The Financial Statement Summary Excel Template for Startups provides a streamlined way to organize and analyze key financial data such as income statements, balance sheets, and cash flow reports. It offers customizable fields to track expenses, revenues, and profitability, helping new businesses maintain clear financial visibility. This template is essential for startups aiming to make informed decisions and attract investors with accurate financial documentation.

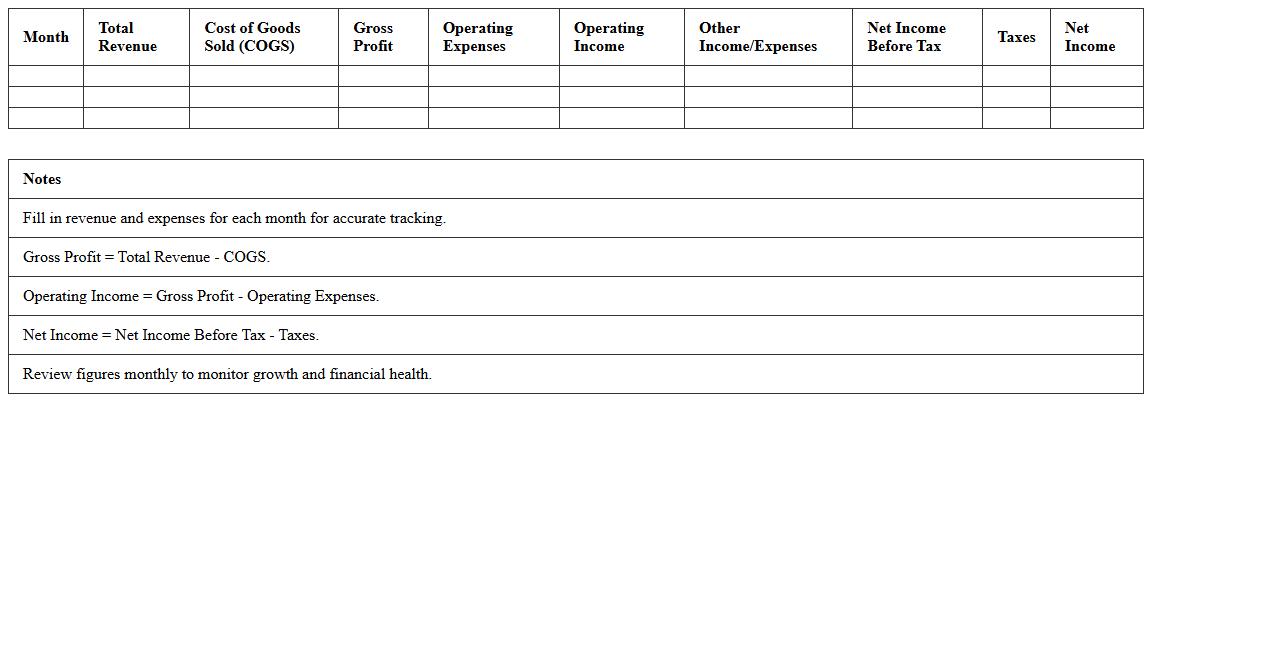

Monthly Income Statement Summary Excel Sheet for Startups

The

Monthly Income Statement Summary Excel Sheet for startups is a financial document designed to track and summarize a company's revenues, expenses, and net profit on a monthly basis. This tool helps startups monitor their financial health, identify trends in income and expenditures, and make informed budgeting decisions. By offering clear insights into the company's profitability, it supports effective cash flow management and strategic planning.

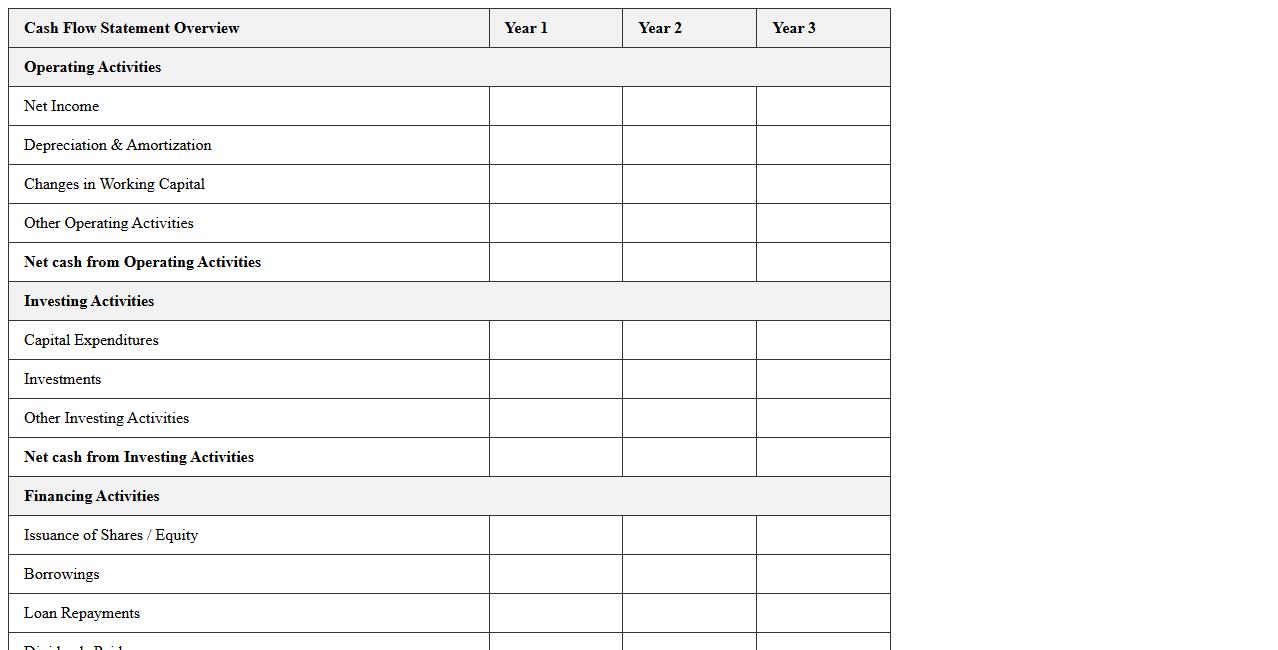

Cash Flow Statement Overview Template for Startup Founders

The

Cash Flow Statement Overview Template for startup founders is a structured document that tracks and summarizes the inflows and outflows of cash within a new business. It helps founders monitor liquidity, plan for future expenses, and ensure the company remains financially solvent during critical growth phases. This template provides clarity on operational, investing, and financing activities, enabling informed decision-making and investor communication.

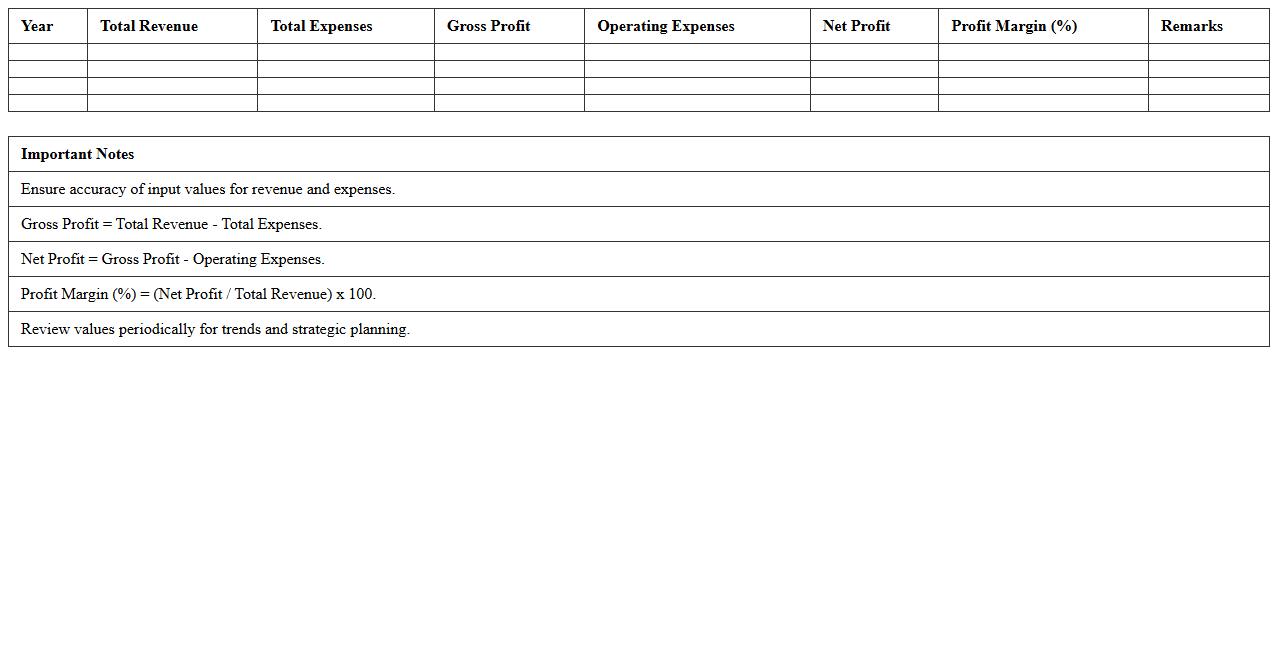

Yearly Financial Performance Summary Excel Template

The

Yearly Financial Performance Summary Excel Template document consolidates annual financial data, providing a clear overview of key metrics such as revenue, expenses, profits, and cash flow. This template helps businesses track financial trends, compare performance year over year, and make informed budgeting and investment decisions. Utilizing this tool enhances accuracy in reporting and streamlines financial analysis, saving time while supporting strategic planning.

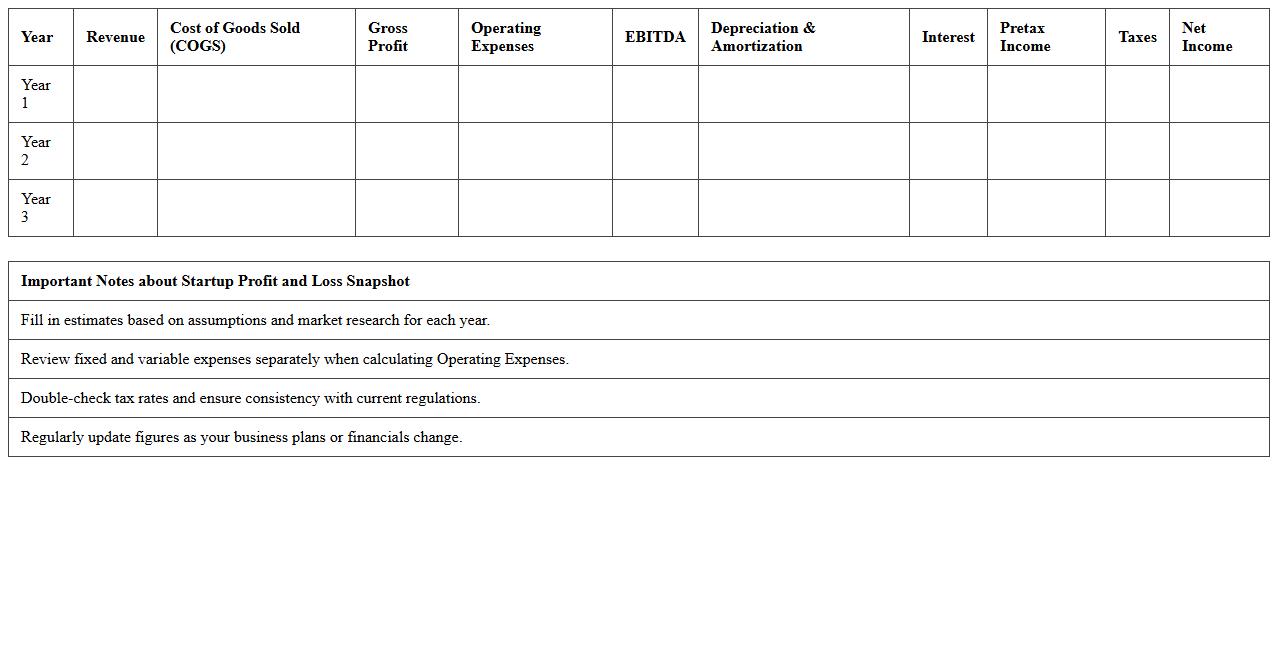

Startup Profit and Loss Snapshot Excel Document

The

Startup Profit and Loss Snapshot Excel Document is a financial tool designed to provide a clear overview of a startup's revenues, expenses, and net profit over a specific period. It helps entrepreneurs monitor cash flow, identify cost trends, and make informed decisions to improve profitability. Using this document enables startups to maintain accurate financial records, track budget adherence, and attract investors with transparent financial reporting.

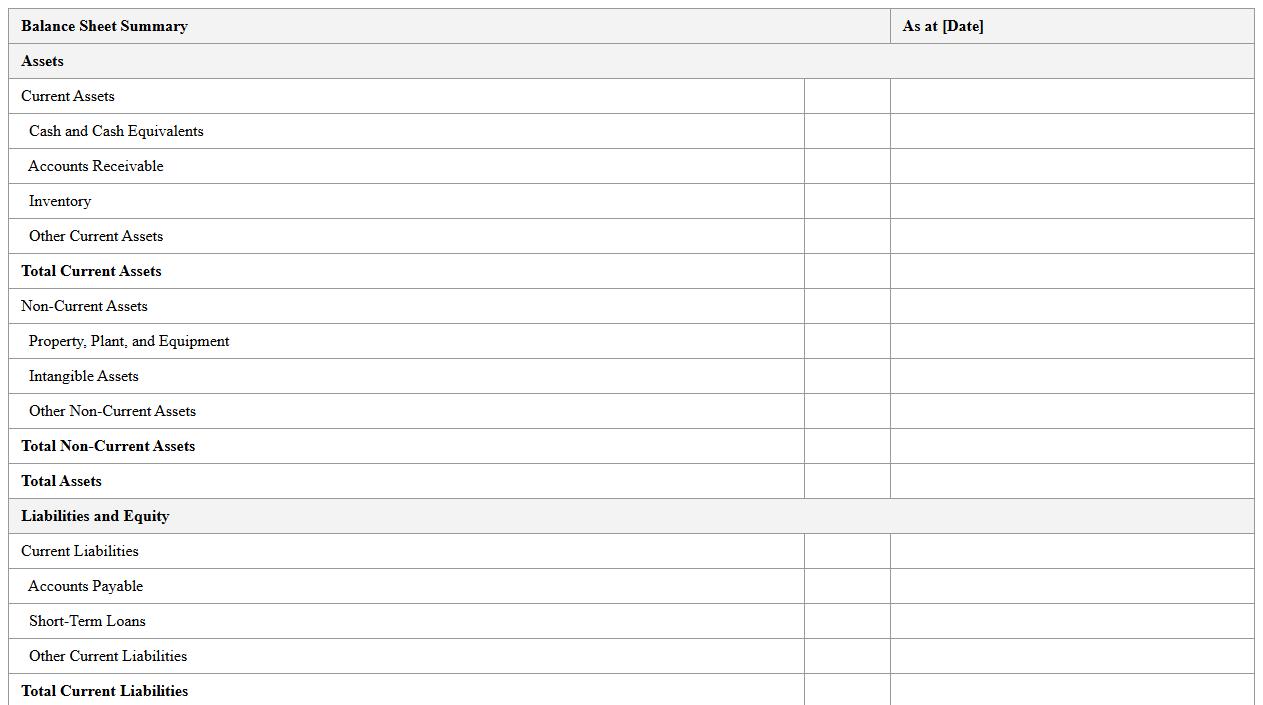

Balance Sheet Summary Excel Format for Startups

The

Balance Sheet Summary Excel Format for Startups is a structured financial template designed to consolidate key assets, liabilities, and equity data, providing a clear snapshot of a startup's financial position. This document enables entrepreneurs and investors to quickly assess the company's financial health and make informed decisions based on accurate, organized information. By using this format, startups can streamline their financial reporting processes and enhance transparency in funding discussions.

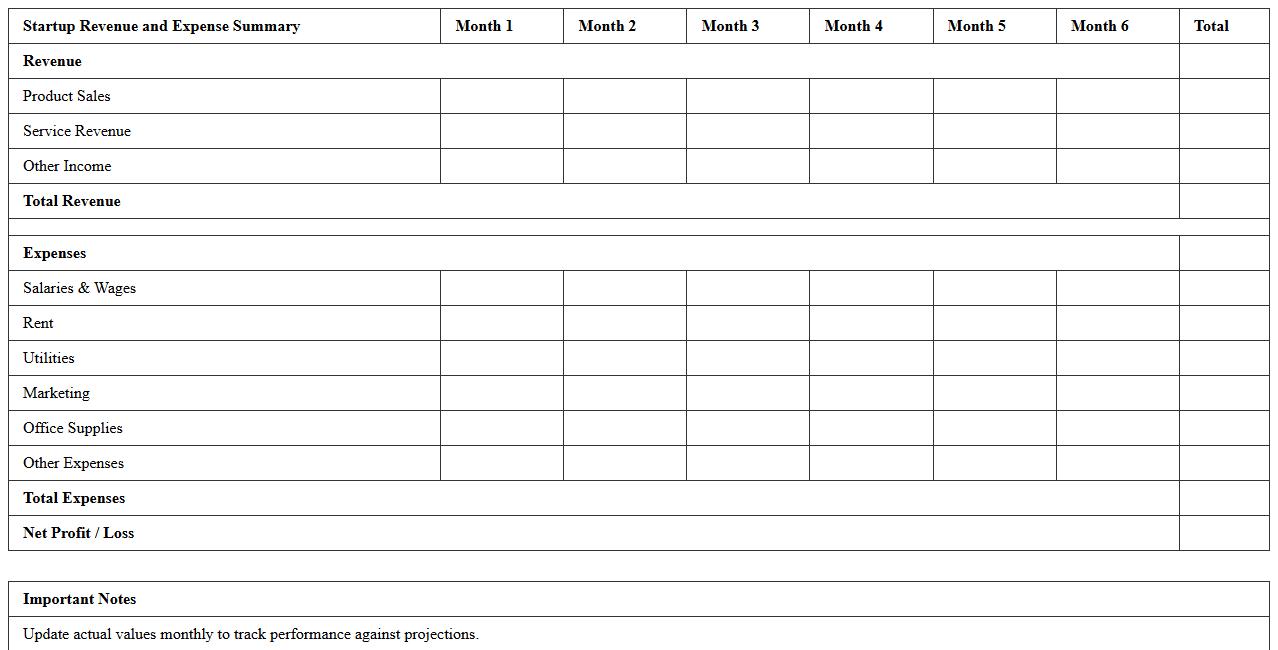

Startup Revenue and Expense Summary Spreadsheet

A

Startup Revenue and Expense Summary Spreadsheet document is a financial tool designed to track and organize all income and outgoing costs associated with a startup business. It helps entrepreneurs monitor cash flow, identify spending patterns, and make informed budgeting decisions to maintain financial health. By providing a clear snapshot of revenues and expenses, this spreadsheet facilitates better financial planning and aids in securing investments or loans.

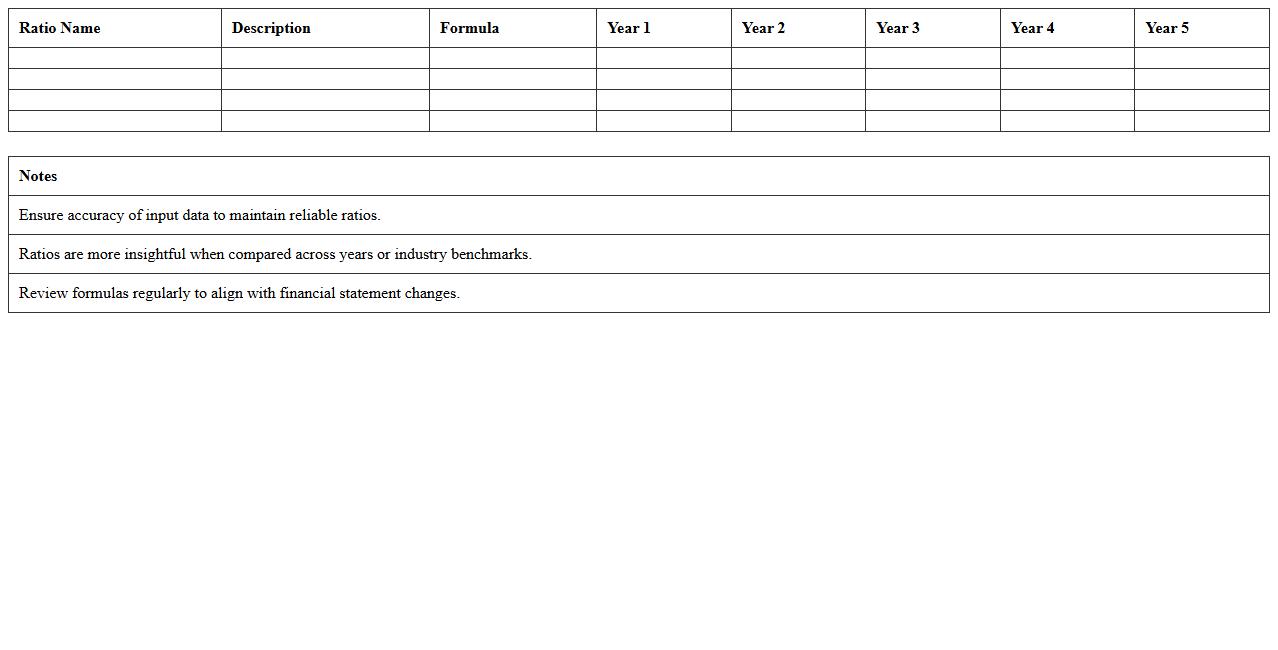

Key Financial Ratios Summary Excel Worksheet for Startups

The

Key Financial Ratios Summary Excel Worksheet for startups is a comprehensive tool designed to track and analyze essential financial metrics such as liquidity, profitability, and solvency ratios. This document helps entrepreneurs and investors quickly assess the financial health and performance of a startup, enabling data-driven decision-making. By consolidating ratios like the current ratio, gross margin, and debt-to-equity ratio in one place, it provides a clear overview for budgeting, forecasting, and attracting investment.

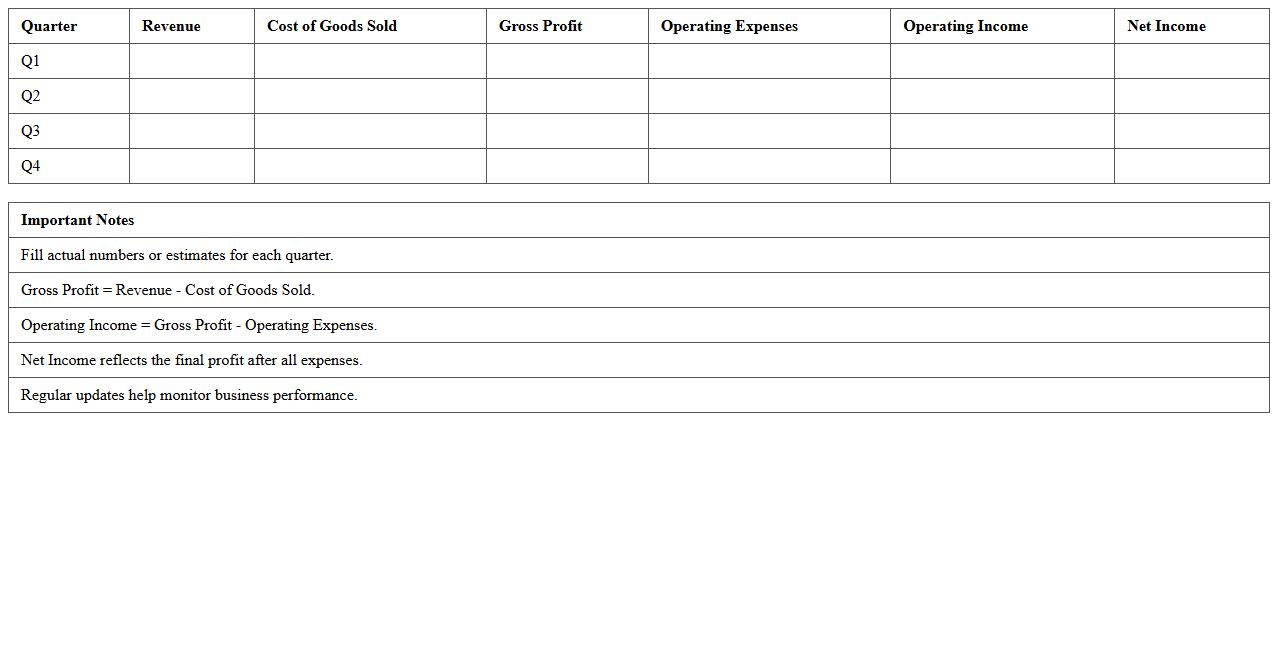

Quarterly Financial Statement Summary Template for New Businesses

A

Quarterly Financial Statement Summary Template for New Businesses is a structured document designed to consolidate key financial data such as income, expenses, profits, and cash flow for a three-month period. It enables new business owners to track financial performance, monitor budget adherence, and identify trends or discrepancies early. Utilizing this template supports informed decision-making and helps maintain financial transparency with stakeholders.

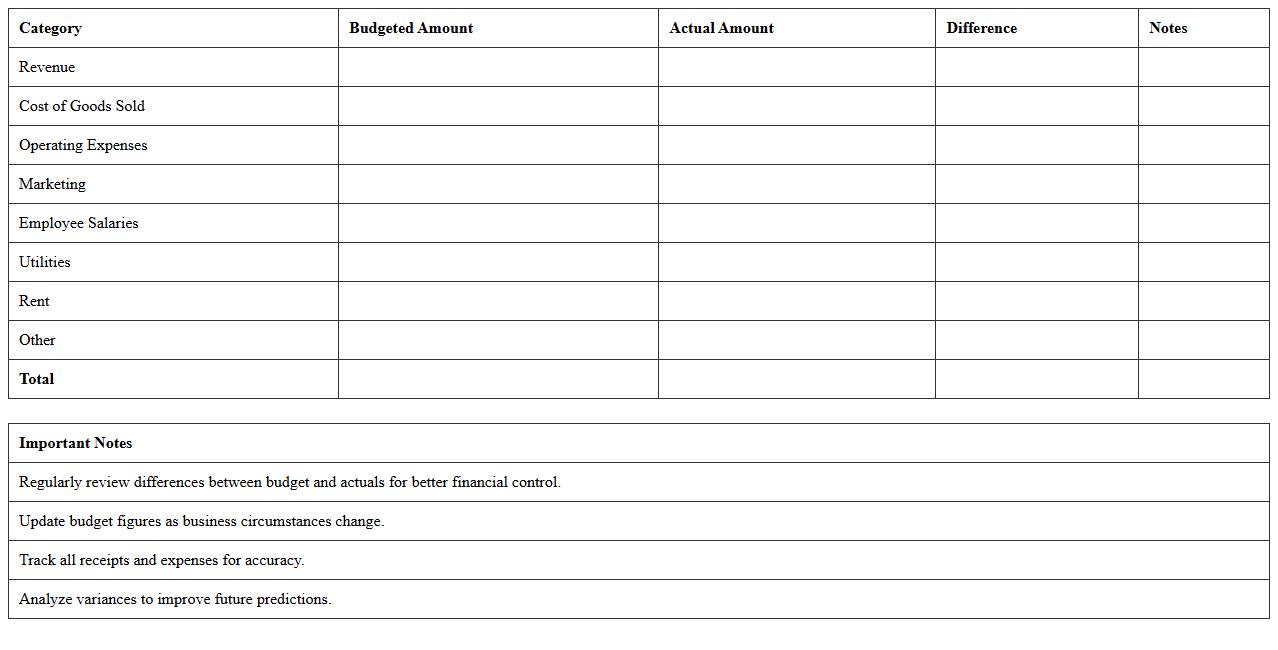

Startup Budget vs Actual Summary Excel Sheet

A

Startup Budget vs Actual Summary Excel Sheet document tracks projected financial plans against real expenses and revenues, enabling precise monitoring of a startup's fiscal health. By highlighting variances between budgeted and actual figures, this tool aids in identifying cost overruns or savings early, facilitating informed decision-making. Entrepreneurs and financial managers use it to streamline cash flow management, ensure accountability, and adjust strategies to maintain profitability and operational efficiency.

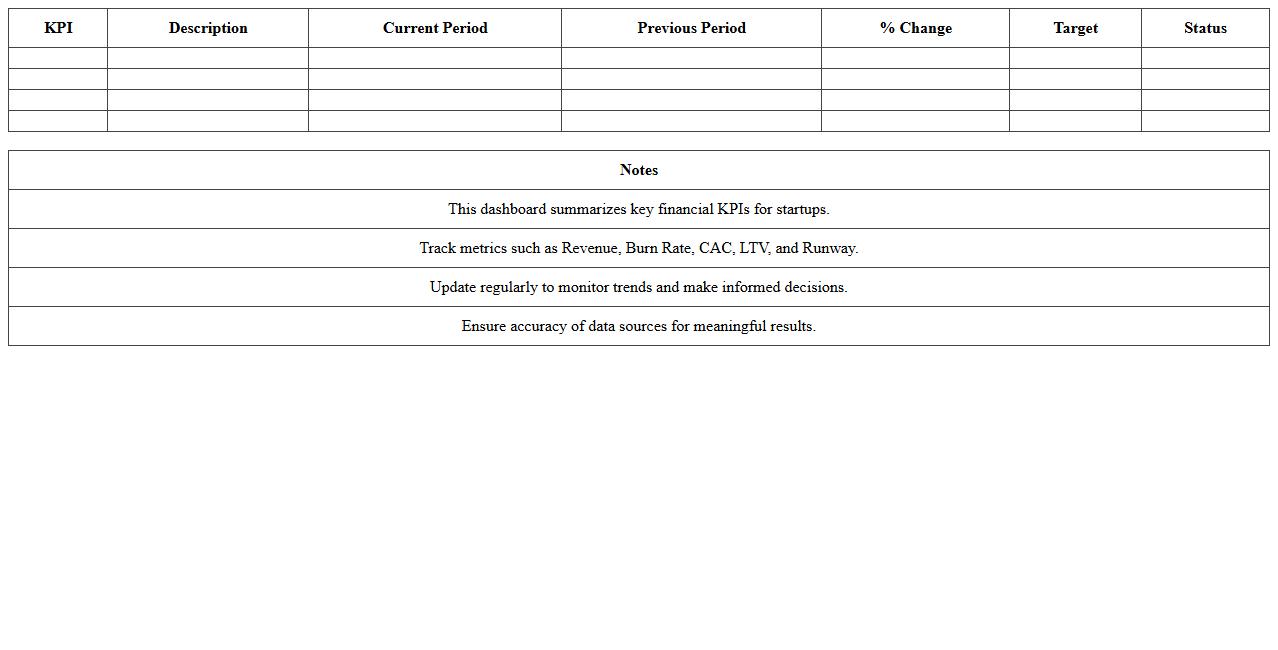

Startup Financial KPIs Dashboard Summary Excel Template

The

Startup Financial KPIs Dashboard Summary Excel Template is a powerful tool designed to track and visualize critical financial metrics such as cash flow, burn rate, revenue growth, and profit margins. It provides entrepreneurs and investors with a clear overview of a startup's financial health, enabling faster decision-making and strategic planning. By consolidating key performance indicators into an easy-to-read format, this template enhances financial management and supports sustainable business growth.

What are key Excel formulas for dynamic financial statement summaries in startup models?

To create dynamic financial statement summaries, SUMIFS and INDEX-MATCH formulas are essential for accurate data aggregation and retrieval based on multiple criteria. The OFFSET function allows flexibility in referencing ranges dynamically as the model grows. Additionally, using IFERROR ensures the model remains robust by managing potential formula errors effectively.

How do I automate cash flow projections using pivot tables in a startup financial summary?

Pivot tables can automate cash flow projections by summarizing transactional data across time periods and categories instantly. Using slicers and filters in pivot tables enables quick adjustments to assumptions, reflecting real-time changes in cash flow forecasts. Furthermore, incorporating calculated fields within pivot tables allows for dynamic cash flow metric computations, enhancing the overall model's responsiveness.

Which Excel templates best visualize equity splits in early-stage startup financials?

Excel templates with waterfall charts effectively visualize equity splits by illustrating ownership dilution and capital contributions clearly. Cap table templates featuring interactive dropdowns allow stakeholders to model different financing scenarios dynamically. Additionally, stacked bar charts are widely used for portraying percentage ownership changes over multiple funding rounds with ease.

How can scenario analysis be integrated into a financial statement summary for SaaS startups?

Scenario analysis in SaaS financial summaries is best implemented through data tables linked to key assumptions like churn rate and customer acquisition costs. Using named ranges for input variables ensures clear separation between assumptions and calculations, facilitating multiple scenario runs. Conditional formatting highlights variance across scenarios, making it easier to compare potential outcomes visually.

What are Excel best practices for consolidating multi-period financial statements for investor decks?

When consolidating multi-period financial statements, using consistent naming conventions for sheets and data ranges enhances clarity and reduces errors. Employing dynamic formulas such as INDIRECT helps reference different periods seamlessly within the same workbook. Lastly, linking summarized data to dashboards ensures investor decks update automatically, presenting cohesive and professional insights.

More Summary Excel Templates