The Financial Savings Plan Excel Template for College Students helps track income, expenses, and savings goals efficiently. This customizable template simplifies budgeting, ensuring students can manage their finances while planning for tuition and living costs. Its user-friendly format allows easy updates and clear visualization of financial progress throughout the academic year.

Monthly College Savings Tracker Excel Template

The

Monthly College Savings Tracker Excel Template is a structured spreadsheet designed to help individuals systematically monitor and manage their college savings over time. By allowing users to input monthly contributions, track growth, and compare savings goals against actual amounts, it simplifies financial planning for higher education expenses. This tool enhances budgeting accuracy and provides clear insights, ensuring users stay on target to meet their college funding objectives efficiently.

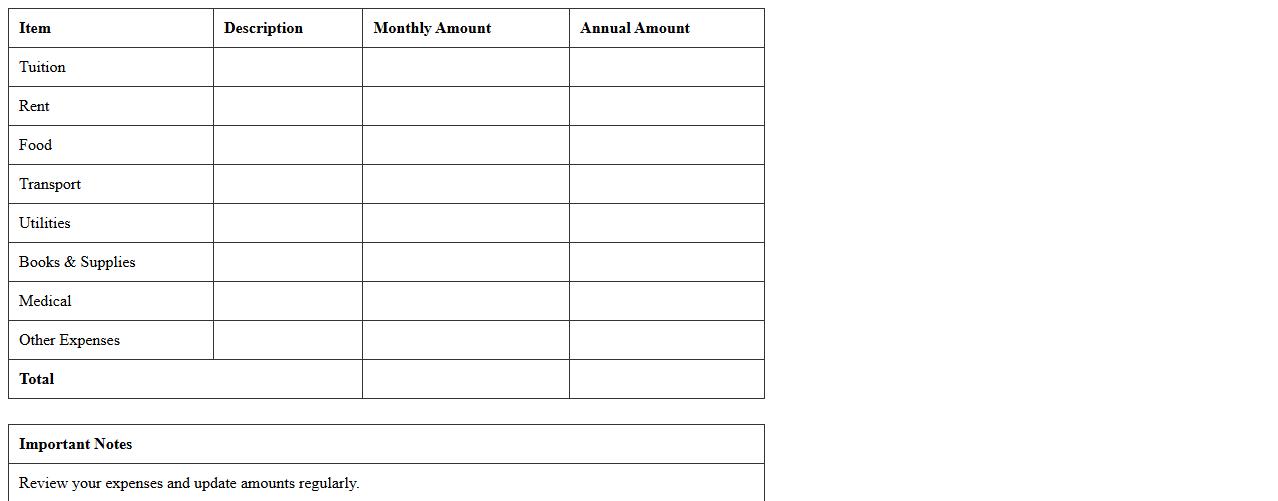

Simple Student Expense and Savings Spreadsheet

The

Simple Student Expense and Savings Spreadsheet document is a practical tool designed to track monthly income, expenses, and savings efficiently. It helps students manage their finances by categorizing spending, setting budgets, and monitoring progress toward financial goals. Using this spreadsheet promotes financial awareness and discipline, enabling better money management and reduced financial stress.

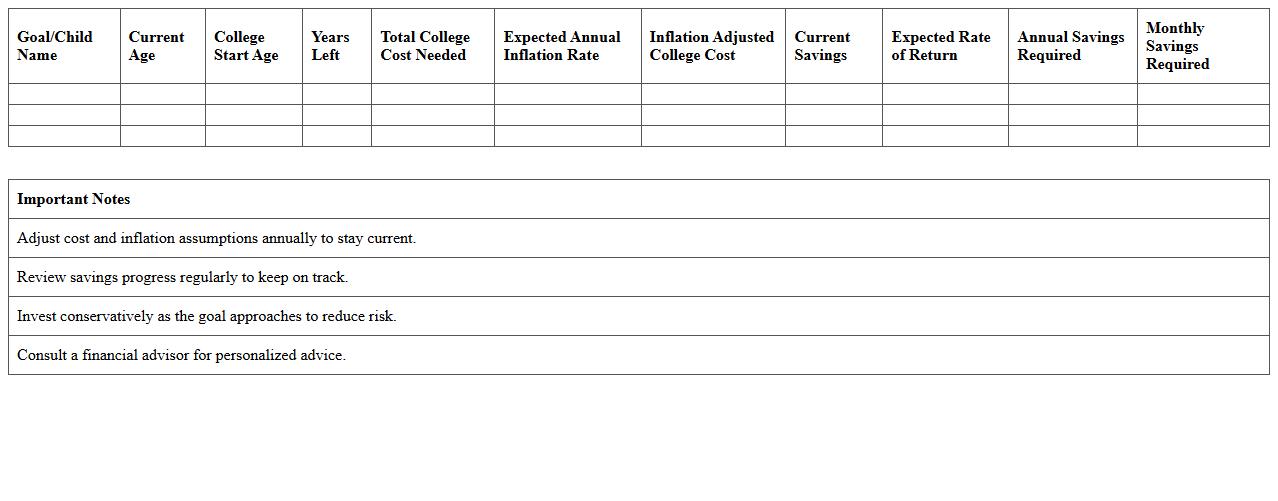

Goal-Based College Fund Savings Plan Sheet

The

Goal-Based College Fund Savings Plan Sheet is a strategic financial tool designed to help families outline and track their savings goals specifically for college expenses. It breaks down the total cost of education into manageable targets, considering factors such as tuition, fees, room, board, and inflation rates. This plan is useful for ensuring disciplined savings, optimizing investment strategies, and providing a clear roadmap to meet future educational funding needs.

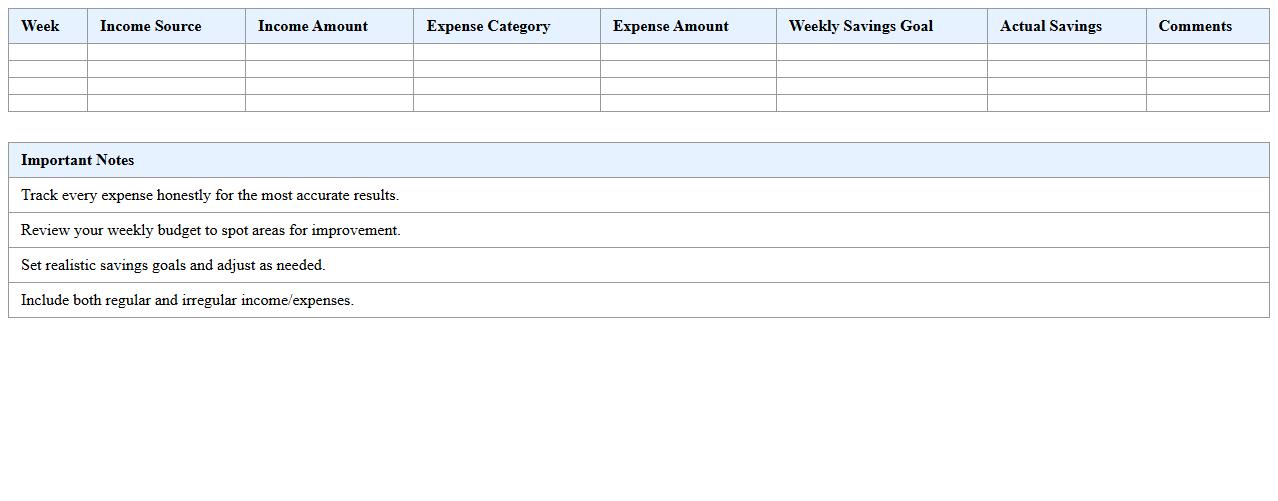

Weekly Budget and Savings Planner for Students

The

Weekly Budget and Savings Planner for Students is a financial management tool designed to help students track their income, expenses, and savings goals on a weekly basis. This document enables students to allocate funds efficiently, monitor spending habits, and identify areas where they can cut costs, promoting financial discipline and responsibility. By using this planner, students can develop strong money management skills that contribute to long-term financial stability and reduced financial stress.

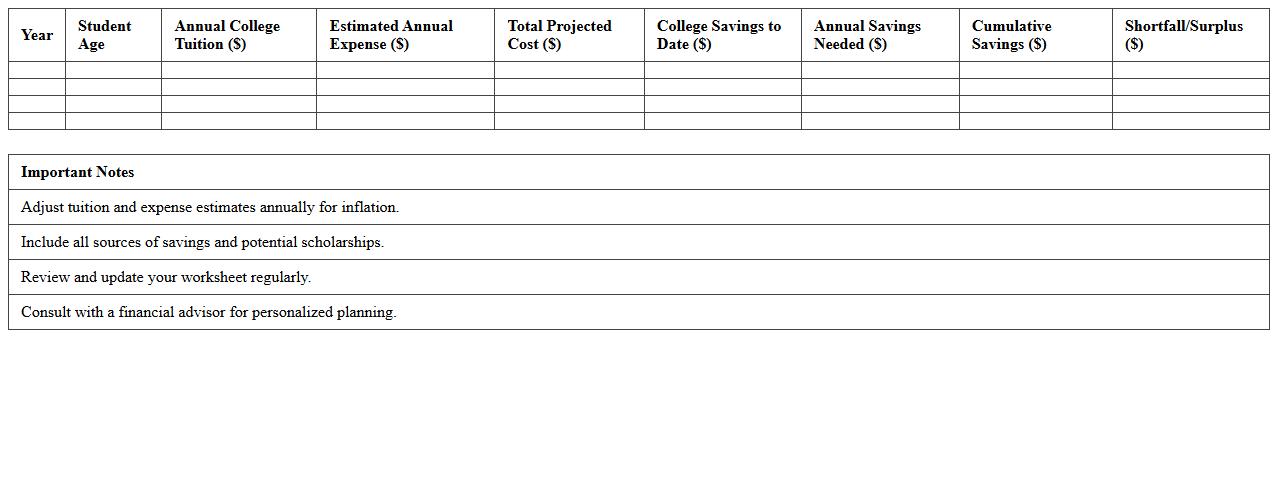

College Tuition Savings Projection Worksheet

The

College Tuition Savings Projection Worksheet is a financial planning tool designed to estimate future college expenses and track savings goals. This document helps families calculate projected tuition costs based on inflation rates, allowing them to determine the amount they need to save regularly. Utilizing this worksheet enables efficient budgeting and ensures that adequate funds are available when college payments are due, minimizing financial stress.

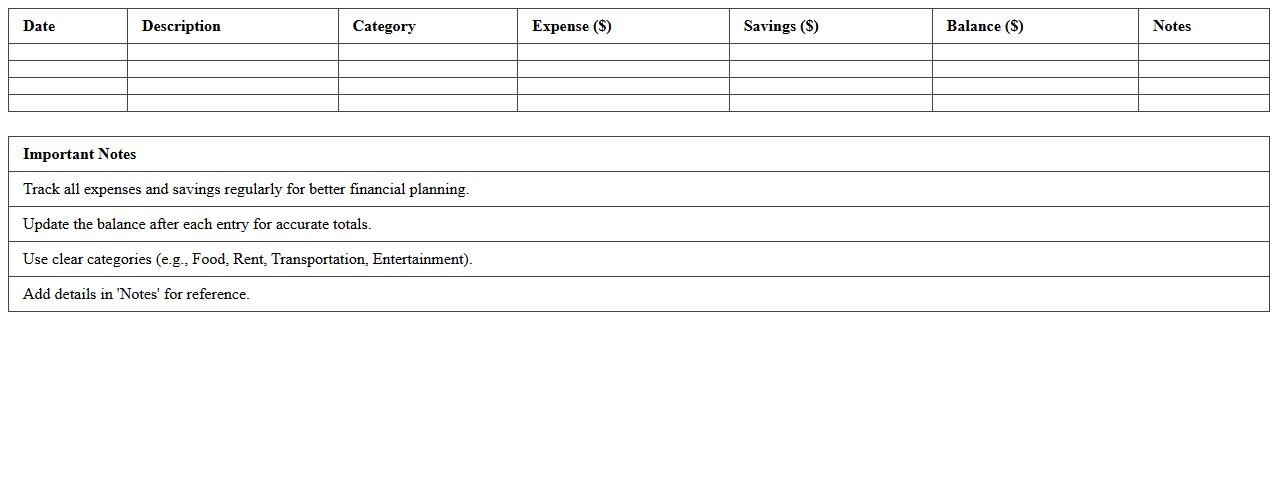

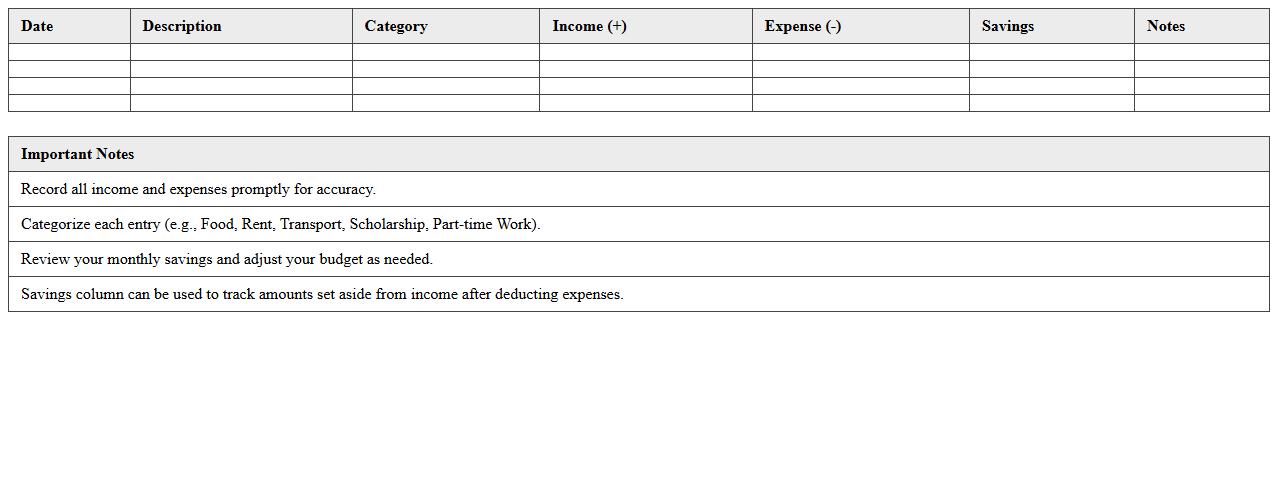

Student Income, Expense & Savings Log

A

Student Income, Expense & Savings Log document is a financial tracking tool designed to help students monitor their sources of income, manage daily expenses, and record savings consistently. It provides clear insights into spending patterns, enabling better budgeting decisions and preventing unnecessary debt. This log is essential for promoting financial literacy and achieving personal financial goals effectively.

College Emergency Fund Savings Calculator

The

College Emergency Fund Savings Calculator document is a financial tool designed to help students and parents accurately estimate the amount of savings required for unexpected college-related expenses. By inputting variables such as tuition, living costs, and potential emergencies, users can create a realistic savings plan to ensure financial stability during college years. This proactive budgeting resource helps prevent debt accumulation and provides peace of mind by preparing families for unforeseen financial challenges.

Part-Time Job Savings Tracking Excel Sheet

The

Part-Time Job Savings Tracking Excel Sheet document is a practical tool designed to monitor income and expenses related to part-time jobs, enabling individuals to manage their finances efficiently. By organizing earnings, savings goals, and expenditures in one place, it helps users maintain a clear overview of their financial progress and make informed budgeting decisions. This spreadsheet enhances financial discipline and supports goal-oriented saving habits, particularly for students and part-time workers.

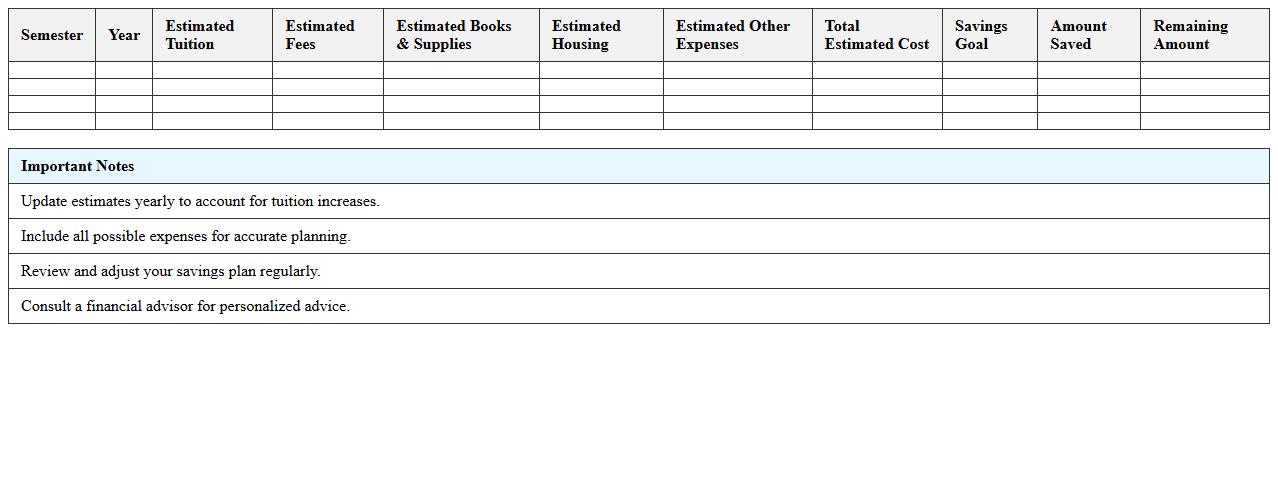

Semester-by-Semester College Savings Plan Template

The

Semester-by-Semester College Savings Plan Template is a detailed financial planning tool designed to help students and families organize and track college expenses on a semester basis. It breaks down tuition, fees, books, and other costs, allowing for precise budgeting and timely savings contributions. Using this template ensures efficient fund management, reduces financial stress, and helps achieve educational funding goals systematically.

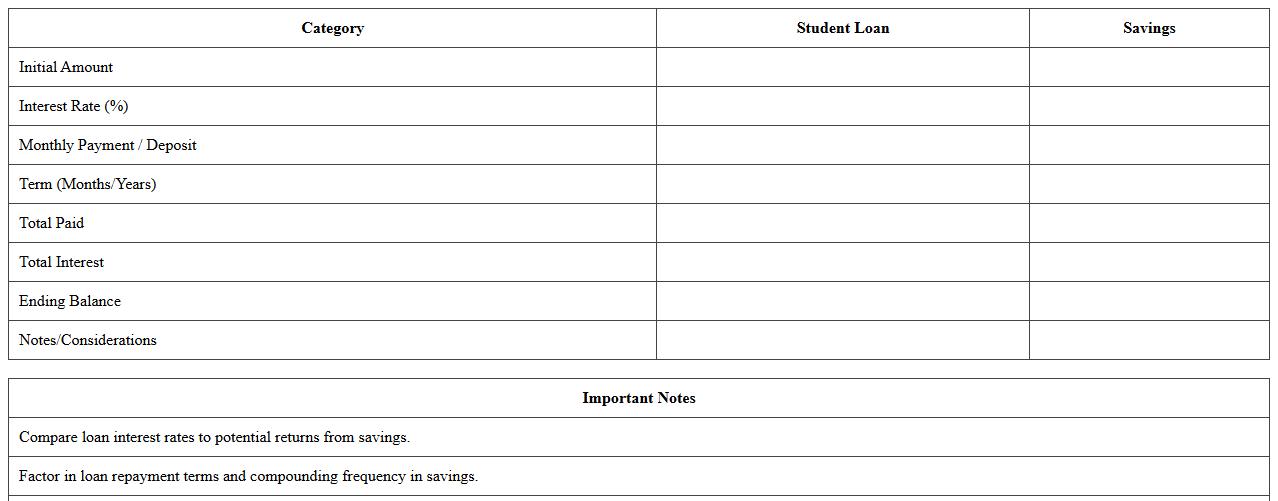

Student Loan vs. Savings Comparison Spreadsheet

A

Student Loan vs. Savings Comparison Spreadsheet is a financial tool designed to help individuals evaluate the cost-effectiveness of using loan funds versus personal savings for education expenses. This document systematically compares interest rates, repayment terms, and overall financial impact, enabling users to make informed decisions about funding their education. By clearly outlining potential debt burdens and savings growth, it assists in optimizing financial planning and minimizing long-term financial risks.

How can Excel formulas automate monthly savings tracking for college students?

Excel formulas like SUM and IF can automate monthly savings calculations by totaling income and expenses each month. Using formulas such as SUMPRODUCT helps calculate weighted expenses and savings goals dynamically. This automation reduces manual errors and provides real-time insights into savings progress.

What specific expense categories should college students include in a financial savings plan spreadsheet?

Students should include essential expense categories like tuition, housing, food, transportation, and utilities. Additionally, budgeting for books, supplies, entertainment, and emergency funds improves financial awareness. Categorizing expenses clearly helps identify areas to optimize savings effectively.

Which Excel chart types best visualize progress toward a college savings goal?

Line charts effectively display cumulative savings progress over time, showing trends clearly. Bar charts compare different monthly savings amounts against targets, making it easy to spot shortfalls. Pie charts can illustrate the distribution of expenses versus savings in a single visual snapshot.

How can conditional formatting alert students when spending exceeds budgeted limits?

Conditional formatting uses color-coded rules to highlight cells where expenses exceed predefined budgets. For example, cells can turn red when spending surpasses limits, prompting immediate action. This visual alert system enhances financial discipline and helps prevent overspending.

What templates or Excel add-ins optimize student financial savings documentation?

Budgeting templates tailored for students streamline data entry and expense tracking with predefined categories. Add-ins like Money in Excel connect bank accounts for automated transaction imports, simplifying record-keeping. These tools enhance accuracy, saving time and improving financial management efficiency.

More Plan Excel Templates