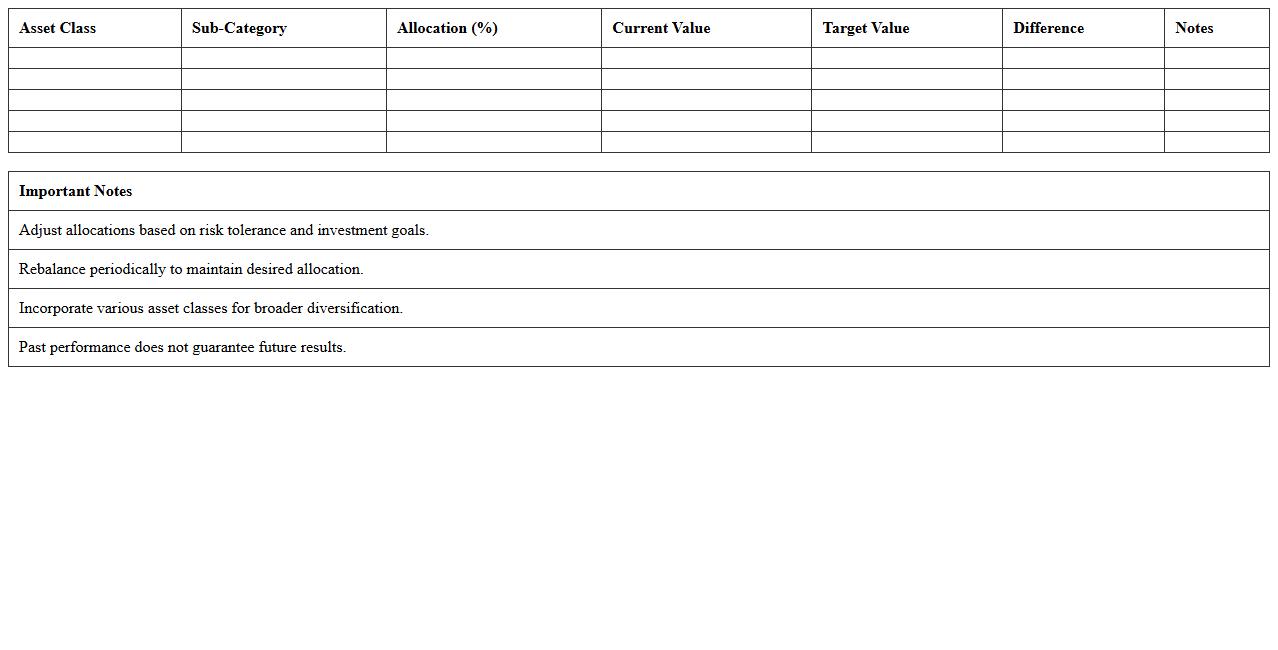

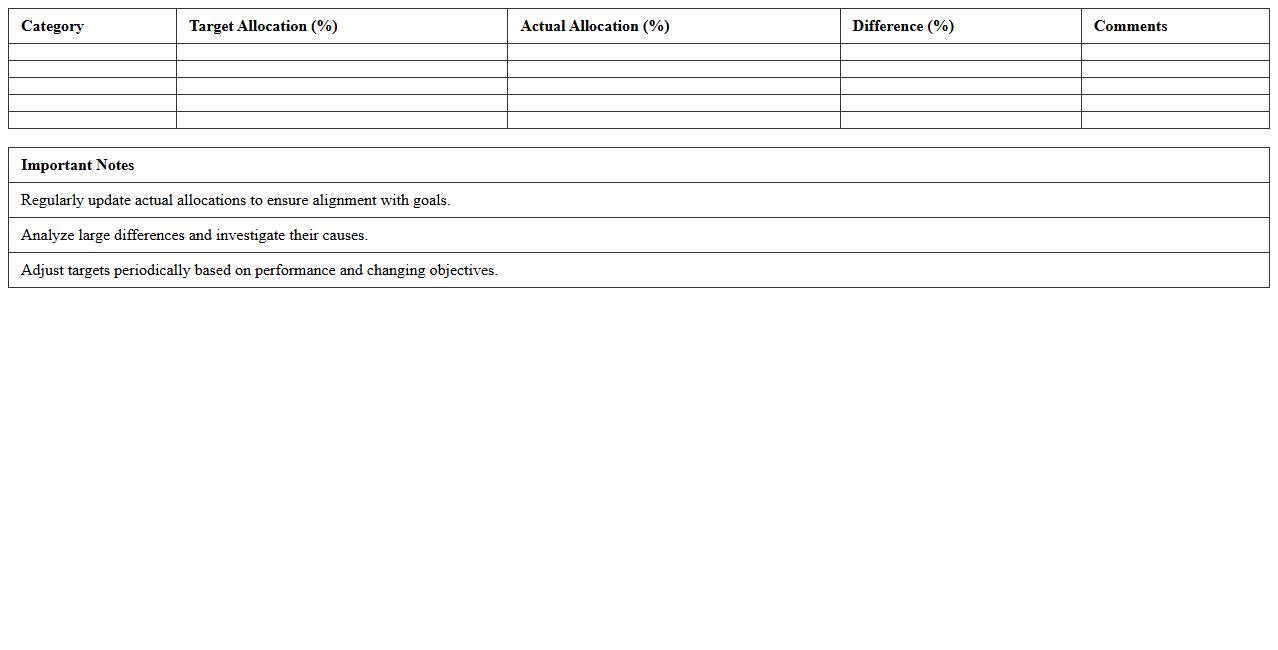

Diversified Asset Allocation Spreadsheet Template

The

Diversified Asset Allocation Spreadsheet Template is a tool designed to help investors distribute their investments across various asset classes such as stocks, bonds, and real estate to minimize risk and optimize returns. This spreadsheet allows for clear visualization of portfolio distribution, making it easier to track and rebalance assets according to individual investment goals and market changes. Using this template enhances financial decision-making by providing detailed insights into asset diversification and portfolio performance.

Investment Portfolio Asset Mix Tracker

An

Investment Portfolio Asset Mix Tracker document systematically records and monitors the distribution of various asset classes within an investment portfolio, such as stocks, bonds, real estate, and cash equivalents. This tracker provides crucial insights into portfolio diversification, risk exposure, and alignment with financial goals by regularly updating asset allocations. Utilizing this tool helps investors make informed decisions, rebalance their portfolio effectively, and optimize returns while managing risk according to their investment strategy.

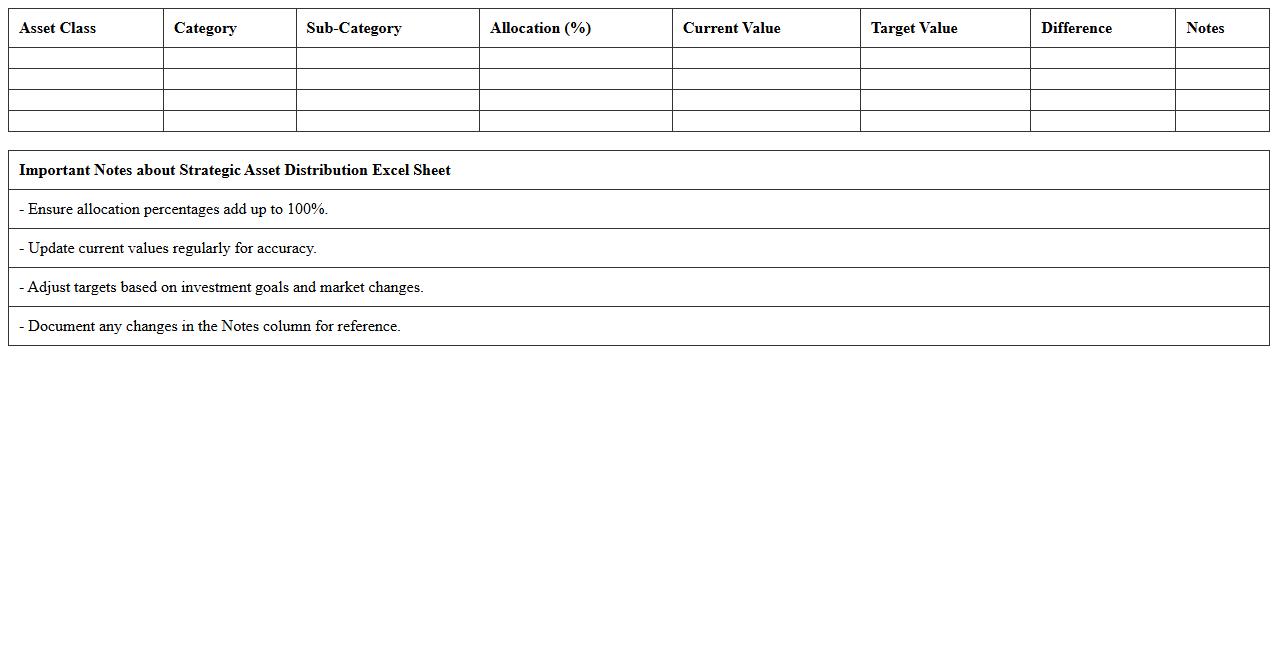

Strategic Asset Distribution Excel Sheet

The

Strategic Asset Distribution Excel Sheet document is a comprehensive tool designed to organize and analyze the allocation of assets across various investment portfolios or business units. It enables users to visualize asset distribution, assess risk exposure, and optimize resource management through customizable charts and formulas. By providing clear data insights, this sheet supports informed decision-making and efficient financial planning in asset management.

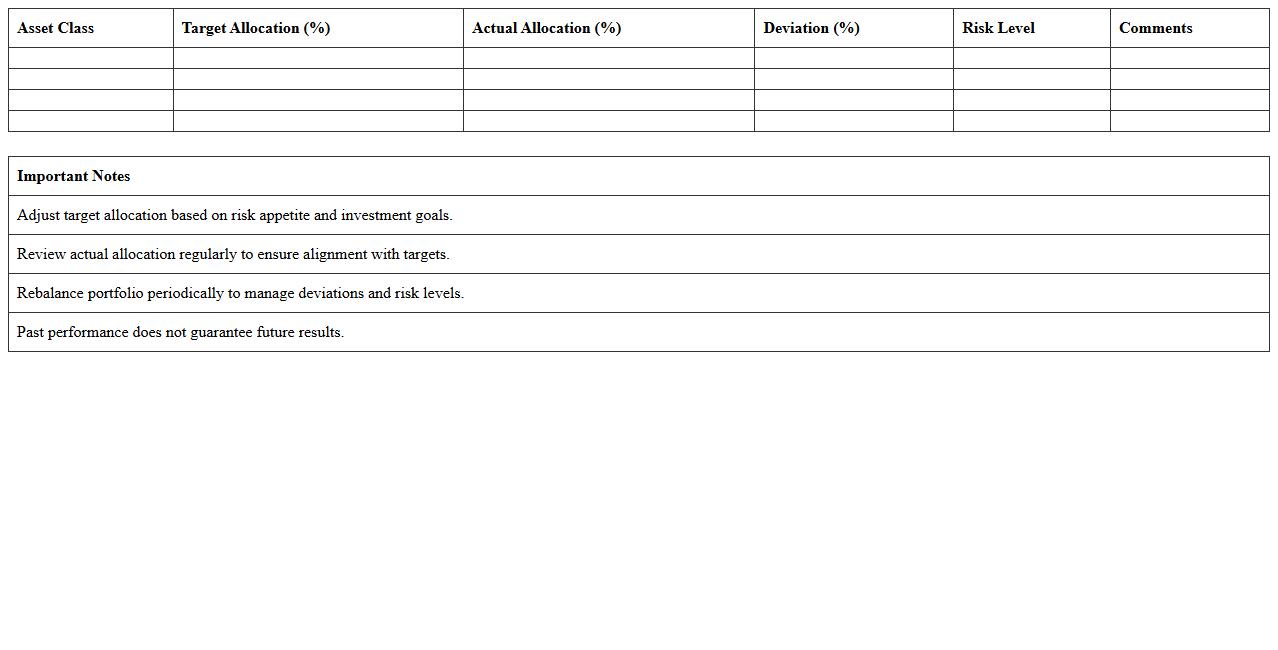

Risk-Based Asset Allocation Planner

A

Risk-Based Asset Allocation Planner is a strategic document that helps investors identify and allocate assets according to their individual risk tolerance and financial goals. By analyzing market volatility, investment horizons, and risk capacity, this planner ensures portfolio diversification and optimized returns while minimizing potential losses. It is useful for making informed investment decisions that align with long-term financial stability and personalized risk management.

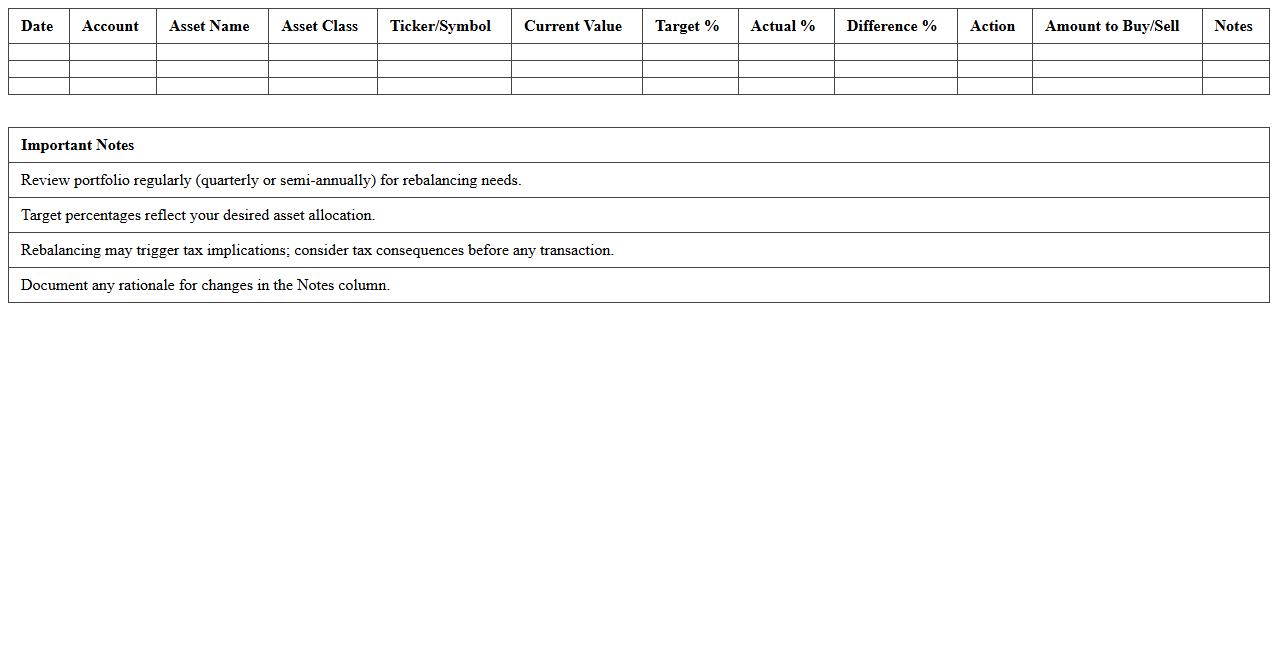

Portfolio Rebalancing Excel Log

A

Portfolio Rebalancing Excel Log document tracks and records adjustments made to an investment portfolio to maintain desired asset allocation. It helps investors monitor the timing and extent of rebalancing activities, ensuring alignment with financial goals and risk tolerance. Using this log enhances decision-making by providing a clear history of changes and their impact on portfolio performance.

Customizable Asset Allocation Model Template

The

Customizable Asset Allocation Model Template document serves as a structured framework for designing investment portfolios based on specific risk tolerance, financial goals, and market conditions. It allows investors and financial advisors to tailor asset distributions across stocks, bonds, and alternative investments to optimize returns while managing risk effectively. Utilizing this template enhances decision-making by providing clear, data-driven insights for dynamic portfolio adjustments and long-term wealth management.

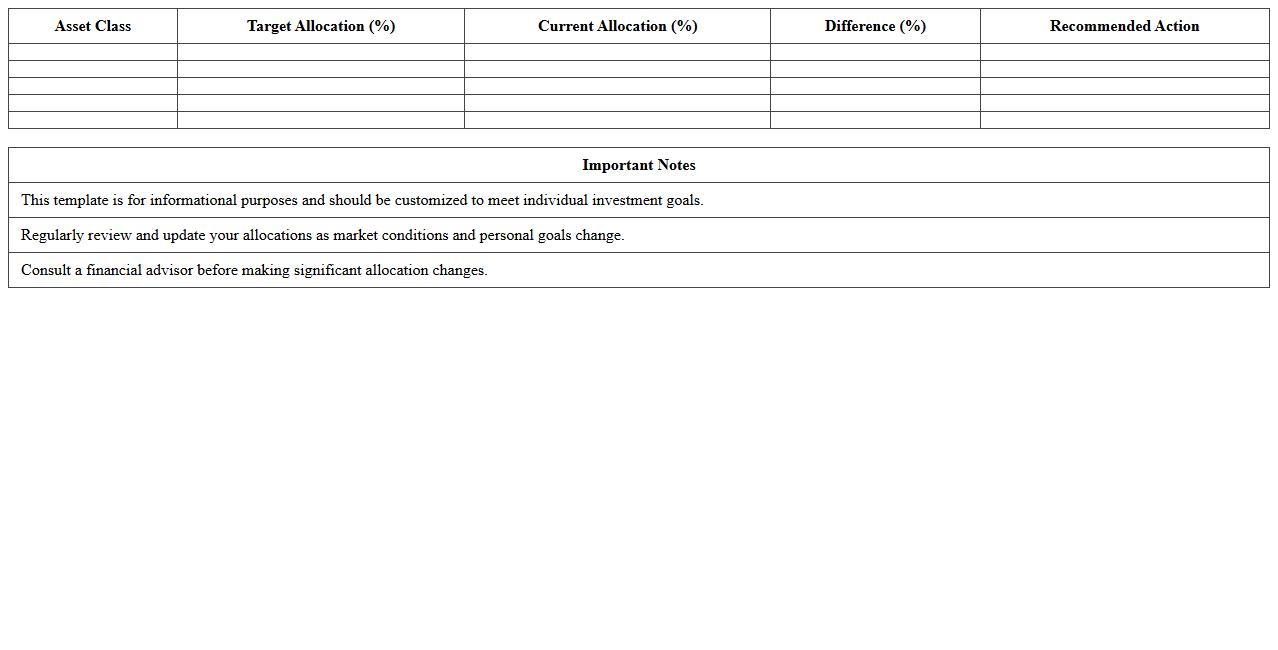

Target vs. Actual Allocation Comparison Sheet

The

Target vs. Actual Allocation Comparison Sheet document provides a detailed analysis of planned resource allocations versus the actual usage across projects or departments. This comparison helps identify discrepancies, optimize resource distribution, and improve budget adherence by highlighting areas of over- or under-allocation. Utilizing this sheet allows organizations to enhance decision-making, ensure efficient resource management, and achieve strategic goals more effectively.

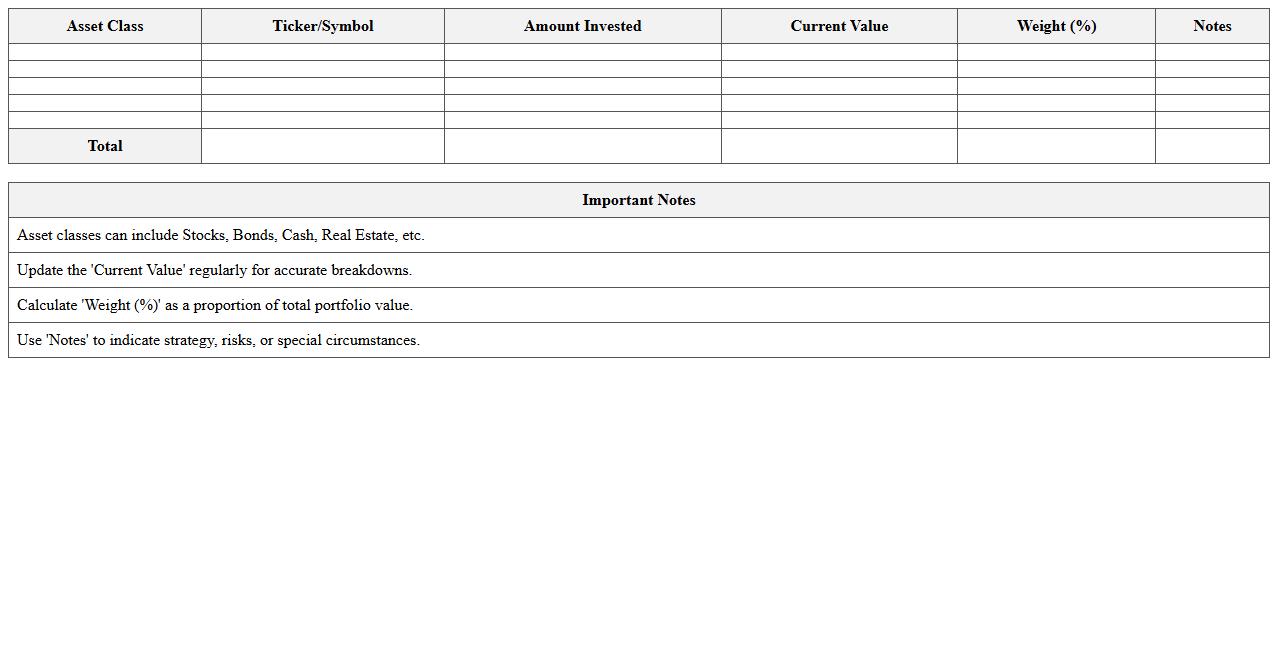

Simple Portfolio Asset Breakdown Template

A

Simple Portfolio Asset Breakdown Template document organizes and categorizes investment assets to provide a clear overview of portfolio allocation. It helps investors track asset distribution across stocks, bonds, real estate, and other categories, ensuring balanced diversification and risk management. This template streamlines portfolio analysis, making it easier to identify underperforming assets and adjust investment strategies effectively.

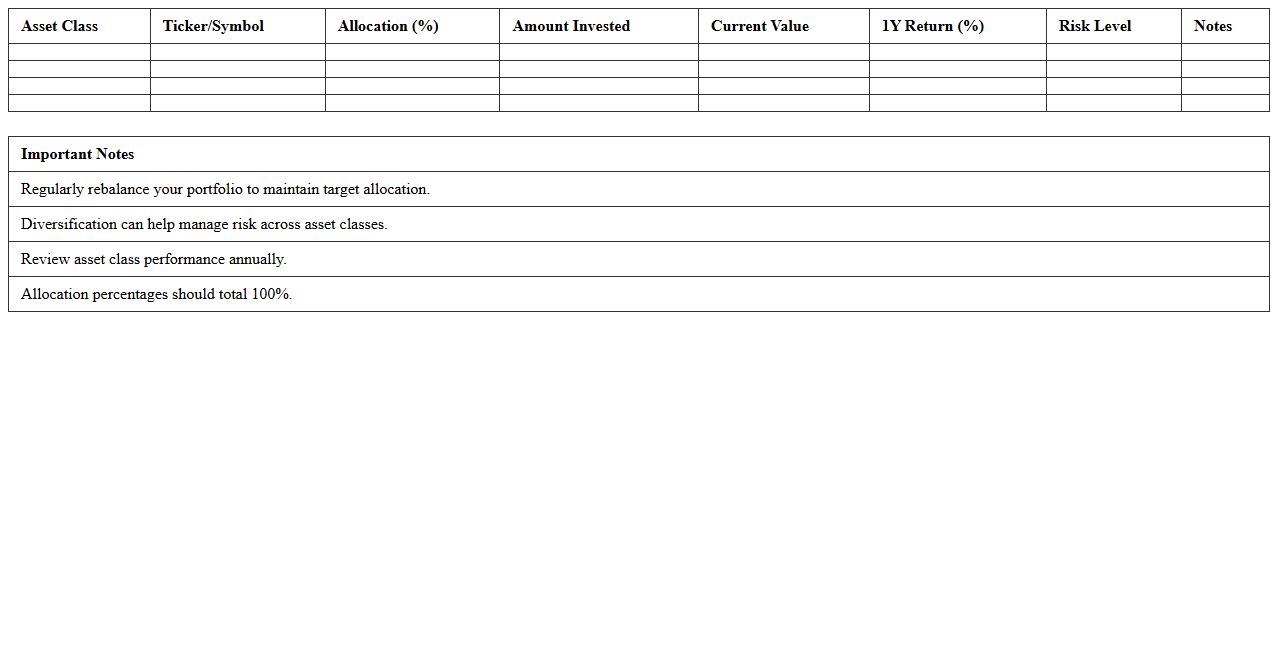

Yearly Asset Allocation Performance Tracker

The

Yearly Asset Allocation Performance Tracker is a financial document that monitors the returns of various asset classes over a specific year, enabling investors to evaluate how their portfolio aligns with their investment goals. This tracker provides detailed insights into the performance of equities, bonds, real estate, and other assets, helping to identify trends and make data-driven decisions. By regularly reviewing this information, investors can optimize their asset allocation strategies to maximize returns and manage risks effectively.

Multi-Asset Portfolio Allocation Dashboard

The

Multi-Asset Portfolio Allocation Dashboard document provides a comprehensive visualization and analysis tool that helps investors monitor and manage diversified investment portfolios across various asset classes. By consolidating data on asset performance, risk metrics, and allocation strategies, it enables informed decision-making to optimize returns while balancing risk exposure. This dashboard is essential for portfolio managers aiming to maintain strategic asset distribution and adapt quickly to market changes.

How can I automate rebalancing triggers in my Asset Allocation Excel template?

Automate rebalancing triggers in Excel by using conditional formulas that compare current weights to target allocations. Implement functions like IF and ABS for percentage deviation checks, triggering alerts when limits exceed defined thresholds. You can also use VBA macros to create dynamic rebalancing notifications and execute adjustments.

What formulas optimize risk-adjusted returns in investment portfolio spreadsheets?

To optimize risk-adjusted returns, use formulas such as the Sharpe Ratio, calculated with expected return, risk-free rate, and portfolio standard deviation functions. Apply Excel's built-in statistical functions like AVERAGE, STDEV.P, and MMULT for covariance matrix calculation. Additionally, Solver can optimize weights to maximize risk-adjusted metrics directly within your spreadsheet.

How do I track multi-currency asset classes in an Excel allocation model?

Track multi-currency asset classes by incorporating live exchange rates using Excel's WEBSERVICE or Power Query functions to fetch current FX rates. Normalize all asset values to a base currency for consistent comparison and total portfolio valuation. Use dynamic formulas to adjust asset weights and returns based on updated currency conversion factors automatically.

What Excel functions best visualize sector versus asset class diversification?

Visualize sector versus asset class diversification with pivot tables and charts, such as pie charts or stacked bar graphs for intuitive data grouping. Utilize the GETPIVOTDATA function to extract and summarize diversification metrics efficiently. Conditional formatting can enhance visual cues by highlighting allocation imbalances across sectors and assets.

How do I incorporate tax implications in asset allocation Excel documents?

Incorporate tax implications by calculating after-tax returns using formulas that account for capital gains, dividends, and interest income tax rates. Use nested IF statements and custom scenarios to model different tax treatments per asset class. Integrate tax impact modeling into overall portfolio performance for comprehensive allocation decision-making.

More Allocation Excel Templates