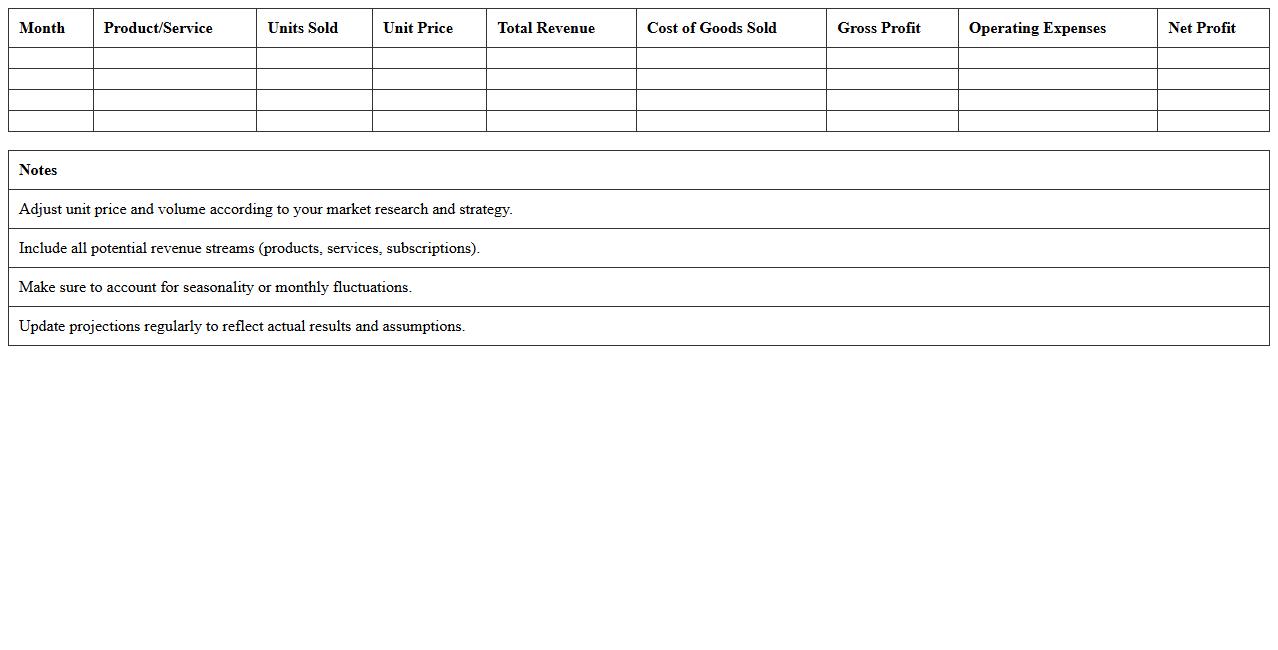

Revenue Projection Excel Template for Startups

The

Revenue Projection Excel Template for Startups is a detailed financial tool designed to estimate future income based on sales forecasts, pricing strategies, and market trends. It helps startups create accurate and dynamic financial models to plan growth, secure funding, and monitor performance against targets. Utilizing this template enables entrepreneurs to make data-driven decisions, optimize resource allocation, and communicate clear revenue expectations to investors.

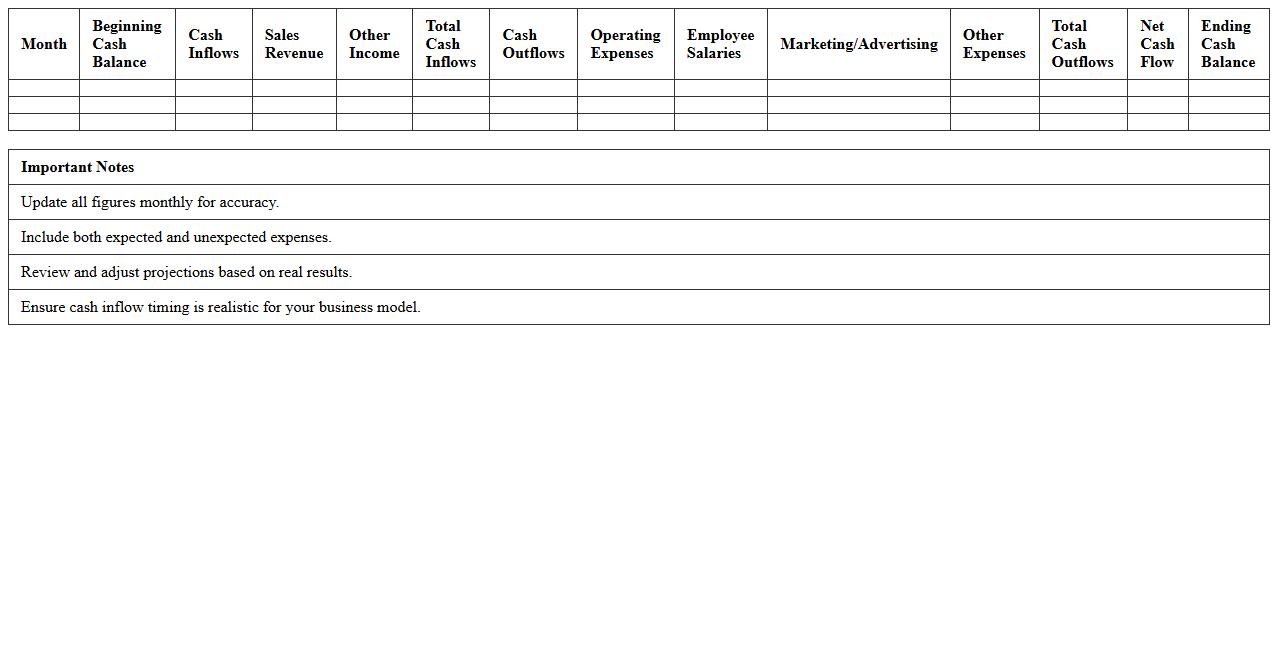

Startup Cash Flow Forecast Excel Spreadsheet

A

Startup Cash Flow Forecast Excel Spreadsheet is a financial tool designed to project incoming and outgoing cash flows for a new business, helping entrepreneurs anticipate liquidity needs. It allows accurate tracking of revenue, expenses, and net cash position over specific periods, facilitating budget planning and ensuring operational viability. This document is essential for decision-making, securing investor confidence, and avoiding cash shortages in the critical early stages of a startup.

Startup Expense Tracking Excel Template

The

Startup Expense Tracking Excel Template is a specialized spreadsheet designed to help new businesses systematically record and monitor their initial costs, including equipment, marketing, and operational expenses. This tool enables entrepreneurs to maintain organized financial records, ensuring accurate budgeting and cash flow management during the critical early stages of the business. By providing clear visibility into spending patterns, the template supports informed decision-making and helps prevent overspending.

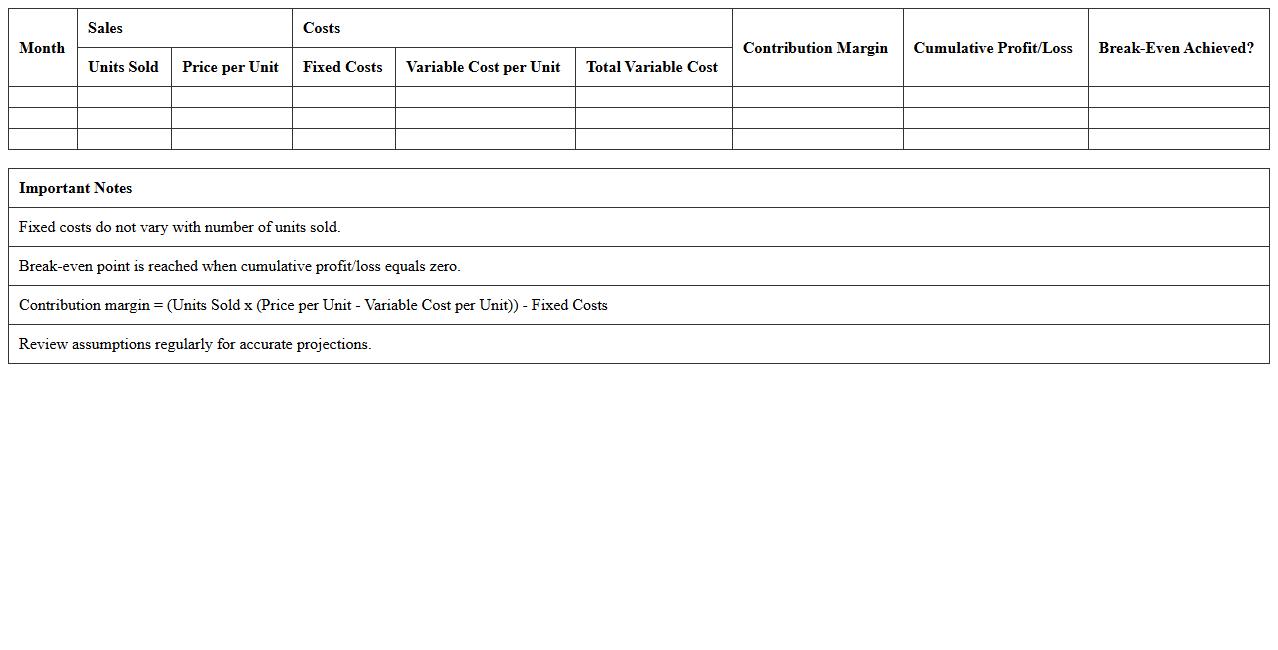

Break-Even Analysis Excel Sheet for Startups

A

Break-Even Analysis Excel Sheet for Startups is a financial tool that calculates the sales volume needed to cover total costs, enabling entrepreneurs to identify when their business will become profitable. It helps startups manage cash flow by clearly showing fixed and variable expenses and projecting revenue targets for sustainability. This document is essential for making informed pricing, budgeting, and investment decisions during the critical early stages of a startup.

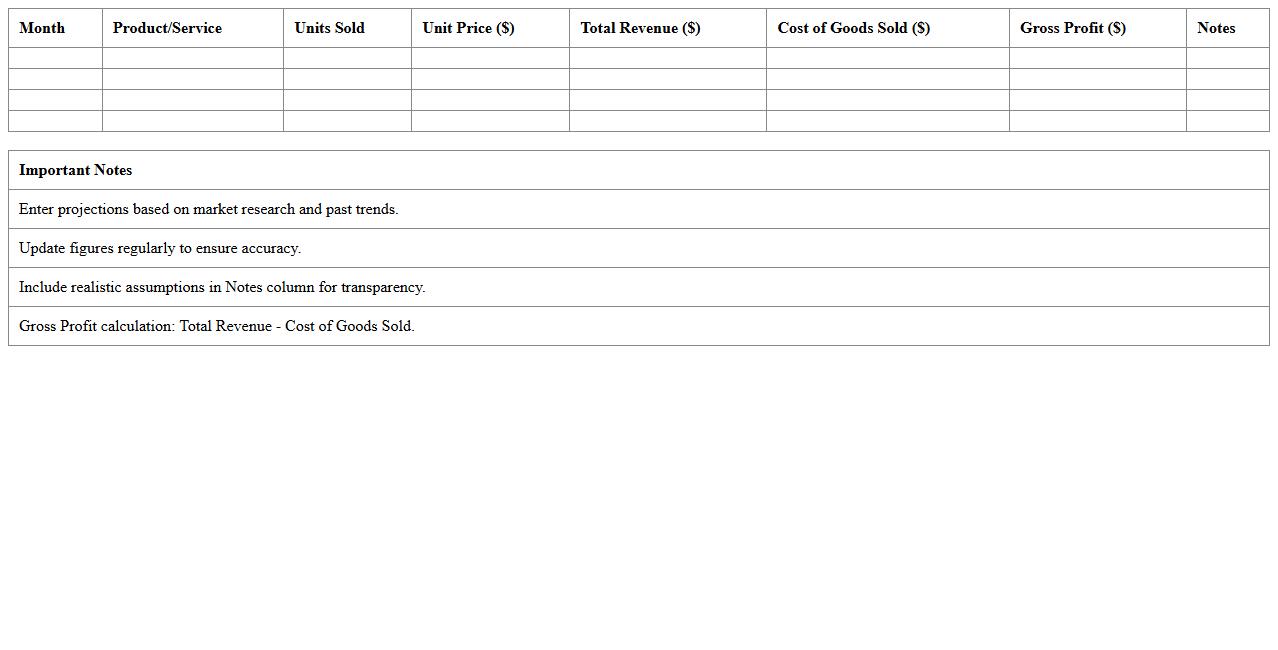

Profit and Loss Statement Excel Template for Startups

A

Profit and Loss Statement Excel Template for Startups is a financial document designed to track revenues, expenses, and net profit over a specific period, providing a clear snapshot of a startup's financial health. This template simplifies complex accounting by organizing financial data into customizable categories, enabling founders to monitor cash flow, measure profitability, and make data-driven decisions. Using this tool helps startups efficiently manage budgets, forecast financial performance, and communicate financial results to investors or stakeholders.

Startup Sales Forecast Excel Model

A

Startup Sales Forecast Excel Model document is a dynamic financial tool designed to project future sales revenue based on various inputs like market size, pricing strategy, and growth rate. It enables startups to create data-driven revenue projections, helping investors evaluate business potential and supporting strategic decision-making. By providing a structured format for sales assumptions and automatic calculations, it enhances accuracy and facilitates scenario analysis for better financial planning.

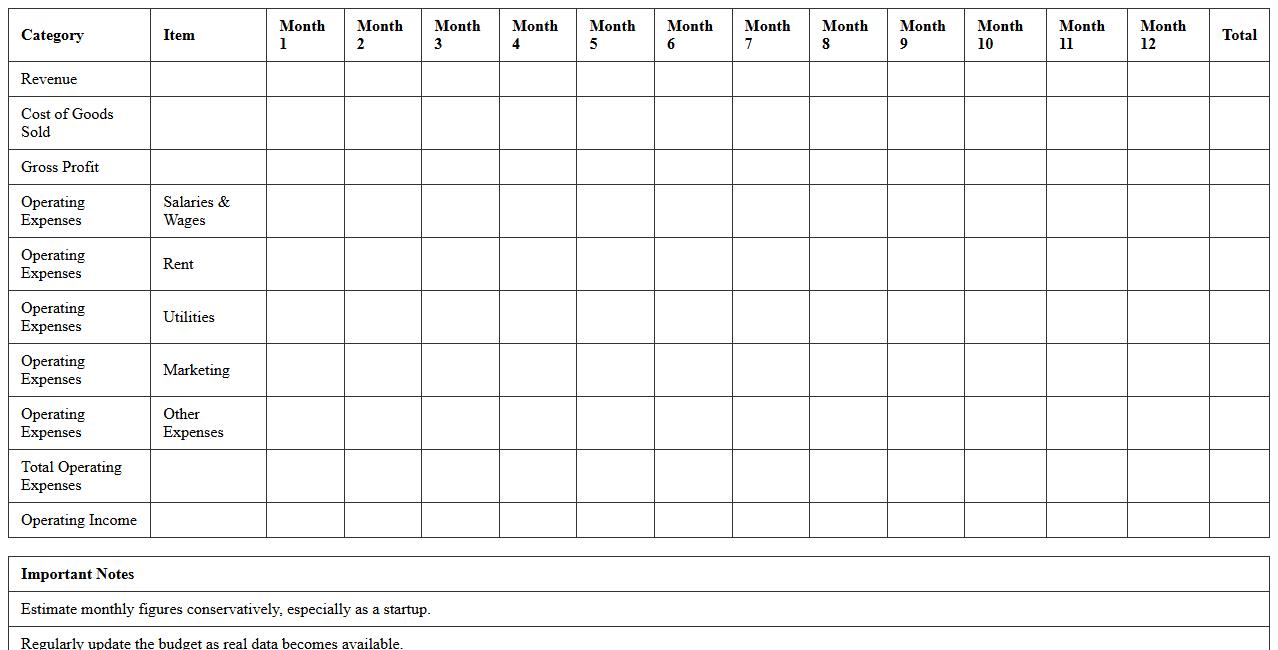

Operating Budget Excel Template for Startups

The

Operating Budget Excel Template for Startups is a comprehensive tool designed to help new businesses plan, track, and control their operating expenses effectively. It organizes key financial data such as salaries, rent, utilities, and marketing costs, enabling startups to forecast cash flow and maintain financial discipline. Using this template improves decision-making by providing clear visibility into budget allocations and helping identify areas where cost-saving measures can be implemented.

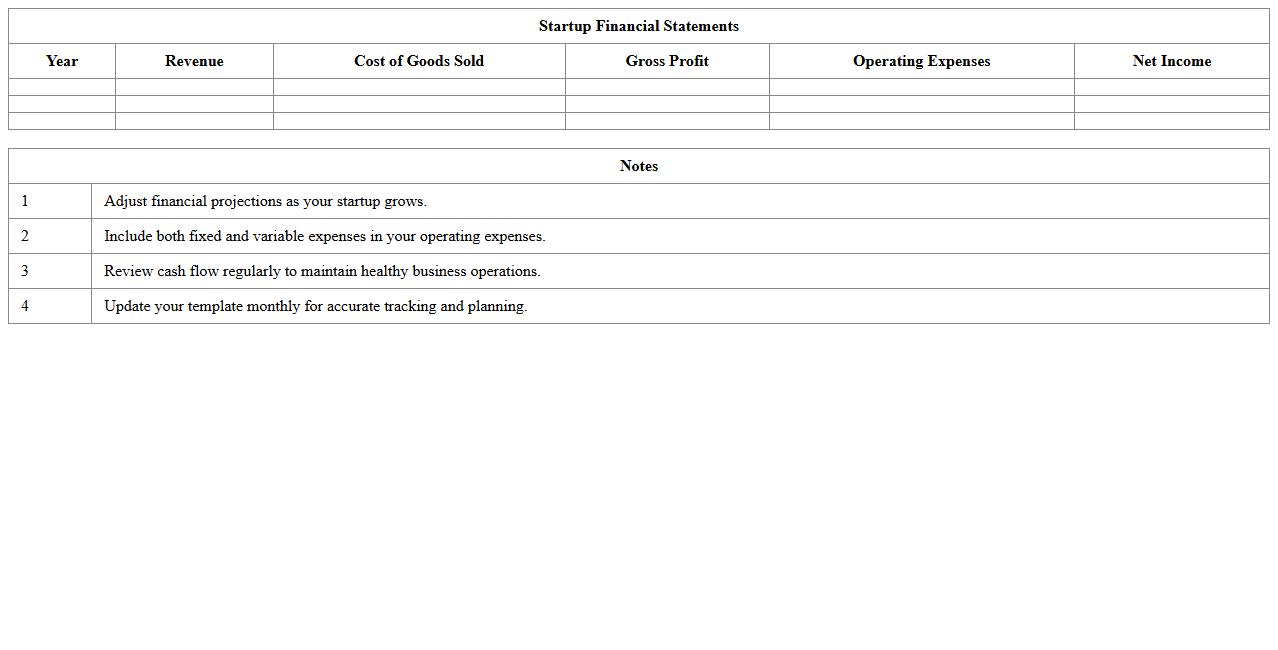

Startup Financial Statements Excel Template

A

Startup Financial Statements Excel Template is a pre-formatted spreadsheet designed to help new businesses organize and analyze their financial data efficiently. It includes essential statements such as profit and loss, balance sheet, and cash flow forecasts, enabling entrepreneurs to track performance and make informed decisions. This template streamlines budgeting, financial planning, and investor reporting, saving time and reducing errors.

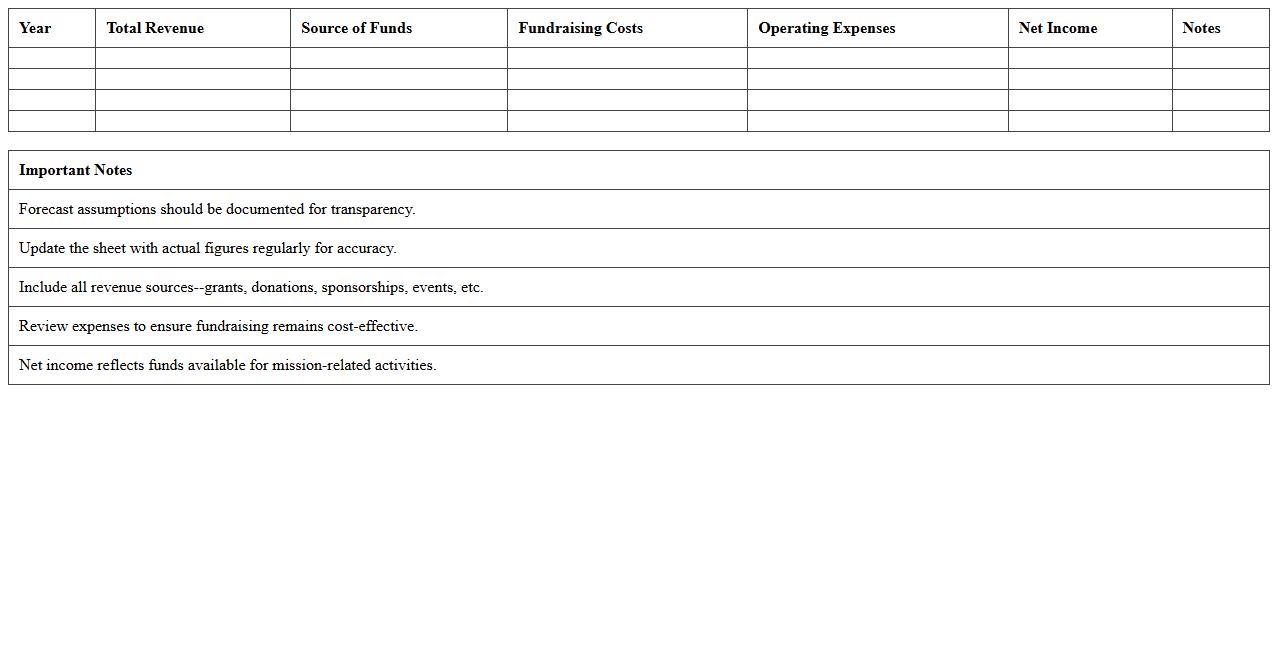

Fundraising Financial Forecast Excel Sheet

A

Fundraising Financial Forecast Excel Sheet is a detailed spreadsheet designed to project future financial performance related to fundraising activities, including expected donation amounts, timing, and expenses. This document helps organizations plan budgets, allocate resources efficiently, and set realistic fundraising targets based on historical data and growth assumptions. Utilizing this forecast enables better decision-making and enhances the ability to secure funding by presenting clear financial expectations to stakeholders.

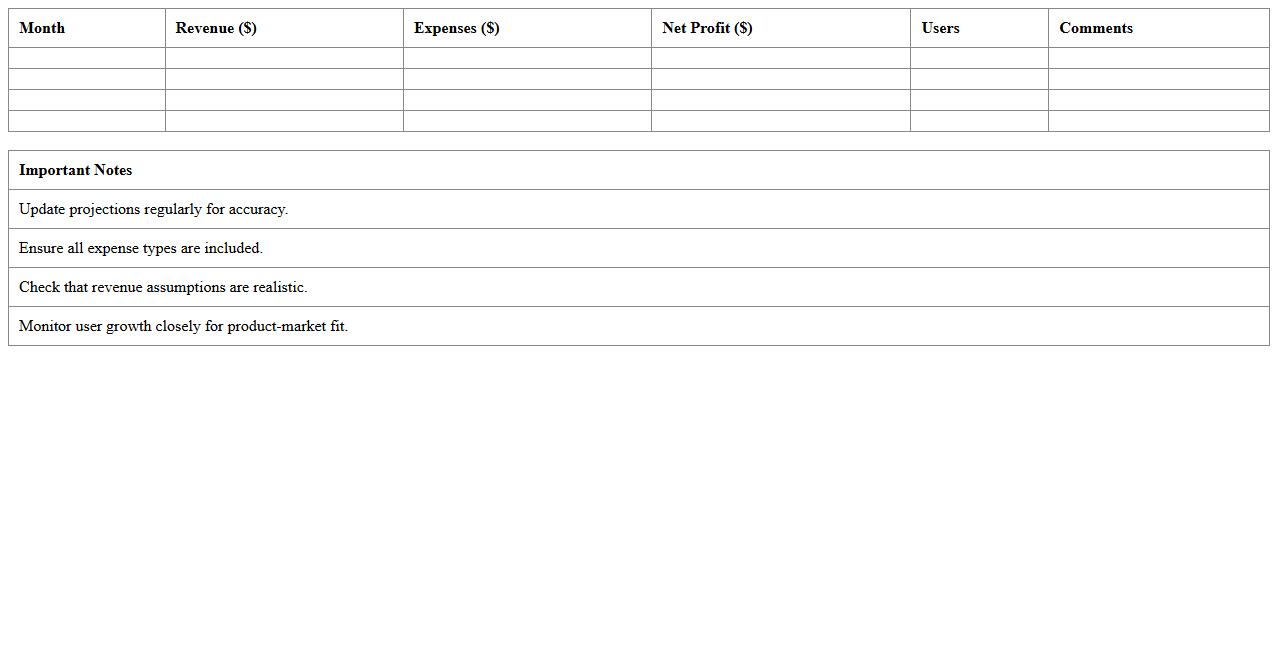

Startup Growth Projection Excel Worksheet

A

Startup Growth Projection Excel Worksheet is a comprehensive financial tool designed to forecast a startup's revenue, expenses, and profitability over time. It helps entrepreneurs visualize potential growth scenarios based on various input factors like sales volume, cost trends, and funding rounds. This worksheet is essential for strategic planning, investor presentations, and making informed decisions to optimize business performance.

How to structure revenue assumptions in a Financial Forecast Excel sheet for SaaS startups?

Begin by defining monthly recurring revenue (MRR) projections based on subscriber growth and average revenue per user (ARPU). Incorporate churn rates and upsell opportunities to refine revenue expectations. Use separate rows for each revenue stream to maintain clarity and facilitate easy updates.

What are key expense categories to include for early-stage fintech startups in financial projections?

Include product development costs, which cover engineering and technology infrastructure. Factor in marketing and customer acquisition expenses to support growth efforts. Don't overlook operational costs such as compliance, legal, and administrative overhead essential for fintech startups.

How to link your cash flow statement with funding rounds in Excel for a startup?

Set up a dedicated section for fundraising inflows in your cash flow sheet, reflecting the timing and amount of each funding round. Connect these inflows directly to your cash balance to ensure accurate cash position tracking. Use dynamic formulas to adjust future cash flow projections based on new funding events.

What formulas best estimate customer acquisition cost (CAC) in startup budget models?

The most common formula is CAC = Total Sales and Marketing Expenses / Number of New Customers. Ensure that costs include all related marketing and sales expenses within a defined period. This ratio helps identify the efficiency and scalability of customer acquisition strategies.

How to automate scenario analysis for burn rate changes in a startup financial forecast Excel doc?

Use Excel's data tables or scenario manager to test different burn rate assumptions easily. Link your expense structure and cash balance calculations to these variables for instantaneous result updates. This approach supports strategic planning by visualizing impacts of cost adjustments on runway.