The Business Loan Proposal Excel Template for Small Enterprises streamlines the process of presenting financial plans to lenders by organizing income, expenses, and cash flow projections clearly. This user-friendly template helps small business owners create detailed, professional loan proposals that enhance credibility and increase approval chances. Customizable fields allow for tailored financial scenarios, ensuring precise and persuasive presentations.

Business Loan Financial Projection Excel Template

The

Business Loan Financial Projection Excel Template document is a powerful tool designed to forecast financial performance, cash flow, and loan repayment schedules for businesses seeking funding. It helps entrepreneurs and financial analysts create detailed financial statements, including profit and loss, balance sheets, and cash flow projections, essential for loan applications and investor presentations. Using this template enables accurate budgeting, risk assessment, and strategic planning, enhancing the chances of securing business loans and managing finances effectively.

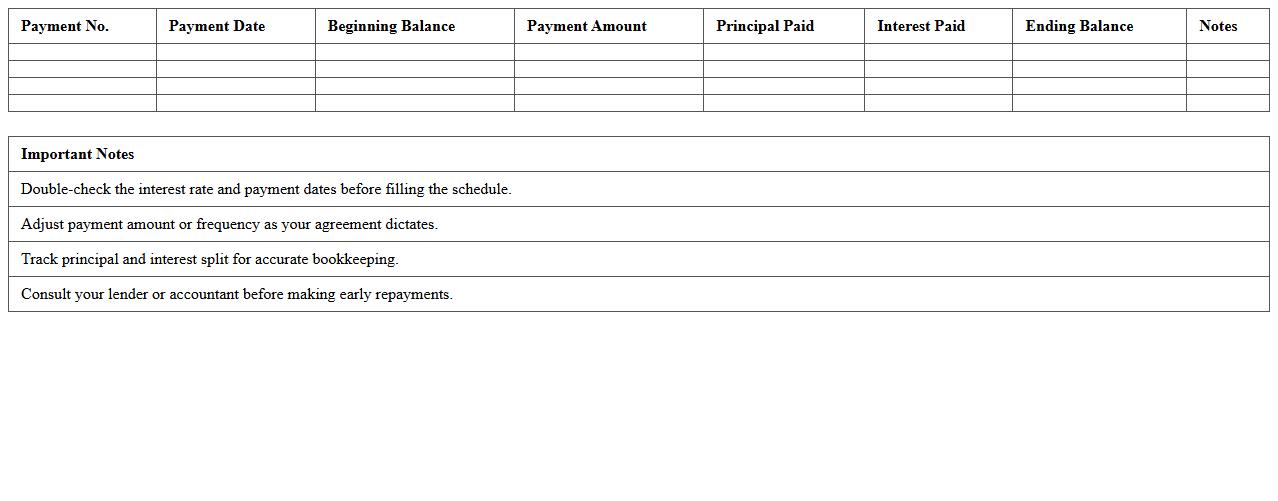

Small Business Loan Repayment Schedule Template

A

Small Business Loan Repayment Schedule Template document outlines the timeline and amounts for repaying a business loan, helping borrowers track payment deadlines and manage cash flow effectively. It provides a clear breakdown of principal and interest payments, ensuring transparency and aiding in accurate financial planning. Utilizing this template reduces the risk of missed payments and supports maintaining good credit standing for the business.

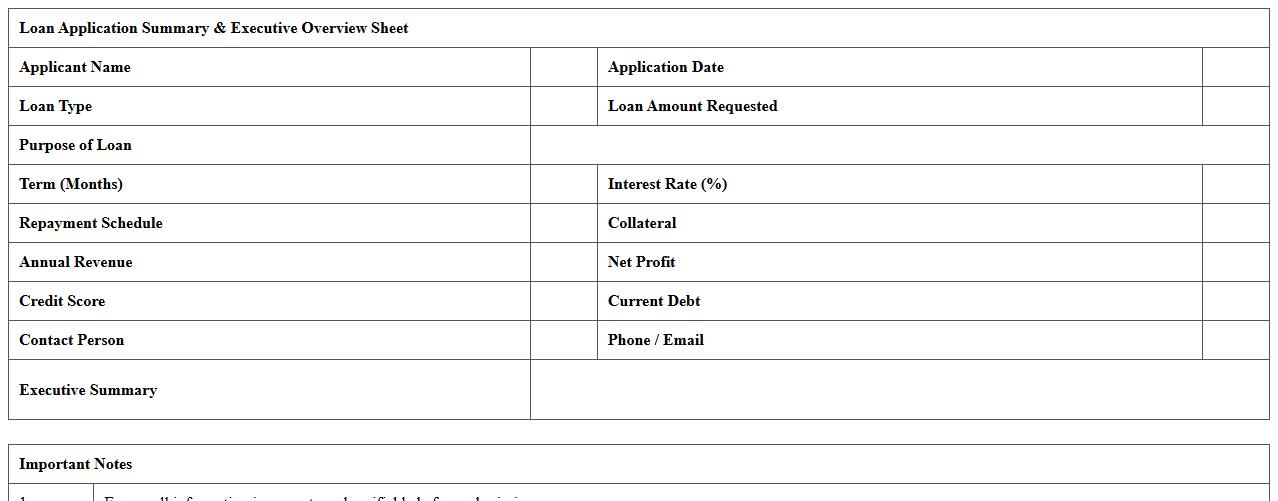

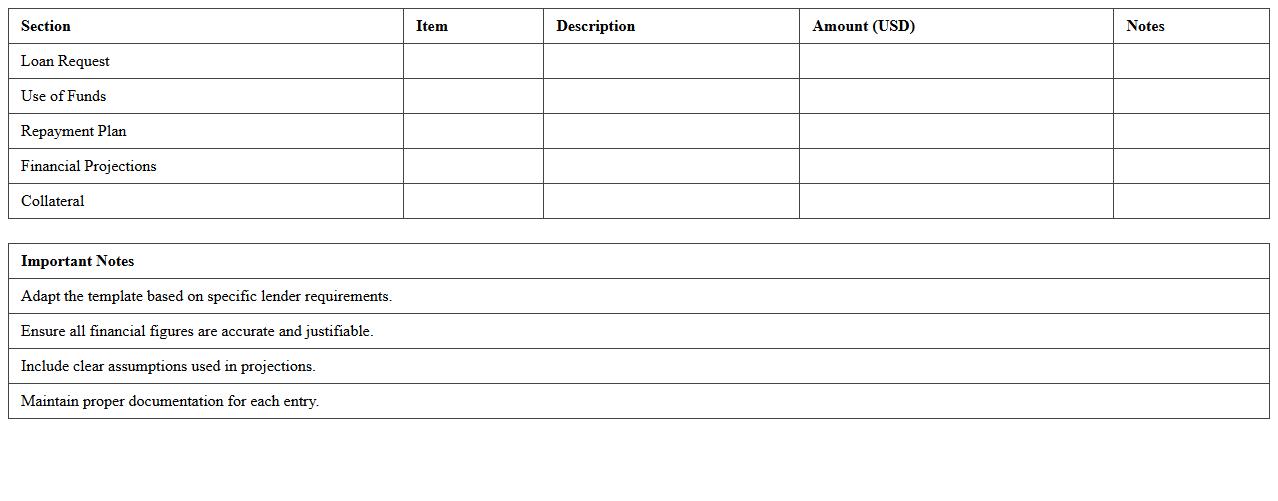

Loan Application Summary & Executive Overview Sheet

The

Loan Application Summary & Executive Overview Sheet is a concise document that consolidates key loan application details, financial data, and borrower information into a clear format. It serves as a critical tool for loan officers and decision-makers to quickly assess the viability and risks associated with a loan request. This document streamlines the review process, enhances communication between stakeholders, and supports informed lending decisions by highlighting essential credit metrics and project summaries.

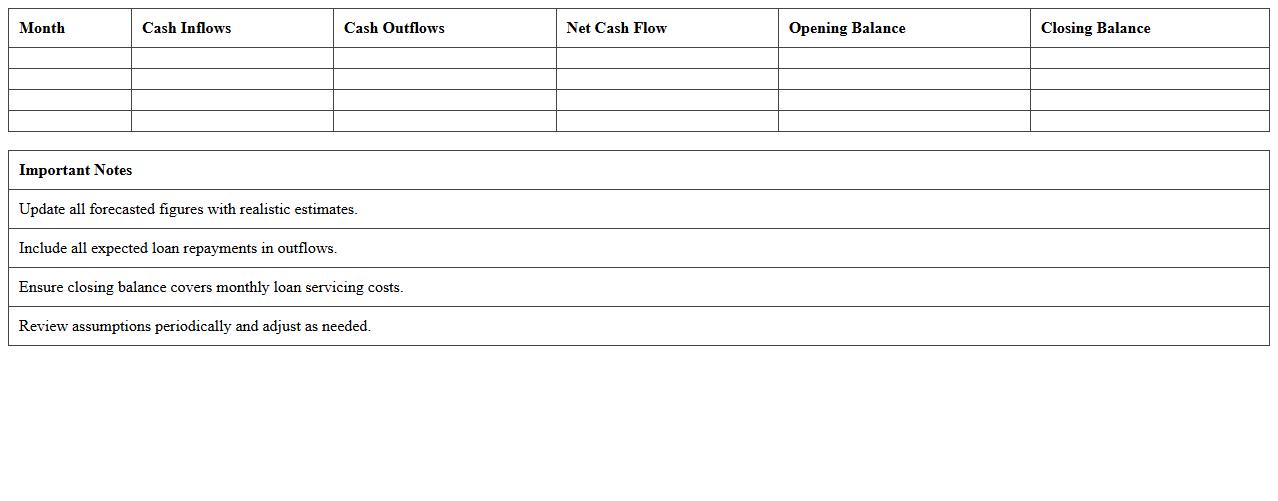

Cash Flow Forecast for Loan Proposal Excel

A

Cash Flow Forecast for a Loan Proposal Excel document projects future cash inflows and outflows to determine an organization's ability to meet loan repayment obligations. It provides lenders with clear insights into the business's financial health and repayment capacity, enhancing the loan approval chances. Using this tool helps businesses plan effectively, manage liquidity, and ensure sustainable cash management during the loan tenure.

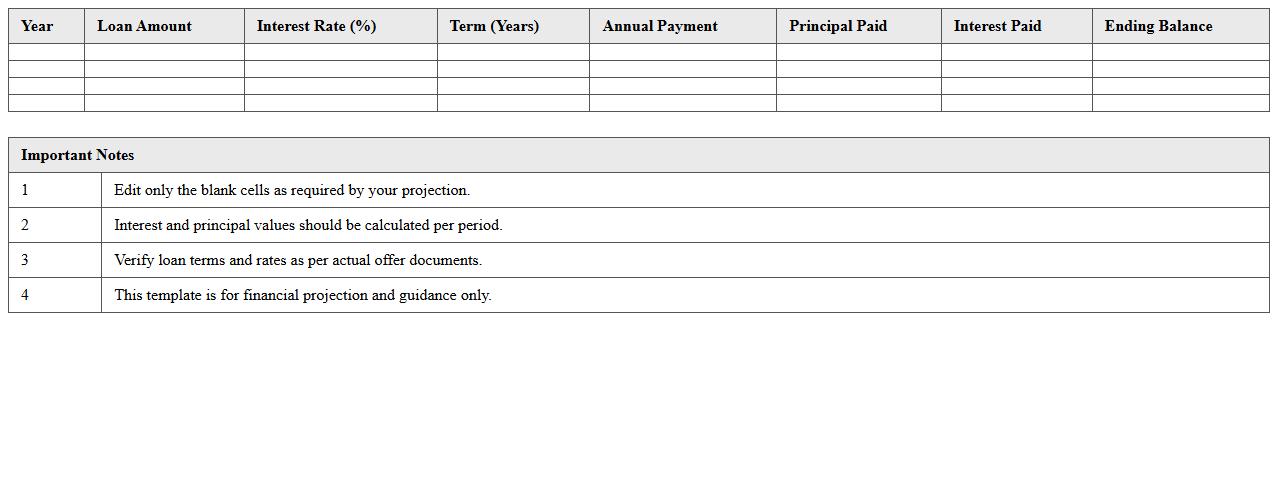

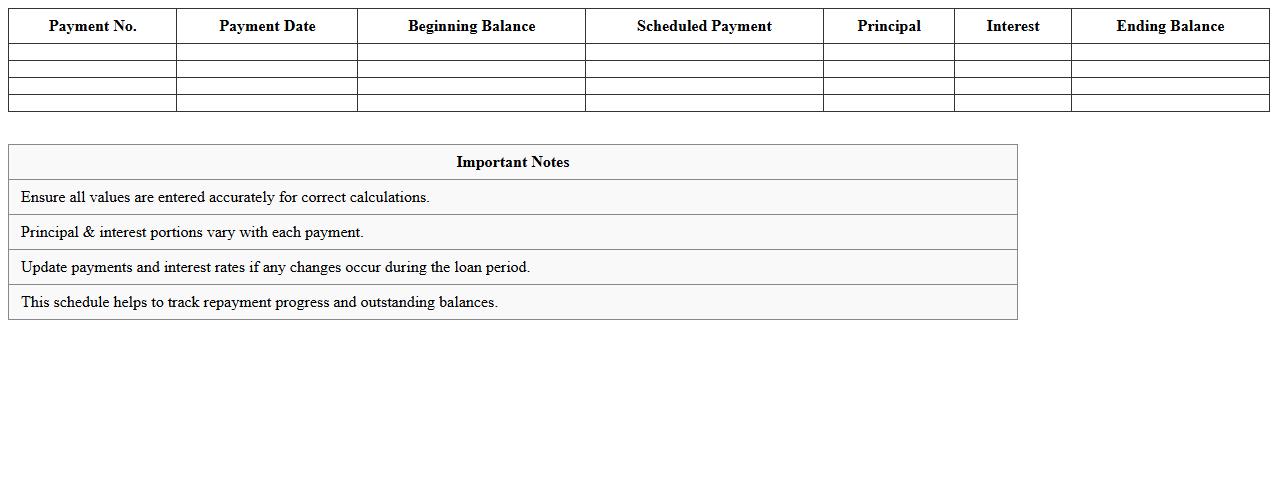

Business Loan Amortization Schedule Excel

A

Business Loan Amortization Schedule Excel document is a detailed spreadsheet that outlines the repayment plan of a business loan, including principal and interest amounts over time. It helps businesses track payment dates, remaining balances, and interest costs, enabling better financial planning and cash flow management. Using this schedule, companies can forecast loan payoff dates and evaluate the impact of additional payments on reducing overall debt.

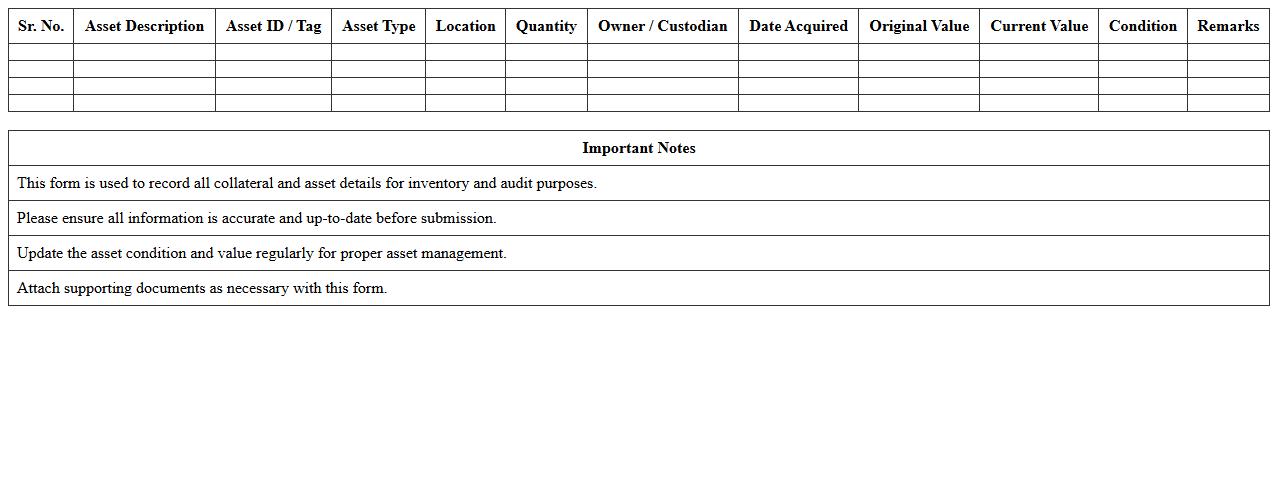

Collateral & Asset Inventory Form Template

A

Collateral & Asset Inventory Form Template is a structured document used to systematically record and track physical and financial assets owned by an organization or individual. This template helps ensure accurate documentation of asset details, including descriptions, values, locations, and conditions, facilitating efficient asset management and risk assessment. Using this form improves accountability, aids in financial reporting, and supports loan applications by clearly identifying collateral available to secure debt.

Startup Loan Request Financial Model Excel

A

Startup Loan Request Financial Model Excel document is a comprehensive spreadsheet designed to project the financial performance of a new business seeking funding. It includes detailed forecasts of cash flow, profit and loss, and balance sheets to demonstrate the startup's ability to repay a loan. This model helps entrepreneurs present credible financial data to lenders, increasing the chances of securing funding while enabling better financial planning and risk assessment.

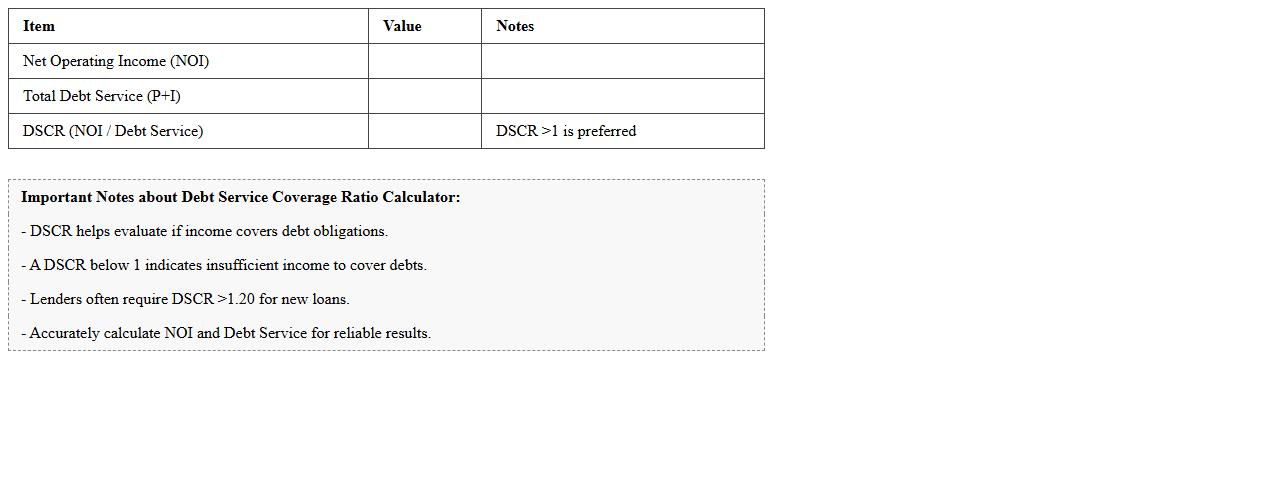

Debt Service Coverage Ratio Calculator Excel

The

Debt Service Coverage Ratio Calculator Excel document is a financial tool designed to measure a company's ability to cover its debt obligations with its operating income. By inputting key financial data such as net operating income and total debt service, users can quickly determine the DSCR, which is critical for lenders and investors assessing credit risk. This calculator helps businesses maintain financial health by ensuring they can meet debt payments and manage cash flow effectively.

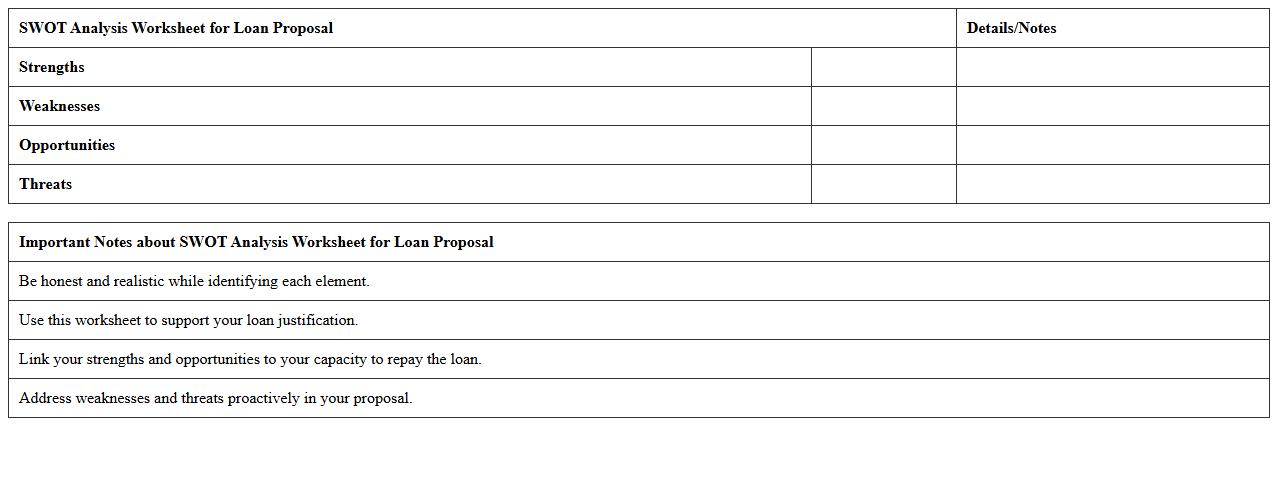

SWOT Analysis Worksheet for Loan Proposal

A

SWOT Analysis Worksheet for Loan Proposal is a strategic tool that helps identify the Strengths, Weaknesses, Opportunities, and Threats related to a loan application. It provides a clear framework for evaluating financial readiness, risk factors, and potential growth areas, enabling lenders and borrowers to make informed decisions. This worksheet enhances the loan approval process by highlighting critical factors that influence creditworthiness and investment viability.

Loan Utilization Plan & Budget Tracker Excel

The

Loan Utilization Plan & Budget Tracker Excel document is a detailed financial tool designed to monitor and manage the allocation and spending of loan funds efficiently. It helps users track loan disbursements, categorize expenses, and compare actual spending against planned budgets to ensure transparent and accountable use of funds. By providing clear visibility into financial activities, this tracker aids in preventing overspending and supports strategic financial planning for individuals or businesses.

What key financial metrics should be highlighted in a Business Loan Proposal Excel for small enterprises?

Highlighting gross revenue, net profit margins, and EBITDA provides clear insights into the business's financial health. Including the debt-to-equity ratio and current ratio enhances understanding of the enterprise's financial stability. These key financial metrics foster lender confidence and are crucial for loan approval.

How can cash flow projections be effectively visualized in the spreadsheet?

Use dynamic line charts and bar graphs to depict monthly or quarterly inflows and outflows, emphasizing trends and seasonality. Integrating conditional formatting helps highlight critical cash shortfalls or peaks in the projections. This visual approach enhances comprehension and supports informed decision-making by lenders.

Which Excel formulas best estimate loan repayment schedules for small business loans?

The PMT function calculates periodic loan payments based on interest rate, loan amount, and term length. Combining PMT with IPMT and PPMT functions allows detailed breakdowns of interest and principal components per payment. These formulas ensure accurate and transparent loan repayment schedules in the worksheet.

What supporting documentation should be referenced within the loan proposal worksheet?

Reference financial statements like balance sheets, income statements, and cash flow statements to validate data accuracy. Including tax returns, business licenses, and credit reports supports the enterprise's credibility. Clearly linking these documents within the worksheet facilitates lender review and verification.

How do you customize risk analysis sections specifically for small enterprises in the proposal Excel?

Incorporate tailored risk indicators such as market volatility, customer concentration, and operational dependencies unique to small businesses. Use risk matrices and sensitivity analysis to quantify potential impacts on cash flows and profitability. Customizing this section enhances the proposal's relevance and strengthens risk management visibility.

More Proposal Excel Templates