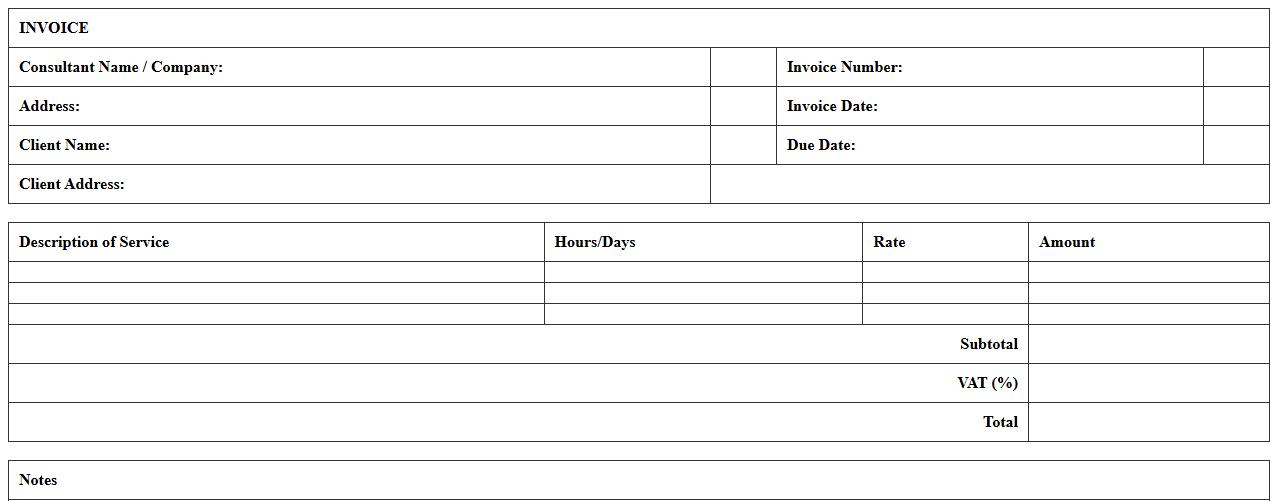

The Invoice Excel Template for Consultants with VAT streamlines billing by allowing professionals to easily calculate and include value-added tax in their invoices. This template features customizable fields for client details, services rendered, and tax rates, ensuring accuracy and professionalism. It helps consultants maintain organized financial records while complying with VAT regulations.

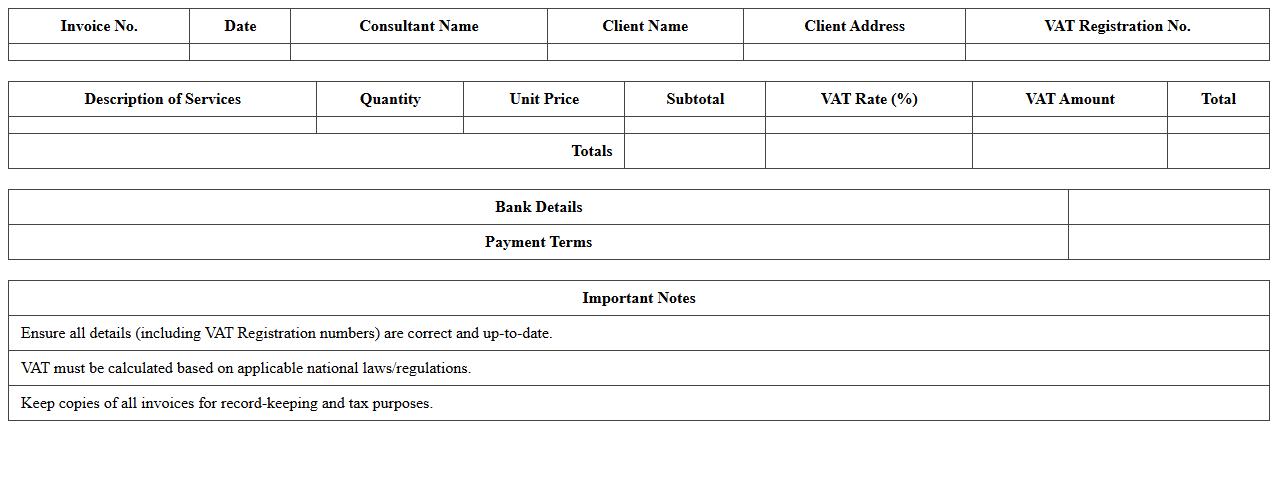

VAT-Compliant Consultant Invoice Excel Template

The

VAT-Compliant Consultant Invoice Excel Template is a pre-designed spreadsheet that ensures all consultant invoices meet the specific requirements of Value Added Tax regulations. It helps businesses accurately calculate VAT, maintain compliance with tax authorities, and avoid penalties by organizing invoice details such as tax rates, client information, and service descriptions. This template streamlines invoicing processes, improves financial accuracy, and supports audit-readiness for consulting professionals and firms.

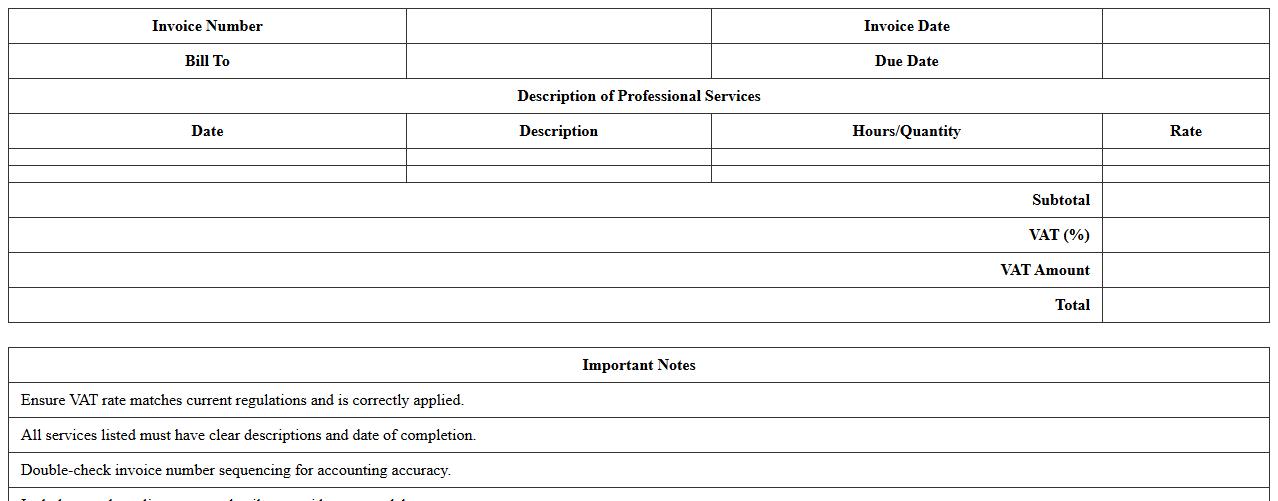

Professional Services Invoice Excel Template with VAT

A

Professional Services Invoice Excel Template with VAT is a customizable document designed to simplify billing for services rendered while accurately calculating Value Added Tax (VAT). This template streamlines invoicing by automatically including essential details such as service descriptions, rates, VAT percentages, and totals, ensuring compliance with tax regulations. Its use enhances financial accuracy, improves record-keeping, and facilitates timely payments from clients.

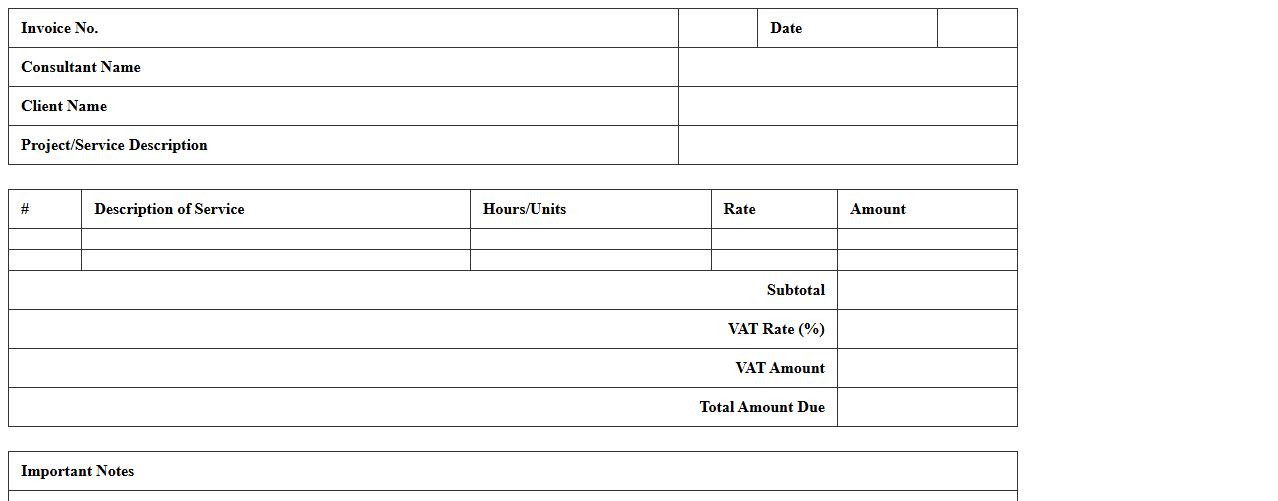

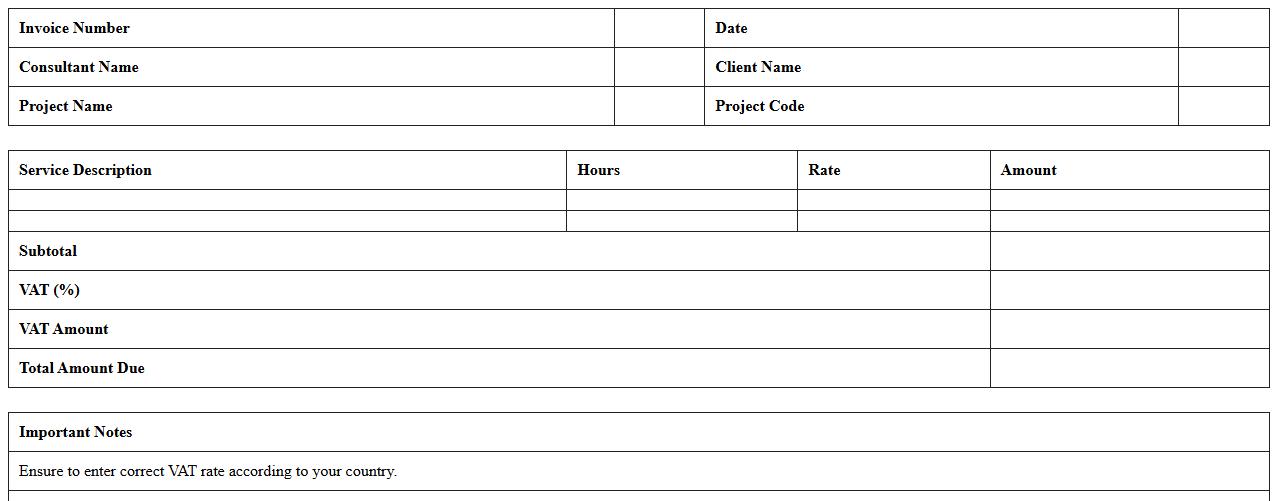

Consulting Fee Invoice Template with VAT Calculation

A

Consulting Fee Invoice Template with VAT Calculation document is a structured format designed to detail the charges for consulting services while automatically including the Value Added Tax (VAT) amount. It streamlines the billing process by ensuring accurate tax computation and compliance with local tax regulations, reducing errors and saving time. This template is useful for businesses and freelancers to maintain clear financial records and facilitate prompt payments from clients.

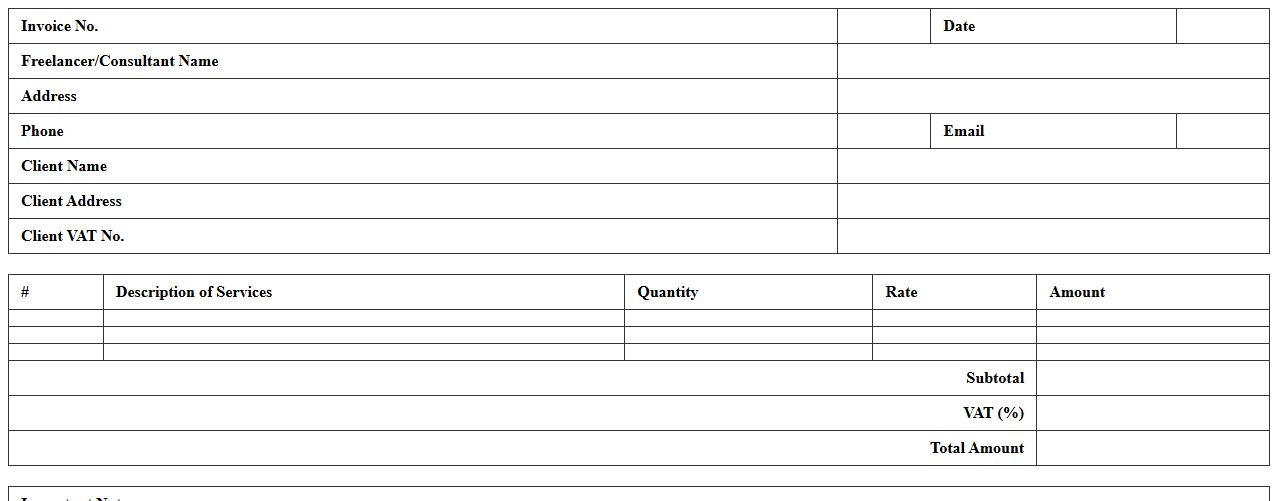

Freelancer Consultant VAT Invoice Excel Sheet

A

Freelancer Consultant VAT Invoice Excel Sheet document is a structured template designed to help freelancers and consultants accurately generate VAT-compliant invoices for their services. It automates calculations of taxable amounts, VAT rates, and totals, ensuring precise financial records and simplifying tax reporting. This tool enhances professional billing practices, reduces errors, and streamlines the invoicing process, aiding in efficient financial management for self-employed professionals.

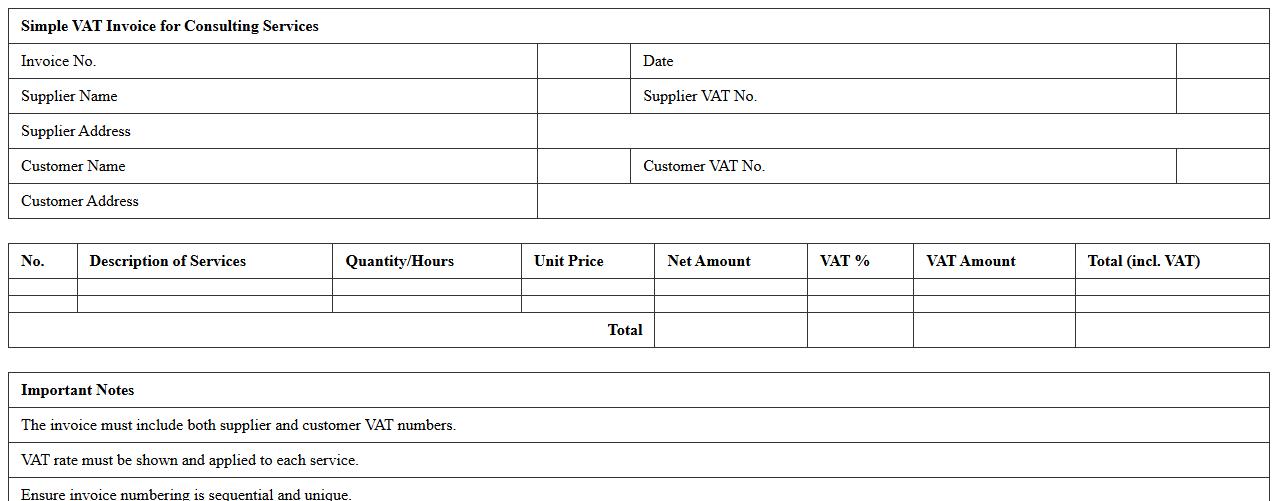

Simple VAT Invoice for Consulting Services in Excel

A

Simple VAT Invoice for Consulting Services in Excel is a streamlined financial document designed to record and calculate the value-added tax on consulting fees accurately. It organizes client information, service details, taxable amounts, and VAT rates, ensuring compliance with tax regulations and facilitating easy tracking of payments. This Excel-based tool enhances efficiency by automating calculations, reducing errors, and providing a professional record for both service providers and clients.

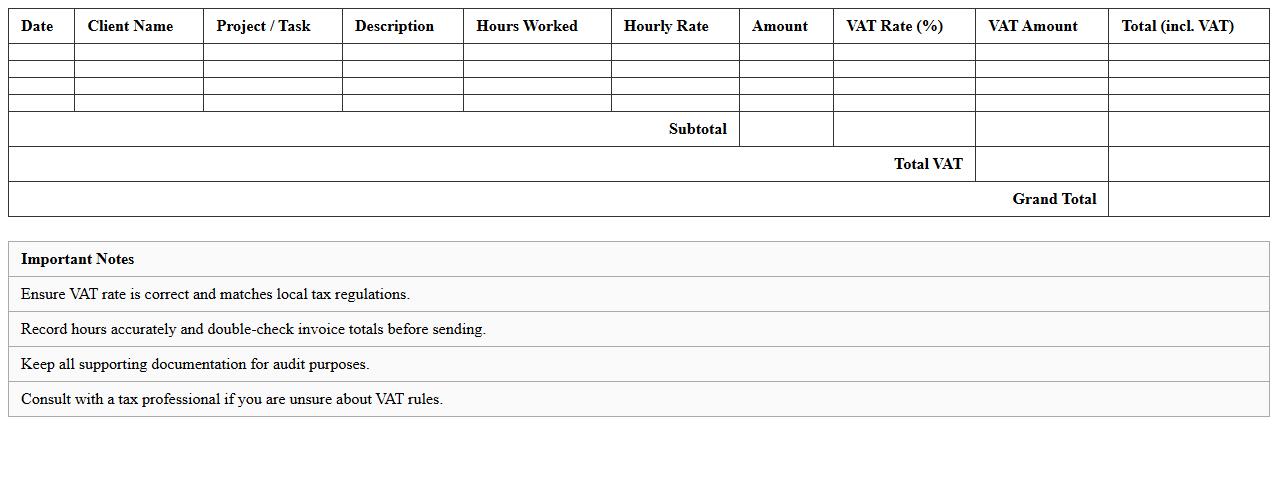

Hourly Consultant Invoice with VAT Breakdown Excel

The

Hourly Consultant Invoice with VAT Breakdown Excel document is a detailed billing tool that helps consultants accurately track hours worked and calculate the corresponding fees, including the Value Added Tax (VAT) component. It provides a clear breakdown of charges and applicable taxes, ensuring transparency and compliance with tax regulations. This document simplifies invoicing processes, improves financial accuracy, and aids in maintaining organized records for audits and client communications.

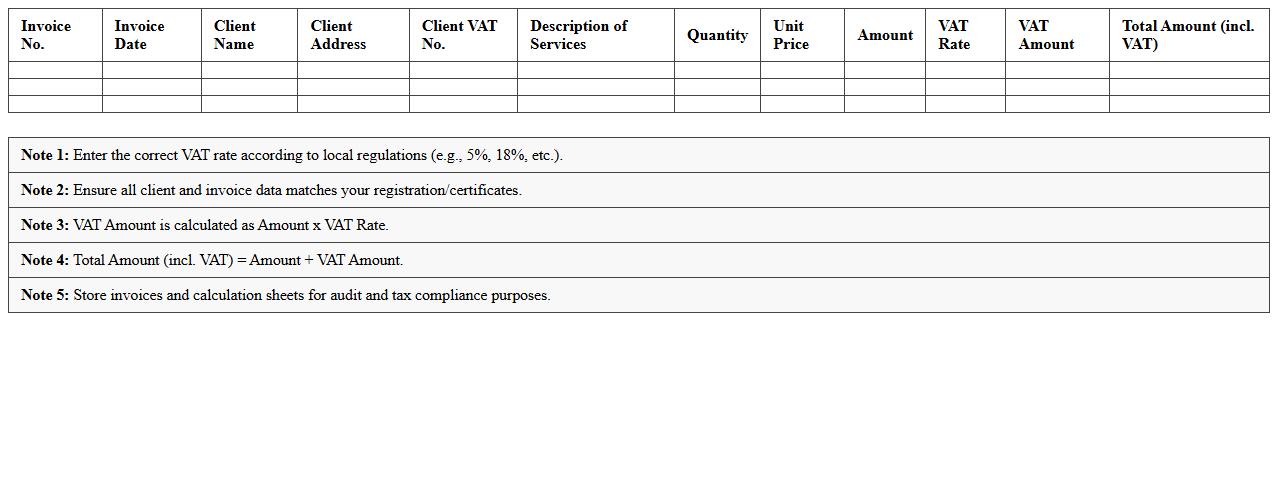

Excel Template for VAT Registered Consulting Invoices

An

Excel Template for VAT Registered Consulting Invoices is a pre-designed spreadsheet tailored to generate professional invoices compliant with VAT regulations. It simplifies the invoicing process by automatically calculating VAT amounts, ensuring accuracy and saving valuable time for consultants managing multiple clients. This template enhances financial organization, facilitates transparent billing, and supports efficient record-keeping for VAT reporting purposes.

Consulting Project Invoice Excel Template with VAT

A

Consulting Project Invoice Excel Template with VAT document is a pre-designed spreadsheet that helps consultants itemize project fees and calculate Value Added Tax accurately. This template streamlines the billing process by automatically computing tax-inclusive totals, ensuring compliance with tax regulations and reducing errors. It is useful for professionals to maintain clear financial records, improve invoice accuracy, and facilitate prompt payment collection.

Detailed Consultant Bill with VAT Tracking in Excel

A

Detailed Consultant Bill with VAT Tracking in an Excel document is a comprehensive financial record that itemizes consultant fees along with the applicable Value Added Tax (VAT) calculations. This tool enables accurate tracking of expenses, ensures compliance with tax regulations, and simplifies audit processes by providing clear visibility into VAT applied on each billing entry. Utilizing this document improves financial management by streamlining invoice verification and supporting efficient tax reporting.

Excel Invoice Template for Consultant Retainers with VAT

An

Excel Invoice Template for Consultant Retainers with VAT is a pre-designed spreadsheet that helps consultants accurately bill clients for ongoing services, incorporating Value Added Tax calculations automatically. This template ensures compliance with tax regulations by itemizing retainers and VAT amounts clearly, simplifying financial record-keeping and client communication. Using this tool enhances billing efficiency, reduces errors, and provides a professional format that supports better cash flow management for consulting businesses.

How to automate VAT calculation in an Invoice Excel template for consultants?

To automate VAT calculation in an invoice Excel template, use formulas that multiply service amounts by the VAT rate. Set the VAT rate in a dedicated cell for easy updates across the worksheet. Incorporate a formula like =Amount*VAT_Rate to dynamically calculate VAT on each line item.

What Excel formulas track consultancy service hours and apply VAT?

Use the =SUM formula to total consultancy service hours recorded in a column. Calculate the subtotal by multiplying hourly rates by hours worked using =Hours*Rate. Apply VAT on the subtotal with a formula such as =Subtotal*VAT_Rate to ensure accurate tax inclusion.

How to customize an Invoice Excel with multiple VAT rates for international clients?

Customize your invoice by setting up a dropdown list for clients' country or VAT rate selection using Data Validation. Use the =VLOOKUP function to pull the correct VAT rate based on the chosen country. Apply the corresponding VAT rate in your VAT calculation formula to reflect international tax differences correctly.

Which columns are essential for VAT-compliant invoices for consultancy in Excel?

Essential columns include Invoice Number, Date, Client Details, Description of Services, Hours Worked, Rate, VAT Rate, VAT Amount, and Total Amount. These fields ensure clarity and compliance with VAT regulations for consultancy services. Including detailed columns improves transparency and audit readiness.

How to generate a unique invoice number sequence in Excel for VAT record-keeping?

Generate a unique invoice number using a combination of the current date and an incremental number with the formula like =TEXT(TODAY(),"YYYYMMDD")&"-"&TEXT(ROW(A1),"000"). This creates a sequential and date-stamped identifier critical for VAT record-keeping. Automating this process avoids duplicate numbers and facilitates tracking.

More Invoice Excel Templates