The Expense Record Excel Template for Small Businesses provides a simple and efficient way to track daily expenses, categorize costs, and monitor financial health. This customizable template helps small business owners maintain organized records, ensuring accurate budgeting and better cash flow management. With built-in formulas and clear layouts, it streamlines expense reporting and supports informed financial decisions.

Monthly Expense Tracker Excel Template for Small Businesses

The

Monthly Expense Tracker Excel Template for Small Businesses is a structured spreadsheet designed to help entrepreneurs monitor and categorize their monthly expenditures efficiently. This document enables small business owners to maintain accurate financial records, identify spending patterns, and manage budgets effectively. By consolidating expenses in one easy-to-use format, it supports better financial decision-making and ensures improved cash flow management.

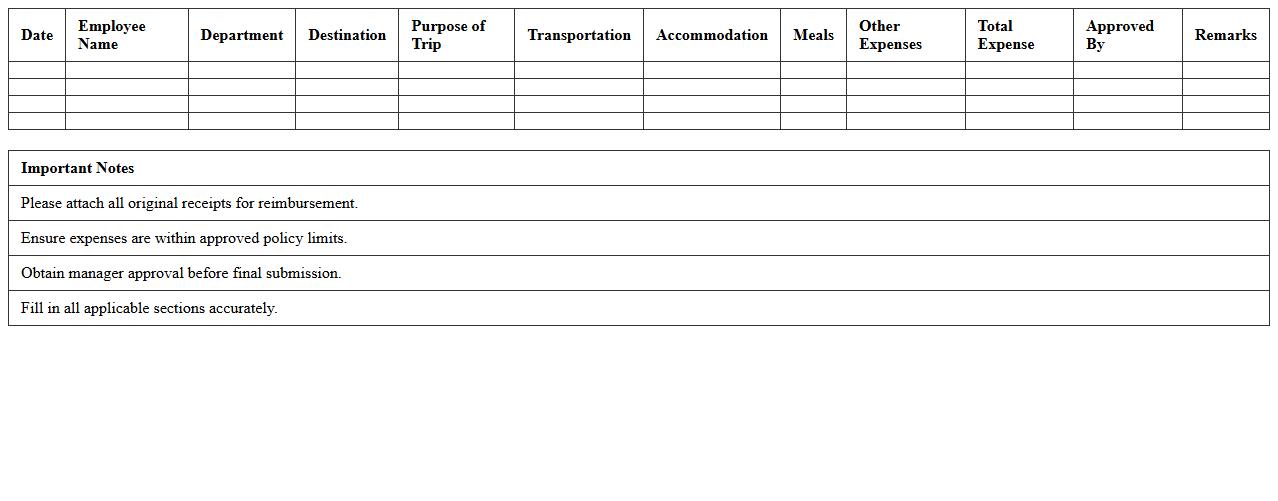

Business Travel Expenses Log Excel Sheet

A

Business Travel Expenses Log Excel Sheet document is a structured tool designed to record and track all costs incurred during business trips. It helps organize expenses such as transportation, accommodation, meals, and incidentals, allowing for accurate budgeting and reimbursement claims. Using this log enhances financial accountability, simplifies expense reporting, and improves overall travel cost management for businesses.

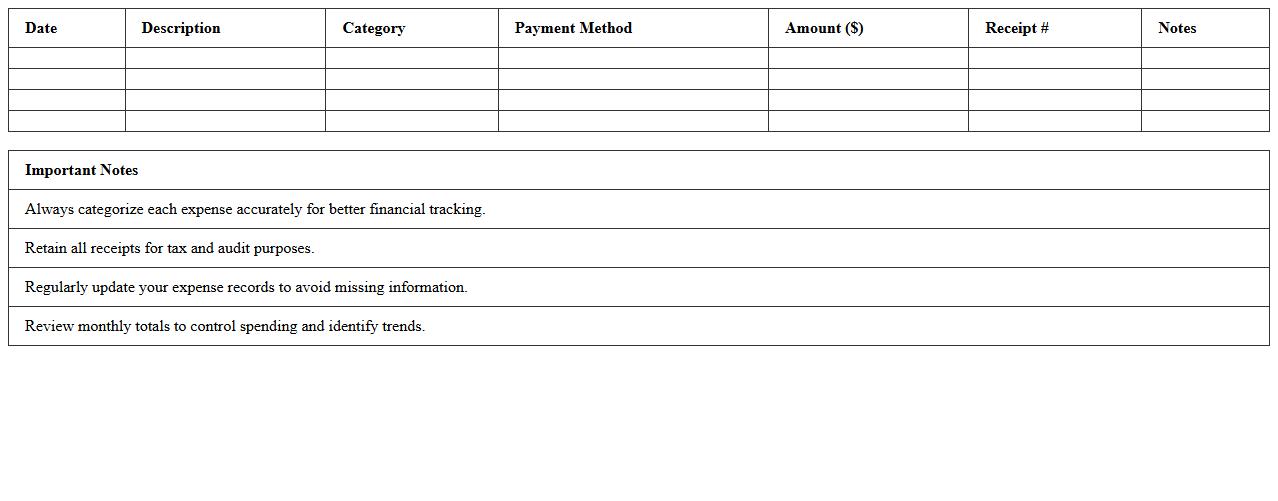

Small Business Daily Expense Record Spreadsheet

A

Small Business Daily Expense Record Spreadsheet is a tool that systematically tracks all daily expenditures of a business, helping owners monitor cash flow and manage budgets effectively. It categorizes expenses such as supplies, utilities, and payroll to provide clear financial insights and ensure accurate record-keeping for tax purposes. This spreadsheet enhances decision-making by offering real-time data on spending patterns, enabling businesses to control costs and improve profitability.

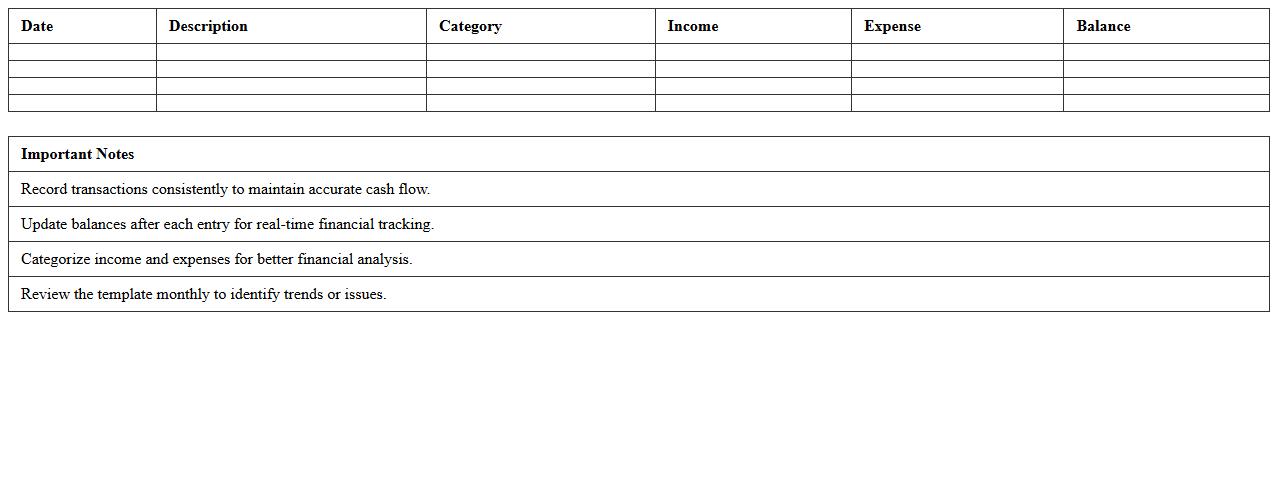

Simple Cash Flow Management Excel Template

The

Simple Cash Flow Management Excel Template is a practical tool designed to track and analyze cash inflows and outflows systematically. It helps users maintain accurate financial records, identify spending patterns, and forecast future cash availability to ensure effective budgeting and financial planning. Businesses and individuals benefit from enhanced liquidity management, reducing the risk of cash shortages and improving decision-making processes.

Vendor Payment Tracking Excel Template for Businesses

A Vendor Payment Tracking Excel Template is a

structured spreadsheet tool designed to monitor and record payments made to suppliers, ensuring timely settlements and preventing overdue invoices. It helps businesses maintain organized financial records, improve cash flow management, and enhance vendor relationships by providing clear insights into payment schedules and outstanding balances. Utilizing this template streamlines accounts payable processes and reduces the risk of errors in financial tracking.

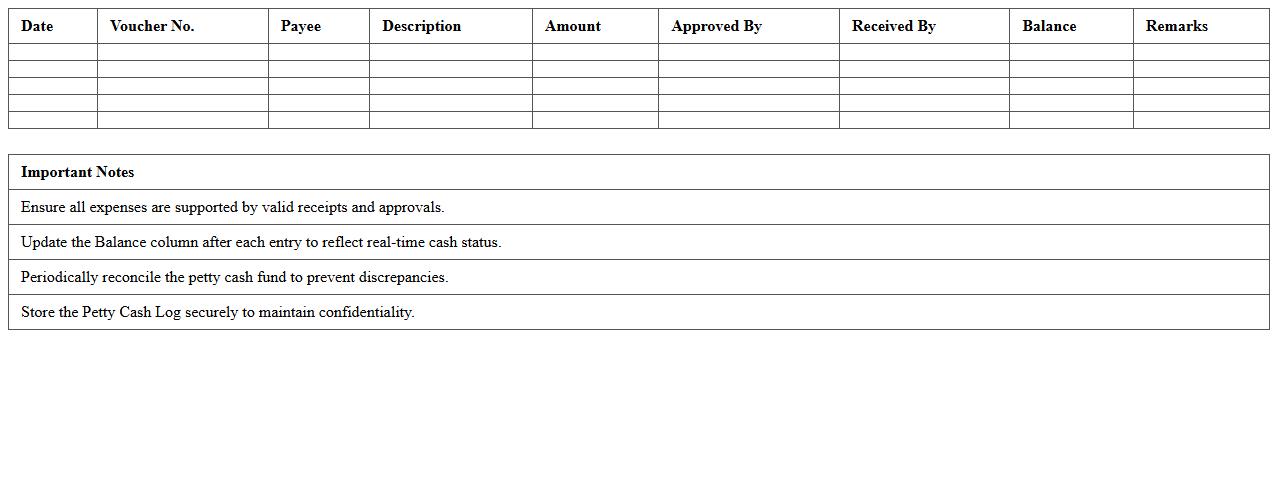

Petty Cash Expense Log Excel Sheet

A

Petty Cash Expense Log Excel Sheet is a structured document designed to track small, everyday business expenses efficiently. It helps maintain accurate records of minor cash transactions, ensuring transparency and accountability in financial management. Using this tool simplifies expense reconciliation, reduces errors, and supports effective budgeting by providing clear, organized data for review.

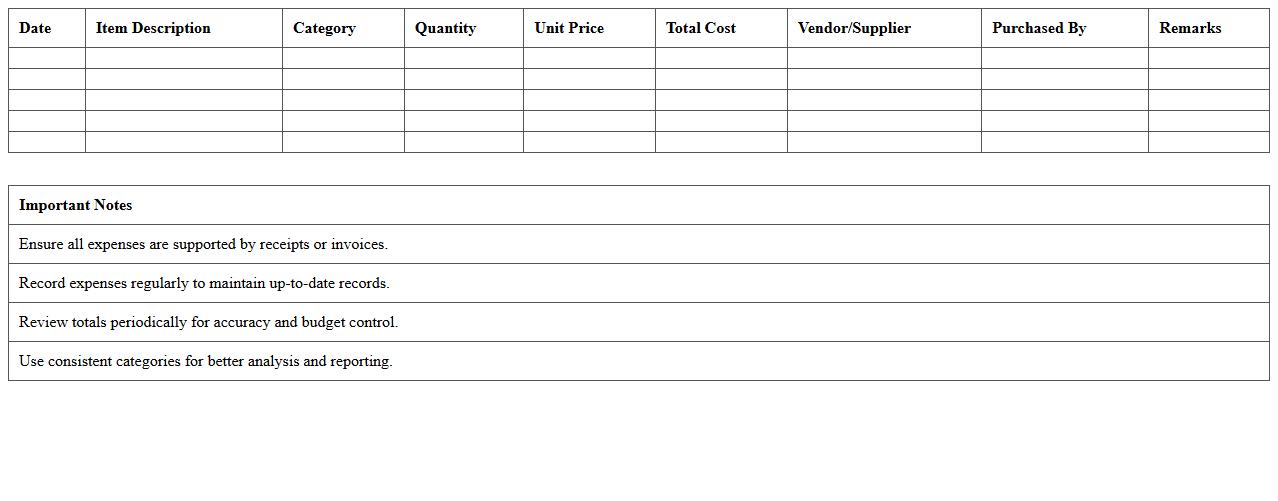

Office Supply Expense Record Excel Template

The

Office Supply Expense Record Excel Template is a structured spreadsheet designed to track and manage office supply purchases and expenditures efficiently. It helps businesses maintain organized records of expenses, monitor budget allocations, and identify spending patterns over time. This template streamlines financial reporting, ensuring accurate expense tracking for accounting and budgeting purposes.

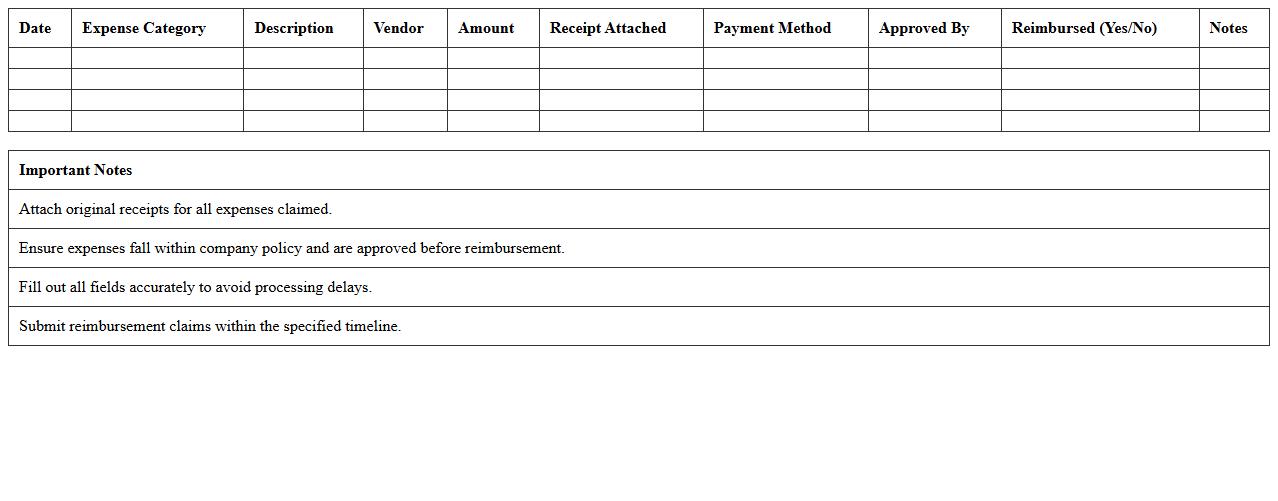

Reimbursable Business Expense Record Excel Sheet

The

Reimbursable Business Expense Record Excel Sheet is a document designed to systematically track and organize employee expenses eligible for reimbursement. It streamlines the process of expense reporting, ensuring accuracy in documentation, facilitating quick approval, and simplifying financial audits. By maintaining clear records, businesses can enhance budget management and prevent discrepancies in reimbursement claims.

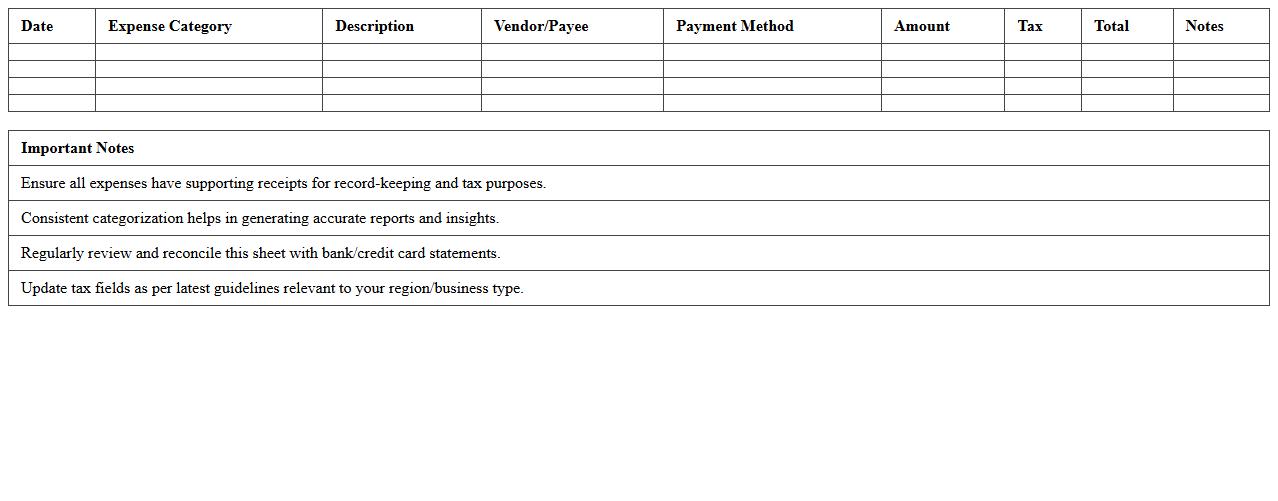

Project-Based Expense Tracking Excel Template

A

Project-Based Expense Tracking Excel Template is a specialized spreadsheet designed to systematically record, organize, and analyze financial expenditures related to specific projects. It enables users to monitor budget allocations, track real-time expenses, and compare costs against projected forecasts, enhancing financial control and accountability. By providing clear visibility into spending patterns, this template supports informed decision-making and helps prevent budget overruns.

Business Expense Category Summary Excel Sheet

The

Business Expense Category Summary Excel Sheet is a comprehensive document designed to organize and track all business expenses by categorizing them into specific groups such as travel, supplies, and utilities. This tool enables businesses to analyze spending patterns, identify cost-saving opportunities, and maintain accurate financial records for budgeting and tax purposes. Using this summary sheet enhances financial management efficiency and supports informed decision-making for business growth.

How to categorize recurring expenses in an Excel expense record template?

To categorize recurring expenses in Excel, create separate columns for the expense type and frequency. Use drop-down lists with data validation to ensure consistent category entries. This method organizes expenses efficiently and simplifies monthly tracking and reporting.

What Excel formulas best track monthly vendor payments for small businesses?

Use the SUMIFS formula to sum payments by vendor and month accurately. Combine TEXT and DATE functions to filter payments within a specific date range. These formulas enable precise tracking of monthly vendor payments for better financial management.

How to set up conditional formatting for flagged unusual expenses in an expense log?

Apply conditional formatting rules based on expense amount thresholds or deviations from average costs. Use formulas like =IF to highlight expenses exceeding a set limit or moving average. This visual cue quickly flags unusual expenses for review, improving oversight.

Which data fields are essential for accurate tax deduction tracking in expense records?

Include date, vendor name, expense category, amount, and tax-related notes fields for comprehensive tax deduction tracking. These fields capture crucial information needed for tax audits and financial statements. Properly documenting expenses ensures maximized deductions and compliance.

How to automate expense approval workflows in Excel for small business documents?

Leverage Excel macros or Power Automate integrations to create an automated expense approval process. Design a status column to track approval stages and use email triggers for notifications. Automation streamlines expense approval workflows and reduces manual errors.

More Record Excel Templates